Ifta Quarterly Tax Form Fill Online, Printable, Fillable 2019

What is the IFTA Quarterly Tax Form?

The IFTA quarterly tax form is a crucial document for businesses operating commercial vehicles across state lines in the United States. This form, often referred to as the IFTA quarterly fuel tax return, is used to report fuel use and calculate taxes owed to various jurisdictions. It consolidates information on fuel purchases and mileage accrued in each state, ensuring compliance with the International Fuel Tax Agreement (IFTA). By filing this form, businesses can streamline their tax obligations and avoid penalties associated with non-compliance.

Steps to Complete the IFTA Quarterly Tax Form

Completing the IFTA quarterly tax form involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary data, including total miles driven in each state and the amount of fuel purchased. Next, accurately fill out the form, entering the mileage and fuel information for each jurisdiction. After completing the form, review it for any errors and ensure all required signatures are included. Finally, submit the form by the designated deadline to avoid penalties.

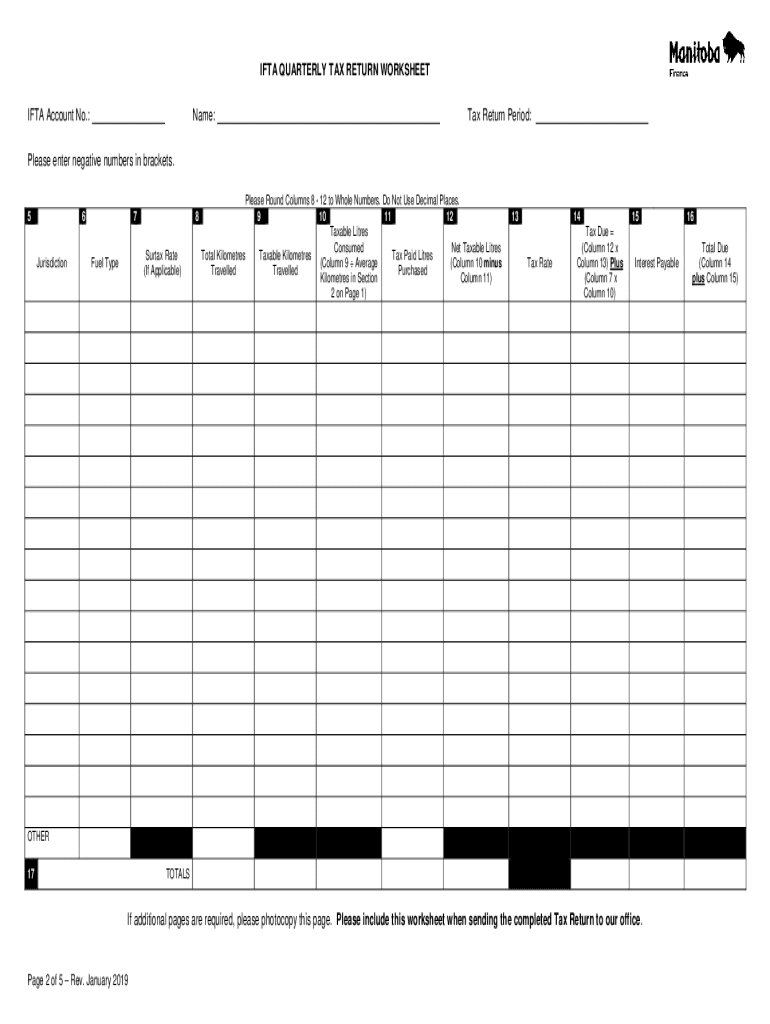

Key Elements of the IFTA Quarterly Tax Form

The IFTA quarterly tax form contains several essential components that must be accurately completed. Key elements include:

- Jurisdiction Information: Details about each state where fuel was purchased and miles were driven.

- Mileage Data: Total miles driven in each jurisdiction, which is critical for calculating taxes.

- Fuel Purchase Data: Amount of fuel purchased in each jurisdiction, necessary for tax calculations.

- Tax Calculation: A section to calculate the total tax owed based on mileage and fuel data.

Filing Deadlines / Important Dates

Filing deadlines for the IFTA quarterly tax form are critical for compliance. Typically, the form must be submitted within one month following the end of each quarter. The specific deadlines are as follows:

- First Quarter: April 30

- Second Quarter: July 31

- Third Quarter: October 31

- Fourth Quarter: January 31

It is essential for businesses to adhere to these deadlines to avoid penalties and interest on late submissions.

Legal Use of the IFTA Quarterly Tax Form

The legal use of the IFTA quarterly tax form is governed by the International Fuel Tax Agreement, which mandates accurate reporting of fuel use and mileage across participating jurisdictions. This form serves as a legal document that must be completed truthfully and submitted on time. Failure to comply with IFTA regulations can result in penalties, including fines and potential audits. Therefore, it is crucial for businesses to understand their legal obligations when completing and submitting this form.

Form Submission Methods

Businesses have several options for submitting the IFTA quarterly tax form. These methods include:

- Online Submission: Many jurisdictions allow electronic filing through their official websites, providing a convenient and efficient way to submit forms.

- Mail: The form can be printed and mailed to the appropriate state tax authority. Ensure it is sent well before the deadline to allow for processing time.

- In-Person: Some businesses may choose to deliver the form in person to their local tax office, ensuring immediate confirmation of receipt.

Quick guide on how to complete ifta quarterly tax form fill online printable fillable

Complete Ifta Quarterly Tax Form Fill Online, Printable, Fillable effortlessly on any device

Online document management has become increasingly popular with businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides all the tools you require to create, edit, and eSign your documents swiftly without delays. Manage Ifta Quarterly Tax Form Fill Online, Printable, Fillable on any device using airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest way to edit and eSign Ifta Quarterly Tax Form Fill Online, Printable, Fillable without hassle

- Locate Ifta Quarterly Tax Form Fill Online, Printable, Fillable and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method of delivering your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets your needs in document management with just a few clicks from your chosen device. Edit and eSign Ifta Quarterly Tax Form Fill Online, Printable, Fillable and ensure effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ifta quarterly tax form fill online printable fillable

Create this form in 5 minutes!

How to create an eSignature for the ifta quarterly tax form fill online printable fillable

How to make an electronic signature for a PDF file online

How to make an electronic signature for a PDF file in Google Chrome

The best way to create an electronic signature for signing PDFs in Gmail

The best way to make an electronic signature from your mobile device

The best way to generate an eSignature for a PDF file on iOS

The best way to make an electronic signature for a PDF file on Android devices

People also ask

-

What is the IFTA form NB quarterly and why is it important?

The IFTA form NB quarterly is a specific tax document used by motor carriers in New Brunswick to report fuel tax. This form is crucial for compliance with state regulations, allowing carriers to accurately report miles traveled and fuel used across jurisdictions, thus enabling them to fulfill their tax obligations efficiently.

-

How does airSlate SignNow simplify the IFTA form NB quarterly submission process?

AirSlate SignNow streamlines the submission of the IFTA form NB quarterly by allowing users to complete and sign the form electronically. Our user-friendly interface makes it easy to input information, ensuring accuracy and reducing the chances of errors that could lead to compliance issues.

-

Is there a cost associated with using airSlate SignNow for IFTA form NB quarterly?

Yes, using airSlate SignNow does involve a subscription fee, which varies depending on the chosen plan. However, our pricing remains competitive, and many customers find that the time and resources saved using our platform for the IFTA form NB quarterly outweigh the expense.

-

Can I integrate airSlate SignNow with other software for handling IFTA form NB quarterly?

Absolutely! airSlate SignNow offers integrations with a variety of business applications, making it easier to manage your IFTA form NB quarterly alongside your other operations. This connectivity allows for seamless data transfer and helps maintain organized records efficiently.

-

What are the benefits of eSigning the IFTA form NB quarterly with airSlate SignNow?

eSigning the IFTA form NB quarterly with airSlate SignNow enhances security and expedites the signing process. Our platform ensures that your documents are legally compliant and securely stored, giving you peace of mind and allowing you to file your forms in a timely manner.

-

Does airSlate SignNow provide support for users filling out the IFTA form NB quarterly?

Yes, airSlate SignNow offers dedicated customer support for users needing assistance with the IFTA form NB quarterly. Our support team is available to help troubleshoot any issues and provide guidance on efficiently completing and submitting the form.

-

How can I track the status of my IFTA form NB quarterly submissions with airSlate SignNow?

With airSlate SignNow, you can easily track the status of your IFTA form NB quarterly submissions through our dashboard. This feature allows you to see whether your documents have been viewed, signed, and submitted, ensuring you always have control over your filing process.

Get more for Ifta Quarterly Tax Form Fill Online, Printable, Fillable

- Ju 080110 hearing findings and conclusions on declination hearing fnfcl washington form

- Ju 080120 order on declination hearing ordj washington form

- Ju 090100 motion for assignment of lawyer washington form

- Wa lawyer form

- Lawyer form

- Juvenile child form

- Wa child welfare form

- Proof mailing form 497430136

Find out other Ifta Quarterly Tax Form Fill Online, Printable, Fillable

- How To Electronic signature Idaho Police Last Will And Testament

- How Do I Electronic signature North Dakota Real Estate Quitclaim Deed

- Can I Electronic signature Ohio Real Estate Agreement

- Electronic signature Ohio Real Estate Quitclaim Deed Later

- How To Electronic signature Oklahoma Real Estate Business Plan Template

- How Can I Electronic signature Georgia Sports Medical History

- Electronic signature Oregon Real Estate Quitclaim Deed Free

- Electronic signature Kansas Police Arbitration Agreement Now

- Electronic signature Hawaii Sports LLC Operating Agreement Free

- Electronic signature Pennsylvania Real Estate Quitclaim Deed Fast

- Electronic signature Michigan Police Business Associate Agreement Simple

- Electronic signature Mississippi Police Living Will Safe

- Can I Electronic signature South Carolina Real Estate Work Order

- How To Electronic signature Indiana Sports RFP

- How Can I Electronic signature Indiana Sports RFP

- Electronic signature South Dakota Real Estate Quitclaim Deed Now

- Electronic signature South Dakota Real Estate Quitclaim Deed Safe

- Electronic signature Indiana Sports Forbearance Agreement Myself

- Help Me With Electronic signature Nevada Police Living Will

- Electronic signature Real Estate Document Utah Safe