Form T5001 'Application for Tax Shelter Identification 2020

What is the Form T5001 'Application For Tax Shelter Identification

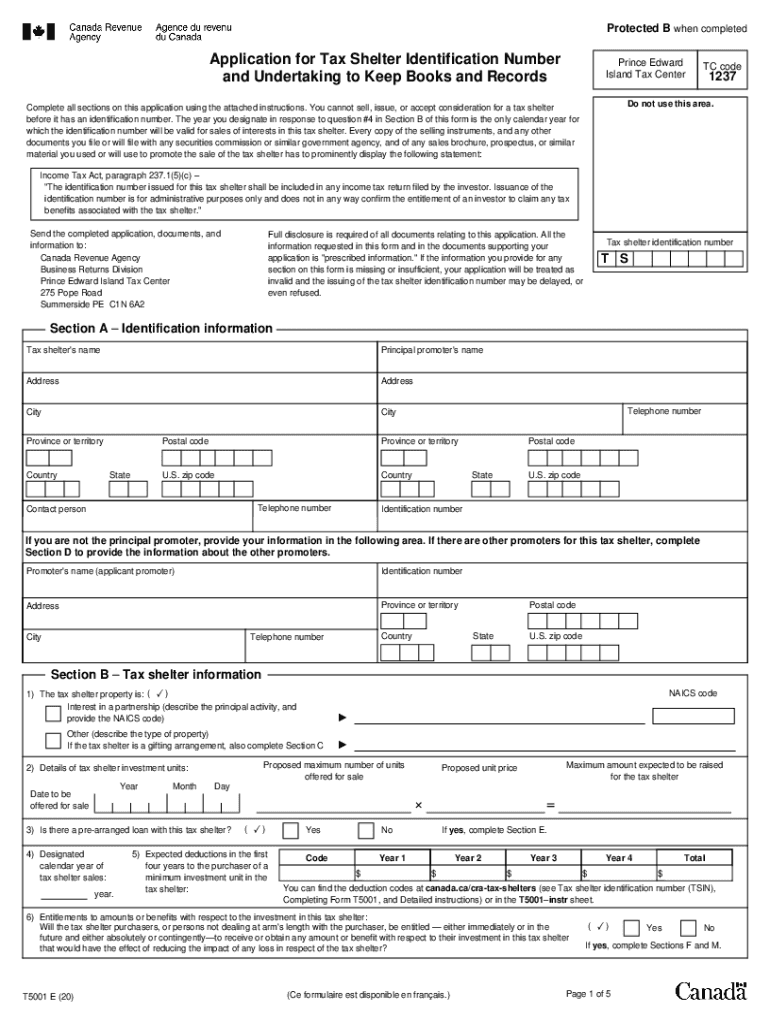

The Form T5001, known as the Application for Tax Shelter Identification, is a crucial document used in the United States for taxpayers seeking to register a tax shelter. This form is essential for individuals and entities that wish to obtain a tax shelter identification number, which is necessary for compliance with tax regulations. The T5001 serves to provide the Internal Revenue Service (IRS) with detailed information about the tax shelter, including its structure, purpose, and the individuals involved. Proper completion of this form helps ensure that the tax shelter is recognized by the IRS, allowing taxpayers to take advantage of any associated tax benefits.

How to use the Form T5001 'Application For Tax Shelter Identification

Using the Form T5001 involves several key steps to ensure accurate and compliant submission. First, gather all necessary information about the tax shelter, including its name, address, and the tax shelter registration number if applicable. Next, fill out the form with precise details, ensuring that all required fields are completed. Once the form is filled out, it should be submitted to the IRS, either electronically or by mail, depending on the specific instructions provided for the form. It is important to keep a copy of the submitted form for your records, as this will be useful for future reference or in case of any inquiries from the IRS.

Steps to complete the Form T5001 'Application For Tax Shelter Identification

Completing the Form T5001 requires careful attention to detail. Follow these steps for successful completion:

- Gather Information: Collect all relevant details about the tax shelter, including its name, address, and the names of individuals involved.

- Fill Out the Form: Complete each section of the form accurately, ensuring that all required fields are filled in.

- Review for Accuracy: Double-check the information provided for any errors or omissions.

- Submit the Form: Send the completed form to the IRS via the specified method, either electronically or by mail.

- Keep Records: Retain a copy of the submitted form and any correspondence with the IRS for your records.

Legal use of the Form T5001 'Application For Tax Shelter Identification

The legal use of the Form T5001 is governed by IRS regulations that outline the requirements for tax shelters. It is essential for taxpayers to understand that submitting this form is a declaration of intent to register a tax shelter. The information provided must be truthful and complete to avoid potential penalties. Compliance with IRS guidelines ensures that the tax shelter is recognized legally, allowing taxpayers to benefit from any associated tax advantages. Failure to comply with these regulations can lead to significant consequences, including fines or disqualification of the tax shelter status.

Eligibility Criteria

Eligibility to use the Form T5001 is primarily determined by the nature of the tax shelter being registered. Generally, individuals or entities that are involved in a tax shelter arrangement and wish to obtain a tax shelter identification number can apply. This includes partnerships, corporations, and other business entities that meet the IRS criteria for tax shelters. It is important to review the specific eligibility requirements outlined by the IRS to ensure compliance and successful registration.

Filing Deadlines / Important Dates

Filing deadlines for the Form T5001 are critical to ensure compliance with IRS regulations. Typically, the form must be submitted by a specific date, which may vary depending on the type of tax shelter and the fiscal year. It is advisable to check the IRS guidelines for the most current deadlines. Missing these deadlines can result in penalties or delays in the processing of the tax shelter registration, impacting the ability to claim any associated tax benefits.

Quick guide on how to complete form t5001 ampquotapplication for tax shelter identification

Complete Form T5001 'Application For Tax Shelter Identification effortlessly on any device

Web-based document organization has become favored by businesses and individuals alike. It offers an excellent eco-friendly substitute for traditional printed and signed documents, as you can locate the necessary form and securely save it online. airSlate SignNow equips you with all the resources required to create, edit, and eSign your documents swiftly without delays. Manage Form T5001 'Application For Tax Shelter Identification on any device using airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to edit and eSign Form T5001 'Application For Tax Shelter Identification with ease

- Locate Form T5001 'Application For Tax Shelter Identification and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Mark pertinent sections of your documents or redact sensitive information with features that airSlate SignNow provides specifically for this purpose.

- Produce your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all details and then click on the Done button to finalize your changes.

- Select your preferred method for sending your form, be it email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management requirements in just a few clicks from any device you choose. Edit and eSign Form T5001 'Application For Tax Shelter Identification and guarantee excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form t5001 ampquotapplication for tax shelter identification

Create this form in 5 minutes!

How to create an eSignature for the form t5001 ampquotapplication for tax shelter identification

How to make an electronic signature for a PDF in the online mode

How to make an electronic signature for a PDF in Chrome

The best way to create an eSignature for putting it on PDFs in Gmail

The best way to make an electronic signature from your smart phone

The best way to generate an eSignature for a PDF on iOS devices

The best way to make an electronic signature for a PDF file on Android OS

People also ask

-

What is the 'form t 5001' and how does airSlate SignNow assist with it?

The 'form t 5001' is a crucial document used for tax purposes. airSlate SignNow allows users to easily upload, fill out, and electronically sign this form, streamlining the process and ensuring compliance with tax regulations.

-

What features does airSlate SignNow offer for managing 'form t 5001'?

airSlate SignNow provides features such as templates, customizable fields, and secure storage specifically for 'form t 5001'. These tools simplify the completion and management of the form, enhancing overall efficiency and accuracy.

-

How much does it cost to use airSlate SignNow for 'form t 5001'?

Pricing for airSlate SignNow is competitive and varies based on the plan you choose. All plans offer comprehensive features that include 'form t 5001' handling, ensuring you get excellent value for your investment.

-

Can airSlate SignNow integrate with other software while handling 'form t 5001'?

Yes, airSlate SignNow offers robust integrations with popular software like Google Drive, Salesforce, and more, facilitating a seamless workflow for managing 'form t 5001'. This integration capability helps in centralizing all document processes in one place.

-

What are the benefits of using airSlate SignNow for 'form t 5001'?

The main benefits of using airSlate SignNow for 'form t 5001' include increased efficiency, reduced processing time, and enhanced security. Additionally, eSigning allows for quicker turnaround, making tax compliance more manageable for businesses.

-

Is it easy to eSign 'form t 5001' with airSlate SignNow?

Absolutely! airSlate SignNow provides a user-friendly interface that makes eSigning 'form t 5001' intuitive. Users can sign documents from any device, ensuring that your workflows remain smooth and efficient.

-

How does airSlate SignNow ensure the security of 'form t 5001' documents?

airSlate SignNow employs industry-standard security measures including encrypted storage and secure eSignature technology to protect 'form t 5001' documents. This commitment to security means you can manage sensitive documents with confidence.

Get more for Form T5001 'Application For Tax Shelter Identification

- Washington small business startup package washington form

- Washington property 497430262 form

- Washington annual corporation form

- Wa bylaws form

- Wa professional corporation form

- Sample organizational minutes for a washington professional corporation washington form

- Sample transmittal letter for articles of incorporation washington form

- Personal restraint petition form

Find out other Form T5001 'Application For Tax Shelter Identification

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template

- How Can I eSignature Nevada Doctors Lease Agreement Template

- eSignature Finance & Tax Accounting Presentation Arkansas Secure

- eSignature Arkansas Government Affidavit Of Heirship Online

- eSignature New Jersey Doctors Permission Slip Mobile

- eSignature Colorado Government Residential Lease Agreement Free

- Help Me With eSignature Colorado Government Medical History