4892, Corporate Income Tax Amended Return State of 2019

What is the 4892, Corporate Income Tax Amended Return State Of

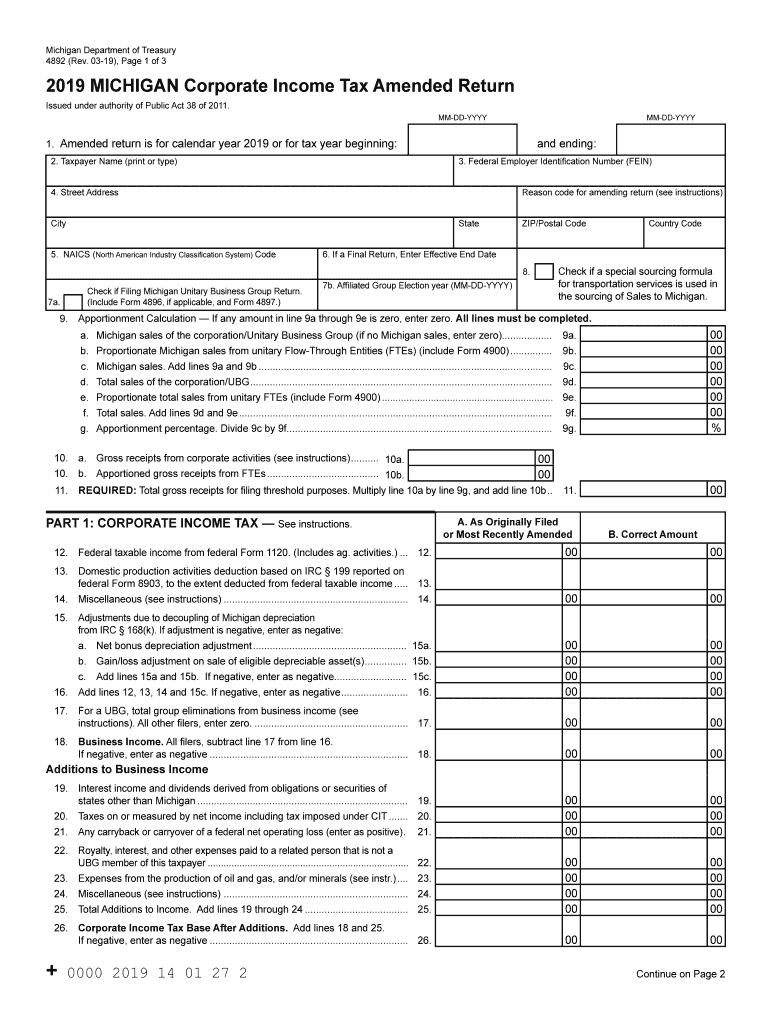

The 4892 form, known as the Corporate Income Tax Amended Return, is a crucial document for businesses in Michigan that need to amend their previously filed corporate income tax returns. This form allows corporations to correct errors, report additional income, or claim deductions that were not included in the original submission. The 4892 is specifically designed for corporate entities, ensuring compliance with state tax regulations and maintaining accurate tax records.

Steps to complete the 4892, Corporate Income Tax Amended Return State Of

Completing the 4892 form involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including the original return and any supporting documentation for the changes being made. Next, clearly indicate the changes in the appropriate sections of the form, detailing the reasons for the amendments. It is essential to provide accurate figures and calculations to avoid any discrepancies. After filling out the form, review it thoroughly for any errors before submission. Finally, submit the amended return to the Michigan Department of Treasury by the specified deadline, ensuring that all required documentation is included.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the 4892 form is critical for compliance. Typically, amended returns must be filed within a specific timeframe following the original return's due date. For most corporations, this deadline is within three years from the original filing date or within one year after the tax was paid, whichever is later. It is essential to stay informed about any changes in deadlines or requirements from the Michigan Department of Treasury to avoid penalties.

Required Documents

When completing the 4892 form, several documents are necessary to support the amendments being made. These may include the original corporate income tax return, any relevant schedules or attachments, and documentation that substantiates the changes, such as financial statements or receipts. Ensuring that all required documents are included with the amended return is vital for a smooth processing experience.

Penalties for Non-Compliance

Failure to file the 4892 form or inaccuracies in the amended return can lead to significant penalties. The Michigan Department of Treasury may impose fines for late submissions or for failing to comply with tax regulations. Additionally, interest may accrue on any unpaid tax liabilities. It is important for corporations to understand these potential consequences and ensure timely and accurate filing to avoid unnecessary financial burdens.

Digital vs. Paper Version

Corporations have the option to file the 4892 form either digitally or via paper submission. The digital version allows for quicker processing and may offer features such as automatic error checking. Conversely, the paper version may be preferred by those who are more comfortable with traditional filing methods. Regardless of the chosen method, it is essential to ensure that all information is accurately completed and submitted according to the Michigan Department of Treasury's guidelines.

Quick guide on how to complete 4892 corporate income tax amended return state of

Complete 4892, Corporate Income Tax Amended Return State Of effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers a seamless eco-friendly alternative to traditional printed and signed documents, allowing you to access the required forms and securely store them online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents promptly without any setbacks. Manage 4892, Corporate Income Tax Amended Return State Of on any device with the airSlate SignNow Android or iOS applications and enhance any document-driven process today.

The easiest way to modify and eSign 4892, Corporate Income Tax Amended Return State Of with ease

- Locate 4892, Corporate Income Tax Amended Return State Of and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or redact sensitive information using tools that airSlate SignNow specifically offers for this purpose.

- Create your signature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your modifications.

- Select how you wish to share your form, via email, text message (SMS), invite link, or download it to your computer.

Forget about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Modify and eSign 4892, Corporate Income Tax Amended Return State Of and ensure effective communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 4892 corporate income tax amended return state of

Create this form in 5 minutes!

How to create an eSignature for the 4892 corporate income tax amended return state of

How to make an eSignature for a PDF online

How to make an eSignature for a PDF in Google Chrome

The way to create an eSignature for signing PDFs in Gmail

The way to create an eSignature straight from your smartphone

The best way to make an eSignature for a PDF on iOS

The way to create an eSignature for a PDF document on Android

People also ask

-

What is the 2016 mi form, and why do I need it?

The 2016 mi form is a tax document required by the state of Michigan for filing personal income taxes. It's crucial for ensuring you accurately report your income and claim any deductions or credits. Understanding this form can help you avoid penalties and ensure compliance with state regulations.

-

Can I fill out the 2016 mi form electronically with airSlate SignNow?

Yes, airSlate SignNow allows you to fill out the 2016 mi form electronically, making the process faster and more efficient. Our intuitive interface lets you easily enter your information and verify it before submission. This helps eliminate errors often associated with manual filling.

-

What are the benefits of using airSlate SignNow for my 2016 mi form?

Using airSlate SignNow for your 2016 mi form offers several benefits, such as enhanced security and ease of use. You can eSign documents quickly and securely, ensuring your information is protected. Additionally, our solution streamlines the submission process, allowing you to focus on other important tasks.

-

Is there a cost associated with using airSlate SignNow for the 2016 mi form?

Yes, airSlate SignNow operates on a subscription-based model, which means there will be a fee for using our eSign and document management features for the 2016 mi form. We offer various pricing plans to suit different business needs. You can choose the plan that best fits your budget and usage requirements.

-

Does airSlate SignNow integrate with other tools for managing my 2016 mi form?

Absolutely! airSlate SignNow integrates seamlessly with various platforms, enhancing your workflow when handling the 2016 mi form. Whether you use cloud storage services or project management tools, our integrations simplify document sharing and collaboration. This helps improve efficiency and organization.

-

How does airSlate SignNow enhance the accuracy of my 2016 mi form?

airSlate SignNow enhances the accuracy of your 2016 mi form by providing built-in validation features. These features help check for common mistakes and prompt you to enter necessary information correctly. By reducing errors, we help you submit a well-prepared form that complies with state standards.

-

Can I save and return to my 2016 mi form later using airSlate SignNow?

Yes, with airSlate SignNow, you can save your progress on the 2016 mi form and return to it later. This flexibility allows you to work at your own pace without the fear of losing any information you've already entered. It's particularly useful for those who may need additional time to gather required documents.

Get more for 4892, Corporate Income Tax Amended Return State Of

- Legal last will and testament form for a single person with minor children washington

- Legal last will and testament form for single person with adult and minor children washington

- Legal last will and testament form for single person with adult children washington

- Legal last will and testament for married person with minor children from prior marriage washington form

- Legal last will and testament for domestic partner with minor children from prior marriage washington form

- Legal last will and testament form for married person with adult children from prior marriage washington

- Legal last will and testament form for divorced person not remarried with adult children washington

- Legal last will and testament form for domestic partner with adult children from prior marriage washington

Find out other 4892, Corporate Income Tax Amended Return State Of

- Sign Wyoming Courts LLC Operating Agreement Online

- How To Sign Wyoming Courts Quitclaim Deed

- eSign Vermont Business Operations Executive Summary Template Mobile

- eSign Vermont Business Operations Executive Summary Template Now

- eSign Virginia Business Operations Affidavit Of Heirship Mobile

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy

- eSign Rhode Island Charity Rental Lease Agreement Secure

- eSign California Construction Promissory Note Template Easy

- eSign Colorado Construction LLC Operating Agreement Simple

- Can I eSign Washington Charity LLC Operating Agreement

- eSign Wyoming Charity Living Will Simple

- eSign Florida Construction Memorandum Of Understanding Easy