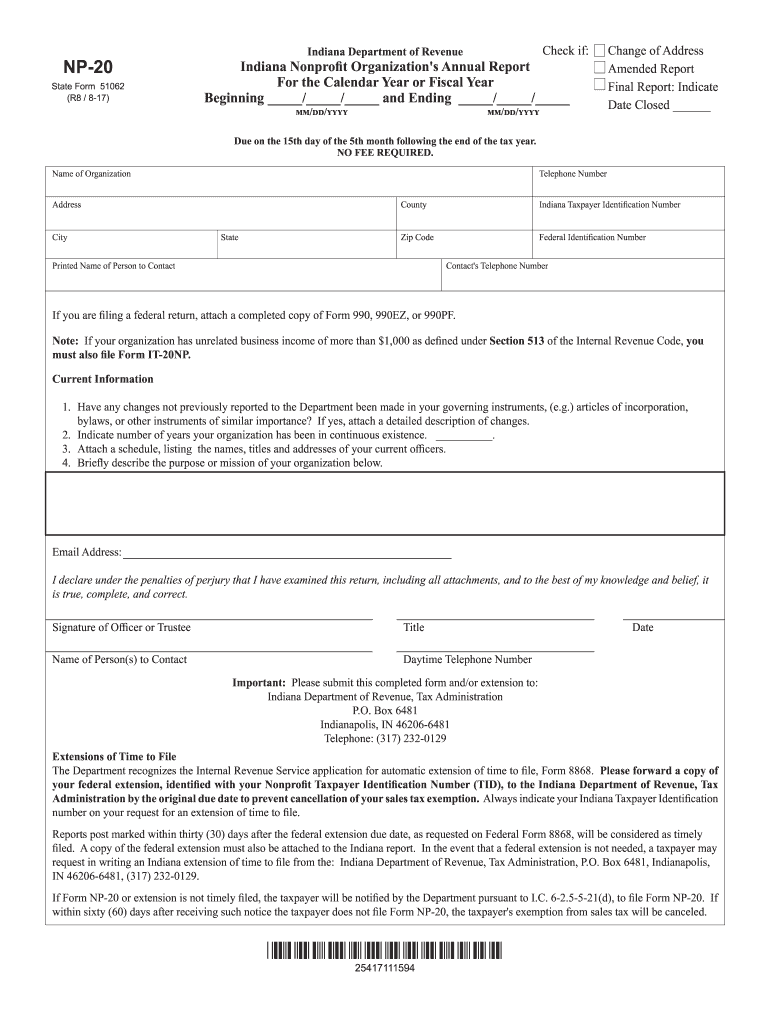

Np 20 Form 2017

What is the Np 20 Form

The Np 20 Form is a specific document used primarily for tax reporting purposes in the United States. This form is essential for individuals and businesses to accurately report their income and calculate their tax obligations. It is designed to collect various types of financial information, ensuring compliance with federal tax regulations. Understanding the purpose and requirements of the Np 20 Form is crucial for anyone looking to fulfill their tax responsibilities effectively.

How to use the Np 20 Form

Using the Np 20 Form involves several steps to ensure accurate completion and submission. First, gather all necessary financial documents, including income statements and previous tax returns. Next, fill out the form with the required information, ensuring that all entries are accurate and complete. After filling out the form, review it for any errors before signing and dating it. Finally, submit the form according to the specified guidelines, which may include electronic submission or mailing to the appropriate tax authority.

Steps to complete the Np 20 Form

Completing the Np 20 Form requires careful attention to detail. Follow these steps:

- Gather all relevant financial documentation, such as W-2s, 1099s, and other income records.

- Begin filling out the form, starting with personal identification information, including your name, address, and Social Security number.

- Input your income details accurately, ensuring all figures are correct and correspond to your documentation.

- Complete any additional sections that apply to your specific tax situation, such as deductions or credits.

- Review the entire form for accuracy and completeness before signing.

- Submit the completed form as per the instructions provided, either electronically or by mail.

Legal use of the Np 20 Form

The Np 20 Form has legal significance as it serves as an official document for tax reporting. It must be completed in accordance with guidelines set by the Internal Revenue Service (IRS) to ensure its validity. Filing the form accurately and on time is essential to avoid potential penalties or legal issues. Furthermore, using an eSignature for the Np 20 Form is legally accepted, provided it meets the requirements of the ESIGN Act, ensuring that electronic submissions are treated with the same legal weight as traditional handwritten signatures.

Filing Deadlines / Important Dates

Timely filing of the Np 20 Form is crucial to avoid penalties. Generally, the deadline for submitting this form aligns with the annual tax filing deadline, which is typically April 15th for individuals. However, specific deadlines may vary based on individual circumstances, such as extensions or special tax situations. It is important to stay informed about any changes to filing dates, especially in light of recent adjustments made by the IRS during extraordinary circumstances.

Required Documents

To complete the Np 20 Form accurately, certain documents are required. These typically include:

- Income statements such as W-2s and 1099s.

- Previous tax returns for reference.

- Documentation supporting any deductions or credits claimed.

- Identification documents, including Social Security numbers.

Having these documents ready will streamline the process of completing the form and ensure accuracy in reporting.

Form Submission Methods (Online / Mail / In-Person)

The Np 20 Form can be submitted through various methods, depending on the preferences of the filer and the requirements of the tax authority. Common submission methods include:

- Online submission through authorized e-filing platforms, which often provide a quicker processing time.

- Mailing a physical copy of the completed form to the designated tax office.

- In-person submission at local tax offices, which may be necessary for specific cases or to address particular concerns.

Choosing the right submission method can affect the processing time and confirmation of receipt, so it is advisable to consider the options carefully.

Quick guide on how to complete np 20 form 2017

Your assistance manual on how to prepare your Np 20 Form

If you’re wondering how to finish and submit your Np 20 Form, here are some straightforward instructions on how to simplify tax filing.

To start, you simply need to create your airSlate SignNow account to transform the way you manage documents online. airSlate SignNow is an extremely user-friendly and robust document solution that allows you to edit, draft, and finalize your income tax forms effortlessly. With its editor, you can toggle between text, checkboxes, and eSignatures, and revise information as necessary. Optimize your tax administration with advanced PDF editing, eSigning, and convenient sharing capabilities.

Follow the steps below to finalize your Np 20 Form in just a few minutes:

- Create your account and start working on PDFs in no time.

- Browse our catalog to locate any IRS tax form; search through versions and schedules.

- Click Get form to access your Np 20 Form in our editor.

- Complete the necessary fillable fields with your details (text, numbers, check marks).

- Utilize the Sign Tool to apply your legally-recognized eSignature (if needed).

- Examine your document and correct any inaccuracies.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to file your taxes electronically with airSlate SignNow. Please be aware that submitting on paper can lead to return discrepancies and postpone reimbursements. Certainly, before e-filing your taxes, verify the IRS website for submission regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct np 20 form 2017

FAQs

-

How do I fill out the CAT Application Form 2017?

CAT 2017 registration opened on August 9, 2017 will close on September 20 at 5PM. CAT online registration form and application form is a single document divided in 5 pages and is to be completed online. The 1st part of CAT online registration form requires your personal details. After completing your online registration, IIMs will send you CAT 2017 registration ID. With this unique ID, you will login to online registration form which will also contain application form and registration form.CAT Registration and application form will require you to fill up your academic details, uploading of photograph, signature and requires category certificates as per the IIMs prescribed format for CAT registration. CAT online application form 2017 consists of programme details on all the 20 IIMs. Candidates have to tick by clicking on the relevant programmes of the IIMs for which they wish to attend the personal Interview Process.

-

How do I fill out the Delhi Polytechnic 2017 form?

Delhi Polytechnic (CET DELHI) entrance examination form has been published. You can visit Welcome to CET Delhi and fill the online form. For more details you can call @ 7042426818

-

How do I fill out the SSC CHSL 2017-18 form?

Its very easy task, you have to just put this link in your browser SSC, this page will appearOn this page click on Apply buttonthere a dialog box appears, in that dialog box click on CHSL a link will come “ Click here to apply” and you will signNow to registration page.I hope you all have understood the procedure. All the best for your exam

-

How do I fill out the NTSE form 2017- 2018 Jharkhand online?

You cannot gove NTSE online or at your own level you have to belong to a school which is conducting ntse. Then download the form online from the page of ntse, fill it and submit it to your school along with fee. If your school is not conducting ntse, sorry to say but you cannot give ntse. It can only be given through, no institutions are allowed to conduct thos exam.

-

How do I fill out the UPSEAT 2017 application forms?

UPESEAT is a placement test directed by the University of Petroleum and Energy Studies. This inclination examination is called as the University of Petroleum and Energy Studies Engineering Entrance Test (UPESEAT). It is essentially an essential sort examination which permits the possibility to apply for the different designing projects on the web. visit - HOW TO FILL THE UPSEAT 2017 APPLICATION FORMS

Create this form in 5 minutes!

How to create an eSignature for the np 20 form 2017

How to generate an eSignature for your Np 20 Form 2017 in the online mode

How to generate an electronic signature for the Np 20 Form 2017 in Chrome

How to generate an eSignature for signing the Np 20 Form 2017 in Gmail

How to generate an eSignature for the Np 20 Form 2017 right from your smartphone

How to generate an eSignature for the Np 20 Form 2017 on iOS devices

How to create an electronic signature for the Np 20 Form 2017 on Android

People also ask

-

What is the Np 20 Form and how is it used?

The Np 20 Form is a critical document used for reporting certain tax information in various jurisdictions. It helps streamline the eSigning and document management process, especially for businesses utilizing airSlate SignNow's features. By integrating the Np 20 Form into your workflows, you can ensure compliance and efficiency.

-

How can I easily eSign the Np 20 Form with airSlate SignNow?

With airSlate SignNow, eSigning the Np 20 Form is a straightforward process. Simply upload the document, add the required signers, and send it out for signatures. Our platform provides a secure and reliable way to complete the Np 20 Form electronically.

-

Is there a cost associated with using the Np 20 Form on airSlate SignNow?

airSlate SignNow offers various pricing plans that cater to different business needs. The use of the Np 20 Form itself does not have an additional fee, but subscription costs may vary based on the features you choose. It's best to review our pricing page for detailed information.

-

What are the main benefits of using the Np 20 Form through airSlate SignNow?

Using the Np 20 Form with airSlate SignNow provides several benefits, including enhanced compliance and faster turnaround times. Additionally, our platform allows for easy tracking and management of the signing process, ensuring that all necessary parties are informed and engaged throughout.

-

Can I integrate the Np 20 Form with other applications using airSlate SignNow?

Yes, airSlate SignNow supports integrations with numerous applications, allowing you to easily incorporate the Np 20 Form into your existing workflows. Popular integrations include CRM systems, project management tools, and cloud storage services to optimize your processes effectively.

-

What features does airSlate SignNow offer for filling out the Np 20 Form?

AirSlate SignNow offers robust features for filling out the Np 20 Form, including drag-and-drop fields, templates, and collaborative editing. These tools make it easy for teams to work together, ensuring that the Np 20 Form is completed accurately and efficiently.

-

Is the Np 20 Form legally binding when signed electronically?

Yes, the Np 20 Form signed electronically through airSlate SignNow is legally binding in many jurisdictions. Our platform complies with eSignature laws, ensuring that your signed documents hold the same legal weight as traditional paper-based signatures.

Get more for Np 20 Form

Find out other Np 20 Form

- Electronic signature Oregon Police Living Will Now

- Electronic signature Pennsylvania Police Executive Summary Template Free

- Electronic signature Pennsylvania Police Forbearance Agreement Fast

- How Do I Electronic signature Pennsylvania Police Forbearance Agreement

- How Can I Electronic signature Pennsylvania Police Forbearance Agreement

- Electronic signature Washington Real Estate Purchase Order Template Mobile

- Electronic signature West Virginia Real Estate Last Will And Testament Online

- Electronic signature Texas Police Lease Termination Letter Safe

- How To Electronic signature Texas Police Stock Certificate

- How Can I Electronic signature Wyoming Real Estate Quitclaim Deed

- Electronic signature Virginia Police Quitclaim Deed Secure

- How Can I Electronic signature West Virginia Police Letter Of Intent

- How Do I Electronic signature Washington Police Promissory Note Template

- Electronic signature Wisconsin Police Permission Slip Free

- Electronic signature Minnesota Sports Limited Power Of Attorney Fast

- Electronic signature Alabama Courts Quitclaim Deed Safe

- How To Electronic signature Alabama Courts Stock Certificate

- Can I Electronic signature Arkansas Courts Operating Agreement

- How Do I Electronic signature Georgia Courts Agreement

- Electronic signature Georgia Courts Rental Application Fast