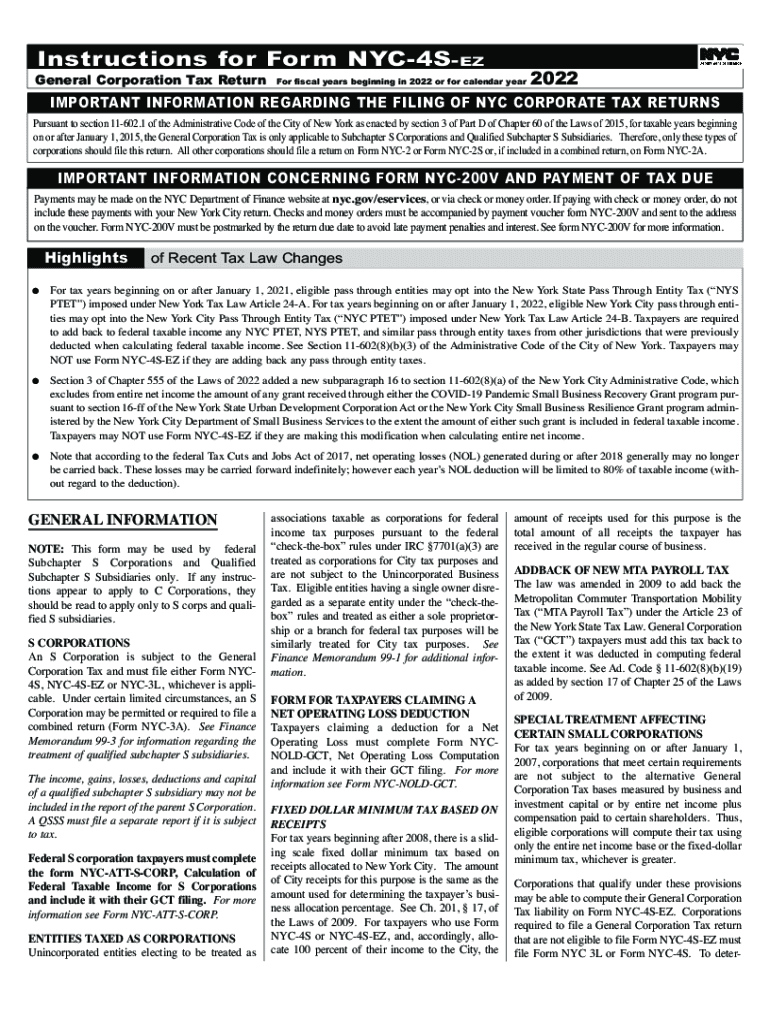

NYC 4S EZ Instructions Form 2022

What is the NYC 4S EZ Instructions Form

The NYC 4S EZ Instructions Form is a simplified tax document designed for eligible New York City residents. This form allows taxpayers to report their income and calculate their tax obligations in a straightforward manner. The NYC 4S EZ is particularly beneficial for individuals with uncomplicated tax situations, enabling them to file their taxes efficiently. It streamlines the process, ensuring that users can complete their tax filings without unnecessary complications.

Steps to complete the NYC 4S EZ Instructions Form

Completing the NYC 4S EZ Instructions Form involves several straightforward steps:

- Gather necessary documents, including your W-2 forms and any other income statements.

- Access the NYC 4S EZ Instructions Form online or through authorized distribution points.

- Carefully fill out the form, ensuring all personal information is accurate and complete.

- Calculate your total income and applicable deductions as outlined in the instructions.

- Review the completed form for any errors before submission.

- Submit the form either electronically or by mailing it to the appropriate tax authority.

Legal use of the NYC 4S EZ Instructions Form

The NYC 4S EZ Instructions Form is legally recognized as a valid method for filing taxes in New York City. To ensure the form's legal standing, it must be filled out accurately and submitted within the designated deadlines. Compliance with local tax laws and regulations is essential, as failure to do so may result in penalties or legal repercussions. Utilizing a reliable eSignature solution, like airSlate SignNow, can enhance the legal validity of the submitted form by providing secure and verifiable signatures.

Filing Deadlines / Important Dates

Filing deadlines for the NYC 4S EZ Instructions Form typically align with federal tax deadlines. It is crucial to be aware of these dates to avoid late fees and penalties. Generally, the deadline for submitting your NYC 4S EZ is April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. Staying informed about these important dates ensures timely compliance with tax obligations.

Required Documents

To complete the NYC 4S EZ Instructions Form, several documents are necessary:

- W-2 forms from employers, detailing your annual income.

- Any additional income statements, such as 1099 forms for freelance work.

- Documentation for deductions, if applicable, such as receipts for charitable contributions.

- Identification information, including your Social Security number.

Who Issues the Form

The NYC 4S EZ Instructions Form is issued by the New York City Department of Finance. This department is responsible for managing tax collection and ensuring compliance with local tax laws. The form is made available to residents through various channels, including online platforms and local tax offices. It is essential to use the most current version of the form to ensure compliance with any recent tax law changes.

Quick guide on how to complete nyc 4s ez instructions form

Prepare NYC 4S EZ Instructions Form effortlessly on any device

Digital document management has gained traction among companies and individuals. It offers a perfect eco-friendly substitute for traditional printed and signed documents, as you can access the right form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents promptly without interruptions. Manage NYC 4S EZ Instructions Form on any platform using airSlate SignNow Android or iOS applications and enhance any document-related workflow today.

The easiest method to alter and eSign NYC 4S EZ Instructions Form effortlessly

- Obtain NYC 4S EZ Instructions Form and then click Get Form to begin.

- Make use of the tools we offer to finalize your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that function.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click the Done button to save your changes.

- Select how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

No more worries about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets all your needs in document management with just a few clicks from any device you prefer. Modify and eSign NYC 4S EZ Instructions Form and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct nyc 4s ez instructions form

Create this form in 5 minutes!

How to create an eSignature for the nyc 4s ez instructions form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is nyc4sez tax?

NYC4SEZ tax refers to tax incentives offered to businesses in New York City that operate within the Special Economic Zones. These incentives can signNowly reduce the tax burden on companies, making it easier for them to thrive in a competitive environment.

-

How can airSlate SignNow help with nyc4sez tax documentation?

AirSlate SignNow simplifies the documentation process associated with nyc4sez tax by allowing users to quickly eSign and send vital tax-related documents. This ensures that businesses can efficiently manage their tax obligations and take advantage of available incentives.

-

What features does airSlate SignNow offer for managing nyc4sez tax forms?

AirSlate SignNow includes features like template creation, document sharing, and advanced eSigning workflows tailored for nyc4sez tax forms. These features streamline the collection and management of necessary forms, helping businesses remain compliant without hassle.

-

Is there a cost associated with using airSlate SignNow for nyc4sez tax-related documents?

Yes, airSlate SignNow offers various pricing plans depending on the level of features needed. Each plan is designed to provide businesses with an affordable way to manage and eSign documents, including those related to nyc4sez tax.

-

Can airSlate SignNow integrate with other tax software for nyc4sez tax management?

Absolutely! AirSlate SignNow seamlessly integrates with leading tax management software, enhancing your ability to handle nyc4sez tax requirements. These integrations save time and improve accuracy by ensuring all necessary documents are readily accessible.

-

What are the benefits of using airSlate SignNow for nyc4sez tax processes?

Using airSlate SignNow for nyc4sez tax processes allows businesses to reduce paperwork, enhance workflow efficiency, and ensure secure document transactions. Additionally, it helps companies stay compliant with local tax regulations, ultimately saving time and resources.

-

How secure is my information when using airSlate SignNow for nyc4sez tax?

AirSlate SignNow prioritizes the security of your documents, employing advanced encryption protocols to protect sensitive nyc4sez tax information. This commitment to security ensures that your data remains confidential and safe from unauthorized access.

Get more for NYC 4S EZ Instructions Form

Find out other NYC 4S EZ Instructions Form

- Electronic signature Kentucky Business Operations Quitclaim Deed Mobile

- Electronic signature Pennsylvania Car Dealer POA Later

- Electronic signature Louisiana Business Operations Last Will And Testament Myself

- Electronic signature South Dakota Car Dealer Quitclaim Deed Myself

- Help Me With Electronic signature South Dakota Car Dealer Quitclaim Deed

- Electronic signature South Dakota Car Dealer Affidavit Of Heirship Free

- Electronic signature Texas Car Dealer Purchase Order Template Online

- Electronic signature Texas Car Dealer Purchase Order Template Fast

- Electronic signature Maryland Business Operations NDA Myself

- Electronic signature Washington Car Dealer Letter Of Intent Computer

- Electronic signature Virginia Car Dealer IOU Fast

- How To Electronic signature Virginia Car Dealer Medical History

- Electronic signature Virginia Car Dealer Separation Agreement Simple

- Electronic signature Wisconsin Car Dealer Contract Simple

- Electronic signature Wyoming Car Dealer Lease Agreement Template Computer

- How Do I Electronic signature Mississippi Business Operations Rental Application

- Electronic signature Missouri Business Operations Business Plan Template Easy

- Electronic signature Missouri Business Operations Stock Certificate Now

- Electronic signature Alabama Charity Promissory Note Template Computer

- Electronic signature Colorado Charity Promissory Note Template Simple