Form ST 108, Sales Tax Affidavit Untitled Transport Trailer, Office 2020-2026

What is the ST-108 Form?

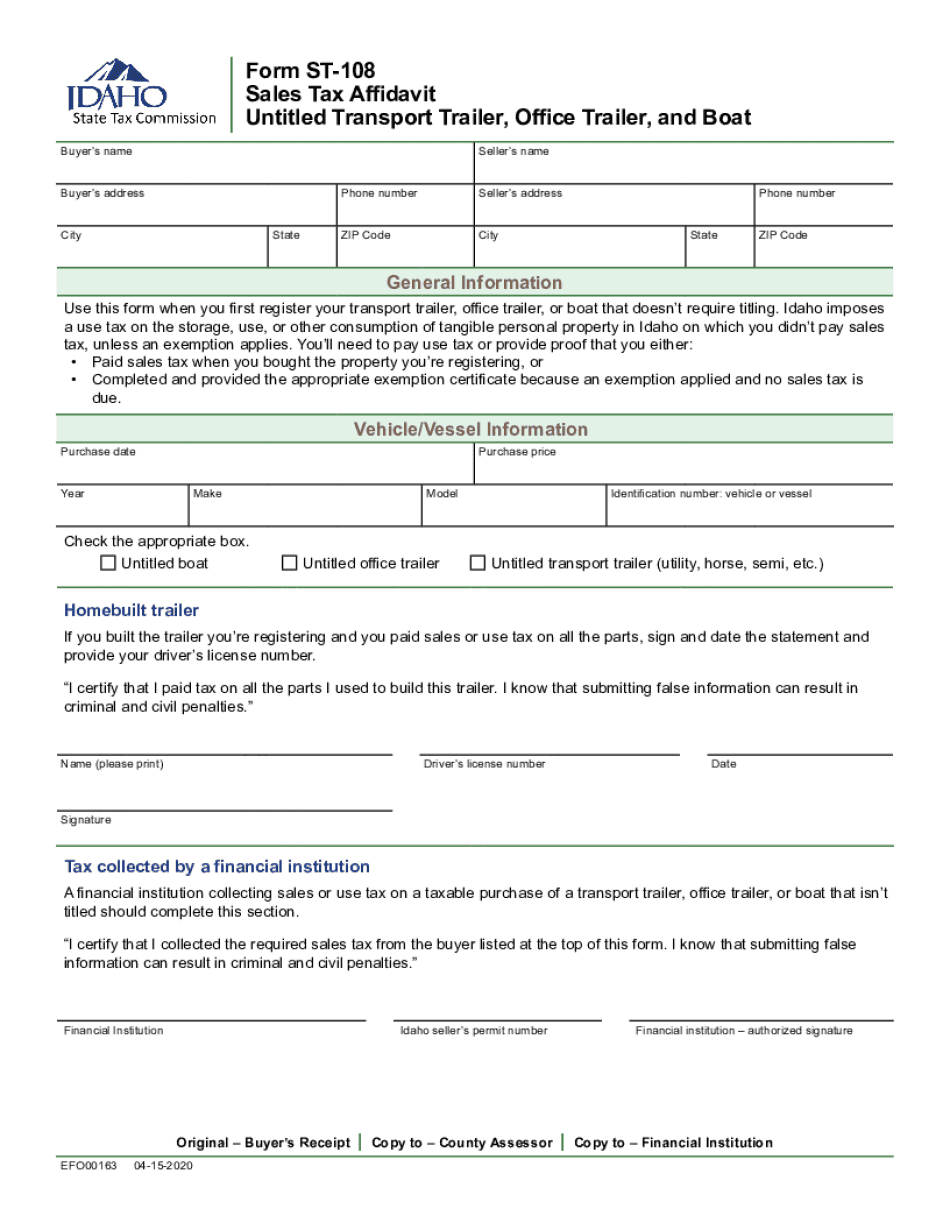

The ST-108 form, also known as the Sales Tax Affidavit for Untitled Transport Trailers, is a document used in the state of Idaho. This form is essential for individuals or businesses that are purchasing untitled transport trailers and need to affirm their eligibility for sales tax exemptions. The ST-108 serves as a declaration that the purchaser is not liable for sales tax on the transaction, provided they meet specific criteria outlined by the Idaho State Tax Commission.

Steps to Complete the ST-108 Form

Completing the ST-108 form involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including the trailer's details and the buyer's information. Next, accurately fill out each section of the form, ensuring that all required fields are completed. It is crucial to review the form for any errors before submission. Finally, sign and date the form to validate it. If you are submitting the form electronically, ensure that you use a secure eSignature solution to maintain the form's legal integrity.

Legal Use of the ST-108 Form

The ST-108 form is legally recognized in Idaho as a valid document for claiming sales tax exemptions on untitled transport trailers. To ensure its legal standing, the form must be filled out correctly and submitted to the appropriate authorities. The Idaho State Tax Commission outlines specific guidelines that must be followed for the form to be accepted. Compliance with these regulations is essential to avoid any potential legal issues or penalties.

Required Documents for the ST-108 Form

When filling out the ST-108 form, certain documents may be required to support the claims made within the affidavit. Typically, this includes proof of identity, such as a driver's license or state ID, and any documentation that verifies the purchase of the untitled transport trailer. Additionally, if the buyer is a business entity, documentation proving the business's tax-exempt status may also be necessary. Having these documents ready can facilitate a smoother submission process.

State-Specific Rules for the ST-108 Form

Idaho has specific rules governing the use of the ST-108 form. These rules dictate who qualifies for a sales tax exemption and under what circumstances. For example, only certain types of purchases may be eligible, and the buyer must provide accurate information regarding their tax status. It is important to familiarize yourself with these state-specific regulations to ensure compliance and avoid any issues during the filing process.

Form Submission Methods

The ST-108 form can be submitted through various methods, including online submission, mailing, or in-person delivery to the Idaho State Tax Commission. Each method has its own requirements and processing times. For online submissions, it is recommended to use a secure platform that ensures the integrity of the document. If mailing, ensure that the form is sent to the correct address and consider using a tracking method for confirmation of receipt.

Quick guide on how to complete form st 108 sales tax affidavit untitled transport trailer office

Effortlessly Complete Form ST 108, Sales Tax Affidavit Untitled Transport Trailer, Office on Any Device

Digital document management has gained traction among businesses and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow provides all the tools required to create, modify, and electronically sign your documents quickly and efficiently. Manage Form ST 108, Sales Tax Affidavit Untitled Transport Trailer, Office on any device using the airSlate SignNow Android or iOS applications and streamline any document-centric procedure today.

The Easiest Way to Modify and eSign Form ST 108, Sales Tax Affidavit Untitled Transport Trailer, Office Effortlessly

- Locate Form ST 108, Sales Tax Affidavit Untitled Transport Trailer, Office and click Get Form to initiate the process.

- Use the tools we provide to fill out your form.

- Emphasize important sections of your documents or redact sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your alterations.

- Choose how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the issues of lost or misplaced documents, tedious form searching, or errors that necessitate printing new document versions. airSlate SignNow meets your document management needs with just a few clicks on the device of your choice. Modify and eSign Form ST 108, Sales Tax Affidavit Untitled Transport Trailer, Office to ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form st 108 sales tax affidavit untitled transport trailer office

Create this form in 5 minutes!

How to create an eSignature for the form st 108 sales tax affidavit untitled transport trailer office

How to create an eSignature for your PDF document in the online mode

How to create an eSignature for your PDF document in Chrome

The best way to make an electronic signature for putting it on PDFs in Gmail

The best way to generate an eSignature from your mobile device

How to generate an electronic signature for a PDF document on iOS devices

The best way to generate an eSignature for a PDF file on Android devices

People also ask

-

What is the st108 form and why is it important?

The st108 form is a document used for sales tax exemption in certain states, allowing exempt organizations to obtain purchases without incurring sales tax. Understanding the st108 form is crucial for businesses to ensure compliance and save on unnecessary expenses related to sales tax.

-

How does airSlate SignNow help in managing the st108 form?

airSlate SignNow provides a streamlined solution for sending and eSigning the st108 form securely. With its user-friendly interface, businesses can easily manage their sales tax exemption documents, reducing delays and ensuring timely approvals from relevant authorities.

-

Is there a cost associated with using airSlate SignNow for the st108 form?

Yes, airSlate SignNow offers various pricing plans to cater to different business needs. These plans provide access to features that simplify the process of managing the st108 form and other essential documents, making it a cost-effective choice for organizations.

-

Can the st108 form be customized within airSlate SignNow?

Absolutely! Users can customize the st108 form within airSlate SignNow to meet specific requirements. This feature enhances the overall efficiency of document management, enabling businesses to tailor the form to their unique needs.

-

What features does airSlate SignNow offer for completing the st108 form?

airSlate SignNow offers features like document templates, automated workflows, and electronic signatures to simplify completing the st108 form. By leveraging these tools, businesses can enhance accuracy and speed up the process of obtaining necessary approvals.

-

Can I integrate airSlate SignNow with other software for processing the st108 form?

Yes, airSlate SignNow supports integrations with various popular software applications, making it easy to process the st108 form alongside your existing systems. This compatibility helps businesses streamline their workflow and ensures that all documents are managed efficiently.

-

What are the benefits of using airSlate SignNow for the st108 form?

Utilizing airSlate SignNow for the st108 form offers numerous benefits, including enhanced security, improved compliance, and faster turnaround times. These advantages lead to a more efficient workflow, allowing businesses to focus on their core operations without worrying about document management.

Get more for Form ST 108, Sales Tax Affidavit Untitled Transport Trailer, Office

- Ju 130210 return of service washington form

- Ju 130215 acceptance of service washington form

- Motion order stay form

- Ju 130350 progress report and followup washington form

- Washington truancy form

- Ju 130600 request of community truancy board for further action washington form

- Ju 130610 order on request of community truancy board for further action washington form

- Show cause hearing washington form

Find out other Form ST 108, Sales Tax Affidavit Untitled Transport Trailer, Office

- Electronic signature Kentucky Business Operations Quitclaim Deed Mobile

- Electronic signature Pennsylvania Car Dealer POA Later

- Electronic signature Louisiana Business Operations Last Will And Testament Myself

- Electronic signature South Dakota Car Dealer Quitclaim Deed Myself

- Help Me With Electronic signature South Dakota Car Dealer Quitclaim Deed

- Electronic signature South Dakota Car Dealer Affidavit Of Heirship Free

- Electronic signature Texas Car Dealer Purchase Order Template Online

- Electronic signature Texas Car Dealer Purchase Order Template Fast

- Electronic signature Maryland Business Operations NDA Myself

- Electronic signature Washington Car Dealer Letter Of Intent Computer

- Electronic signature Virginia Car Dealer IOU Fast

- How To Electronic signature Virginia Car Dealer Medical History

- Electronic signature Virginia Car Dealer Separation Agreement Simple

- Electronic signature Wisconsin Car Dealer Contract Simple

- Electronic signature Wyoming Car Dealer Lease Agreement Template Computer

- How Do I Electronic signature Mississippi Business Operations Rental Application

- Electronic signature Missouri Business Operations Business Plan Template Easy

- Electronic signature Missouri Business Operations Stock Certificate Now

- Electronic signature Alabama Charity Promissory Note Template Computer

- Electronic signature Colorado Charity Promissory Note Template Simple