4892, Michigan Corporate Income Tax Amended Return 4892, Michigan Corporate Income Tax Amended Return 2020

What is the Michigan Corporate Income Tax Amended Return 4892?

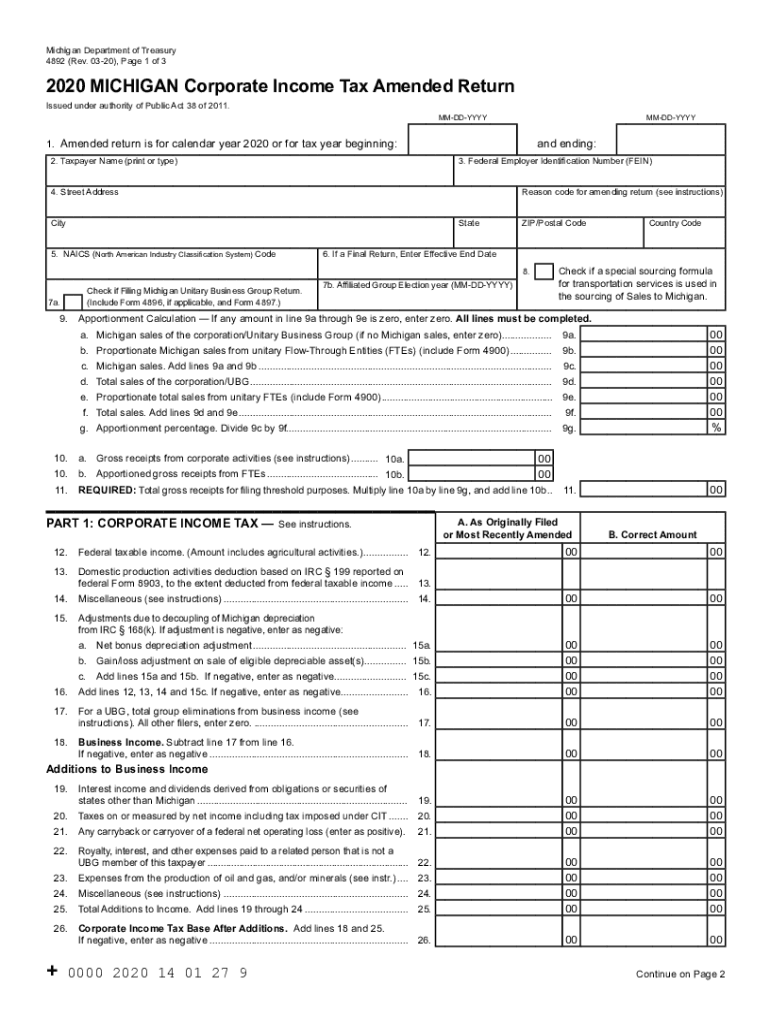

The Michigan Corporate Income Tax Amended Return, commonly referred to as Form 4892, is a document that corporations in Michigan use to amend their previously filed corporate income tax returns. This form allows businesses to correct errors or make changes to their tax filings, ensuring that their tax obligations are accurately reported. It is essential for corporations that need to adjust their income, deductions, or credits after the original return has been submitted.

Steps to Complete the Michigan Corporate Income Tax Amended Return 4892

Filling out Form 4892 requires careful attention to detail to ensure compliance with Michigan tax laws. Here are the steps to complete the form:

- Gather all relevant financial documents and the original return that needs amending.

- Clearly indicate the tax year for which you are amending the return at the top of the form.

- Fill out the required sections, including any changes in income, deductions, and credits.

- Provide a detailed explanation for each amendment in the designated section of the form.

- Review the completed form for accuracy before submission.

How to Obtain the Michigan Corporate Income Tax Amended Return 4892

Form 4892 can be obtained through several means. Corporations can download the form directly from the Michigan Department of Treasury's website. Additionally, businesses may request a paper copy by contacting the department or visiting their local office. It is important to ensure that you are using the most current version of the form to avoid any compliance issues.

Key Elements of the Michigan Corporate Income Tax Amended Return 4892

Understanding the key elements of Form 4892 is crucial for accurate completion. The form includes sections for:

- Identification of the corporation, including name, address, and tax identification number.

- Details of the original return being amended, including the tax year and any previously reported amounts.

- Revised amounts for income, deductions, and credits that reflect the changes being made.

- An explanation of the reasons for the amendments, which is essential for transparency and compliance.

Filing Deadlines for the Michigan Corporate Income Tax Amended Return 4892

Corporations must adhere to specific deadlines when filing Form 4892. Generally, the amended return should be filed within three years from the original due date of the return or within one year from the date the tax was paid, whichever is later. It is important to keep track of these deadlines to avoid penalties and ensure that the amendments are processed in a timely manner.

Penalties for Non-Compliance with the Michigan Corporate Income Tax Amended Return 4892

Failure to file Form 4892 or inaccuracies in the amended return can result in penalties imposed by the Michigan Department of Treasury. These penalties may include fines or interest on any unpaid taxes. It is essential for corporations to ensure that their amended returns are complete and accurate to avoid these financial consequences.

Quick guide on how to complete 4892 2020 michigan corporate income tax amended return 4892 2020 michigan corporate income tax amended return

Effortlessly Prepare 4892, Michigan Corporate Income Tax Amended Return 4892, Michigan Corporate Income Tax Amended Return on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute to traditional printed and signed documents, as you can locate the appropriate form and safely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents swiftly and without delays. Manage 4892, Michigan Corporate Income Tax Amended Return 4892, Michigan Corporate Income Tax Amended Return across any platform with airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to Modify and eSign 4892, Michigan Corporate Income Tax Amended Return 4892, Michigan Corporate Income Tax Amended Return With Ease

- Obtain 4892, Michigan Corporate Income Tax Amended Return 4892, Michigan Corporate Income Tax Amended Return and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of the documents or redact sensitive information using the tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose your preferred method for delivering your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements with just a few clicks from any device you prefer. Alter and eSign 4892, Michigan Corporate Income Tax Amended Return 4892, Michigan Corporate Income Tax Amended Return to ensure excellent communication at every step of the form preparation procedure with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 4892 2020 michigan corporate income tax amended return 4892 2020 michigan corporate income tax amended return

Create this form in 5 minutes!

How to create an eSignature for the 4892 2020 michigan corporate income tax amended return 4892 2020 michigan corporate income tax amended return

How to create an electronic signature for a PDF document in the online mode

How to create an electronic signature for a PDF document in Chrome

How to generate an eSignature for putting it on PDFs in Gmail

The best way to create an eSignature from your mobile device

How to create an eSignature for a PDF document on iOS devices

The best way to create an eSignature for a PDF file on Android devices

People also ask

-

What is form 4892?

Form 4892 is a specific document used for various administrative and compliance purposes. This form is essential for businesses that need to submit certain details to regulatory bodies, ensuring they remain compliant while using solutions like airSlate SignNow.

-

How does airSlate SignNow assist with form 4892?

airSlate SignNow simplifies the process of completing and eSigning form 4892. Our platform allows users to fill out the form electronically, ensuring quick submission and saving time that can be better spent on other business activities.

-

Is there a cost associated with using airSlate SignNow for form 4892?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs. Each plan provides access to essential features for managing documents like form 4892, while also ensuring cost-effectiveness for organizations of all sizes.

-

What features does airSlate SignNow offer for managing form 4892?

Our platform provides a range of features including customizable templates, eSignature capabilities, and real-time tracking for form 4892. These tools enhance efficiency and help streamline the document management process.

-

Can I integrate airSlate SignNow with other software for form 4892?

Absolutely! airSlate SignNow integrates seamlessly with various software platforms, enabling you to manage form 4892 efficiently. This integration means you can automate workflows and enhance productivity across your business.

-

What are the benefits of using airSlate SignNow for form 4892?

Using airSlate SignNow for form 4892 offers numerous benefits including faster processing times, reduced paperwork, and improved accuracy. These advantages contribute to streamlined operations and a more organized approach to document management.

-

Can I use airSlate SignNow on mobile devices for form 4892?

Yes, airSlate SignNow is mobile-friendly, allowing you to complete and eSign form 4892 from anywhere. This flexibility ensures that you can manage important documents on the go, without the need for a desktop computer.

Get more for 4892, Michigan Corporate Income Tax Amended Return 4892, Michigan Corporate Income Tax Amended Return

- Police enquiry form

- Saif zone forms 100626017

- Aapi 2 1 form

- Career maturity inventory questionnaire pdf form

- Form 57

- My favourite food portfolio form

- Super chef lisa tosses a chicken to super chef linda the images of the chicken are shown at exactly one second intervals form

- Nkl autobank d8 manual form

Find out other 4892, Michigan Corporate Income Tax Amended Return 4892, Michigan Corporate Income Tax Amended Return

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy

- How To eSignature Maryland Business Operations Business Letter Template

- How Do I eSignature Arizona Charity Rental Application

- How To eSignature Minnesota Car Dealer Bill Of Lading

- eSignature Delaware Charity Quitclaim Deed Computer

- eSignature Colorado Charity LLC Operating Agreement Now

- eSignature Missouri Car Dealer Purchase Order Template Easy

- eSignature Indiana Charity Residential Lease Agreement Simple

- How Can I eSignature Maine Charity Quitclaim Deed

- How Do I eSignature Michigan Charity LLC Operating Agreement

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile

- eSignature New Jersey Business Operations Memorandum Of Understanding Computer

- eSignature North Dakota Car Dealer Lease Agreement Safe

- eSignature Oklahoma Car Dealer Warranty Deed Easy

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online