DOR Nonprofit Tax Forms in Gov 2020

Understanding the Indiana Department Form NP 20

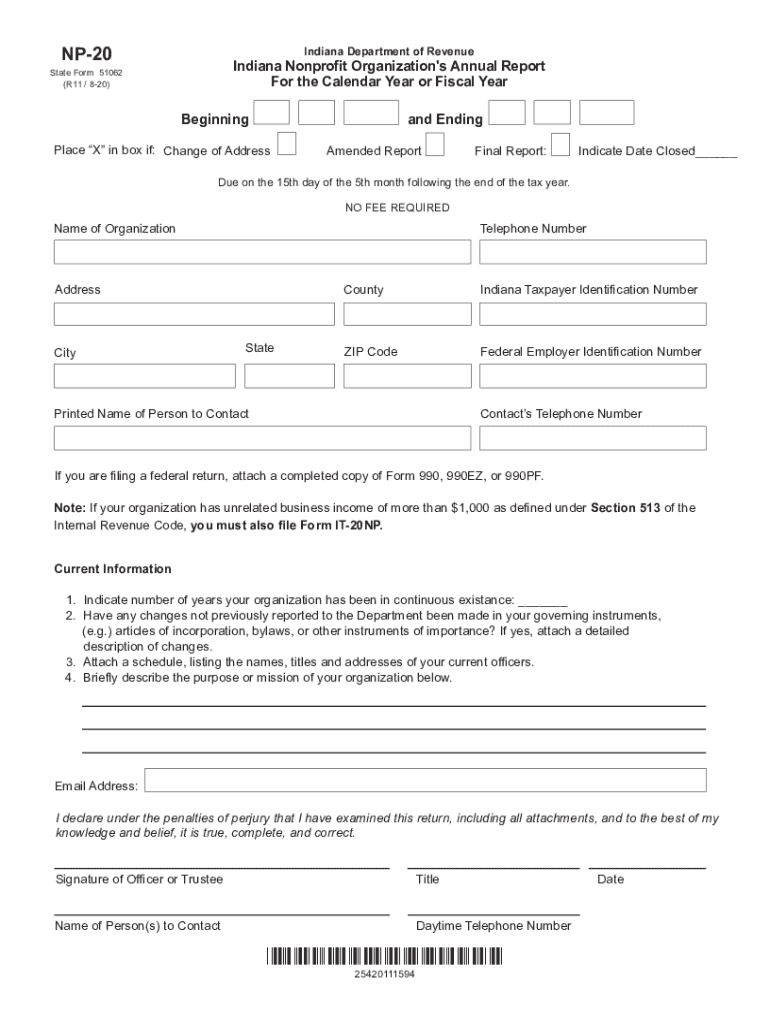

The Indiana Department Form NP 20 is a crucial document for nonprofit organizations operating within the state. This form is used to report income and claim tax-exempt status under Indiana law. Organizations must ensure that they accurately complete this form to maintain their tax-exempt status and comply with state regulations.

Steps to Complete the Indiana Department Form NP 20

Completing the NP 20 form involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements and expense reports. Next, fill out the form by providing detailed information about the organization, including its mission, activities, and financial activities for the reporting period. After completing the form, review it for any errors or omissions before submission. Finally, ensure that the form is signed by an authorized representative of the organization to validate the submission.

Legal Use of the Indiana Department Form NP 20

The NP 20 form serves as a legal document that demonstrates compliance with Indiana tax laws for nonprofit organizations. Proper completion and submission of the form are essential for maintaining tax-exempt status. Failure to submit the form or inaccuracies in reporting can lead to penalties or loss of tax-exempt status. It is important for organizations to understand the legal implications of the information provided in the NP 20 form.

Filing Deadlines for the Indiana Department Form NP 20

Nonprofit organizations must adhere to specific filing deadlines for the NP 20 form to avoid penalties. Typically, the form is due on the fifteenth day of the fifth month following the close of the organization’s fiscal year. Organizations should mark their calendars and prepare the necessary documentation in advance to ensure timely filing.

Required Documents for the Indiana Department Form NP 20

When completing the NP 20 form, organizations must include several supporting documents. These typically include financial statements, a list of board members, and any relevant tax-exempt status documentation. Providing comprehensive and accurate documentation is vital for the successful processing of the form.

Form Submission Methods for the Indiana Department Form NP 20

The NP 20 form can be submitted through various methods, including online submission, mail, or in-person delivery to the Indiana Department of Revenue. Each method has its own set of guidelines and requirements, so organizations should choose the most convenient and efficient option for their needs. Online submission is often preferred for its speed and ease of tracking.

Penalties for Non-Compliance with the Indiana Department Form NP 20

Non-compliance with the requirements of the NP 20 form can result in significant penalties for nonprofit organizations. These penalties may include fines, loss of tax-exempt status, and other legal repercussions. Organizations should prioritize compliance to avoid these risks and ensure their continued operation within Indiana’s legal framework.

Quick guide on how to complete dor nonprofit tax forms ingov

Complete DOR Nonprofit Tax Forms IN gov effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an excellent environmentally friendly alternative to traditional printed and signed forms, allowing you to access the appropriate template and securely store it online. airSlate SignNow provides all the resources you need to create, edit, and eSign your documents promptly without delays. Manage DOR Nonprofit Tax Forms IN gov on any device with airSlate SignNow's Android or iOS applications and streamline any document-driven process today.

The simplest method to edit and eSign DOR Nonprofit Tax Forms IN gov with ease

- Locate DOR Nonprofit Tax Forms IN gov and then click Get Form to initiate the process.

- Utilize the tools we provide to complete your document.

- Emphasize crucial sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Choose your preferred method of delivering your form, whether by email, text message (SMS), invitation link, or download it to your PC.

Eliminate worries about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Edit and eSign DOR Nonprofit Tax Forms IN gov and ensure superior communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct dor nonprofit tax forms ingov

Create this form in 5 minutes!

How to create an eSignature for the dor nonprofit tax forms ingov

The way to generate an eSignature for a PDF document in the online mode

The way to generate an eSignature for a PDF document in Chrome

How to generate an eSignature for putting it on PDFs in Gmail

How to generate an eSignature from your mobile device

The way to create an eSignature for a PDF document on iOS devices

How to generate an eSignature for a PDF file on Android devices

People also ask

-

What is the Indiana Department Form NP 20?

The Indiana Department Form NP 20 is a specific form used for various regulatory purposes in Indiana. Understanding its requirements is crucial for compliance, and businesses can utilize airSlate SignNow to streamline the process of preparing and signing this important document.

-

How can airSlate SignNow help with the Indiana Department Form NP 20?

airSlate SignNow offers a user-friendly interface that allows you to quickly fill out and eSign the Indiana Department Form NP 20. Its features facilitate efficient document management, ensuring that you can meet submission deadlines seamlessly.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow provides cost-effective pricing plans designed to fit various business needs. By selecting the right plan, users can benefit from unlimited document signing and enhanced features specifically suitable for forms like the Indiana Department Form NP 20.

-

Is airSlate SignNow secure for handling forms like the Indiana Department Form NP 20?

Yes, airSlate SignNow prioritizes security, ensuring that documents such as the Indiana Department Form NP 20 are handled with state-of-the-art encryption and compliance. Businesses can trust that their sensitive information remains protected throughout the signing process.

-

Can airSlate SignNow integrate with other applications for managing the Indiana Department Form NP 20?

Absolutely! airSlate SignNow integrates seamlessly with various applications, allowing users to manage the Indiana Department Form NP 20 directly from platforms they already use. This enhances workflow efficiency and reduces the time spent on document management.

-

What are the benefits of using airSlate SignNow for the Indiana Department Form NP 20?

Using airSlate SignNow for the Indiana Department Form NP 20 offers numerous benefits, including time savings, reduced paperwork, and increased accuracy in submissions. The platform simplifies collaboration, making it easier for teams to work on documents together in real-time.

-

Is training available for using airSlate SignNow with the Indiana Department Form NP 20?

Yes, airSlate SignNow offers comprehensive training resources and customer support. Users can easily access tutorials and guides to learn how to efficiently complete the Indiana Department Form NP 20 using the platform.

Get more for DOR Nonprofit Tax Forms IN gov

Find out other DOR Nonprofit Tax Forms IN gov

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy

- eSign Rhode Island Charity Rental Lease Agreement Secure

- eSign California Construction Promissory Note Template Easy

- eSign Colorado Construction LLC Operating Agreement Simple

- Can I eSign Washington Charity LLC Operating Agreement

- eSign Wyoming Charity Living Will Simple

- eSign Florida Construction Memorandum Of Understanding Easy

- eSign Arkansas Doctors LLC Operating Agreement Free

- eSign Hawaii Construction Lease Agreement Mobile

- Help Me With eSign Hawaii Construction LLC Operating Agreement

- eSign Hawaii Construction Work Order Myself

- eSign Delaware Doctors Quitclaim Deed Free

- eSign Colorado Doctors Operating Agreement Computer

- Help Me With eSign Florida Doctors Lease Termination Letter

- eSign Florida Doctors Lease Termination Letter Myself