Form PTE EX Withholding Exemption Certificate for Members 2022

What is the Form PTE EX Withholding Exemption Certificate for Members

The Form PTE EX Withholding Exemption Certificate is a crucial document for members of pass-through entities in the United States. This form allows eligible members to claim an exemption from withholding on certain income types, particularly when the income is not subject to federal or state tax withholding. Understanding the purpose of this form is essential for ensuring compliance with tax regulations and maximizing tax efficiency.

Steps to Complete the Form PTE EX Withholding Exemption Certificate for Members

Completing the Form PTE EX requires careful attention to detail. Members should follow these steps:

- Gather necessary information, including your name, address, and taxpayer identification number.

- Indicate the type of income for which you are claiming the exemption.

- Provide details about the pass-through entity, including its name and identification number.

- Sign and date the form, ensuring that all information is accurate and complete.

Accuracy is vital, as errors can lead to delays or issues with tax compliance.

Eligibility Criteria for the Form PTE EX Withholding Exemption Certificate for Members

To qualify for the withholding exemption, members must meet specific eligibility criteria. Generally, this includes:

- Being a member of a recognized pass-through entity, such as an LLC or partnership.

- Having income that meets the exemption requirements set forth by state and federal guidelines.

- Providing accurate and complete information on the form to avoid penalties.

It is important to review the criteria carefully to ensure compliance and avoid unnecessary withholding.

Legal Use of the Form PTE EX Withholding Exemption Certificate for Members

The legal use of the Form PTE EX is governed by both state and federal tax laws. This form must be used in accordance with the relevant regulations to ensure that the exemption is valid. Members should be aware of the legal implications of submitting this form, including the potential for audits or penalties if the information provided is inaccurate or misleading. Proper use of the form can help members avoid unnecessary tax liabilities.

Filing Deadlines and Important Dates for the Form PTE EX Withholding Exemption Certificate for Members

Timely submission of the Form PTE EX is essential to avoid penalties. Members should be aware of the following important dates:

- Annual filing deadline for the form, typically aligned with the entity's tax return due date.

- Any state-specific deadlines that may apply.

- Additional deadlines for submitting supporting documentation if required.

Staying informed about these deadlines helps ensure compliance and prevents unnecessary complications.

Form Submission Methods for the Form PTE EX Withholding Exemption Certificate for Members

Members have several options for submitting the Form PTE EX. These methods typically include:

- Online submission through the state tax authority's website.

- Mailing the completed form to the appropriate tax office.

- In-person submission at designated tax offices, if available.

Selecting the appropriate submission method is important for ensuring that the form is processed in a timely manner.

Quick guide on how to complete form pte ex withholding exemption certificate for members

Complete Form PTE EX Withholding Exemption Certificate For Members effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, as you can easily find the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without any hold-ups. Manage Form PTE EX Withholding Exemption Certificate For Members on any device with airSlate SignNow's Android or iOS applications and streamline any document-focused procedure today.

How to modify and eSign Form PTE EX Withholding Exemption Certificate For Members effortlessly

- Find Form PTE EX Withholding Exemption Certificate For Members and click on Get Form to initiate.

- Utilize the tools at your disposal to finalize your document.

- Emphasize important sections of your documents or obscure sensitive details with tools specifically offered by airSlate SignNow for this purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal standing as a conventional wet ink signature.

- Review the information carefully and click on the Done button to save your updates.

- Select your preferred method of sharing your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that necessitate printing new copies of documents. airSlate SignNow meets all your document management needs with just a few clicks from any device you choose. Modify and eSign Form PTE EX Withholding Exemption Certificate For Members to ensure excellent communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form pte ex withholding exemption certificate for members

Create this form in 5 minutes!

How to create an eSignature for the form pte ex withholding exemption certificate for members

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

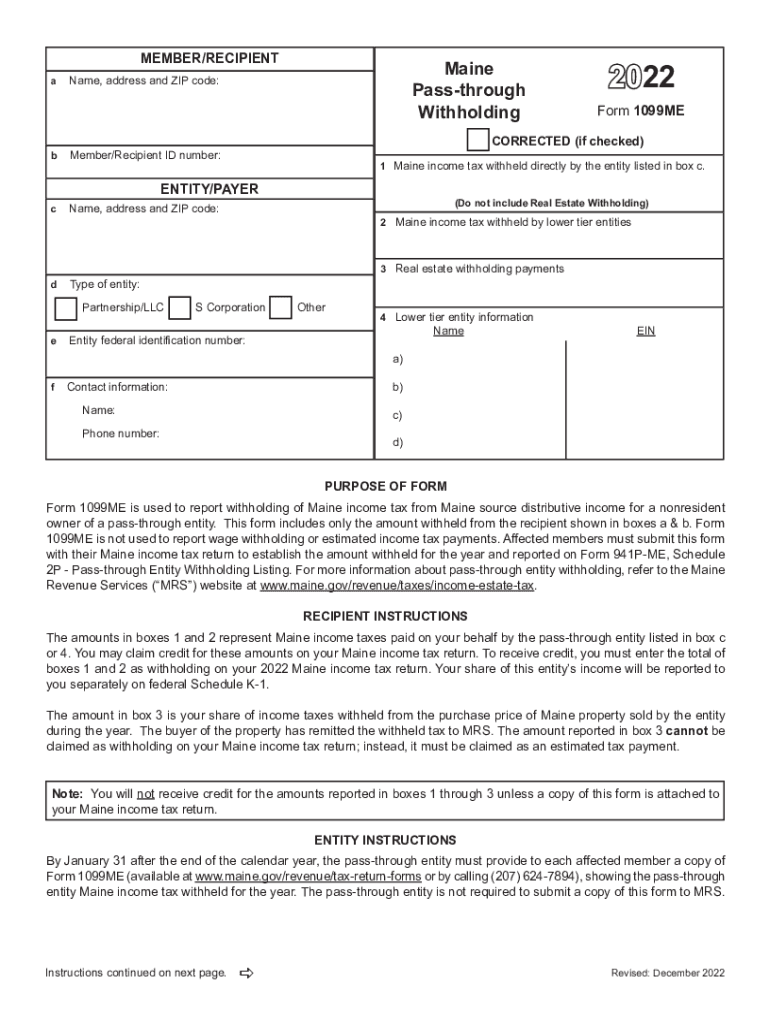

What is 1099me and how does it work?

1099me is a streamlined solution designed to help individuals and businesses effortlessly handle their 1099 forms. It integrates seamlessly with your financial systems to simplify the generation, distribution, and eSigning of documents, ensuring compliance and accuracy. With 1099me, users can manage tax documentation efficiently and avoid the hassle of manual processing.

-

What are the pricing options for 1099me?

1099me offers flexible pricing plans tailored to various business needs, starting from a basic plan suitable for freelancers to comprehensive packages ideal for larger organizations. Customers can choose monthly or annual billing options to match their budgets. Enjoy a cost-effective solution without compromising on essential features.

-

What features does 1099me offer?

1099me includes a range of features such as automated document generation, real-time tracking, and customizable templates for 1099 forms. Additionally, it supports eSigning, which allows users to obtain signatures quickly and securely. These features streamline the entire process, making tax documentation simpler and more efficient.

-

How can 1099me benefit my business?

By using 1099me, businesses can save valuable time and resources during tax season. The automated processes reduce the risk of errors and ensure compliance with IRS regulations, eliminating the stress associated with paperwork. This means you can focus more on your core business activities instead of getting bogged down with tax forms.

-

Is 1099me secure for handling sensitive information?

Absolutely! 1099me prioritizes security by implementing robust encryption protocols and ensuring that all data is securely stored and transmitted. Your sensitive information is protected, giving you peace of mind when handling critical tax documents. Compliance with privacy regulations further guarantees your data's safety.

-

Can 1099me integrate with my existing accounting software?

Yes, 1099me offers seamless integrations with popular accounting software like QuickBooks, Xero, and more. This feature allows for automatic syncing of financial data, making the document management process even more efficient. With these integrations, users can avoid duplicate data entry and streamline their workflows.

-

Are there customer support options for 1099me users?

1099me provides excellent customer support to assist users with any questions or issues they may encounter. Support is available through multiple channels, including email, phone, and live chat. The dedicated team is ready to ensure that you have a smooth experience while using 1099me.

Get more for Form PTE EX Withholding Exemption Certificate For Members

- Pasi form

- Speed time and distance worksheet form

- Occupancy affidavit form

- Nyc doe covid consent form

- Grammar review quiz comparatives and superlatives form

- Samples form

- Pcdasc form

- Adoption agreement trust company of america solo 401k profit sharing plan caution failure to properly fill out this adoption form

Find out other Form PTE EX Withholding Exemption Certificate For Members

- eSignature New Jersey Last Will and Testament Online

- eSignature Pennsylvania Last Will and Testament Now

- eSign Arkansas Software Development Agreement Template Easy

- eSign Michigan Operating Agreement Free

- Help Me With eSign Nevada Software Development Agreement Template

- eSign Arkansas IT Consulting Agreement Computer

- How To eSignature Connecticut Living Will

- eSign Alaska Web Hosting Agreement Computer

- eSign Alaska Web Hosting Agreement Now

- eSign Colorado Web Hosting Agreement Simple

- How Do I eSign Colorado Joint Venture Agreement Template

- How To eSign Louisiana Joint Venture Agreement Template

- eSign Hawaii Web Hosting Agreement Now

- eSign New Jersey Joint Venture Agreement Template Online

- eSign Missouri Web Hosting Agreement Now

- eSign New Jersey Web Hosting Agreement Now

- eSign Texas Deposit Receipt Template Online

- Help Me With eSign Nebraska Budget Proposal Template

- eSign New Mexico Budget Proposal Template Now

- eSign New York Budget Proposal Template Easy