1099me 2019

What is the 1099me

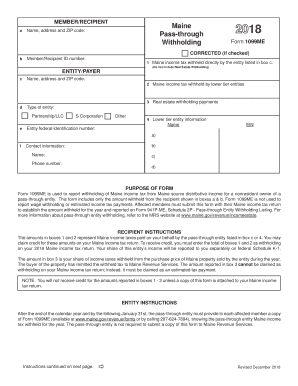

The 1099me form is a tax document used in the United States to report income received by individuals who are not classified as employees. This form is particularly relevant for freelancers, contractors, and self-employed individuals who earn income from various sources. The 1099me serves to inform the Internal Revenue Service (IRS) about payments made to these individuals, ensuring proper tax reporting and compliance. Each payer must issue a 1099me to report payments totaling $600 or more within a tax year, making it an essential document for accurate income tracking.

How to use the 1099me

Using the 1099me form involves several straightforward steps. First, gather all necessary information, including the payee's name, address, and taxpayer identification number (TIN). Next, document the total amount paid during the year. Once you have this information, you can fill out the 1099me form accurately. It is crucial to ensure that all details are correct to avoid potential issues with the IRS. After completing the form, you must provide copies to both the payee and the IRS by the specified deadlines.

Steps to complete the 1099me

Completing the 1099me form requires careful attention to detail. Follow these steps to ensure accuracy:

- Gather the payee's information, including their legal name, address, and TIN.

- Determine the total payments made to the payee during the tax year.

- Fill out the 1099me form, ensuring all fields are completed correctly.

- Review the form for any errors or omissions.

- Distribute copies of the completed form to the payee and the IRS.

- Retain a copy for your records.

Legal use of the 1099me

The legal use of the 1099me form is governed by IRS regulations. To ensure compliance, it is essential to issue the form to all eligible payees who meet the income threshold. The form must be filed accurately and on time to avoid penalties. Additionally, the information reported on the 1099me must match the records kept by the payee, as discrepancies can lead to audits or other tax-related issues. Understanding the legal implications of the 1099me helps individuals and businesses maintain compliance with tax laws.

Filing Deadlines / Important Dates

Filing deadlines for the 1099me form are critical for compliance. Typically, the form must be sent to the payee by January thirty-first of the year following the tax year in which payments were made. The IRS deadline for submitting the form, whether electronically or by mail, is usually set for the end of February or March, depending on the filing method. Staying aware of these deadlines helps ensure that all necessary forms are submitted on time, avoiding potential penalties.

Who Issues the Form

The 1099me form is issued by businesses or individuals who have made payments to non-employees. This includes a variety of entities such as sole proprietors, partnerships, corporations, and nonprofit organizations. If a business pays an independent contractor or freelancer $600 or more in a tax year, it is responsible for issuing the 1099me form. Understanding who must issue the form is essential for compliance and accurate tax reporting.

Quick guide on how to complete 1099me

Easily prepare 1099me on any device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, adjust, and electronically sign your documents swiftly without delays. Manage 1099me on any device with airSlate SignNow's Android or iOS applications and simplify any document-based task today.

How to modify and electronically sign 1099me effortlessly

- Find 1099me and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign feature, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the issues of lost or misplaced documents, tiresome form searches, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choosing. Modify and electronically sign 1099me while ensuring clear communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 1099me

Create this form in 5 minutes!

How to create an eSignature for the 1099me

The way to create an electronic signature for your PDF in the online mode

The way to create an electronic signature for your PDF in Chrome

How to generate an electronic signature for putting it on PDFs in Gmail

How to make an eSignature straight from your smart phone

The best way to create an electronic signature for a PDF on iOS devices

How to make an eSignature for a PDF document on Android OS

People also ask

-

What is 1099me and how does it work with airSlate SignNow?

1099me is a feature integrated within airSlate SignNow that allows users to easily generate, send, and eSign 1099 forms. This streamlines the process, enabling businesses to manage their document workflows more efficiently and ensure compliance with tax regulations.

-

How much does 1099me cost when using airSlate SignNow?

The pricing for 1099me within airSlate SignNow depends on the plan you choose, which can vary based on the number of users and the volume of documents processed. Generally, airSlate SignNow offers competitive pricing that reflects its features, making it a cost-effective solution for businesses.

-

What are the key features of 1099me with airSlate SignNow?

Key features of 1099me include the ability to automatically generate 1099 forms, easy eSignature capabilities, and efficient document management. Additionally, it allows for batch processing of 1099s, saving time and reducing manual errors.

-

How does 1099me benefit small businesses using airSlate SignNow?

1099me is particularly beneficial for small businesses as it simplifies tax document management and reduces administrative burdens. By automating the creation and signing of 1099 forms, businesses can focus more on their core operations without worrying about compliance issues.

-

Can 1099me integrate with other software solutions?

Yes, 1099me through airSlate SignNow can integrate seamlessly with various accounting and financial software, allowing for easy data transfer and streamlined processes. This ensures that businesses can maintain their workflows without interruptions and enhances overall efficiency.

-

Is there a trial period for using 1099me in airSlate SignNow?

airSlate SignNow typically offers a free trial period for new users, allowing them to explore 1099me and other features without any financial commitment. This is a great opportunity for businesses to evaluate how well 1099me meets their needs before making a purchase.

-

How secure is 1099me when used with airSlate SignNow?

1099me employs robust security measures, including end-to-end encryption and secure cloud storage, to protect sensitive information. Using 1099me within airSlate SignNow helps ensure that your tax documents are kept safe and compliant with legal standards.

Get more for 1099me

- Certification by prosecuting agency verifying identity theft or mistaken identity wisconsin form

- Wisconsin temporary guardianship form

- Order and notice of hearing wisconsin form

- Waiver guardianship form

- Wisconsin affidavit service form

- Notice of rights prior to examination by physician or psychologist wisconsin form

- Psychologist report template form

- Proposed guardian form

Find out other 1099me

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT