Form 40 ES Estimated Tax Payment Voucher Corporation 2022-2026

Key elements of the 2nes form

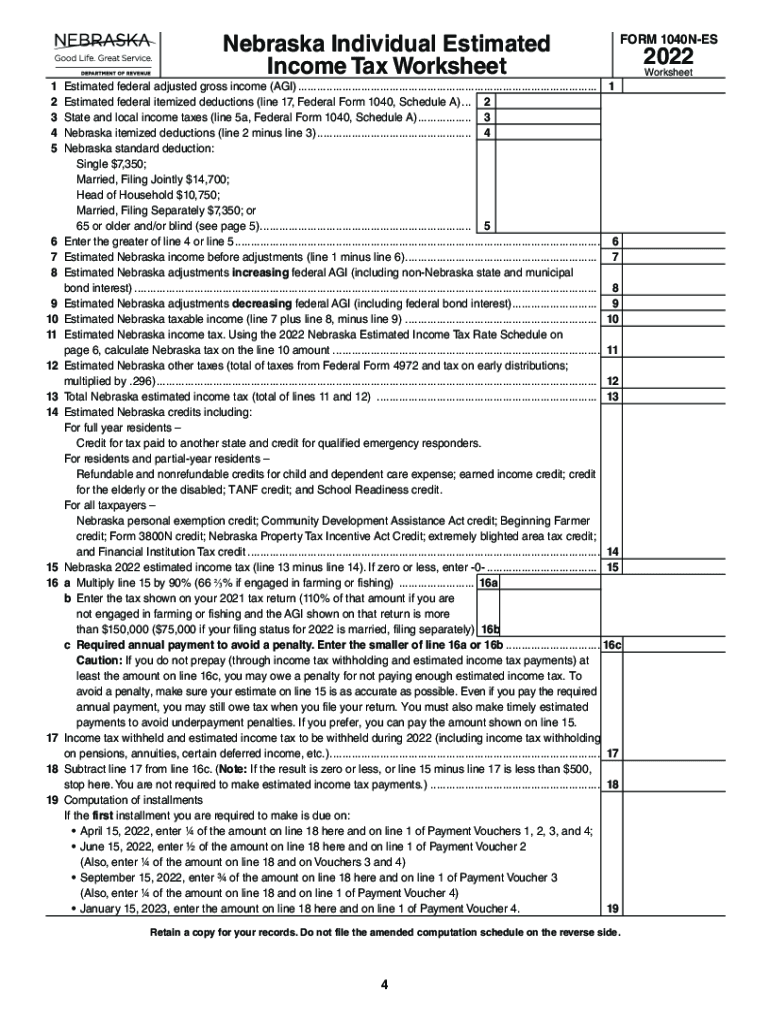

The 2nes form is essential for Nebraska residents who need to report their income and calculate their state tax obligations. This form includes several key elements that taxpayers must understand to ensure accurate completion:

- Personal Information: This section requires the taxpayer's name, address, and Social Security number. Accurate information is crucial for proper identification.

- Income Reporting: Taxpayers must report all sources of income, including wages, interest, and dividends. This section determines the total income subject to taxation.

- Adjustments to Income: Taxpayers can claim certain adjustments, such as contributions to retirement accounts or student loan interest, which may reduce taxable income.

- Tax Calculation: The form provides a method for calculating the total tax owed based on the reported income and applicable tax rates.

- Payments and Credits: This section allows taxpayers to report any tax payments made throughout the year and claim any eligible tax credits, which can reduce the overall tax liability.

- Signature and Date: A signature is required to validate the form, along with the date of signing, confirming that the information provided is accurate and complete.

Steps to complete the 2nes form

Completing the 2nes form involves several systematic steps to ensure accuracy and compliance with Nebraska tax laws:

- Gather Documentation: Collect all necessary documents, including W-2s, 1099s, and any other income statements.

- Fill Out Personal Information: Enter your name, address, and Social Security number at the top of the form.

- Report Income: Accurately report all sources of income in the designated sections, ensuring that all figures match your documentation.

- Claim Adjustments: If applicable, list any adjustments to your income that you qualify for, such as retirement contributions.

- Calculate Tax: Use the provided tax tables or formulas to determine your total tax liability based on your reported income.

- Report Payments and Credits: Include any tax payments made during the year and claim any credits you are eligible for.

- Sign and Date: Finally, sign and date the form to certify that all information is true and complete.

Legal use of the 2nes form

The 2nes form serves as a legal document for filing state income taxes in Nebraska. To ensure its legal validity, taxpayers must adhere to specific guidelines:

- Compliance with State Laws: The form must be completed in accordance with Nebraska tax laws and regulations.

- Accurate Information: Providing truthful and accurate information is crucial; discrepancies may lead to penalties or legal issues.

- Signature Requirement: A signature is necessary to validate the form, indicating that the taxpayer accepts responsibility for the accuracy of the information provided.

- Timely Submission: The form must be submitted by the designated deadline to avoid late fees or penalties.

Filing Deadlines / Important Dates

Staying informed about filing deadlines is essential for compliance with Nebraska tax laws. Key dates for the 2nes form include:

- Filing Deadline: The due date for submitting the 2nes form is typically April 15 of the following year, unless it falls on a weekend or holiday.

- Extension Requests: If additional time is needed, taxpayers can file for an extension, which generally allows for an additional six months to submit the form.

- Payment Deadlines: Any taxes owed must be paid by the original filing deadline to avoid interest and penalties.

Form Submission Methods

Taxpayers have several options for submitting the 2nes form, ensuring flexibility and convenience:

- Online Submission: Many taxpayers choose to file electronically through state-approved e-filing services, which can expedite processing.

- Mail Submission: The form can be printed and mailed to the appropriate Nebraska Department of Revenue address. Ensure that it is postmarked by the filing deadline.

- In-Person Submission: Taxpayers may also visit local tax offices to submit their forms in person, which can provide immediate confirmation of receipt.

IRS Guidelines

While the 2nes form is specific to Nebraska, it is essential to understand the IRS guidelines that may affect state tax filings:

- Federal Compliance: Ensure that all income reported on the 1040nes aligns with federal tax filings, as discrepancies can trigger audits.

- Tax Credits and Deductions: Familiarize yourself with federal tax credits and deductions that may impact state tax calculations.

- Record Keeping: Maintain accurate records of all income and deductions, as both state and federal authorities may require documentation for verification.

Quick guide on how to complete form 40 es estimated tax payment voucher corporation

Complete Form 40 ES Estimated Tax Payment Voucher Corporation effortlessly on any device

Digital document management has become increasingly popular among companies and individuals. It offers an excellent eco-friendly option to conventional printed and signed documents, allowing you to find the right form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly and efficiently. Manage Form 40 ES Estimated Tax Payment Voucher Corporation on any device using the airSlate SignNow Android or iOS applications and enhance any document-focused operation today.

How to modify and eSign Form 40 ES Estimated Tax Payment Voucher Corporation with ease

- Obtain Form 40 ES Estimated Tax Payment Voucher Corporation and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of the documents or obscure sensitive data with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Verify all the details and click the Done button to save your changes.

- Select your preferred method to deliver your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device. Edit and eSign Form 40 ES Estimated Tax Payment Voucher Corporation and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 40 es estimated tax payment voucher corporation

Create this form in 5 minutes!

How to create an eSignature for the form 40 es estimated tax payment voucher corporation

The best way to create an electronic signature for your PDF file in the online mode

The best way to create an electronic signature for your PDF file in Chrome

How to make an e-signature for putting it on PDFs in Gmail

How to generate an electronic signature right from your smartphone

The way to create an electronic signature for a PDF file on iOS devices

How to generate an electronic signature for a PDF on Android

People also ask

-

What are Nebraska estimated tax forms 2024?

Nebraska estimated tax forms 2024 are documents used by individuals and businesses in Nebraska to report and pay estimated tax payments for the tax year 2024. These forms help ensure that taxpayers meet their tax obligations, avoiding underpayment penalties. Staying informed about these forms is essential for financial planning in Nebraska.

-

How can I access Nebraska estimated tax forms 2024?

You can access Nebraska estimated tax forms 2024 online through the Nebraska Department of Revenue's website or through various accounting software platforms. Additionally, airSlate SignNow allows you to manage and sign these forms electronically, streamlining your tax preparation process. It's a convenient way to ensure your forms are completed accurately.

-

What features does airSlate SignNow offer for managing Nebraska estimated tax forms 2024?

airSlate SignNow offers features such as easy document creation, electronic signatures, and seamless collaboration to manage Nebraska estimated tax forms 2024. Its user-friendly interface ensures that you can complete and send your forms quickly. This digital solution saves you time and enhances your workflow efficiency.

-

Are there any costs associated with using airSlate SignNow for Nebraska estimated tax forms 2024?

Yes, while airSlate SignNow provides a cost-effective solution, there are subscription plans that you may choose based on your business needs. These plans offer various features to support the management of Nebraska estimated tax forms 2024. It's best to review the pricing options to find the one that best fits your budget.

-

How does airSlate SignNow ensure the security of my Nebraska estimated tax forms 2024?

airSlate SignNow prioritizes security with advanced encryption protocols to protect your Nebraska estimated tax forms 2024. The platform is compliant with industry standards, ensuring that your sensitive information remains confidential. You can trust airSlate SignNow for secure document management and electronic signatures.

-

Can airSlate SignNow integrate with other accounting software for Nebraska estimated tax forms 2024?

Absolutely! airSlate SignNow seamlessly integrates with various accounting software, making it easy to import and manage Nebraska estimated tax forms 2024. These integrations help streamline your workflow, allowing for smooth data transfer and efficient document handling. It's a valuable feature for businesses looking to enhance their tax preparation processes.

-

What are the benefits of using airSlate SignNow for Nebraska estimated tax forms 2024?

Using airSlate SignNow for Nebraska estimated tax forms 2024 provides numerous benefits, including improved efficiency, reduced paperwork, and enhanced accuracy in filing. The platform allows for quick electronic signatures, helping to expedite the submission process. Overall, it simplifies tax preparation while ensuring compliance with state regulations.

Get more for Form 40 ES Estimated Tax Payment Voucher Corporation

- Cancellation release 497319611 form

- Premarital agreements package new jersey form

- Painting contractor package new jersey form

- Framing contractor package new jersey form

- Foundation contractor package new jersey form

- Plumbing contractor package new jersey form

- Brick mason contractor package new jersey form

- Roofing contractor package new jersey form

Find out other Form 40 ES Estimated Tax Payment Voucher Corporation

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free

- Sign Kansas Insurance Rental Lease Agreement Fast

- Sign Kansas Insurance Rental Lease Agreement Safe

- How To Sign Kansas Insurance Rental Lease Agreement

- How Can I Sign Kansas Lawers Promissory Note Template

- Sign Kentucky Lawers Living Will Free

- Sign Kentucky Lawers LLC Operating Agreement Mobile