Nebraska Department of Revenue 2021

What is the Nebraska Department of Revenue

The Nebraska Department of Revenue is the state agency responsible for administering tax laws and collecting taxes in Nebraska. It oversees various tax programs, including income tax, sales tax, and property tax. The department ensures compliance with tax regulations and provides resources to help taxpayers understand their obligations. It also plays a vital role in the distribution of state funds, ensuring that revenue collected is allocated appropriately for public services.

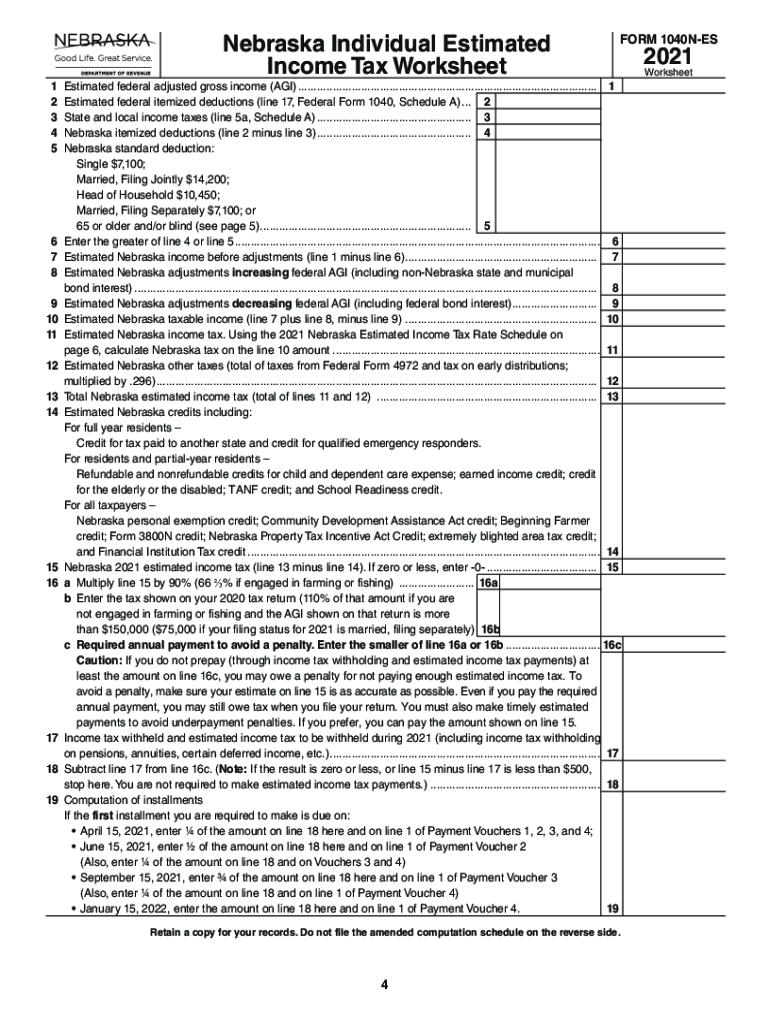

Steps to complete the Nebraska Department of Revenue forms

Completing forms for the Nebraska Department of Revenue involves several key steps. First, determine which form you need based on your tax situation, such as the Nebraska individual estimated tax or the Nebraska income tax form 1040N. Next, gather all necessary documentation, including income statements and deductions. After that, fill out the form accurately, ensuring that all information is correct to avoid penalties. Finally, review your completed form before submission to ensure accuracy and compliance with state regulations.

Filing Deadlines / Important Dates

Filing deadlines for Nebraska taxes are crucial to avoid penalties. For individual income tax, the standard deadline is April 15. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Additionally, estimated tax payments are typically due on the 15th of April, June, September, and January of the following year. Staying informed about these important dates helps ensure timely filing and payment.

Required Documents

When filing taxes with the Nebraska Department of Revenue, specific documents are necessary. Commonly required documents include W-2 forms from employers, 1099 forms for other income, and documentation for deductions such as mortgage interest or medical expenses. It's essential to have these documents organized and accessible to facilitate accurate completion of your tax forms.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers in Nebraska have several options for submitting their forms to the Department of Revenue. Forms can be filed online through the Nebraska Department of Revenue website, which offers a secure and efficient method. Alternatively, taxpayers may choose to mail their completed forms to the appropriate address provided on the form. In-person submissions are also accepted at designated locations, allowing for direct interaction with department staff for assistance.

Penalties for Non-Compliance

Failure to comply with Nebraska tax regulations can result in significant penalties. These may include late filing fees, interest on unpaid taxes, and additional fines for inaccuracies. Understanding the potential consequences of non-compliance is essential for all taxpayers to avoid unnecessary financial burdens and ensure adherence to state tax laws.

Eligibility Criteria

Eligibility for various tax programs and forms within the Nebraska Department of Revenue is determined by specific criteria. For instance, individuals must meet income thresholds to qualify for certain deductions or credits. Additionally, business entities must adhere to regulations based on their classification, such as LLCs or corporations. Familiarizing oneself with these eligibility requirements is crucial for accurate tax filing and maximizing potential benefits.

Quick guide on how to complete 2020 nebraska department of revenue

Finalize Nebraska Department Of Revenue effortlessly on any device

Web-based document management has become widely adopted by enterprises and individuals alike. It serves as an excellent eco-friendly alternative to traditional printed and signed documents, enabling you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the essential tools to create, alter, and electronically sign your documents swiftly without holdups. Administer Nebraska Department Of Revenue on any platform using airSlate SignNow's Android or iOS applications and enhance any document-focused workflow today.

The easiest way to modify and electronically sign Nebraska Department Of Revenue effortlessly

- Obtain Nebraska Department Of Revenue and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow has specifically designed for that purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your modifications.

- Choose how you wish to share your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form hunting, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Nebraska Department Of Revenue and ensure exceptional communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 nebraska department of revenue

Create this form in 5 minutes!

How to create an eSignature for the 2020 nebraska department of revenue

How to make an electronic signature for your PDF in the online mode

How to make an electronic signature for your PDF in Chrome

The best way to generate an electronic signature for putting it on PDFs in Gmail

The way to create an eSignature right from your smart phone

The best way to generate an electronic signature for a PDF on iOS devices

The way to create an eSignature for a PDF on Android OS

People also ask

-

What is airSlate SignNow's pricing for Nebraska tax-related documents?

airSlate SignNow offers competitive pricing plans that cater to businesses handling Nebraska tax documents. These plans provide ample users' access and scalable options to efficiently manage your eSigning needs while staying compliant with Nebraska tax regulations.

-

How does airSlate SignNow ensure compliance with Nebraska tax laws?

airSlate SignNow is designed to keep your documents secure and compliant with Nebraska tax laws. Our platform uses advanced encryption and industry-standard practices to ensure that any electronic signatures you obtain meet Nebraska tax requirements.

-

What are the key features of airSlate SignNow for managing Nebraska tax documents?

Some key features include customizable templates, automated workflows, and real-time tracking of document status. These capabilities make it easier for businesses to manage their Nebraska tax documents efficiently and effectively.

-

Can airSlate SignNow integrate with other accounting software for Nebraska tax filings?

Yes, airSlate SignNow integrates seamlessly with popular accounting software solutions, facilitating smoother workflows for Nebraska tax filings. These integrations help streamline processes and reduce errors, making tax preparation easier.

-

How can airSlate SignNow improve the signing process for Nebraska tax documents?

By using airSlate SignNow, businesses can simplify the signing process for Nebraska tax documents. Our user-friendly interface allows multiple parties to eSign documents swiftly, reducing the turnaround time for tax-related paperwork.

-

Is airSlate SignNow suitable for large businesses dealing with Nebraska tax forms?

Absolutely! airSlate SignNow is scalable and can accommodate the needs of large businesses managing numerous Nebraska tax forms. The platform can handle high volumes of documents while maintaining security and compliance.

-

What benefits does airSlate SignNow offer for small businesses with Nebraska tax needs?

For small businesses, airSlate SignNow provides an efficient, cost-effective solution to manage Nebraska tax documents. Our platform reduces administrative burdens through automation, allowing small business owners to focus on growth instead of paperwork.

Get more for Nebraska Department Of Revenue

- Mltc 62 nebraska form

- Algemeen aanvraagformulier voor farmacie en hulpmiddelen menzis

- Bb glow pdf form

- Scdot form 600 01

- New york form it 212 investment credit

- Prescription pickup authorization form hotel pharmacy

- Verification of employment as an administrator form

- Register for schedule h1 medicines form

Find out other Nebraska Department Of Revenue

- Sign Minnesota Insurance Residential Lease Agreement Fast

- How Do I Sign Ohio Lawers LLC Operating Agreement

- Sign Oregon Lawers Limited Power Of Attorney Simple

- Sign Oregon Lawers POA Online

- Sign Mississippi Insurance POA Fast

- How Do I Sign South Carolina Lawers Limited Power Of Attorney

- Sign South Dakota Lawers Quitclaim Deed Fast

- Sign South Dakota Lawers Memorandum Of Understanding Free

- Sign South Dakota Lawers Limited Power Of Attorney Now

- Sign Texas Lawers Limited Power Of Attorney Safe

- Sign Tennessee Lawers Affidavit Of Heirship Free

- Sign Vermont Lawers Quitclaim Deed Simple

- Sign Vermont Lawers Cease And Desist Letter Free

- Sign Nevada Insurance Lease Agreement Mobile

- Can I Sign Washington Lawers Quitclaim Deed

- Sign West Virginia Lawers Arbitration Agreement Secure

- Sign Wyoming Lawers Lease Agreement Now

- How To Sign Alabama Legal LLC Operating Agreement

- Sign Alabama Legal Cease And Desist Letter Now

- Sign Alabama Legal Cease And Desist Letter Later