St108 2014

What is the ST108?

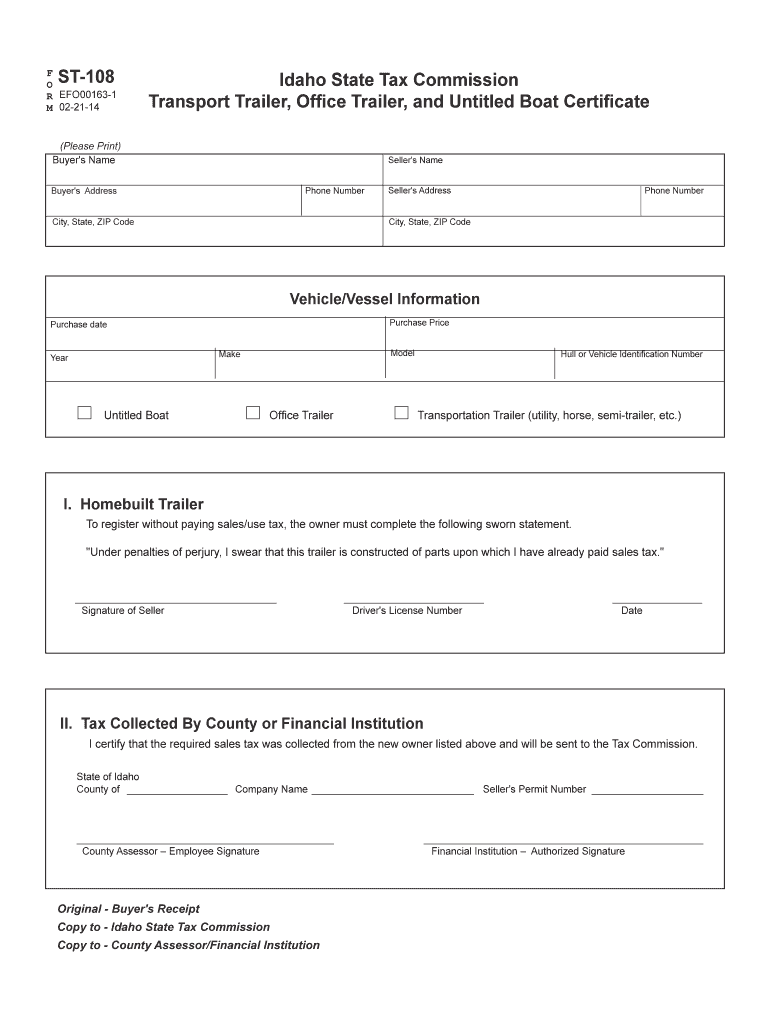

The ST108 form, known as the Idaho Property Tax Exemption Application, is a document used by property owners in Idaho to apply for property tax exemptions. This form is essential for individuals and businesses seeking to reduce their property tax burden by qualifying for specific exemptions available under Idaho law. The ST108 is particularly relevant for those who own agricultural land, residential properties, or properties used for charitable purposes.

How to Use the ST108

Using the ST108 form involves several steps to ensure that applicants provide the necessary information accurately. First, gather all relevant documentation that supports your claim for exemption, such as proof of ownership and any applicable financial statements. Next, fill out the form with accurate details, including your name, address, and the specific exemption you are applying for. Once completed, submit the form to your local county assessor’s office for review. It is important to ensure that all information is correct to avoid delays in processing.

Steps to Complete the ST108

Completing the ST108 form requires careful attention to detail. Follow these steps:

- Obtain the ST108 form from your local county assessor’s office or download it from the Idaho state website.

- Fill in your personal information, including your name, mailing address, and property details.

- Indicate the type of exemption you are applying for and provide any necessary supporting documents.

- Review the form for accuracy and completeness before submission.

- Submit the completed form to your local county assessor’s office by the specified deadline.

Legal Use of the ST108

The ST108 form is legally recognized in Idaho for applying for property tax exemptions. To be considered valid, the form must be completed accurately and submitted within the required timeframe. Compliance with state regulations is essential to ensure that the application is processed without issues. The exemptions granted through this form can significantly impact the financial obligations of property owners, making it crucial to understand the legal implications of the information provided.

Key Elements of the ST108

Several key elements must be included in the ST108 form to ensure its validity:

- Property Information: Details about the property for which the exemption is being requested, including location and type.

- Applicant Information: Full name and contact information of the applicant.

- Exemption Type: Clearly indicate the specific exemption being applied for, such as agricultural or charitable.

- Supporting Documentation: Any required documents that substantiate the claim for exemption.

Filing Deadlines / Important Dates

Filing deadlines for the ST108 form vary depending on the type of exemption being sought. Generally, property owners should submit their applications by April 15th of the assessment year to qualify for the exemption for that year. It is advisable to check with the local county assessor’s office for specific deadlines and any updates to the filing process. Missing the deadline may result in the denial of the exemption request.

Quick guide on how to complete st108

Handle St108 effortlessly on any device

Managing documents online has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can locate the correct template and securely keep it online. airSlate SignNow equips you with all the resources needed to create, modify, and electronically sign your documents quickly without holdups. Manage St108 on any device using airSlate SignNow's Android or iOS applications and enhance any document-based operation today.

The easiest way to modify and electronically sign St108 with ease

- Obtain St108 and click Get Form to begin.

- Use the features we provide to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive details with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes moments and carries the same legal validity as a traditional handwritten signature.

- Review all the information and click on the Done button to save your updates.

- Select your preferred method to share your form, whether via email, SMS, or invite link, or download it to your computer.

Eliminate worries about lost or misfiled documents, tedious form hunts, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from your chosen device. Modify and electronically sign St108 and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct st108

Create this form in 5 minutes!

How to create an eSignature for the st108

The best way to generate an electronic signature for a PDF document online

The best way to generate an electronic signature for a PDF document in Google Chrome

The way to generate an eSignature for signing PDFs in Gmail

The way to make an electronic signature right from your smart phone

The way to make an eSignature for a PDF document on iOS

The way to make an electronic signature for a PDF on Android OS

People also ask

-

What is st108 and how does it relate to airSlate SignNow?

The st108 is a specific document type that can be efficiently managed using airSlate SignNow. With its user-friendly interface, businesses can easily create, send, and eSign st108 documents securely. This integration ensures that all your important documents are handled seamlessly and go through the eSignature process without any hassles.

-

How does the pricing for st108 document eSigning work with airSlate SignNow?

airSlate SignNow offers competitive pricing plans that cater to various business needs for managing st108 documents. The pricing is typically subscription-based, allowing businesses to choose a plan that best fits their operational requirements. Additionally, our cost-effective solution ensures you get the best value while managing your st108 documents.

-

What features does airSlate SignNow provide for handling st108 documents?

airSlate SignNow provides several features specifically designed for handling st108 documents, including customizable templates, secure storage, and real-time tracking of document status. These features simplify the eSigning process and enhance collaboration among users. With airSlate SignNow, managing st108 documents becomes streamlined and efficient.

-

Can I integrate other tools with airSlate SignNow for st108 document management?

Yes, airSlate SignNow offers seamless integrations with various tools and applications, enhancing how you manage st108 documents. You can easily integrate with platforms like Google Drive, Salesforce, and more to streamline your workflows. This flexibility allows for enhanced productivity and efficient handling of all your st108 documents.

-

Are there any compliance measures for eSigning st108 documents with airSlate SignNow?

Absolutely! airSlate SignNow complies with various legal standards and regulations, ensuring that eSigning st108 documents is both secure and legally binding. We follow industry best practices to maintain data privacy and integrity. You can confidently eSign your st108 documents, knowing they meet compliance requirements.

-

How does airSlate SignNow improve the workflow for st108 document processing?

airSlate SignNow signNowly improves workflow for st108 document processing by automating various tasks involved in the signing process. This includes features like automated reminders and notifications, which help keep all parties on track. As a result, your team can focus on more strategic activities rather than manual document management.

-

What are the main benefits of using airSlate SignNow for st108 documents?

Using airSlate SignNow for st108 documents offers numerous benefits, including time savings, improved accuracy, and enhanced security. The platform simplifies the eSigning experience, allowing users to complete crucial paperwork swiftly and securely. Additionally, you'll benefit from reduced paper usage and more streamlined operations.

Get more for St108

- Warranty deed from two individuals to llc wisconsin form

- Subcontractors claim of lien by corporation or llc wisconsin form

- Public demand for payment individual wisconsin form

- Quitclaim deed by two individuals to corporation wisconsin form

- Wi warranty deed form

- Transfer death deed 497430551 form

- Demand payment form

- Lien rights wisconsin form

Find out other St108

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors