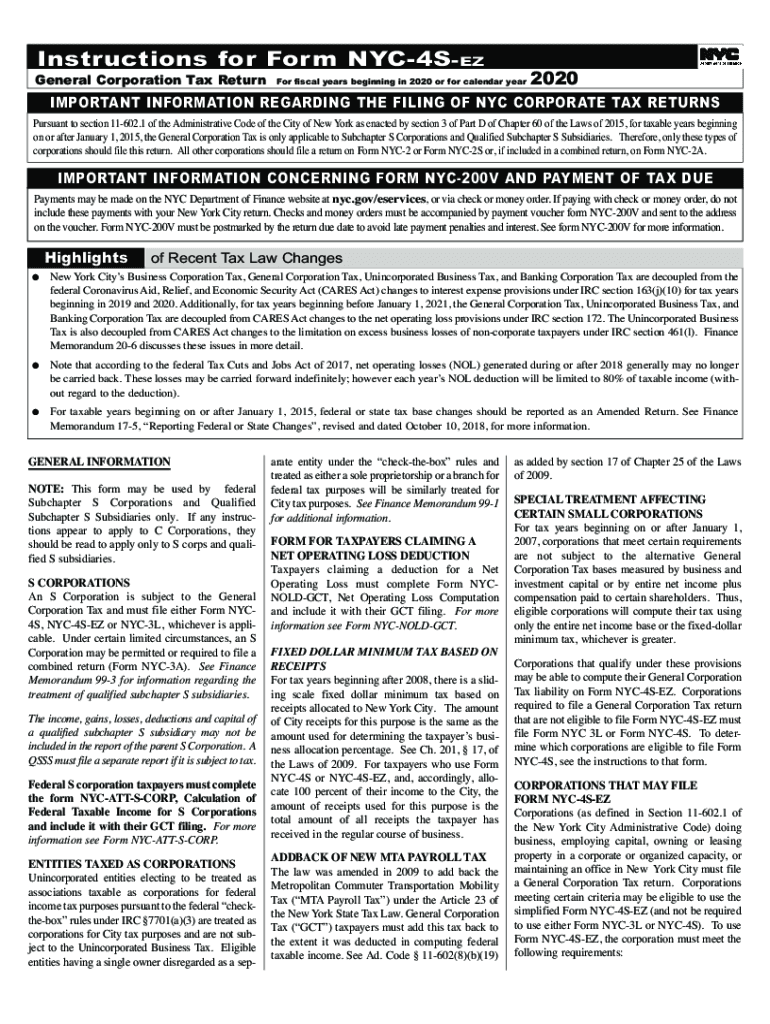

for Fiscal Years Beginning in or for Calendar Year 2020

What is the NYC 2A Instructions 2020?

The NYC 2A instructions 2020 provide essential guidance for taxpayers in New York City regarding the completion of the NYC 2A form. This form is primarily used for reporting business income and calculating the appropriate tax obligations for the fiscal year. Understanding the specific requirements outlined in the instructions is crucial for ensuring compliance with local tax regulations.

Steps to Complete the NYC 2A Instructions 2020

Completing the NYC 2A form involves several key steps:

- Gather all necessary financial documents, including income statements and expense records.

- Carefully read the instructions to understand the specific sections of the form.

- Fill out each section accurately, ensuring that all numbers are correct and align with your financial records.

- Review the completed form for any errors or omissions before submission.

- Submit the form either electronically or by mail, following the guidelines provided in the instructions.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines associated with the NYC 2A form. Generally, the form must be submitted by the due date specified for your tax year. For businesses operating on a calendar year, the deadline typically falls on March fifteenth of the following year. Late submissions may incur penalties, so timely filing is essential.

Legal Use of the NYC 2A Instructions 2020

The NYC 2A instructions 2020 are legally binding and must be adhered to by all taxpayers required to file the form. Compliance with these instructions ensures that taxpayers accurately report their income and fulfill their tax obligations. Failure to follow the instructions may result in penalties or additional scrutiny from tax authorities.

Required Documents for NYC 2A Submission

To complete the NYC 2A form, certain documents are required. These typically include:

- Financial statements, such as profit and loss statements.

- Records of business expenses.

- Any prior year tax returns that may provide context for the current filing.

- Supporting documentation for deductions claimed.

Who Issues the NYC 2A Form?

The NYC 2A form is issued by the New York City Department of Finance. This department is responsible for administering the city's tax laws and ensuring compliance among businesses operating within its jurisdiction. Taxpayers can find the form and its instructions on the official website of the Department of Finance.

Quick guide on how to complete for fiscal years beginning in 2020 or for calendar year

Complete For Fiscal Years Beginning In Or For Calendar Year with ease on any device

Digital document management has gained popularity among companies and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, enabling you to obtain the correct version and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and eSign your documents swiftly and without issues. Manage For Fiscal Years Beginning In Or For Calendar Year on any device using the airSlate SignNow Android or iOS applications and enhance any document-related procedure today.

The most convenient method to edit and eSign For Fiscal Years Beginning In Or For Calendar Year effortlessly

- Locate For Fiscal Years Beginning In Or For Calendar Year and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize key sections of your documents or redact sensitive details with the tools that airSlate SignNow specifically offers for this purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and click the Done button to preserve your changes.

- Select the method of delivering your form: via email, text message (SMS), an invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign For Fiscal Years Beginning In Or For Calendar Year to ensure exceptional communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct for fiscal years beginning in 2020 or for calendar year

Create this form in 5 minutes!

How to create an eSignature for the for fiscal years beginning in 2020 or for calendar year

The way to make an eSignature for your PDF file in the online mode

The way to make an eSignature for your PDF file in Chrome

The way to make an eSignature for putting it on PDFs in Gmail

How to make an electronic signature straight from your smartphone

The way to make an electronic signature for a PDF file on iOS devices

How to make an electronic signature for a PDF document on Android

People also ask

-

What are the NYC 2A instructions for 2020?

The NYC 2A instructions for 2020 provide detailed guidelines on how to fill out and submit the 2A forms required by the New York City tax authorities. Understanding these instructions is crucial for accurate tax filing and compliance. For more insights, consider browsing resources specifically tailored to the 'nyc 2a instructions 2020'.

-

How can airSlate SignNow assist with completing NYC 2A forms?

AirSlate SignNow simplifies the process of completing NYC 2A forms by providing a user-friendly platform for eSigning and document management. Our solution allows you to gather signatures and distribute documents efficiently, ensuring compliance with the 'nyc 2a instructions 2020'. Make tax season easier with our seamless integration.

-

Are there any costs associated with using airSlate SignNow for NYC 2A instructions?

Yes, airSlate SignNow offers various pricing plans designed to suit different business needs. Our plans are cost-effective while providing robust features to streamline your workflow, including easy access to manage 'nyc 2a instructions 2020'. Check our pricing page for specific details.

-

What features does airSlate SignNow offer for document signing?

AirSlate SignNow includes a variety of features such as customizable templates, automated workflows, and multi-party signing options. These features enhance the eSigning process, making it easier to comply with requirements like the 'nyc 2a instructions 2020'. Our platform is designed to improve productivity and reduce turnaround time.

-

Can airSlate SignNow be integrated with other applications?

Yes, airSlate SignNow offers integrations with numerous third-party applications that support various business processes. This capability allows you to incorporate eSigning seamlessly into your existing systems while adhering to guidelines such as the 'nyc 2a instructions 2020'. Explore our integrations to enhance your workflow.

-

What are the benefits of using airSlate SignNow for NYC 2A document management?

Using airSlate SignNow for managing NYC 2A documents streamlines your workflow, enhances accessibility, and ensures document security. By optimizing your management practices, you can effectively follow the 'nyc 2a instructions 2020' and reduce errors in your submissions. Efficiency and compliance go hand in hand with our platform.

-

Is training available for new users of airSlate SignNow?

Absolutely. We provide comprehensive training resources, including webinars and tutorials, for new users to get acquainted with airSlate SignNow. This ensures that you can efficiently utilize our features in alignment with the 'nyc 2a instructions 2020', making the onboarding process smoother for your team.

Get more for For Fiscal Years Beginning In Or For Calendar Year

- Wa domestic contract form

- Office lease agreement washington form

- Commercial sublease washington form

- Washington lease agreement 497429753 form

- Notice to lessor exercising option to purchase washington form

- Assignment of lease and rent from borrower to lender washington form

- Assignment of lease from lessor with notice of assignment washington form

- Tenant abandoned property form

Find out other For Fiscal Years Beginning In Or For Calendar Year

- Can I Sign Kentucky Performance Contract

- How Do I Sign Florida Investment Contract

- Sign Colorado General Power of Attorney Template Simple

- How Do I Sign Florida General Power of Attorney Template

- Sign South Dakota Sponsorship Proposal Template Safe

- Sign West Virginia Sponsorship Proposal Template Free

- Sign Tennessee Investment Contract Safe

- Sign Maryland Consulting Agreement Template Fast

- Sign California Distributor Agreement Template Myself

- How Do I Sign Louisiana Startup Business Plan Template

- Can I Sign Nevada Startup Business Plan Template

- Sign Rhode Island Startup Business Plan Template Now

- How Can I Sign Connecticut Business Letter Template

- Sign Georgia Business Letter Template Easy

- Sign Massachusetts Business Letter Template Fast

- Can I Sign Virginia Business Letter Template

- Can I Sign Ohio Startup Costs Budget Worksheet

- How Do I Sign Maryland 12 Month Sales Forecast

- How Do I Sign Maine Profit and Loss Statement

- How To Sign Wisconsin Operational Budget Template