Instructions for Completing the Form 511 Oklahoma Resident Income Tax Return 2021

Instructions for Completing the 2018 Oklahoma Resident Income Tax Return

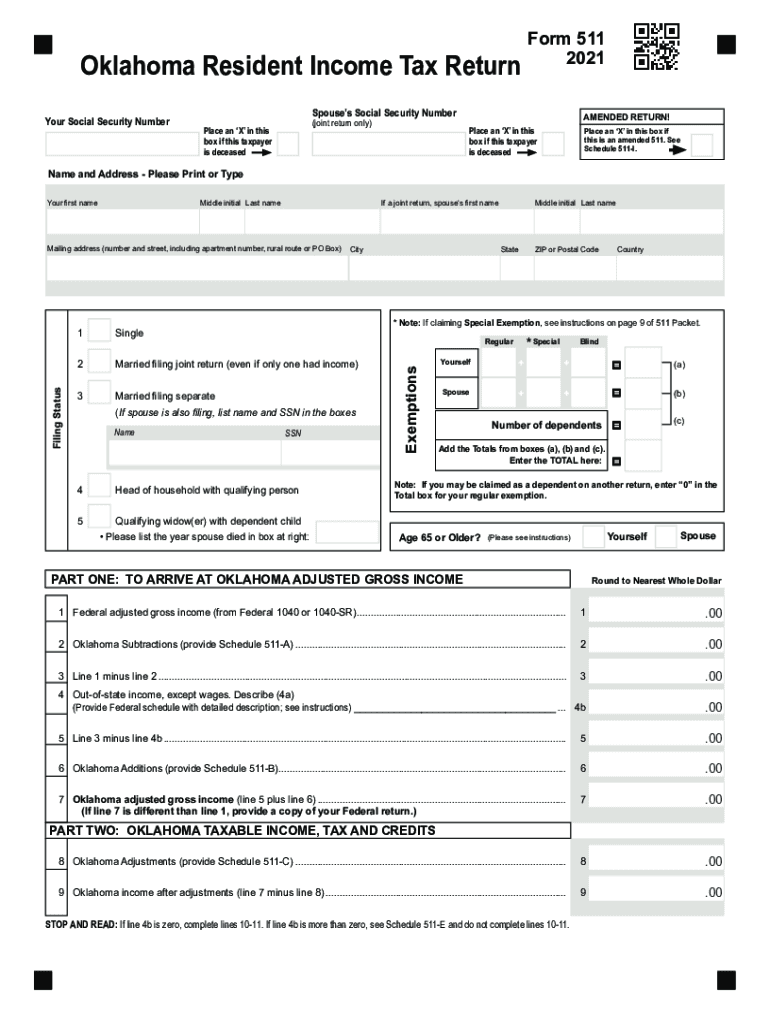

The 2018 Oklahoma tax form 511 is designed for residents to report their income and calculate their state tax liability. The form requires specific information about your income sources, deductions, and credits. To complete it accurately, gather all necessary financial documents, including W-2s, 1099s, and any other relevant income statements. Carefully follow the instructions provided on the form to ensure all sections are filled out correctly, including personal information, income details, and tax calculations.

Steps to Complete the 2018 Oklahoma Tax Form 511

Completing the Oklahoma Form 511 involves several key steps:

- Gather all required documents, such as your W-2 and any 1099 forms.

- Fill out your personal information, including your name, address, and Social Security number.

- Report your total income from all sources, ensuring to include any taxable interest and dividends.

- Claim any eligible deductions, such as standard deductions or itemized deductions, based on your financial situation.

- Calculate your total tax liability using the tax tables provided in the instructions.

- Review your completed form for accuracy before submitting it.

Required Documents for Form 511

To successfully complete the 2018 Oklahoma tax form 511, you will need several documents:

- W-2 forms from all employers.

- 1099 forms for any additional income, such as freelance work or interest.

- Records of any deductions you plan to claim, including receipts for medical expenses and charitable contributions.

- Any prior year tax returns for reference, if needed.

Filing Deadlines for Oklahoma Form 511

It is important to be aware of the filing deadlines for the 2018 Oklahoma tax form 511. Typically, the deadline to file your state income tax return is April 15 of the following year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Ensure that your completed form is submitted by this date to avoid any penalties.

Form Submission Methods for Oklahoma Tax Form 511

There are several methods to submit your completed 2018 Oklahoma tax form 511:

- Online: Use the Oklahoma Tax Commission's website for electronic filing.

- By Mail: Send your completed form to the designated address provided in the instructions.

- In-Person: You may also deliver your form directly to your local tax office.

Penalties for Non-Compliance with Oklahoma Tax Regulations

Failing to file the 2018 Oklahoma tax form 511 by the deadline can result in penalties. The state may impose a late filing fee, which can accumulate over time. Additionally, if you owe taxes and do not pay by the deadline, interest will accrue on the unpaid balance. It is essential to file your return on time and pay any taxes owed to avoid these consequences.

Quick guide on how to complete instructions for completing the form 511 oklahoma resident income tax return

Prepare Instructions For Completing The Form 511 Oklahoma Resident Income Tax Return effortlessly on any device

Web-based document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally-friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents promptly without delays. Manage Instructions For Completing The Form 511 Oklahoma Resident Income Tax Return on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to modify and electronically sign Instructions For Completing The Form 511 Oklahoma Resident Income Tax Return with ease

- Find Instructions For Completing The Form 511 Oklahoma Resident Income Tax Return and then click Get Form to begin.

- Utilize the resources we offer to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click the Done button to save your changes.

- Select your preferred method of delivering your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow manages all your document administration needs in just a few clicks from any device you choose. Edit and electronically sign Instructions For Completing The Form 511 Oklahoma Resident Income Tax Return to ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct instructions for completing the form 511 oklahoma resident income tax return

Create this form in 5 minutes!

How to create an eSignature for the instructions for completing the form 511 oklahoma resident income tax return

The best way to create an e-signature for a PDF online

The best way to create an e-signature for a PDF in Google Chrome

The best way to create an e-signature for signing PDFs in Gmail

How to generate an electronic signature from your smartphone

The way to generate an e-signature for a PDF on iOS

How to generate an electronic signature for a PDF file on Android

People also ask

-

What is the 2018 Oklahoma tax form 511 used for?

The 2018 Oklahoma tax form 511 is used for individual income tax filing in Oklahoma. It allows taxpayers to report their income, calculate taxes owed, and claim credits or deductions. Utilizing airSlate SignNow can simplify the process of filling and submitting your 2018 Oklahoma tax form 511 with its user-friendly eSigning features.

-

How can airSlate SignNow assist with the 2018 Oklahoma tax form 511?

airSlate SignNow provides a seamless platform for electronically signing and managing your 2018 Oklahoma tax form 511. Our solution ensures that you can easily fill out the form, sign it, and share it securely with tax authorities. This saves time and reduces the hassle associated with traditional paper submission.

-

Are there any costs associated with using airSlate SignNow for the 2018 Oklahoma tax form 511?

Using airSlate SignNow is a cost-effective solution for handling the 2018 Oklahoma tax form 511. We offer competitive pricing plans based on your needs, which include features like unlimited eSignatures and access to templates. With our solution, you can manage all your document signing at an affordable rate.

-

Can I integrate airSlate SignNow with other tools for the 2018 Oklahoma tax form 511?

Yes, airSlate SignNow easily integrates with various tools and applications to streamline the management of the 2018 Oklahoma tax form 511. Whether you use CRM systems or cloud storage services, our platform can connect seamlessly, enhancing your workflow and document handling processes.

-

What are the benefits of using airSlate SignNow for my 2018 Oklahoma tax form 511?

By using airSlate SignNow for your 2018 Oklahoma tax form 511, you gain efficiency, security, and ease of use. The platform allows you to complete and sign documents from anywhere, reducing the time spent on paperwork. Additionally, your documents are securely stored, ensuring confidentiality and compliance.

-

Is it safe to sign the 2018 Oklahoma tax form 511 using airSlate SignNow?

Absolutely! airSlate SignNow prioritizes your security and compliance when signing the 2018 Oklahoma tax form 511. Our platform uses advanced encryption and authentication methods to ensure that your information remains protected during the signing process.

-

What features does airSlate SignNow offer for completing the 2018 Oklahoma tax form 511?

airSlate SignNow offers multiple features to efficiently complete your 2018 Oklahoma tax form 511, such as customizable templates and tracking options. You can easily edit the form, make necessary adjustments, and track its status from your dashboard. This streamlines your filing process and keeps you organized.

Get more for Instructions For Completing The Form 511 Oklahoma Resident Income Tax Return

- Notice of intent not to renew at end of specified term from landlord to tenant for residential property florida form

- Notice of intent not to renew at end of specified term from landlord to tenant for nonresidential or commercial property florida form

- Agreed written termination of lease by landlord and tenant florida form

- Notice of breach of written lease for violating specific provisions of lease with right to cure for residential property from 497303165 form

- Notice breach lease form

- Florida violating form

- Florida provisions form

- Business credit application florida form

Find out other Instructions For Completing The Form 511 Oklahoma Resident Income Tax Return

- Sign Police Word Missouri Computer

- Sign Missouri Police Resignation Letter Fast

- Sign Ohio Police Promissory Note Template Easy

- Sign Alabama Courts Affidavit Of Heirship Simple

- How To Sign Arizona Courts Residential Lease Agreement

- How Do I Sign Arizona Courts Residential Lease Agreement

- Help Me With Sign Arizona Courts Residential Lease Agreement

- How Can I Sign Arizona Courts Residential Lease Agreement

- Sign Colorado Courts LLC Operating Agreement Mobile

- Sign Connecticut Courts Living Will Computer

- How Do I Sign Connecticut Courts Quitclaim Deed

- eSign Colorado Banking Rental Application Online

- Can I eSign Colorado Banking Medical History

- eSign Connecticut Banking Quitclaim Deed Free

- eSign Connecticut Banking Business Associate Agreement Secure

- Sign Georgia Courts Moving Checklist Simple

- Sign Georgia Courts IOU Mobile

- How Can I Sign Georgia Courts Lease Termination Letter

- eSign Hawaii Banking Agreement Simple

- eSign Hawaii Banking Rental Application Computer