Maine Pass through Withholding Maine Gov 2020

Understanding the Maine Pass-Through Withholding

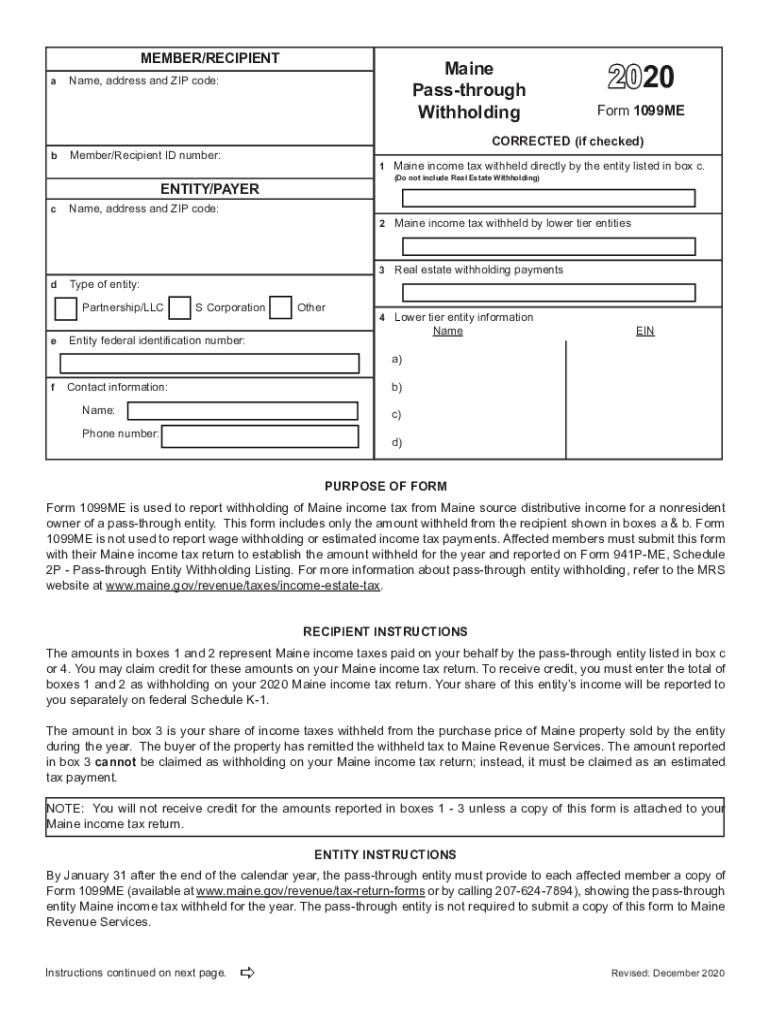

The Maine Pass-Through Withholding is a tax mechanism designed for certain business entities, such as partnerships and LLCs, that pass income through to their owners. This system allows the state to collect income tax on the earnings of these entities before they are distributed to individual members. It is essential for businesses operating in Maine to understand how this withholding operates to ensure compliance with state tax regulations.

Steps to Complete the Maine Pass-Through Withholding

Completing the Maine Pass-Through Withholding involves several key steps. First, businesses must determine their eligibility based on their entity type. Next, they need to calculate the amount to withhold based on the income distributed to each member. This amount is then reported on the appropriate tax forms. Finally, businesses must submit the withheld taxes to the state by the specified deadlines. Proper record-keeping throughout this process is crucial for compliance and future audits.

Filing Deadlines and Important Dates

Timely filing is critical for the Maine Pass-Through Withholding. Generally, the withholding must be reported and paid to the state on a quarterly basis. Specific deadlines may vary based on the entity's fiscal year and the type of income distributed. It is important for businesses to stay informed about these dates to avoid penalties and ensure that they meet their tax obligations.

Required Documents for Maine Pass-Through Withholding

To properly file the Maine Pass-Through Withholding, businesses must gather several documents. These typically include the entity's formation documents, income statements, and any prior tax filings. Additionally, businesses may need to complete specific forms provided by the Maine Revenue Services, which detail the amounts withheld and distributed. Ensuring that all necessary documentation is accurate and complete will facilitate a smoother filing process.

IRS Guidelines Related to Pass-Through Entities

While the Maine Pass-Through Withholding is governed by state law, it is also important to understand the IRS guidelines that apply to pass-through entities. The IRS outlines how income should be reported, the types of deductions that may be claimed, and the overall tax treatment of these entities. Familiarity with these federal guidelines can help businesses navigate both state and federal tax obligations effectively.

Penalties for Non-Compliance

Failure to comply with the Maine Pass-Through Withholding requirements can result in significant penalties. These may include fines, interest on unpaid taxes, and potential legal action. It is essential for businesses to remain vigilant in their tax practices, ensuring that they meet all withholding obligations to avoid these repercussions.

Quick guide on how to complete maine pass through withholding mainegov

Effortlessly Prepare Maine Pass through Withholding Maine gov on Any Device

Managing documents online has become increasingly favored by businesses and individuals alike. It presents an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to obtain the appropriate form and securely save it online. airSlate SignNow provides you with all the tools necessary to create, edit, and electronically sign your documents swiftly without any delays. Handle Maine Pass through Withholding Maine gov on any device using the airSlate SignNow Android or iOS applications and simplify any document-related tasks today.

How to Edit and Electronically Sign Maine Pass through Withholding Maine gov with Ease

- Find Maine Pass through Withholding Maine gov and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or conceal sensitive data using the tools that airSlate SignNow provides specifically for this purpose.

- Create your signature with the Sign tool, which takes just moments and has the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method to send your form: via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your chosen device. Edit and electronically sign Maine Pass through Withholding Maine gov and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct maine pass through withholding mainegov

Create this form in 5 minutes!

How to create an eSignature for the maine pass through withholding mainegov

How to generate an eSignature for your PDF file in the online mode

How to generate an eSignature for your PDF file in Chrome

How to make an eSignature for putting it on PDFs in Gmail

The best way to make an electronic signature right from your smartphone

The best way to create an electronic signature for a PDF file on iOS devices

The best way to make an electronic signature for a PDF on Android

People also ask

-

What is 1099me and how does it work?

1099me is a user-friendly platform that simplifies the process of creating and managing 1099 forms. With airSlate SignNow, you can easily eSign, send, and store 1099 documents securely online, making tax season much less stressful.

-

How much does 1099me cost?

Pricing for 1099me varies based on the features you need and your usage levels. AirSlate SignNow offers cost-effective solutions designed for businesses of all sizes, ensuring you get value for your investment while managing your 1099 forms efficiently.

-

What features does 1099me offer?

1099me includes a variety of features such as document eSigning, customizable templates, real-time tracking, and secure storage. These features streamline the preparation and submission of 1099 forms, helping you manage your compliance needs with ease.

-

Is 1099me secure for my data?

Absolutely! 1099me prioritizes your data security with top-notch encryption and secure access controls. AirSlate SignNow takes all necessary precautions to protect sensitive information, ensuring your 1099 forms are safe and confidential.

-

Can I integrate 1099me with other software?

Yes! 1099me can be seamlessly integrated with various accounting and payroll software. This ensures that your data syncs automatically, making the management of your 1099 forms even easier while maintaining accuracy in your financial records.

-

What benefits does 1099me provide for businesses?

1099me provides businesses with a streamlined process for handling 1099 forms, which saves time and reduces the risk of errors. By using airSlate SignNow's solution, you can enhance your workflow efficiency, allowing you to focus more on your core business operations.

-

How can 1099me save me time during tax season?

1099me automates the preparation and submission of 1099 forms, which can drastically reduce the time spent on manual tasks during tax season. With airSlate SignNow, you can quickly send out forms and track their status without the hassle of paper forms.

Get more for Maine Pass through Withholding Maine gov

- New caney isd physical form

- Optimum bill pdf form

- Iupac nomenclature practice exercises with answers form

- Printable form ol 3 ez

- Prentice hall gold geometry form

- Services for senior citizens rtc southern nevada form

- Bsf329 4 application to transact marine operations with form

- Fillable online if you need to print out a copy of the requisition form

Find out other Maine Pass through Withholding Maine gov

- Sign Illinois Business Operations Affidavit Of Heirship Later

- How Do I Sign Kansas Business Operations LLC Operating Agreement

- Sign Kansas Business Operations Emergency Contact Form Easy

- How To Sign Montana Business Operations Warranty Deed

- Sign Nevada Business Operations Emergency Contact Form Simple

- Sign New Hampshire Business Operations Month To Month Lease Later

- Can I Sign New York Business Operations Promissory Note Template

- Sign Oklahoma Business Operations Contract Safe

- Sign Oregon Business Operations LLC Operating Agreement Now

- Sign Utah Business Operations LLC Operating Agreement Computer

- Sign West Virginia Business Operations Rental Lease Agreement Now

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile

- Sign Delaware Car Dealer Limited Power Of Attorney Fast

- How To Sign Georgia Car Dealer Lease Agreement Form

- How To Sign Iowa Car Dealer Resignation Letter

- Sign Iowa Car Dealer Contract Safe

- Sign Iowa Car Dealer Limited Power Of Attorney Computer