Motor Fuel International Fuel Tax Agreement IFTA Forms 2021-2026

What is the Motor Fuel International Fuel Tax Agreement IFTA Forms

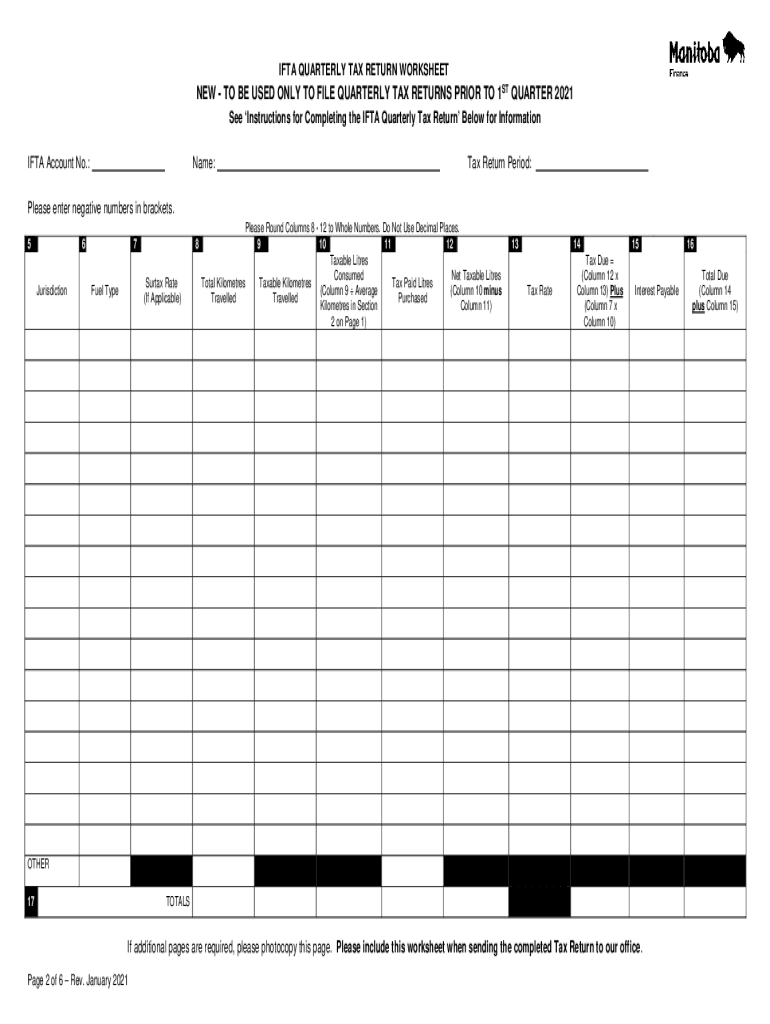

The International Fuel Tax Agreement (IFTA) is a cooperative agreement among the contiguous United States and Canadian provinces that simplifies the reporting of fuel use by motor carriers operating in multiple jurisdictions. The IFTA forms are essential for reporting fuel taxes owed to various states based on the miles driven and fuel consumed. These forms help ensure compliance with state regulations and facilitate the equitable distribution of tax revenues among participating jurisdictions.

Steps to complete the Motor Fuel International Fuel Tax Agreement IFTA Forms

Completing the IFTA forms involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation, including mileage records and fuel purchase receipts for the reporting period. Next, calculate the total miles driven and the amount of fuel consumed in each jurisdiction. Then, fill out the IFTA report form, detailing the mileage and fuel usage for each state. Finally, review the completed form for accuracy before submitting it to the appropriate state authority, either online or via mail.

Legal use of the Motor Fuel International Fuel Tax Agreement IFTA Forms

The IFTA forms are legally binding documents that must be filled out accurately to avoid penalties. Each jurisdiction has specific regulations governing the use of these forms, and compliance with IFTA requirements is crucial for maintaining good standing with tax authorities. The forms must be submitted by the designated filing deadlines to ensure that all taxes owed are properly accounted for and paid.

Filing Deadlines / Important Dates

Filing deadlines for the IFTA forms are typically set on a quarterly basis. Carriers must submit their IFTA reports by the last day of the month following the end of each quarter. For example, the first quarter ends on March 31, and the report is due by April 30. It is important for carriers to keep track of these dates to avoid late fees and potential penalties for non-compliance.

Examples of using the Motor Fuel International Fuel Tax Agreement IFTA Forms

Examples of using IFTA forms include scenarios where a trucking company operates across multiple states and needs to report fuel consumption accurately. For instance, if a carrier drives through California, Texas, and Florida, they must report the miles driven and fuel purchased in each state on their IFTA forms. This ensures that the correct amount of fuel tax is paid to each jurisdiction based on their specific rates and regulations.

Required Documents

To complete the IFTA forms, several documents are necessary. These include:

- Mileage logs detailing miles driven in each jurisdiction

- Fuel purchase receipts for all fuel bought during the reporting period

- Previous IFTA reports for reference

Having these documents organized and readily available can streamline the completion process and ensure compliance with reporting requirements.

Form Submission Methods (Online / Mail / In-Person)

IFTA forms can be submitted through various methods, depending on the state regulations. Many jurisdictions offer online submission options, allowing for quick and efficient filing. Alternatively, forms can be mailed to the appropriate state agency or submitted in person at designated locations. It is essential to check the specific submission guidelines for each state to ensure that the forms are submitted correctly and on time.

Quick guide on how to complete motor fuel international fuel tax agreement ifta forms

Effortlessly Complete Motor Fuel International Fuel Tax Agreement IFTA Forms on Any Device

Managing documents online has gained immense popularity among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to locate the necessary form and securely save it online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents quickly without delays. Access Motor Fuel International Fuel Tax Agreement IFTA Forms on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The Easiest Method to Edit and Electronically Sign Motor Fuel International Fuel Tax Agreement IFTA Forms

- Obtain Motor Fuel International Fuel Tax Agreement IFTA Forms and select Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with features specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method to send your document, whether by email, SMS, invitation link, or download it to your computer.

Forget the hassle of misplaced or lost documents, tedious form searches, or mistakes that require new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device of your choosing. Revise and electronically sign Motor Fuel International Fuel Tax Agreement IFTA Forms to ensure effective communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct motor fuel international fuel tax agreement ifta forms

Create this form in 5 minutes!

How to create an eSignature for the motor fuel international fuel tax agreement ifta forms

The way to generate an eSignature for a PDF document in the online mode

The way to generate an eSignature for a PDF document in Chrome

How to generate an eSignature for putting it on PDFs in Gmail

The way to generate an eSignature from your mobile device

The way to create an eSignature for a PDF document on iOS devices

The way to generate an eSignature for a PDF file on Android devices

People also ask

-

What is an IFTA form and why do I need it?

An IFTA form, or International Fuel Tax Agreement form, is a necessary document for commercial vehicle operators traveling across multiple jurisdictions in the United States and Canada. It simplifies the reporting of fuel usage and helps businesses pay the correct fuel taxes. Using the right IFTA form can save time and avoid penalties.

-

How can airSlate SignNow help with my IFTA form submission?

airSlate SignNow streamlines the process of filling out and eSigning your IFTA form. With our easy-to-use platform, you can complete your form digitally, ensuring accuracy and compliance. Plus, you can track the status of your submissions for greater peace of mind.

-

Is there a cost associated with using airSlate SignNow for IFTA forms?

Yes, airSlate SignNow offers a cost-effective pricing structure for businesses looking to manage their IFTA forms. We provide flexible subscription plans to accommodate various business sizes and needs, ensuring you only pay for what you use.

-

What features does airSlate SignNow offer for IFTA form completion?

airSlate SignNow provides robust features such as customizable templates, eSignature capabilities, and document management tools, specifically designed for IFTA forms. These tools streamline the entire process, enabling quick and efficient submissions while maintaining compliance with tax regulations.

-

Can I integrate airSlate SignNow with my existing accounting software?

Absolutely! airSlate SignNow supports integrations with popular accounting software, making it easy to incorporate your IFTA form submissions into your existing workflows. This allows for automatic tracking of expenses and ensures your financial records are always up to date.

-

What are the benefits of using airSlate SignNow for IFTA forms?

Using airSlate SignNow for your IFTA forms provides numerous benefits, including enhanced efficiency, reduced processing time, and improved accuracy. Our platform minimizes the chances of errors, helping you stay compliant with tax regulations and preventing costly penalties.

-

Is support available if I need help with my IFTA forms?

Yes, airSlate SignNow offers dedicated customer support to assist you with any questions regarding your IFTA forms. Whether you need help navigating the platform or have specific inquiries about the form's requirements, our support team is readily available to provide guidance.

Get more for Motor Fuel International Fuel Tax Agreement IFTA Forms

- Oregon form or wrannual withholding tax

- Recredentialing application packetuc davis health form

- Form bcii 8270 rev 706 california department of justice

- 122 printable police report forms and templates fillable

- Advance directives and medical power of attorney form

- Guardians report form

- 11200 request for extension of time to earn eagle scout form

- Declaration of tax residence for entitiespart xix of the income tax act form

Find out other Motor Fuel International Fuel Tax Agreement IFTA Forms

- eSignature Mississippi Life Sciences Lease Agreement Myself

- How Can I eSignature Mississippi Life Sciences Last Will And Testament

- How To eSignature Illinois Non-Profit Contract

- eSignature Louisiana Non-Profit Business Plan Template Now

- How Do I eSignature North Dakota Life Sciences Operating Agreement

- eSignature Oregon Life Sciences Job Offer Myself

- eSignature Oregon Life Sciences Job Offer Fast

- eSignature Oregon Life Sciences Warranty Deed Myself

- eSignature Maryland Non-Profit Cease And Desist Letter Fast

- eSignature Pennsylvania Life Sciences Rental Lease Agreement Easy

- eSignature Washington Life Sciences Permission Slip Now

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure