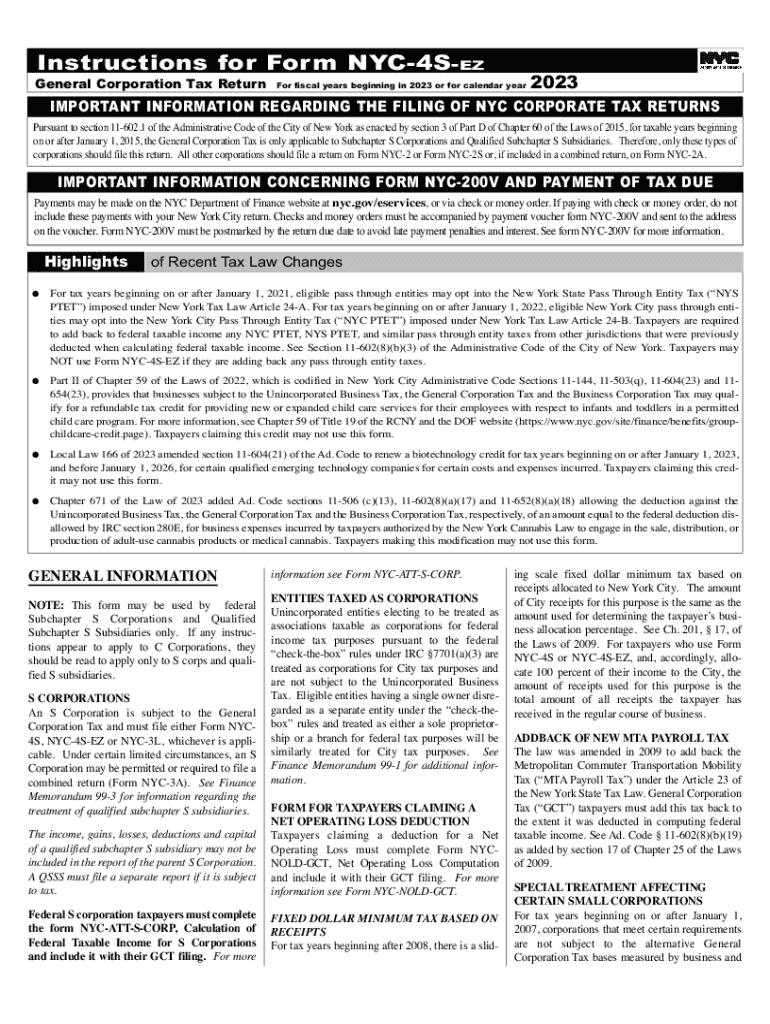

Instructions for Form NYC4SEZ General Corporation 2023

Understanding NYC Form 2A Instructions for General Corporations

The NYC Form 2A instructions provide essential guidance for general corporations operating in New York City. This form is critical for businesses to ensure compliance with local regulations and tax obligations. The instructions outline the necessary steps and requirements for completing the form accurately, which is essential for maintaining good standing with the city and state authorities.

Steps to Complete NYC Form 2A

Completing the NYC Form 2A involves several key steps:

- Gather all required information about your corporation, including its legal name, address, and tax identification number.

- Review the specific sections of the form to understand what information is needed for each part.

- Fill out the form carefully, ensuring that all entries are accurate and complete to avoid delays.

- Double-check your calculations and any supporting documentation that may be required.

- Submit the form by the designated deadline to avoid any penalties.

Required Documents for NYC Form 2A

To successfully complete NYC Form 2A, certain documents are necessary. These typically include:

- Proof of the corporation's formation, such as the Articles of Incorporation.

- Financial statements that reflect the corporation's income and expenses.

- Any prior year tax returns that may be relevant to the current filing.

- Documentation supporting any deductions or credits claimed on the form.

Filing Deadlines for NYC Form 2A

Being aware of the filing deadlines is crucial for compliance. The NYC Form 2A must generally be submitted by:

- The 15th day of the fourth month following the end of your corporation's tax year.

- Any extensions granted must also be adhered to, and it is advisable to file for extensions well in advance.

Submission Methods for NYC Form 2A

Corporations have several options for submitting NYC Form 2A:

- Online submission through the NYC Department of Finance website, which is often the fastest method.

- Mailing a physical copy of the form to the specified address provided in the instructions.

- In-person submission at designated city offices, which may be useful for those requiring immediate assistance.

Legal Use of NYC Form 2A

NYC Form 2A is legally binding and must be used in accordance with local laws. It is essential for corporations to:

- Ensure that all information provided is truthful and accurate.

- Understand the implications of submitting false information, which can result in penalties or legal action.

- Keep a copy of the submitted form and any correspondence for their records.

Key Elements of NYC Form 2A

When filling out NYC Form 2A, certain key elements must be addressed:

- The corporation's identification details, including name and address.

- Financial information, including income, deductions, and credits.

- Signature of an authorized representative, confirming the accuracy of the information provided.

Create this form in 5 minutes or less

Find and fill out the correct instructions for form nyc4sez general corporation

Create this form in 5 minutes!

How to create an eSignature for the instructions for form nyc4sez general corporation

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the NYC Form 2A instructions for 2023?

The NYC Form 2A instructions for 2023 provide detailed guidance on how to complete the form accurately. This includes information on required fields, submission deadlines, and any supporting documents needed. Following these instructions ensures compliance with local regulations.

-

How can airSlate SignNow help with NYC Form 2A submissions?

airSlate SignNow simplifies the process of submitting NYC Form 2A by allowing users to eSign and send documents securely. Our platform ensures that all necessary fields are filled out correctly, reducing the risk of errors. This makes it easier to adhere to the NYC Form 2A instructions for 2023.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow offers a range of features including customizable templates, real-time tracking, and secure cloud storage. These features enhance the document management process, making it easier to follow the NYC Form 2A instructions for 2023. Users can also collaborate seamlessly with team members.

-

Is airSlate SignNow cost-effective for small businesses?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes, including small businesses. Our pricing plans are flexible and cater to various needs, ensuring that you can manage your documents efficiently while following the NYC Form 2A instructions for 2023 without breaking the bank.

-

Can I integrate airSlate SignNow with other software?

Absolutely! airSlate SignNow offers integrations with various software applications, enhancing your workflow. This allows you to manage your documents and follow the NYC Form 2A instructions for 2023 seamlessly within your existing systems.

-

What are the benefits of using airSlate SignNow for eSigning?

Using airSlate SignNow for eSigning provides numerous benefits, including increased efficiency and reduced turnaround times. Our platform ensures that you can complete and submit documents in line with the NYC Form 2A instructions for 2023 quickly and securely. This leads to improved productivity for your business.

-

How secure is airSlate SignNow for handling sensitive documents?

airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect your sensitive documents. This ensures that your submissions, including those related to the NYC Form 2A instructions for 2023, are handled with the utmost care and confidentiality.

Get more for Instructions For Form NYC4SEZ General Corporation

Find out other Instructions For Form NYC4SEZ General Corporation

- How To eSign Illinois Rental application

- How To eSignature Maryland Affidavit of Identity

- eSignature New York Affidavit of Service Easy

- How To eSignature Idaho Affidavit of Title

- eSign Wisconsin Real estate forms Secure

- How To eSign California Real estate investment proposal template

- eSignature Oregon Affidavit of Title Free

- eSign Colorado Real estate investment proposal template Simple

- eSign Louisiana Real estate investment proposal template Fast

- eSign Wyoming Real estate investment proposal template Free

- How Can I eSign New York Residential lease

- eSignature Colorado Cease and Desist Letter Later

- How Do I eSignature Maine Cease and Desist Letter

- How Can I eSignature Maine Cease and Desist Letter

- eSignature Nevada Cease and Desist Letter Later

- Help Me With eSign Hawaii Event Vendor Contract

- How To eSignature Louisiana End User License Agreement (EULA)

- How To eSign Hawaii Franchise Contract

- eSignature Missouri End User License Agreement (EULA) Free

- eSign Delaware Consulting Agreement Template Now