Ifta Worksheet 2009

What is the IFTA Worksheet

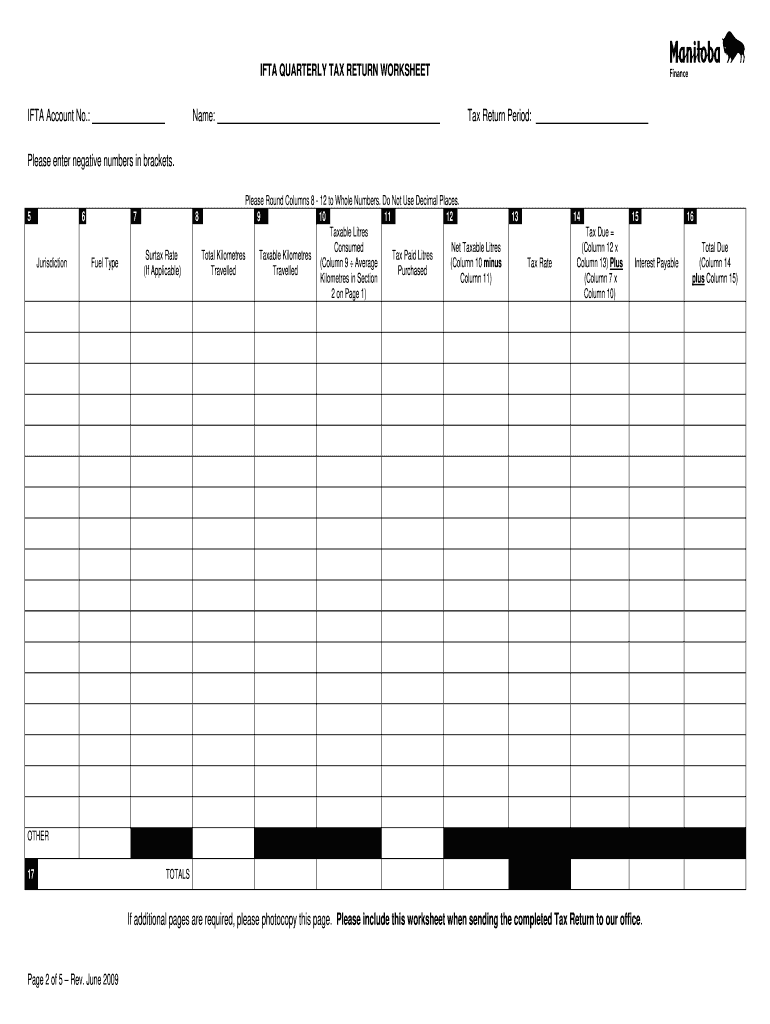

The International Fuel Tax Agreement (IFTA) Worksheet is a crucial document used by commercial vehicle operators to calculate the fuel taxes owed to various jurisdictions. This form simplifies the reporting process for interstate travel, allowing truckers and fleet operators to report fuel consumption and mileage across participating states and provinces in a single document. The IFTA Worksheet ensures compliance with state regulations and helps avoid penalties associated with fuel tax misreporting.

How to use the IFTA Worksheet

To use the IFTA Worksheet effectively, operators should first gather all necessary data, including fuel purchase receipts and mileage logs for each jurisdiction traveled. The form typically includes sections for entering total miles driven, fuel purchased, and tax rates for each state. By following the structured format of the worksheet, users can accurately calculate their tax liability, ensuring that all information is correctly reported for each jurisdiction. It is essential to double-check entries to prevent errors that could lead to fines or audits.

Steps to complete the IFTA Worksheet

Completing the IFTA Worksheet involves several key steps:

- Collect all relevant data, including fuel receipts and mileage records for the reporting period.

- Fill in the total miles driven in each jurisdiction, ensuring accuracy.

- Record the amount of fuel purchased in each state, noting the type of fuel and gallons.

- Apply the appropriate tax rates for each jurisdiction to calculate the total tax owed.

- Review the completed worksheet for accuracy before submission.

Following these steps will help ensure that the IFTA Worksheet is completed correctly, minimizing the risk of errors.

Legal use of the IFTA Worksheet

The IFTA Worksheet is legally recognized as a valid document for reporting fuel taxes across multiple jurisdictions. To ensure its legal standing, it must be completed accurately and submitted within the designated filing deadlines. Compliance with state regulations and maintaining proper records are essential to uphold the legality of the submitted information. Electronic signatures via platforms like signNow can enhance the legitimacy of the document, providing a secure and verifiable method for signing.

Filing Deadlines / Important Dates

Filing deadlines for the IFTA Worksheet are critical for compliance. Typically, the IFTA Worksheet must be filed quarterly, with specific due dates depending on the jurisdiction. Operators should be aware of these dates to avoid late fees and penalties. It is advisable to mark these deadlines on a calendar and prepare the necessary documentation ahead of time to ensure timely submission.

Required Documents

To complete the IFTA Worksheet, several documents are required:

- Mileage logs detailing the miles driven in each jurisdiction.

- Fuel purchase receipts for all fuel bought during the reporting period.

- Previous IFTA returns, if applicable, for reference.

- Any additional state-specific documentation required by the jurisdictions involved.

Having these documents readily available will facilitate a smoother completion process of the IFTA Worksheet.

Penalties for Non-Compliance

Failure to comply with IFTA reporting requirements can result in significant penalties. These may include fines, interest on unpaid taxes, and potential audits by state authorities. Non-compliance can also lead to the suspension of the IFTA license, which could severely impact business operations. It is crucial for operators to adhere to filing requirements and ensure accuracy in their submissions to avoid these consequences.

Quick guide on how to complete ifta worksheet

Complete Ifta Worksheet effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can access the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Handle Ifta Worksheet on any device with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to modify and eSign Ifta Worksheet with ease

- Locate Ifta Worksheet and click Get Form to get started.

- Use the tools we offer to complete your form.

- Emphasize important parts of your documents or conceal sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you want to send your form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device of your preference. Edit and eSign Ifta Worksheet to ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ifta worksheet

Create this form in 5 minutes!

How to create an eSignature for the ifta worksheet

The best way to make an eSignature for a PDF in the online mode

The best way to make an eSignature for a PDF in Chrome

The way to create an eSignature for putting it on PDFs in Gmail

How to generate an eSignature straight from your smart phone

How to make an eSignature for a PDF on iOS devices

How to generate an eSignature for a PDF document on Android OS

People also ask

-

What are printable IFTA fuel tax forms?

Printable IFTA fuel tax forms are official documents used by truckers and fleet operators to report their fuel use and calculate International Fuel Tax Agreement (IFTA) taxes. These forms are necessary for compliance with state regulations, ensuring that you pay the correct amount of fuel taxes across different jurisdictions. airSlate SignNow provides an efficient way to prepare and manage these forms.

-

How can I access printable IFTA fuel tax forms through airSlate SignNow?

You can easily access printable IFTA fuel tax forms by signing up for airSlate SignNow. Once registered, you can utilize our templates to generate the necessary forms, fill them out digitally, and print them as needed. This streamlined process saves you time and ensures accuracy in your tax submissions.

-

What are the benefits of using airSlate SignNow for printable IFTA fuel tax forms?

Using airSlate SignNow for printable IFTA fuel tax forms simplifies the process of filling out and submitting these documents. Our platform allows for easy edits and ensures compliance with state regulations, which minimizes the risk of errors. Additionally, you can eSign documents directly, saving you from the hassles of printing and scanning.

-

Are there any costs associated with using airSlate SignNow for printable IFTA fuel tax forms?

Yes, airSlate SignNow offers a variety of pricing plans depending on your business needs. Each plan includes access to all features for creating and managing printable IFTA fuel tax forms, along with unlimited eSignatures. We recommend checking our pricing page for the most current information and to find a plan that suits your requirements.

-

Can I integrate airSlate SignNow with other applications for printable IFTA fuel tax forms?

Absolutely! airSlate SignNow offers integration capabilities with various applications and software. This means you can seamlessly link your accounting or fleet management software to streamline the process of generating and submitting printable IFTA fuel tax forms.

-

How do I ensure my printable IFTA fuel tax forms are compliant?

To ensure your printable IFTA fuel tax forms are compliant, it’s important to use up-to-date templates and follow state-specific filing requirements. airSlate SignNow regularly updates its templates to reflect the latest regulations, which helps you stay compliant and avoid any potential penalties.

-

Can I track the status of my printable IFTA fuel tax forms once submitted?

While airSlate SignNow allows you to see the status of documents sent for eSignature, tracking the submission of printed IFTA fuel tax forms after they've been sent to tax authorities usually depends on the specific agency's processes. However, using our platform helps keep organized records of all completed forms and communications related to your filings.

Get more for Ifta Worksheet

- Affidavit child custody form

- Wisconsin disclosure form

- Confidential petition addendum form

- Wi case form

- Wi petition form

- Request to correct error in court records wisconsin form

- Certification by prosecuting agency verifying identity theft or mistaken identity wisconsin form

- Wisconsin temporary guardianship form

Find out other Ifta Worksheet

- eSign Wisconsin Car Dealer Warranty Deed Safe

- eSign Business Operations PPT New Hampshire Safe

- Sign Rhode Island Courts Warranty Deed Online

- Sign Tennessee Courts Residential Lease Agreement Online

- How Do I eSign Arkansas Charity LLC Operating Agreement

- eSign Colorado Charity LLC Operating Agreement Fast

- eSign Connecticut Charity Living Will Later

- How Can I Sign West Virginia Courts Quitclaim Deed

- Sign Courts Form Wisconsin Easy

- Sign Wyoming Courts LLC Operating Agreement Online

- How To Sign Wyoming Courts Quitclaim Deed

- eSign Vermont Business Operations Executive Summary Template Mobile

- eSign Vermont Business Operations Executive Summary Template Now

- eSign Virginia Business Operations Affidavit Of Heirship Mobile

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure