Il 4852 2019

What is the IL 4852?

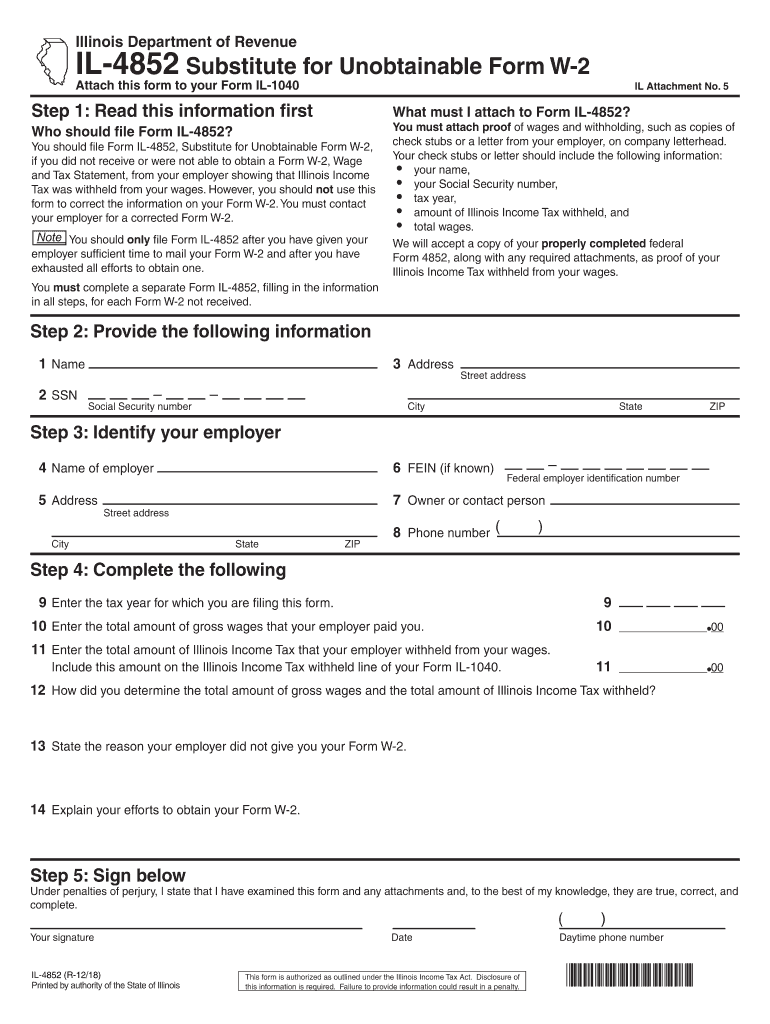

The IL 4852 form is an important document used in the state of Illinois, primarily for tax purposes. It serves as a notification for individuals who have received a wage or salary but have not been issued a W-2 form by their employer. This form allows taxpayers to report their income and calculate the appropriate tax owed to the state. Understanding the purpose and function of the IL 4852 is essential for ensuring compliance with state tax regulations.

Steps to Complete the IL 4852

Completing the IL 4852 form involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including your personal details, income amounts, and any relevant tax deductions. Next, accurately fill out each section of the form, ensuring that all figures are correct. After completing the form, review it for any errors or omissions. Finally, submit the form to the appropriate state tax authority by the designated deadline.

How to Obtain the IL 4852

The IL 4852 form can be obtained through the Illinois Department of Revenue's official website or by visiting local tax offices. It is available as a downloadable PDF, which can be printed and filled out manually. Additionally, taxpayers can request a physical copy by contacting the department directly. Ensuring you have the correct version of the form is crucial for accurate filing.

Legal Use of the IL 4852

The IL 4852 form is legally recognized for reporting income when a W-2 is not available. It is essential for compliance with Illinois tax laws. When completed accurately and submitted on time, this form protects taxpayers from potential penalties for underreporting income. Understanding the legal implications of using the IL 4852 is vital for maintaining good standing with tax authorities.

Filing Deadlines / Important Dates

Filing deadlines for the IL 4852 are typically aligned with the annual tax filing season. Taxpayers should be aware of the specific dates set by the Illinois Department of Revenue to avoid late penalties. Generally, the deadline for filing state income tax returns, including the IL 4852, is April fifteenth of each year. However, it is advisable to verify any changes to these dates annually.

Examples of Using the IL 4852

There are various scenarios where the IL 4852 may be necessary. For instance, a freelancer who has not received a W-2 from a client may use this form to report their earnings. Similarly, an employee who worked for a company that failed to issue a W-2 can utilize the IL 4852 to ensure their income is reported accurately. These examples highlight the form's importance in diverse employment situations.

Quick guide on how to complete il 4852

Effortlessly Prepare Il 4852 on Any Device

Digital document management has gained signNow traction among companies and individuals alike. It offers a remarkable eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary forms and securely archive them online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage Il 4852 on any platform using airSlate SignNow's Android or iOS applications and enhance your document-driven processes today.

The Simplest Way to Edit and eSign Il 4852 with Ease

- Locate Il 4852 and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of your documents or obscure sensitive information using tools that airSlate SignNow specifically provides for that purpose.

- Generate your signature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to finalize your changes.

- Select your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs with just a few clicks from your chosen device. Modify and eSign Il 4852 to ensure effective communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct il 4852

Create this form in 5 minutes!

How to create an eSignature for the il 4852

The best way to create an eSignature for your PDF document online

The best way to create an eSignature for your PDF document in Google Chrome

The best way to make an electronic signature for signing PDFs in Gmail

The way to make an eSignature from your smart phone

The way to generate an electronic signature for a PDF document on iOS

The way to make an eSignature for a PDF file on Android OS

People also ask

-

What is the IL 4852 form and why is it important?

The IL 4852 form is a crucial document used in the state of Illinois for reporting income and tax obligations. This form helps individuals and businesses accurately report their earnings, ensuring compliance with tax regulations. Understanding the IL 4852 form can help you avoid penalties and streamline your tax filing process.

-

How does airSlate SignNow assist with the IL 4852 form?

airSlate SignNow provides a user-friendly platform for electronically signing and sending the IL 4852 form with ease. Our solution simplifies the process by allowing you to create, edit, and eSign documents quickly. With airSlate SignNow, managing your IL 4852 form becomes efficient, reducing the time spent on paperwork.

-

Is there a cost associated with using airSlate SignNow for the IL 4852 form?

Yes, airSlate SignNow offers flexible pricing plans tailored to meet various needs. While there may be a fee to access premium features for handling the IL 4852 form, the cost is often offset by the time and efficiency gained. We provide a cost-effective solution to streamline your document management process.

-

What features does airSlate SignNow offer for the IL 4852 form?

airSlate SignNow includes features such as eSignature, document templates, and secure cloud storage tailored for the IL 4852 form. These features allow you to customize your documents, ensuring they meet your specific needs. With these tools, you can enhance collaboration and improve document turnaround times.

-

Can I track the status of my IL 4852 form after sending it?

Absolutely! With airSlate SignNow, you can track the status of your IL 4852 form in real time. Our platform provides notifications and updates, allowing you to see when the document is viewed, signed, or completed. This visibility can enhance your workflow and improve communication with stakeholders.

-

Are there integrations available for managing the IL 4852 form?

Yes, airSlate SignNow offers integrations with various popular applications, making it easier to manage the IL 4852 form alongside your other business tools. Whether it's CRMs, cloud storage services, or accounting software, our integrations help streamline your workflow and keep all your documents organized.

-

Is it safe to use airSlate SignNow for the IL 4852 form?

Yes, security is a top priority for airSlate SignNow. We implement advanced encryption and security measures to protect your IL 4852 form and other sensitive documents. You can trust that your information is secure while using our platform for electronic signatures and document management.

Get more for Il 4852

- Woodside sports complex online waiver form

- Liability child form

- Waiver and release from liability for adult for parachuting form

- Release minor child form 497427143

- Waiver basketball form

- Waiver basketball form 497427145

- Waiver and release from liability for adult for baseball stadium form

- Waiver and release from liability for minor child for baseball stadium form

Find out other Il 4852

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now

- eSign Texas Education LLC Operating Agreement Fast

- eSign Utah Education Warranty Deed Online

- eSign Utah Education Warranty Deed Later

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer

- eSign West Virginia Construction Letter Of Intent Online

- eSign West Virginia Construction Arbitration Agreement Myself

- eSign West Virginia Education Resignation Letter Secure

- eSign Education PDF Wyoming Mobile

- Can I eSign Nebraska Finance & Tax Accounting Business Plan Template

- eSign Nebraska Finance & Tax Accounting Business Letter Template Online

- eSign Nevada Finance & Tax Accounting Resignation Letter Simple

- eSign Arkansas Government Affidavit Of Heirship Easy

- eSign California Government LLC Operating Agreement Computer

- eSign Oklahoma Finance & Tax Accounting Executive Summary Template Computer

- eSign Tennessee Finance & Tax Accounting Cease And Desist Letter Myself

- eSign Finance & Tax Accounting Form Texas Now