Instructions for 941P ME Maine Gov 2019

Understanding the 1099me Form

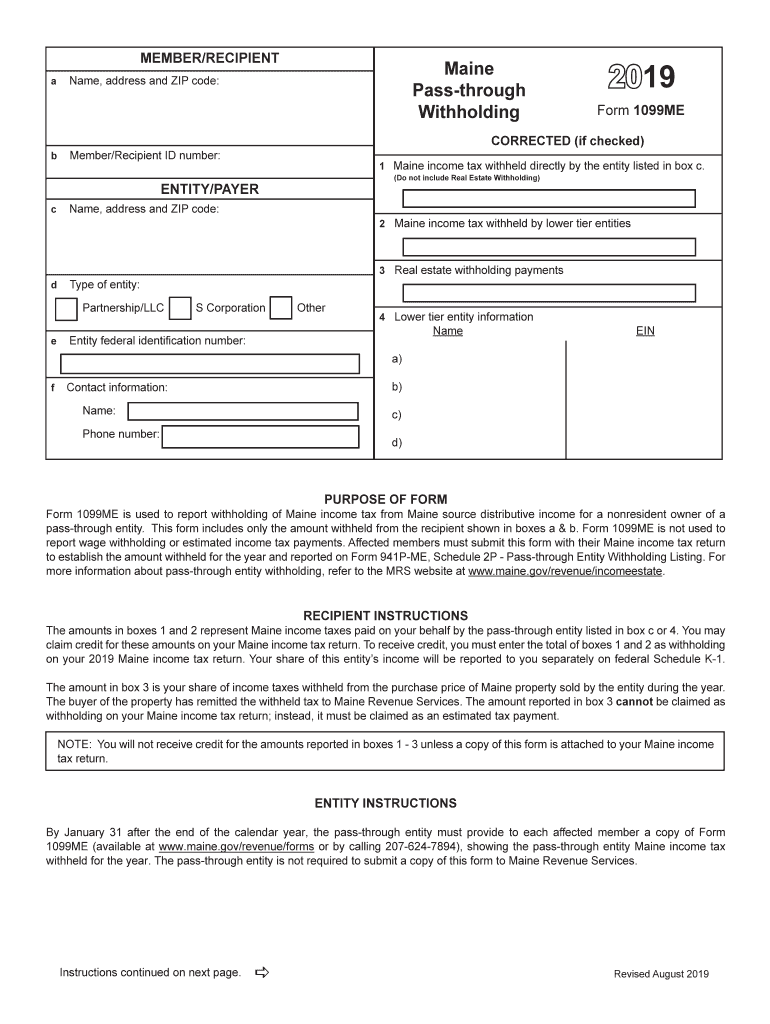

The 1099me form is a crucial document used for reporting various types of income received by individuals and businesses in the United States. This form is particularly relevant for freelancers, independent contractors, and self-employed individuals who receive payments that are not classified as wages. It serves to report income to the Internal Revenue Service (IRS) and ensures that all earnings are accounted for during tax season. Understanding the specifics of the 1099me form helps individuals comply with tax regulations and avoid potential penalties.

Steps to Complete the 1099me Form

Completing the 1099me form involves several key steps to ensure accurate reporting. First, gather all relevant information, including your taxpayer identification number, the recipient's details, and the total amount paid during the tax year. Next, accurately fill out the form, ensuring that all fields are completed correctly. Pay special attention to the income amount and any applicable deductions. After filling out the form, review it for accuracy before submitting it to the IRS and providing a copy to the recipient. This process helps maintain compliance and ensures that all parties have the necessary documentation for their records.

Filing Deadlines for the 1099me Form

Timely filing of the 1099me form is essential to avoid penalties. The IRS requires that the form be submitted by January thirty-first of the year following the tax year in which the payments were made. If you are filing electronically, the deadline may extend to March thirty-first. It is important to mark these dates on your calendar to ensure that you meet the requirements and avoid any late fees or complications with your tax filings.

Legal Use of the 1099me Form

The legal use of the 1099me form is governed by IRS regulations, which stipulate that the form must be used to report payments made in the course of a trade or business. This includes payments for services rendered by independent contractors and other non-employee compensation. Ensuring that the form is filled out correctly and submitted on time is vital for compliance with tax laws. Failure to do so can result in penalties, including fines and interest on unpaid taxes.

Required Documents for Filing the 1099me Form

To file the 1099me form, several documents are required to ensure accurate reporting. You will need the recipient's taxpayer identification number, which can be obtained through a W-9 form. Additionally, keep records of all payments made to the recipient throughout the year, including invoices and receipts. Having these documents organized will facilitate the completion of the form and support your reporting in case of an audit.

Examples of Using the 1099me Form

Examples of when to use the 1099me form include payments made to freelancers for services such as graphic design, consulting, or writing. If a business pays a contractor more than six hundred dollars in a tax year, it is required to issue a 1099me form to report that income. Other scenarios include payments made to attorneys or for rent. Understanding these examples helps clarify the situations in which the 1099me form is applicable and necessary.

Penalties for Non-Compliance with the 1099me Form

Non-compliance with the 1099me filing requirements can lead to significant penalties imposed by the IRS. If the form is not filed on time, the business may face fines that increase with the length of the delay. Additionally, failing to provide the recipient with their copy of the form can result in further penalties. Understanding these risks emphasizes the importance of timely and accurate filing to maintain compliance with tax regulations.

Quick guide on how to complete instructions for 941p me mainegov

Set up Instructions For 941P ME Maine gov effortlessly on any device

Digital document management has become widely embraced by businesses and individuals alike. It offers an ideal environmentally-friendly substitute to traditional printed and signed documents, enabling you to obtain the proper form and securely save it online. airSlate SignNow equips you with all the resources necessary to create, edit, and eSign your documents swiftly without delays. Manage Instructions For 941P ME Maine gov on any device using airSlate SignNow Android or iOS applications and streamline any document-related process now.

The easiest way to edit and eSign Instructions For 941P ME Maine gov without any hassle

- Find Instructions For 941P ME Maine gov and click Get Form to initiate.

- Utilize the tools we offer to fill out your document.

- Mark important sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow.

- Create your signature using the Sign feature, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method to deliver your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, frustrating form searches, or errors that require reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign Instructions For 941P ME Maine gov and maintain excellent communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct instructions for 941p me mainegov

Create this form in 5 minutes!

How to create an eSignature for the instructions for 941p me mainegov

The best way to generate an eSignature for a PDF document in the online mode

The best way to generate an eSignature for a PDF document in Chrome

How to generate an eSignature for putting it on PDFs in Gmail

How to create an eSignature from your mobile device

How to create an eSignature for a PDF document on iOS devices

How to create an eSignature for a PDF file on Android devices

People also ask

-

What is 1099me and how does it work?

1099me is a comprehensive solution that streamlines the process of creating, sending, and eSigning 1099 forms. With airSlate SignNow, users can easily generate 1099 documents, manage recipient information, and ensure compliance with tax regulations efficiently. This user-friendly platform is designed to save time and reduce errors.

-

How much does 1099me cost?

Pricing for 1099me varies depending on your subscription plan, which usually includes various features suited for individual users or businesses. With airSlate SignNow, users can choose a plan that provides flexibility and access to essential tools for managing 1099 forms. The cost-effectiveness of 1099me makes it an attractive option for businesses of all sizes.

-

What features are included with 1099me?

1099me offers a range of features such as automated form creation, eSignature capabilities, and secure document storage. Users benefit from real-time tracking, which allows them to monitor the status of their 1099 forms. With airSlate SignNow, businesses gain access to a simplified document management system tailored to their needs.

-

How does 1099me ensure compliance with IRS regulations?

1099me is designed to help users comply with IRS regulations by providing accurate templates and up-to-date information on 1099 forms. The platform simplifies the process of preparing and submitting these forms, reducing the risk of errors that could result in penalties. airSlate SignNow's dedicated support ensures that users stay informed about compliance requirements.

-

Can I integrate 1099me with other applications?

Yes, 1099me seamlessly integrates with various applications, enhancing its functionality and user experience. This feature allows businesses to connect their existing software tools with airSlate SignNow, streamlining their workflow. Popular integrations include accounting software and project management tools that help centralize document management.

-

Is 1099me suitable for small businesses?

Absolutely! 1099me is ideal for small businesses looking for a cost-effective solution to manage 1099 forms efficiently. The user-friendly interface and comprehensive features provided by airSlate SignNow make it easy for small teams to handle their documentation needs without requiring extensive training or technical expertise.

-

What benefits does 1099me offer for remote teams?

1099me is advantageous for remote teams, enabling them to access and eSign documents from anywhere. This flexibility ensures that all team members can collaborate efficiently, even when working remotely. With airSlate SignNow, remote teams can maintain productivity while managing 1099 forms securely and efficiently.

Get more for Instructions For 941P ME Maine gov

- Plumbing contract for contractor utah form

- Brick mason contract for contractor utah form

- Roofing contract for contractor utah form

- Electrical contract for contractor utah form

- Sheetrock drywall contract for contractor utah form

- Flooring contract for contractor utah form

- Agreement or contract for deed for sale and purchase of real estate aka land or executory contract utah form

- Notice of intent to enforce forfeiture provisions of contact for deed utah form

Find out other Instructions For 941P ME Maine gov

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy

- Electronic signature Oregon Articles of Incorporation Template Simple

- eSignature Montana Direct Deposit Enrollment Form Easy

- How To Electronic signature Nevada Acknowledgement Letter

- Electronic signature New Jersey Acknowledgement Letter Free

- Can I eSignature Oregon Direct Deposit Enrollment Form

- Electronic signature Colorado Attorney Approval Later

- How To Electronic signature Alabama Unlimited Power of Attorney

- Electronic signature Arizona Unlimited Power of Attorney Easy

- Can I Electronic signature California Retainer Agreement Template

- How Can I Electronic signature Missouri Unlimited Power of Attorney

- Electronic signature Montana Unlimited Power of Attorney Secure