Form 511 Oklahoma Resident Individual Income Tax Forms Packet & Instructions 2022

Understanding the 2016 Oklahoma Form 511

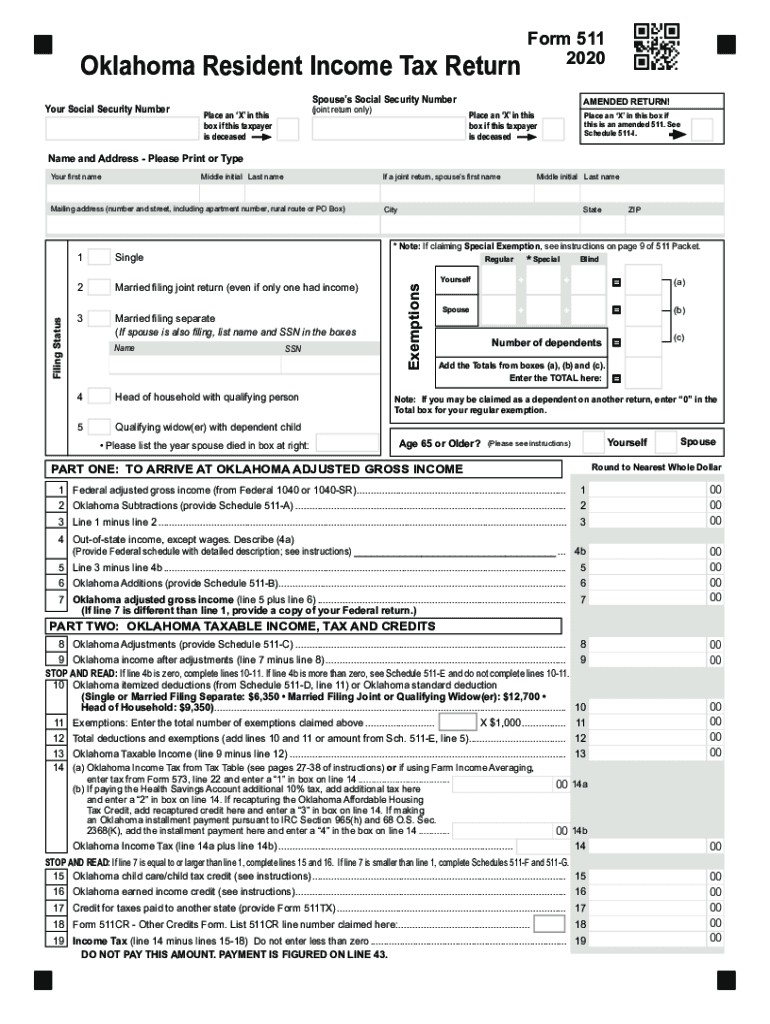

The 2016 Oklahoma Form 511 is the Resident Individual Income Tax Form used by individuals residing in Oklahoma to report their income and calculate their state tax liability. This form is essential for residents who need to file their state taxes accurately. It includes various sections that require personal information, income details, deductions, and credits applicable to the taxpayer's situation. Proper completion of this form ensures compliance with state tax laws and helps avoid potential penalties.

Steps to Complete the 2016 Oklahoma Form 511

Completing the 2016 Oklahoma Form 511 involves several key steps:

- Gather Necessary Documents: Collect all relevant documents, including W-2s, 1099s, and any other income statements.

- Fill Out Personal Information: Enter your name, address, and Social Security number at the top of the form.

- Report Income: Include all sources of income on the form, ensuring accuracy in reporting.

- Claim Deductions and Credits: Identify and apply any eligible deductions or tax credits that may reduce your taxable income.

- Calculate Tax Liability: Follow the instructions to compute the total tax owed or refund due.

- Review and Sign: Carefully review the completed form for accuracy before signing and dating it.

Legal Use of the 2016 Oklahoma Form 511

The 2016 Oklahoma Form 511 is legally recognized for filing state income taxes. To ensure its validity, taxpayers must adhere to the guidelines set forth by the Oklahoma Tax Commission. This includes accurately reporting income, claiming only legitimate deductions, and submitting the form by the designated filing deadline. Failure to comply with these legal requirements may result in penalties or audits by the state tax authorities.

Filing Deadlines for the 2016 Oklahoma Form 511

The deadline for filing the 2016 Oklahoma Form 511 typically aligns with the federal tax filing deadline, which is April 15. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should be aware of any changes or extensions announced by the Oklahoma Tax Commission to ensure timely submission.

Obtaining the 2016 Oklahoma Form 511

Taxpayers can obtain the 2016 Oklahoma Form 511 through several methods. It is available for download from the Oklahoma Tax Commission's official website, where individuals can access the form in a printable format. Additionally, physical copies may be available at local tax offices or libraries. Ensuring you have the correct version of the form is crucial for accurate filing.

Required Documents for the 2016 Oklahoma Form 511

When preparing to complete the 2016 Oklahoma Form 511, taxpayers should gather the following documents:

- W-2 forms from employers

- 1099 forms for other income sources

- Documentation for any deductions or credits claimed

- Previous year’s tax return for reference

Having these documents ready will facilitate a smoother filing process and help ensure that all necessary information is included.

Quick guide on how to complete 2020 form 511 oklahoma resident individual income tax forms packet ampamp instructions

Complete Form 511 Oklahoma Resident Individual Income Tax Forms Packet & Instructions effortlessly on any device

Web-based document management has become increasingly favored by businesses and individuals. It serves as an ideal environmentally-friendly alternative to traditional printed and signed paperwork, allowing you to locate the correct form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your documents swiftly without delays. Handle Form 511 Oklahoma Resident Individual Income Tax Forms Packet & Instructions on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to modify and electronically sign Form 511 Oklahoma Resident Individual Income Tax Forms Packet & Instructions with ease

- Find Form 511 Oklahoma Resident Individual Income Tax Forms Packet & Instructions and then click Get Form to initiate.

- Utilize the tools we provide to fill out your form.

- Emphasize essential parts of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your adjustments.

- Choose how you wish to send your form, via email, text message (SMS), invitation link, or download it to your PC.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and electronically sign Form 511 Oklahoma Resident Individual Income Tax Forms Packet & Instructions and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 form 511 oklahoma resident individual income tax forms packet ampamp instructions

Create this form in 5 minutes!

How to create an eSignature for the 2020 form 511 oklahoma resident individual income tax forms packet ampamp instructions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is 2016 Oklahoma 511 and how does it relate to airSlate SignNow?

The 2016 Oklahoma 511 is a critical traffic and travel information system that can be utilized to enhance communication and documentation for businesses using airSlate SignNow. By integrating this data, companies can streamline their document processes, ensuring timely updates related to travel and safety.

-

How can airSlate SignNow improve my business processes with information from 2016 Oklahoma 511?

airSlate SignNow can improve your business processes by allowing you to eSign and manage documents related to the 2016 Oklahoma 511 updates effectively. Whether it's for logistics, compliance, or communication, this integration helps ensure all relevant information is seamlessly included in your document workflows.

-

What pricing plans does airSlate SignNow offer for businesses interested in using 2016 Oklahoma 511?

AirSlate SignNow offers flexible pricing plans designed to meet the needs of various businesses, including those utilizing the 2016 Oklahoma 511 traffic system. Each plan is tailored to provide access to features that facilitate efficient eSigning and document management without breaking the bank.

-

What features of airSlate SignNow make it suitable for handling documents relating to 2016 Oklahoma 511?

Key features of airSlate SignNow that are particularly beneficial for handling documents related to the 2016 Oklahoma 511 include customizable templates, real-time tracking of document status, and secure eSignature capabilities. These features ensure that businesses can efficiently manage important updates while maintaining compliance.

-

Are there any benefits of using airSlate SignNow with data from 2016 Oklahoma 511?

Using airSlate SignNow with data from 2016 Oklahoma 511 offers numerous benefits, including improved efficiency in document processing and enhanced accuracy in information management. This synergy helps companies ensure they are abiding by state regulations while also streamlining their workflows.

-

Can airSlate SignNow integrate with other tools to help manage 2016 Oklahoma 511 documents?

Yes, airSlate SignNow provides numerous integration options with other software tools that can further enhance your management of documents related to the 2016 Oklahoma 511. These integrations help create a more connected and efficient environment for handling all relevant operational documents.

-

Is airSlate SignNow user-friendly for beginners dealing with 2016 Oklahoma 511 documents?

Absolutely! AirSlate SignNow is designed to be user-friendly, making it easy for beginners to navigate and use its features effectively when dealing with 2016 Oklahoma 511 documents. The intuitive interface, along with helpful resources, ensures that users can quickly adapt and start eSigning their documents.

Get more for Form 511 Oklahoma Resident Individual Income Tax Forms Packet & Instructions

- Warranty deed from corporation to husband and wife rhode island form

- Quitclaim deed from corporation to individual rhode island form

- Rhode island corporation 497325018 form

- Quitclaim deed from corporation to llc rhode island form

- Quitclaim deed from corporation to corporation rhode island form

- Warranty deed from corporation to corporation rhode island form

- Quitclaim deed from corporation to two individuals rhode island form

- Warranty deed from corporation to two individuals rhode island form

Find out other Form 511 Oklahoma Resident Individual Income Tax Forms Packet & Instructions

- eSign Indiana New Hire Onboarding Online

- eSign Delaware Software Development Proposal Template Free

- eSign Nevada Software Development Proposal Template Mobile

- Can I eSign Colorado Mobile App Design Proposal Template

- How Can I eSignature California Cohabitation Agreement

- How Do I eSignature Colorado Cohabitation Agreement

- How Do I eSignature New Jersey Cohabitation Agreement

- Can I eSign Utah Mobile App Design Proposal Template

- eSign Arkansas IT Project Proposal Template Online

- eSign North Dakota IT Project Proposal Template Online

- eSignature New Jersey Last Will and Testament Online

- eSignature Pennsylvania Last Will and Testament Now

- eSign Arkansas Software Development Agreement Template Easy

- eSign Michigan Operating Agreement Free

- Help Me With eSign Nevada Software Development Agreement Template

- eSign Arkansas IT Consulting Agreement Computer

- How To eSignature Connecticut Living Will

- eSign Alaska Web Hosting Agreement Computer

- eSign Alaska Web Hosting Agreement Now

- eSign Colorado Web Hosting Agreement Simple