4892, Michigan Corporate Income Tax Amended Return 4892, Michigan Corporate Income Tax Amended Return 2023

What is the Michigan Corporate Income Tax Amended Return 4892?

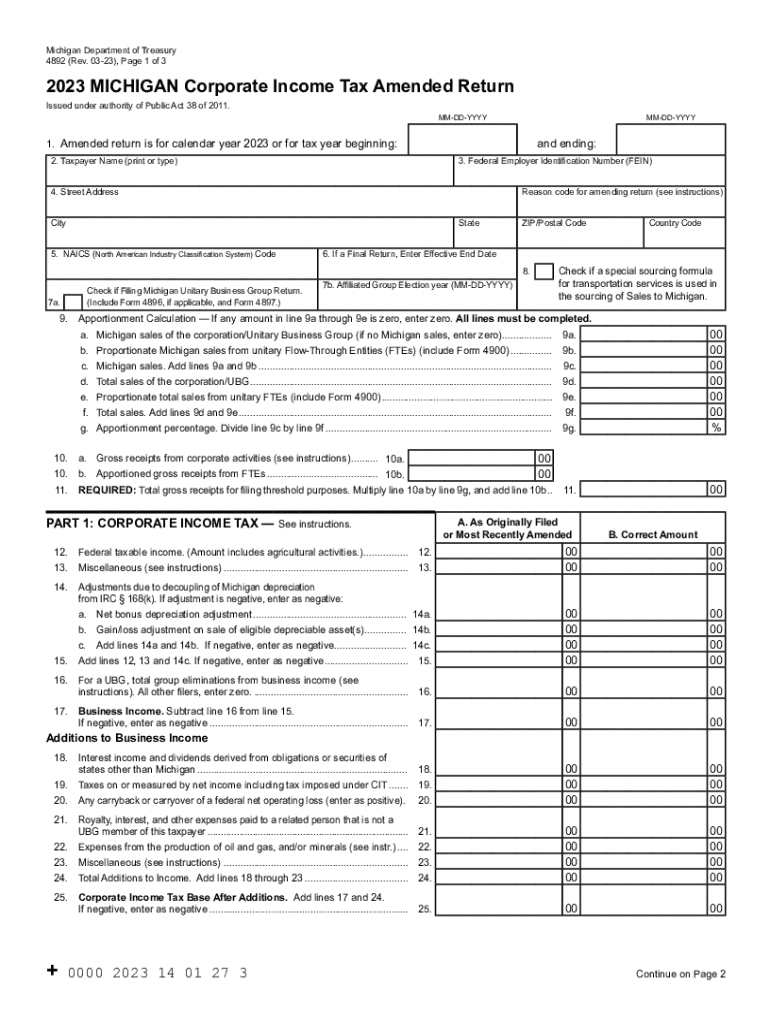

The 2023 Michigan Form 4892 is the Amended Return for Corporate Income Tax. This form is used by corporations to correct errors or make changes to previously filed tax returns. It allows businesses to adjust their taxable income, deductions, and credits to ensure compliance with Michigan tax laws. Filing this form is essential for maintaining accurate tax records and avoiding potential penalties.

How to Obtain the Michigan Corporate Income Tax Amended Return 4892

The 2023 Michigan Form 4892 can be obtained through the Michigan Department of Treasury's official website. The form is available in a downloadable PDF format, which can be printed and filled out manually. Additionally, businesses can request a copy by contacting the Department of Treasury directly. Ensuring you have the correct version of the form is crucial for accurate filing.

Steps to Complete the Michigan Corporate Income Tax Amended Return 4892

Completing the 2023 Michigan Form 4892 involves several steps:

- Gather all relevant financial documents, including the original tax return and any supporting documentation for the changes.

- Carefully review the instructions provided with the form to understand the requirements for amendments.

- Fill out the form, ensuring all changes are clearly indicated and calculations are accurate.

- Double-check the amended figures against your original return to confirm the adjustments.

- Submit the completed form along with any required attachments to the Michigan Department of Treasury.

Key Elements of the Michigan Corporate Income Tax Amended Return 4892

The 2023 Michigan Form 4892 includes several key elements that must be accurately completed:

- Identification Information: This includes the corporation's name, address, and tax identification number.

- Amendment Details: Clearly specify the year of the return being amended and the reasons for the changes.

- Financial Adjustments: Provide detailed information on income, deductions, and credits that are being amended.

- Signature: The form must be signed by an authorized representative of the corporation.

Filing Deadlines for the Michigan Corporate Income Tax Amended Return 4892

The deadline for filing the 2023 Michigan Form 4892 typically aligns with the original due date of the tax return being amended. It is essential to file the amended return within the specified timeframe to avoid penalties. Generally, corporations must file their amended returns within three years from the original due date of the return or within one year from the date the tax was paid, whichever is later.

Penalties for Non-Compliance with the Michigan Corporate Income Tax Amended Return 4892

Failure to file the 2023 Michigan Form 4892 or inaccuracies in the information provided can result in penalties. These may include fines, interest on unpaid taxes, and potential audits. It is crucial for corporations to ensure their amendments are accurate and submitted on time to avoid these consequences.

Quick guide on how to complete 4892 michigan corporate income tax amended return 4892 michigan corporate income tax amended return

Complete 4892, Michigan Corporate Income Tax Amended Return 4892, Michigan Corporate Income Tax Amended Return effortlessly on any device

Managing documents online has become increasingly prevalent among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed papers, allowing you to find the right template and securely store it in the cloud. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your files quickly and efficiently. Handle 4892, Michigan Corporate Income Tax Amended Return 4892, Michigan Corporate Income Tax Amended Return on any platform with airSlate SignNow's Android or iOS applications and enhance any document-related task today.

How to modify and electronically sign 4892, Michigan Corporate Income Tax Amended Return 4892, Michigan Corporate Income Tax Amended Return with ease

- Find 4892, Michigan Corporate Income Tax Amended Return 4892, Michigan Corporate Income Tax Amended Return and then click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of the documents or redact sensitive information with specialized tools provided by airSlate SignNow.

- Create your signature using the Sign feature, which takes just seconds and holds the same legal validity as a conventional ink signature.

- Review the details and then click on the Done button to save your modifications.

- Choose your preferred method to submit your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or disorganized documents, frustrating form searches, or mistakes that require reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Alter and electronically sign 4892, Michigan Corporate Income Tax Amended Return 4892, Michigan Corporate Income Tax Amended Return while ensuring outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 4892 michigan corporate income tax amended return 4892 michigan corporate income tax amended return

Create this form in 5 minutes!

How to create an eSignature for the 4892 michigan corporate income tax amended return 4892 michigan corporate income tax amended return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2023 Michigan form and why is it important?

The 2023 Michigan form is a vital document for businesses and individuals operating in Michigan, as it contains essential information for tax and compliance purposes. This form ensures that your filings are accurate and up-to-date, helping you avoid potential penalties. By using airSlate SignNow, you can easily manage and eSign your 2023 Michigan form, streamlining your document workflow.

-

How can I automate the filing of my 2023 Michigan form?

Using airSlate SignNow, you can automate the process of filing your 2023 Michigan form through customizable workflows. The platform allows you to create templates that auto-fill required information, making submissions quick and efficient. This saves time and reduces the risk of errors associated with manual entry.

-

What features does airSlate SignNow offer for managing the 2023 Michigan form?

airSlate SignNow provides several features designed to simplify the management of your 2023 Michigan form, including eSigning, document tracking, and cloud storage. You can edit your forms directly within the platform and collaborate with others in real time. This makes it easy to keep your files organized and accessible when you need them.

-

Is airSlate SignNow cost-effective for handling the 2023 Michigan form?

Yes, airSlate SignNow offers competitive pricing plans that make it a budget-friendly option for handling the 2023 Michigan form. By using our solution, you can save on printing and shipping costs while ensuring compliance with Michigan's regulations. Our pricing scales with your business needs, making it suitable for both individual users and larger teams.

-

Can I integrate airSlate SignNow with other software for the 2023 Michigan form?

Absolutely! airSlate SignNow seamlessly integrates with various applications, including CRMs and accounting software, to facilitate the management of your 2023 Michigan form. This interoperability allows for easy data transfer and synchronization, ensuring that your documents are always up to date and accessible across platforms.

-

How secure is my information when eSigning the 2023 Michigan form with airSlate SignNow?

When you eSign your 2023 Michigan form using airSlate SignNow, your data security is our top priority. We implement robust encryption protocols and comply with industry standards to protect your sensitive information. This ensures that your documents remain confidential and secure during the signing process.

-

What are the benefits of using airSlate SignNow for my 2023 Michigan form?

Using airSlate SignNow for your 2023 Michigan form provides numerous benefits, including increased efficiency, reduced costs, and enhanced collaboration. With our platform, you can manage and eSign documents anytime, anywhere, eliminating the delays caused by traditional paper-based processes. This allows you to focus more on your core activities rather than getting bogged down by paperwork.

Get more for 4892, Michigan Corporate Income Tax Amended Return 4892, Michigan Corporate Income Tax Amended Return

- 2014 summer school program teacher application form vancouver

- Good faith agreement template form

- General aviation inspection and audit checklists manual form

- Mep2389 form

- White pages phone book no charge form

- Prospect identification form

- Application form for canadian migration 100098349

- Statement of finances statement of finances 99028 form

Find out other 4892, Michigan Corporate Income Tax Amended Return 4892, Michigan Corporate Income Tax Amended Return

- How To Electronic signature Idaho Police Last Will And Testament

- How Do I Electronic signature North Dakota Real Estate Quitclaim Deed

- Can I Electronic signature Ohio Real Estate Agreement

- Electronic signature Ohio Real Estate Quitclaim Deed Later

- How To Electronic signature Oklahoma Real Estate Business Plan Template

- How Can I Electronic signature Georgia Sports Medical History

- Electronic signature Oregon Real Estate Quitclaim Deed Free

- Electronic signature Kansas Police Arbitration Agreement Now

- Electronic signature Hawaii Sports LLC Operating Agreement Free

- Electronic signature Pennsylvania Real Estate Quitclaim Deed Fast

- Electronic signature Michigan Police Business Associate Agreement Simple

- Electronic signature Mississippi Police Living Will Safe

- Can I Electronic signature South Carolina Real Estate Work Order

- How To Electronic signature Indiana Sports RFP

- How Can I Electronic signature Indiana Sports RFP

- Electronic signature South Dakota Real Estate Quitclaim Deed Now

- Electronic signature South Dakota Real Estate Quitclaim Deed Safe

- Electronic signature Indiana Sports Forbearance Agreement Myself

- Help Me With Electronic signature Nevada Police Living Will

- Electronic signature Real Estate Document Utah Safe