Www in GovdorDOR Indiana Department of Revenue 2021-2026

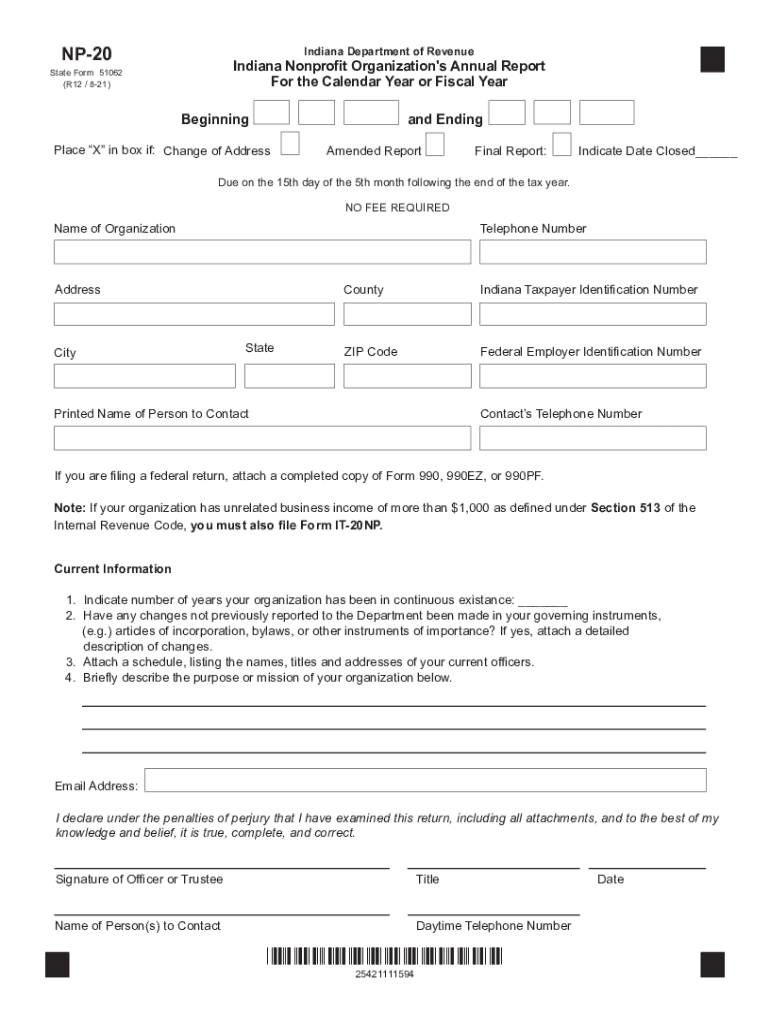

What is the Indiana Form NP-1?

The Indiana Form NP-1 is a crucial document used for various tax-related purposes within the state. This form is primarily utilized by individuals and businesses to report non-resident income or to claim tax exemptions. Understanding the specifics of the NP-1 form is essential for compliance with Indiana tax regulations.

Steps to Complete the Indiana Form NP-1

Completing the Indiana Form NP-1 involves several important steps:

- Begin by downloading the Indiana Form NP-1 printable version from the official Indiana Department of Revenue website.

- Fill in your personal information, including your name, address, and Social Security number.

- Provide details about your income sources, ensuring you accurately report all non-resident income.

- Calculate any applicable deductions and exemptions you may qualify for.

- Review the completed form for accuracy before submission.

Required Documents for Indiana Form NP-1

When filling out the Indiana Form NP-1, it is important to have the following documents on hand:

- Proof of income, such as W-2 forms or 1099 statements.

- Documentation supporting any claimed deductions or credits.

- A copy of your federal tax return, if applicable.

Form Submission Methods for Indiana Form NP-1

The Indiana Form NP-1 can be submitted through various methods:

- Online submission via the Indiana Department of Revenue’s e-filing system.

- Mailing the completed form to the appropriate address provided on the form.

- In-person submission at designated state tax offices.

Legal Use of the Indiana Form NP-1

The Indiana Form NP-1 is legally recognized for reporting non-resident income and claiming tax exemptions. It is vital to ensure that the form is filled out correctly and submitted by the deadline to avoid penalties. Adhering to state tax laws ensures compliance and protects against potential legal issues.

Filing Deadlines for Indiana Form NP-1

Filing deadlines for the Indiana Form NP-1 are typically aligned with federal tax deadlines. It is important to check the Indiana Department of Revenue’s official website for specific dates, as they may vary each tax year. Timely submission of the form is crucial to avoid late fees and penalties.

Quick guide on how to complete wwwingovdordor indiana department of revenue

Accomplish Www in govdorDOR Indiana Department Of Revenue effortlessly on any gadget

Digital document management has become increasingly favored by both businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, as you can access the required form and securely save it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly and without interruptions. Manage Www in govdorDOR Indiana Department Of Revenue on any device using the airSlate SignNow Android or iOS applications and enhance any document-based task today.

Steps to modify and eSign Www in govdorDOR Indiana Department Of Revenue with ease

- Obtain Www in govdorDOR Indiana Department Of Revenue and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of the documents or obscure sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to store your changes.

- Select your preferred method to submit your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form navigation, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any chosen device. Modify and eSign Www in govdorDOR Indiana Department Of Revenue and ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct wwwingovdordor indiana department of revenue

Create this form in 5 minutes!

How to create an eSignature for the wwwingovdordor indiana department of revenue

How to generate an electronic signature for a PDF in the online mode

How to generate an electronic signature for a PDF in Chrome

The way to create an e-signature for putting it on PDFs in Gmail

The way to generate an e-signature straight from your smart phone

How to make an e-signature for a PDF on iOS devices

The way to generate an e-signature for a PDF document on Android OS

People also ask

-

What is the Indiana form NP 1 printable?

The Indiana form NP 1 printable is a specific document used for non-profit organizations in Indiana to register and obtain tax-exempt status. By utilizing this printable form, organizations can efficiently complete their registration process.

-

How do I obtain the Indiana form NP 1 printable?

You can access the Indiana form NP 1 printable directly from the Indiana Secretary of State’s website or download it from our site. This makes it easy for you to start your non-profit registration process effortlessly.

-

Can I fill out the Indiana form NP 1 printable online?

While the Indiana form NP 1 printable is primarily designed for printing, you can fill it out electronically using PDF editing software before printing it. This feature allows for accuracy and convenience during the completion of the form.

-

What are the benefits of using airSlate SignNow for the Indiana form NP 1 printable?

By using airSlate SignNow, you can eSign the Indiana form NP 1 printable quickly and securely. This not only saves time but also ensures that your documents are legally binding and can be completed from anywhere.

-

Is there a cost associated with using airSlate SignNow for the Indiana form NP 1 printable?

AirSlate SignNow offers various pricing plans, including a free trial for new users. This allows you to explore the benefits of eSigning your Indiana form NP 1 printable without any initial investment.

-

What features does airSlate SignNow offer for handling documents like the Indiana form NP 1 printable?

AirSlate SignNow provides robust features such as templates, reminders, and real-time tracking for documents, including the Indiana form NP 1 printable. These features enhance your document management experience and ensure you never miss a deadline.

-

What integrations does airSlate SignNow support for the Indiana form NP 1 printable?

AirSlate SignNow integrates seamlessly with various productivity and cloud storage platforms. This allows you to easily retrieve and send documents like the Indiana form NP 1 printable directly from your preferred applications.

Get more for Www in govdorDOR Indiana Department Of Revenue

- Ar sample letter 497296651 form

- Supplemental residential lease forms package arkansas

- Arkansas landlord 497296653 form

- Notice of option for recording arkansas form

- Ar will form

- General durable power of attorney for property and finances or financial effective upon disability arkansas form

- Essential legal life documents for baby boomers arkansas form

- Arkansas general 497296664 form

Find out other Www in govdorDOR Indiana Department Of Revenue

- How Do I Sign Massachusetts Car Dealer Warranty Deed

- How To Sign Nebraska Car Dealer Resignation Letter

- How Can I Sign New Jersey Car Dealer Arbitration Agreement

- How Can I Sign Ohio Car Dealer Cease And Desist Letter

- How To Sign Ohio Car Dealer Arbitration Agreement

- How To Sign Oregon Car Dealer Limited Power Of Attorney

- How To Sign Pennsylvania Car Dealer Quitclaim Deed

- How Can I Sign Pennsylvania Car Dealer Quitclaim Deed

- Sign Rhode Island Car Dealer Agreement Safe

- Sign South Dakota Car Dealer Limited Power Of Attorney Now

- Sign Wisconsin Car Dealer Quitclaim Deed Myself

- Sign Wisconsin Car Dealer Quitclaim Deed Free

- Sign Virginia Car Dealer POA Safe

- Sign Wisconsin Car Dealer Quitclaim Deed Fast

- How To Sign Wisconsin Car Dealer Rental Lease Agreement

- How To Sign Wisconsin Car Dealer Quitclaim Deed

- How Do I Sign Wisconsin Car Dealer Quitclaim Deed

- Sign Wyoming Car Dealer Purchase Order Template Mobile

- Sign Arizona Charity Business Plan Template Easy

- Can I Sign Georgia Charity Warranty Deed