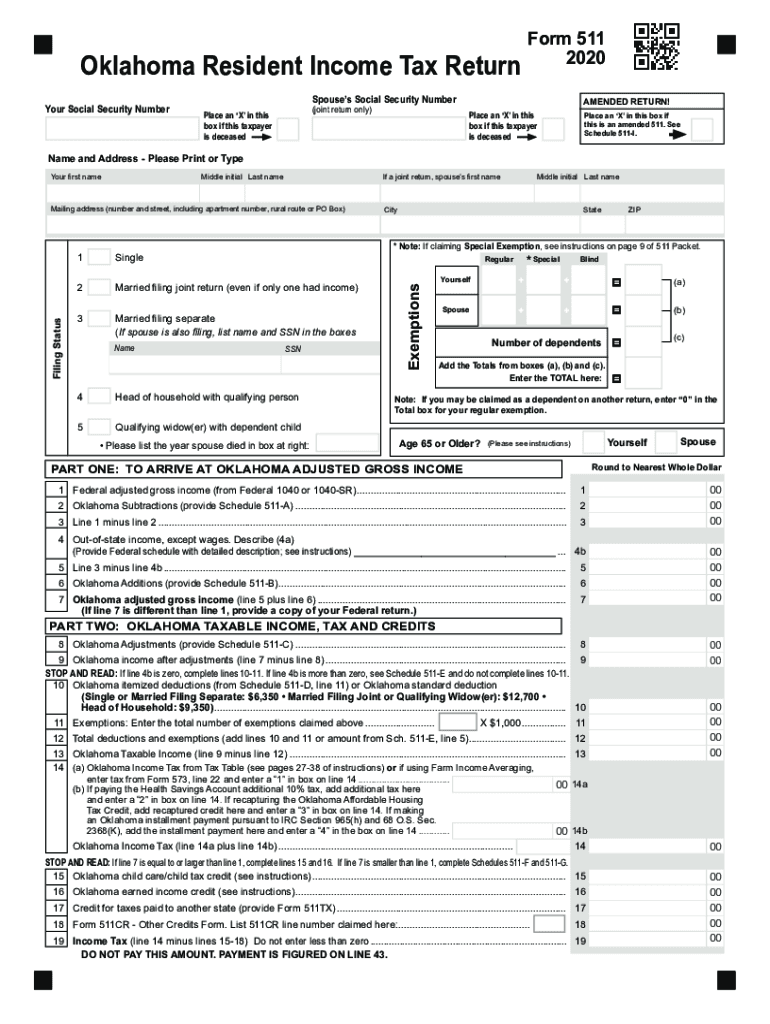

511 Packet Instructions Oklahoma Resident Individual Income Tax Forms and Instructions 2020

What is the form 538 S Oklahoma 2018?

The form 538 S Oklahoma 2018 is a specific tax form used by residents of Oklahoma for reporting certain income and deductions related to their state income tax. This form is part of the Oklahoma state tax filing process and is essential for individuals who need to report specific types of income that may not be covered by the standard income tax forms. Understanding the purpose and requirements of this form is crucial for accurate tax reporting and compliance with state regulations.

Steps to complete the form 538 S Oklahoma 2018

Completing the form 538 S Oklahoma 2018 involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation, including income statements, previous tax returns, and any relevant deductions. Next, fill out the form by entering your personal information, including your name, address, and Social Security number. Carefully input your income details and deductions as instructed on the form. After completing the form, review it for any errors or omissions. Finally, sign and date the form before submission to the appropriate tax authority.

Required documents for form 538 S Oklahoma 2018

When preparing to fill out the form 538 S Oklahoma 2018, several documents are necessary to ensure accurate reporting. These typically include:

- W-2 forms from employers

- 1099 forms for any freelance or contract work

- Records of any additional income, such as rental income or dividends

- Documentation for deductions, including receipts for medical expenses or charitable contributions

- Previous year’s tax return for reference

Having these documents on hand will streamline the process and help ensure that all information reported is correct and complete.

Filing deadlines for form 538 S Oklahoma 2018

It is important to be aware of the filing deadlines associated with the form 538 S Oklahoma 2018 to avoid penalties. Typically, state income tax forms must be filed by April 15 of the following year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also consider any extensions that may be available, but it is crucial to file any extension requests before the original deadline to avoid late fees.

Legal use of the form 538 S Oklahoma 2018

The form 538 S Oklahoma 2018 is legally binding when completed and submitted in accordance with Oklahoma state tax laws. To ensure its legal validity, taxpayers must provide accurate information and sign the form. The use of electronic signatures is permissible, provided that the eSignature complies with the Electronic Signatures in Global and National Commerce (ESIGN) Act and other relevant regulations. Understanding the legal implications of this form is essential for maintaining compliance and avoiding potential legal issues.

Form submission methods for 538 S Oklahoma 2018

Taxpayers have several options for submitting the form 538 S Oklahoma 2018. The form can be filed electronically through the Oklahoma Tax Commission's online portal, which is a convenient option for many. Alternatively, individuals may choose to print the completed form and mail it to the appropriate tax office. In-person submission is also an option at designated tax offices. Each submission method has its own processing times and requirements, so it is advisable to choose the method that best fits individual circumstances.

Quick guide on how to complete 2020 511 packet instructions oklahoma resident individual income tax forms and instructions

Complete 511 Packet Instructions Oklahoma Resident Individual Income Tax Forms And Instructions seamlessly on any device

Online document handling has gained popularity among companies and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can easily locate the appropriate form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents quickly without delays. Manage 511 Packet Instructions Oklahoma Resident Individual Income Tax Forms And Instructions on any platform with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to adjust and eSign 511 Packet Instructions Oklahoma Resident Individual Income Tax Forms And Instructions effortlessly

- Locate 511 Packet Instructions Oklahoma Resident Individual Income Tax Forms And Instructions and then click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize relevant parts of your documents or conceal sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Review the information and then click the Done button to save your updates.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form navigation, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign 511 Packet Instructions Oklahoma Resident Individual Income Tax Forms And Instructions and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 511 packet instructions oklahoma resident individual income tax forms and instructions

Create this form in 5 minutes!

How to create an eSignature for the 2020 511 packet instructions oklahoma resident individual income tax forms and instructions

The way to generate an electronic signature for your PDF document in the online mode

The way to generate an electronic signature for your PDF document in Chrome

The way to make an electronic signature for putting it on PDFs in Gmail

How to create an electronic signature straight from your mobile device

The best way to make an electronic signature for a PDF document on iOS devices

How to create an electronic signature for a PDF document on Android devices

People also ask

-

What is form 538 s oklahoma 2018?

Form 538 S Oklahoma 2018 is a document used for tax purposes in Oklahoma, specifically for reporting and claiming certain credits. Understanding this form is crucial for businesses to ensure compliance and benefit from available tax incentives.

-

How can airSlate SignNow help with form 538 s oklahoma 2018?

airSlate SignNow provides an easy way to fill out and eSign form 538 s oklahoma 2018 digitally. This streamlines the filing process, reduces paper use, and helps ensure accuracy, making it a great solution for businesses managing tax documents.

-

What are the pricing options for using airSlate SignNow for form 538 s oklahoma 2018?

airSlate SignNow offers competitive pricing plans that cater to various business needs, ensuring access to features that support eSigning documents like form 538 s oklahoma 2018. You can choose a plan that fits your budget without compromising on essential functionality.

-

What features does airSlate SignNow provide for managing form 538 s oklahoma 2018?

With airSlate SignNow, you get features like customizable templates, real-time tracking, and secure storage. These capabilities simplify the management of form 538 s oklahoma 2018, allowing users to focus more on their core business activities.

-

Why should I use airSlate SignNow for form 538 s oklahoma 2018 instead of traditional methods?

Using airSlate SignNow for form 538 s oklahoma 2018 eliminates the hassle of printing, signing, and scanning paperwork. The platform enhances efficiency, reduces processing time, and provides a more secure way to handle sensitive documents.

-

Can I integrate airSlate SignNow with other tools when working with form 538 s oklahoma 2018?

Yes, airSlate SignNow offers seamless integrations with popular tools such as Google Drive and Dropbox. This enables you to manage form 538 s oklahoma 2018 alongside your existing workflows, enhancing productivity.

-

How secure is my data when using airSlate SignNow for form 538 s oklahoma 2018?

airSlate SignNow prioritizes data security, employing industry-standard encryption protocols for documents like form 538 s oklahoma 2018. You can trust that your information is protected throughout the signing process.

Get more for 511 Packet Instructions Oklahoma Resident Individual Income Tax Forms And Instructions

- Wpf ps 010280 motion and declaration to serve by mail mt washington form

- Washington service mail 497429445 form

- Wpf ps 010290 summons by mail parentage sm washington form

- Wpf ps 010300 response to petition for establishment of parentage rsp washington form

- Wpf ps 010310 acceptance of service parentage acsr washington form

- Washington notice appearance form

- Wpf ps 010330 joinder parentage jn washington form

- Wpf ps 010400 parenting plan proposed pp temporary ppt final order pp washington form

Find out other 511 Packet Instructions Oklahoma Resident Individual Income Tax Forms And Instructions

- Sign Florida Resignation Letter Easy

- Sign Maine Leave of Absence Agreement Safe

- Sign Massachusetts Leave of Absence Agreement Simple

- Sign Connecticut Acknowledgement of Resignation Fast

- How To Sign Massachusetts Resignation Letter

- Sign New Mexico Resignation Letter Now

- How Do I Sign Oklahoma Junior Employment Offer Letter

- Sign Oklahoma Resignation Letter Simple

- How Do I Sign Oklahoma Acknowledgement of Resignation

- Can I Sign Pennsylvania Resignation Letter

- How To Sign Rhode Island Resignation Letter

- Sign Texas Resignation Letter Easy

- Sign Maine Alternative Work Offer Letter Later

- Sign Wisconsin Resignation Letter Free

- Help Me With Sign Wyoming Resignation Letter

- How To Sign Hawaii Military Leave Policy

- How Do I Sign Alaska Paid-Time-Off Policy

- Sign Virginia Drug and Alcohol Policy Easy

- How To Sign New Jersey Funeral Leave Policy

- How Can I Sign Michigan Personal Leave Policy