Oklahoma Resident Individual Income Tax Forms 2024-2026

What is the Oklahoma Resident Individual Income Tax Form?

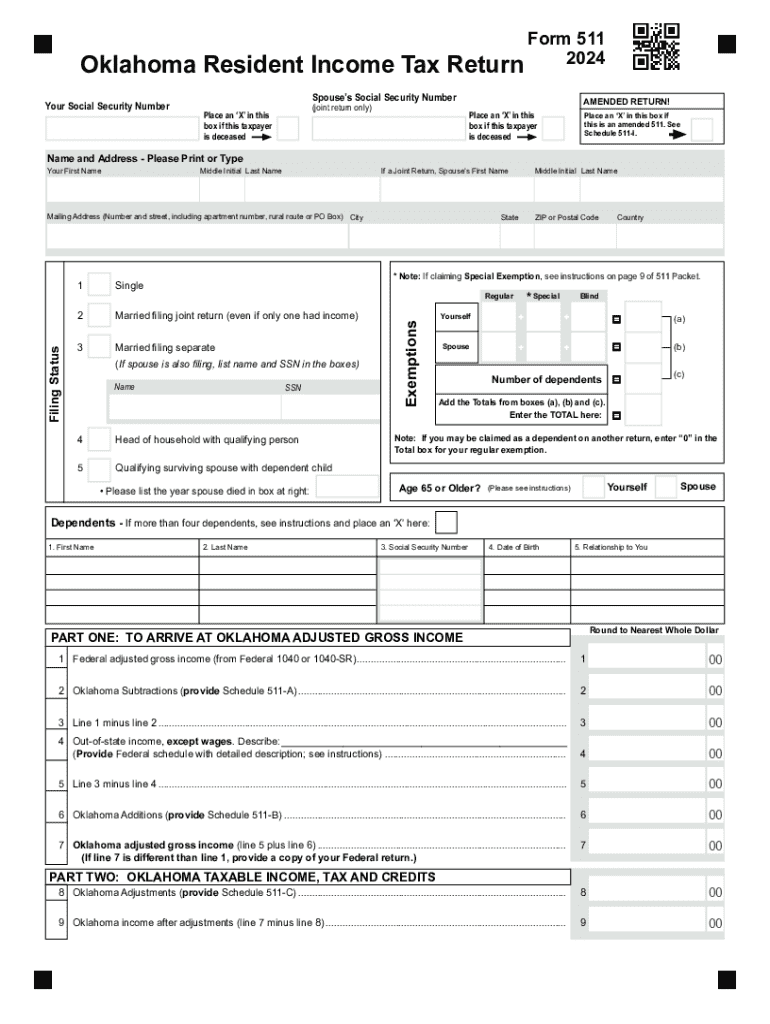

The 2024 Oklahoma 511 form, officially known as the Oklahoma Resident Individual Income Tax Form, is a crucial document for residents of Oklahoma who need to report their income and calculate their state tax obligations. This form is used by individuals to declare their earnings, claim deductions, and determine the amount of tax owed to the state. It is essential for ensuring compliance with state tax laws and for facilitating the proper calculation of tax liabilities.

Steps to Complete the Oklahoma Resident Individual Income Tax Form

Completing the 2024 Oklahoma 511 form involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including W-2s, 1099s, and any other income statements. Next, follow these steps:

- Begin by entering your personal information, including your name, address, and Social Security number.

- Report your total income from all sources, ensuring that you include all taxable income.

- Claim any applicable deductions, such as those for dependents or specific expenses, to reduce your taxable income.

- Calculate your tax liability based on the provided tax tables or rates.

- Review the completed form for accuracy before submission.

How to Obtain the Oklahoma Resident Individual Income Tax Form

The 2024 Oklahoma 511 form can be obtained through several channels. Residents can access the form online via the Oklahoma Tax Commission's official website, where it is available for download in PDF format. Additionally, physical copies of the form may be available at local tax offices or public libraries. It is advisable to ensure you have the most current version of the form to avoid any issues during filing.

Filing Deadlines / Important Dates

For the 2024 tax year, the filing deadline for the Oklahoma Resident Individual Income Tax Form is typically April 15, unless that date falls on a weekend or holiday. It is important to stay informed about any changes to deadlines, as extensions may be available under certain circumstances. Marking these dates on your calendar can help ensure timely submission and avoid penalties.

Required Documents

When preparing to fill out the 2024 Oklahoma 511 form, several documents are necessary to support your income claims and deductions. These include:

- W-2 forms from employers

- 1099 forms for freelance or contract work

- Records of any additional income, such as rental income or dividends

- Documentation for deductions, such as receipts for medical expenses or educational costs

Key Elements of the Oklahoma Resident Individual Income Tax Form

The 2024 Oklahoma 511 form includes several key sections that must be completed accurately. These sections typically consist of:

- Personal information, including filing status and number of dependents

- Income section, where all sources of income are reported

- Deductions and credits, allowing taxpayers to reduce their taxable income

- Tax calculation, which determines the total tax owed

Create this form in 5 minutes or less

Find and fill out the correct oklahoma resident individual income tax forms

Create this form in 5 minutes!

How to create an eSignature for the oklahoma resident individual income tax forms

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2024 Oklahoma 511 form?

The 2024 Oklahoma 511 form is a document used for reporting various transportation-related incidents and conditions in Oklahoma. It is essential for ensuring compliance with state regulations and improving road safety. By utilizing the airSlate SignNow platform, you can easily fill out and eSign the 2024 Oklahoma 511 form.

-

How can I access the 2024 Oklahoma 511 form through airSlate SignNow?

You can access the 2024 Oklahoma 511 form directly through the airSlate SignNow platform. Simply log in to your account, navigate to the forms section, and search for the 2024 Oklahoma 511 form. Our user-friendly interface makes it easy to find and complete the necessary documents.

-

Is there a cost associated with using the 2024 Oklahoma 511 form on airSlate SignNow?

Yes, there is a cost associated with using the 2024 Oklahoma 511 form on airSlate SignNow, but we offer competitive pricing plans to suit various business needs. Our plans are designed to be cost-effective while providing access to essential features for document management and eSigning. You can choose a plan that best fits your requirements.

-

What features does airSlate SignNow offer for the 2024 Oklahoma 511 form?

airSlate SignNow offers a range of features for the 2024 Oklahoma 511 form, including customizable templates, secure eSigning, and real-time tracking of document status. These features streamline the process of completing and submitting the form, making it more efficient for users. Additionally, you can collaborate with team members directly within the platform.

-

How does using the 2024 Oklahoma 511 form benefit my business?

Using the 2024 Oklahoma 511 form through airSlate SignNow can signNowly benefit your business by ensuring compliance with state regulations and improving operational efficiency. The platform allows for quick and secure document handling, reducing the time spent on paperwork. This enables your team to focus on more critical tasks while maintaining accurate records.

-

Can I integrate airSlate SignNow with other applications for the 2024 Oklahoma 511 form?

Yes, airSlate SignNow offers integration capabilities with various applications, allowing you to streamline your workflow when using the 2024 Oklahoma 511 form. You can connect with popular tools like Google Drive, Dropbox, and CRM systems to enhance your document management process. This integration ensures that all your data is synchronized and easily accessible.

-

Is it easy to eSign the 2024 Oklahoma 511 form using airSlate SignNow?

Absolutely! eSigning the 2024 Oklahoma 511 form using airSlate SignNow is straightforward and user-friendly. Our platform guides you through the signing process, ensuring that you can complete the form quickly and securely. You can sign from any device, making it convenient for users on the go.

Get more for Oklahoma Resident Individual Income Tax Forms

Find out other Oklahoma Resident Individual Income Tax Forms

- Electronic signature New Jersey Non-Profit Business Plan Template Online

- Electronic signature Massachusetts Legal Resignation Letter Now

- Electronic signature Massachusetts Legal Quitclaim Deed Easy

- Electronic signature Minnesota Legal LLC Operating Agreement Free

- Electronic signature Minnesota Legal LLC Operating Agreement Secure

- Electronic signature Louisiana Life Sciences LLC Operating Agreement Now

- Electronic signature Oregon Non-Profit POA Free

- Electronic signature South Dakota Non-Profit Business Plan Template Now

- Electronic signature South Dakota Non-Profit Lease Agreement Template Online

- Electronic signature Legal Document Missouri Online

- Electronic signature Missouri Legal Claim Online

- Can I Electronic signature Texas Non-Profit Permission Slip

- Electronic signature Missouri Legal Rental Lease Agreement Simple

- Electronic signature Utah Non-Profit Cease And Desist Letter Fast

- Electronic signature Missouri Legal Lease Agreement Template Free

- Electronic signature Non-Profit PDF Vermont Online

- Electronic signature Non-Profit PDF Vermont Computer

- Electronic signature Missouri Legal Medical History Mobile

- Help Me With Electronic signature West Virginia Non-Profit Business Plan Template

- Electronic signature Nebraska Legal Living Will Simple