Get the Complete the FedEx Express PN Transmission Form Using 2020

Understanding Nebraska Tax Forms

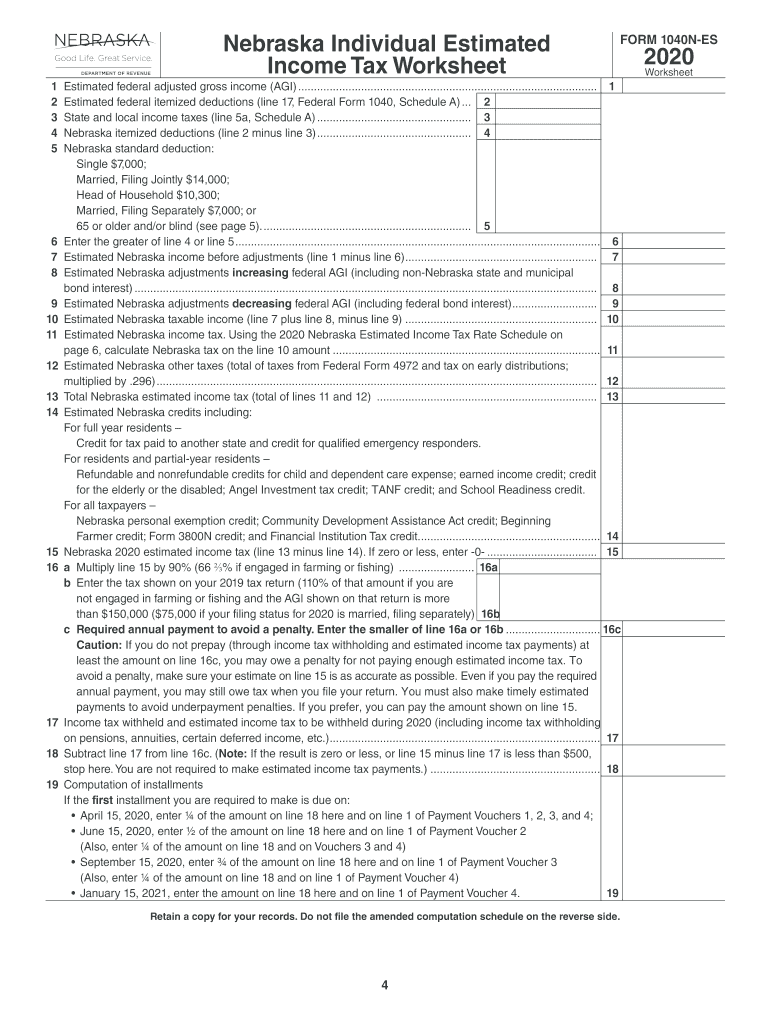

Nebraska tax forms are essential documents for individuals and businesses to report their income and calculate their tax obligations. The primary form used by residents is the Nebraska Individual Income Tax Form, also known as the 1040N. This form is used to report income, claim deductions, and determine the amount of tax owed or refund due. Understanding the specific requirements and instructions for filling out this form can help ensure compliance and accuracy in your tax filings.

Filing Deadlines and Important Dates

It is crucial to be aware of the filing deadlines for Nebraska tax forms to avoid penalties. Typically, the deadline for filing the Nebraska Individual Income Tax Form is April 15th, following the end of the tax year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Additionally, taxpayers should keep track of any extensions that may apply, as well as deadlines for estimated tax payments, which often occur on a quarterly basis.

Required Documents for Filing

When preparing to file your Nebraska tax forms, gather all necessary documents to ensure a smooth process. Commonly required documents include:

- W-2 forms from employers

- 1099 forms for additional income

- Records of any deductions or credits you plan to claim

- Proof of payment for estimated taxes, if applicable

Having these documents ready will facilitate accurate completion of the 1040N and help avoid delays in processing your return.

Form Submission Methods

Taxpayers in Nebraska have several options for submitting their tax forms. You can file your Nebraska tax forms online, which is often the fastest method. Many taxpayers choose to use e-filing software, which can streamline the process and help ensure accuracy. Alternatively, you can mail your completed forms to the appropriate Nebraska Department of Revenue address. In-person submissions are also possible at designated locations, although this method may require an appointment.

Penalties for Non-Compliance

Failing to comply with Nebraska tax filing requirements can lead to significant penalties. Common penalties include late filing fees, interest on unpaid taxes, and potential legal consequences for willful non-compliance. It is essential to file your forms accurately and on time to avoid these repercussions. Understanding the specific penalties associated with late or incorrect filings can help motivate timely compliance with tax obligations.

Digital vs. Paper Version of Nebraska Tax Forms

Taxpayers have the option to choose between digital and paper versions of Nebraska tax forms. The digital version, available through e-filing platforms, offers benefits such as automatic calculations and quicker processing times. Conversely, the paper version can be filled out manually and mailed. While both versions are legally valid, many taxpayers prefer the digital format for its convenience and efficiency.

Eligibility Criteria for Filing

Eligibility criteria for filing Nebraska tax forms vary based on factors such as income level, residency status, and specific tax situations. Generally, all residents and non-residents earning income in Nebraska must file a return if their income exceeds certain thresholds. Additionally, specific forms may be required for different taxpayer scenarios, such as self-employed individuals or those claiming specific deductions. Understanding these criteria is vital to ensure compliance and accurate reporting.

Quick guide on how to complete get the complete the fedex express pn transmission form using

Effortlessly Prepare Get The Complete The FedEx Express PN Transmission Form Using on Any Device

Managing documents online has gained traction among companies and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents promptly without any hold-ups. Handle Get The Complete The FedEx Express PN Transmission Form Using on any device with airSlate SignNow's Android or iOS applications and streamline your document-related tasks today.

How to Adjust and eSign Get The Complete The FedEx Express PN Transmission Form Using with Ease

- Find Get The Complete The FedEx Express PN Transmission Form Using and click Obtain Form to begin.

- Utilize the tools available to fill out your document.

- Emphasize critical sections of the documents or black out confidential information using tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature with the Sign tool, which takes just seconds and holds the same legal validity as a conventional handwritten signature.

- Verify the information and then click on the Finish button to save your alterations.

- Select your preferred method for sharing your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or mislaid files, tedious document searching, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign Get The Complete The FedEx Express PN Transmission Form Using to ensure smooth communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct get the complete the fedex express pn transmission form using

Create this form in 5 minutes!

How to create an eSignature for the get the complete the fedex express pn transmission form using

How to generate an electronic signature for your PDF document online

How to generate an electronic signature for your PDF document in Google Chrome

The way to make an electronic signature for signing PDFs in Gmail

The way to generate an electronic signature straight from your smart phone

How to make an electronic signature for a PDF document on iOS

The way to generate an electronic signature for a PDF document on Android OS

People also ask

-

What is Nebraska tax and how can airSlate SignNow help manage it?

Nebraska tax refers to the various taxation requirements applied by the state. airSlate SignNow streamlines the documentation process for tax-related forms, making it easier for businesses and individuals to stay compliant with Nebraska tax regulations. By simplifying eSigning and management of tax documents, it ensures you can focus on meeting tax deadlines efficiently.

-

How much does airSlate SignNow cost for managing Nebraska tax documents?

The pricing for airSlate SignNow varies based on the features you select, but it is designed to be cost-effective for businesses of all sizes. Our plans cater to organizations needing to handle Nebraska tax documentation efficiently without inflated costs. Visit our pricing page for complete details and choose a plan that aligns with your Nebraska tax management needs.

-

What features does airSlate SignNow offer for Nebraska tax document eSigning?

airSlate SignNow offers a suite of features tailored for Nebraska tax documentation, including secure eSignature capabilities, template creation, and document tracking. These features eliminate the need for paper-based signing and greatly expedite your Nebraska tax paperwork processes. By providing a smooth and compliant eSigning experience, you can effectively manage all your tax-related tasks.

-

Can I integrate airSlate SignNow with other software for Nebraska tax management?

Yes, airSlate SignNow seamlessly integrates with various software applications that help manage Nebraska tax processes. With integrations ranging from CRM systems to accounting software, you can ensure that your workflows are cohesive. This connectivity assists in efficiently managing your tax-related activities and staying compliant with Nebraska tax obligations.

-

What are the benefits of using airSlate SignNow for Nebraska tax forms?

Using airSlate SignNow for your Nebraska tax forms offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced compliance. The ability to eSign documents quickly and securely translates into less time spent on administrative tasks and more focus on your core business. Additionally, the platform provides a reliable audit trail for your Nebraska tax submissions.

-

How does airSlate SignNow ensure the security of Nebraska tax documents?

Security is a top priority for airSlate SignNow, especially when handling sensitive Nebraska tax documents. We utilize advanced encryption and multi-factor authentication to safeguard your data. This ensures that your Nebraska tax documents are protected throughout the signing process, giving you peace of mind regarding compliance and data privacy.

-

Is airSlate SignNow user-friendly for Nebraska tax document management?

Absolutely! airSlate SignNow is designed with an intuitive interface that makes managing Nebraska tax documents user-friendly. Whether you are an experienced user or new to eSigning, our platform provides a straightforward experience. This ease of use allows you to focus on completing your tax tasks without unnecessary complications.

Get more for Get The Complete The FedEx Express PN Transmission Form Using

- Excavation contractor package virginia form

- Virginia contractor form

- Concrete mason contractor package virginia form

- Demolition contractor package virginia form

- Security contractor package virginia form

- Insulation contractor package virginia form

- Paving contractor package virginia form

- Site work contractor package virginia form

Find out other Get The Complete The FedEx Express PN Transmission Form Using

- How Can I Electronic signature Illinois Real Estate Document

- How Do I Electronic signature Indiana Real Estate Presentation

- How Can I Electronic signature Ohio Plumbing PPT

- Can I Electronic signature Texas Plumbing Document

- How To Electronic signature Michigan Real Estate Form

- How To Electronic signature Arizona Police PDF

- Help Me With Electronic signature New Hampshire Real Estate PDF

- Can I Electronic signature New Hampshire Real Estate Form

- Can I Electronic signature New Mexico Real Estate Form

- How Can I Electronic signature Ohio Real Estate Document

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word

- How To Electronic signature Tennessee Real Estate Document

- How Do I Electronic signature Utah Real Estate Form

- How To Electronic signature Utah Real Estate PPT

- How Can I Electronic signature Virginia Real Estate PPT

- How Can I Electronic signature Massachusetts Sports Presentation

- How To Electronic signature Colorado Courts PDF