CALIFORNIA 540 Forms & Instructions Personal Income Tax Booklet CALIFORNIA 540 Forms & Instructions Personal Income Tax 2019-2026

Understanding the California 540 Form

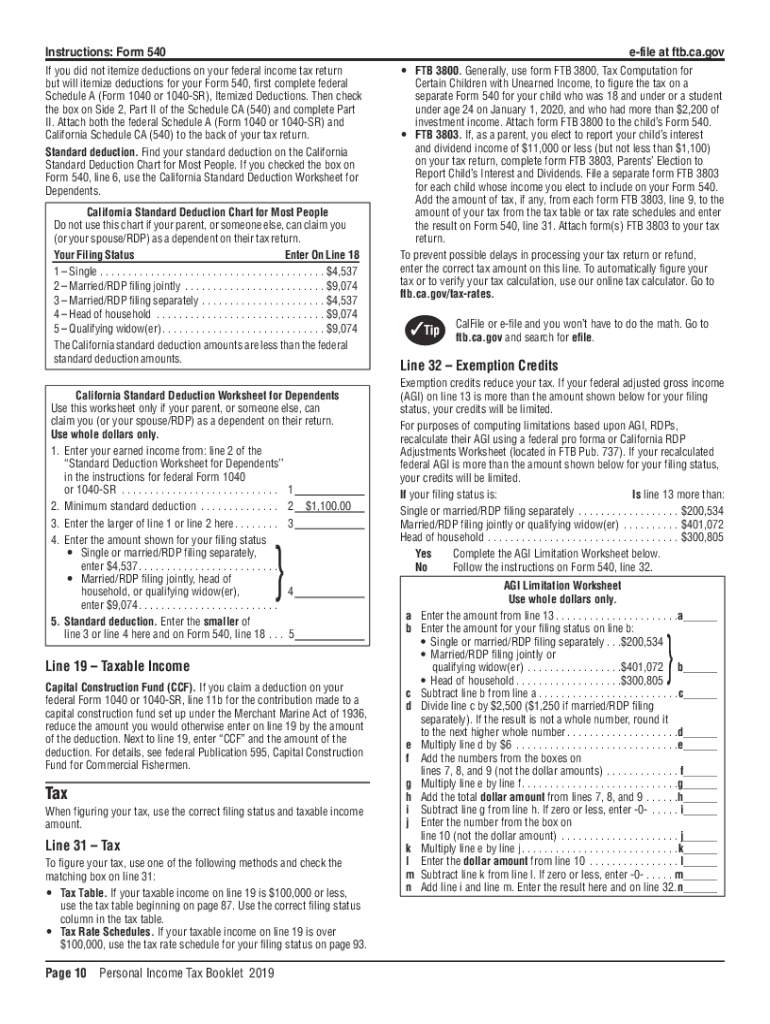

The California 540 form is a crucial document for individuals filing personal income taxes in California. It is designed for residents of the state and is used to report income, calculate tax liability, and claim any applicable credits. The form includes various sections that require detailed information about income sources, deductions, and personal information. Understanding the purpose and structure of the California 540 form is essential for accurate tax filing.

Steps to Complete the California 540 Form

Filling out the California 540 form involves several steps to ensure accuracy and compliance with state tax laws. Begin by gathering all necessary documents, such as W-2s, 1099s, and records of other income. Next, follow these steps:

- Provide personal information, including your name, address, and Social Security number.

- Report your income from various sources, including wages, interest, and dividends.

- Claim deductions and credits applicable to your situation, such as standard deductions or itemized deductions.

- Calculate your total tax liability based on the income reported and deductions claimed.

- Review your form for accuracy before submission.

Legal Use of the California 540 Form

The California 540 form is legally binding when filled out correctly and submitted to the California Franchise Tax Board. It must comply with all applicable state laws and regulations. Electronic signatures are accepted, provided they meet the requirements set forth by the ESIGN Act and UETA. This ensures that the document is recognized as valid and enforceable in legal contexts.

Filing Deadlines for the California 540 Form

Timely filing of the California 540 form is essential to avoid penalties and interest. The standard deadline for filing is typically April 15 of the following year after the tax year ends. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be aware of any extensions that may apply, as well as specific deadlines for certain types of income or deductions.

Required Documents for Filing the California 540 Form

To complete the California 540 form accurately, you will need several key documents. These typically include:

- W-2 forms from employers that report your annual income.

- 1099 forms for any freelance or contract work.

- Records of any additional income, such as rental income or investment earnings.

- Documentation for deductions, including receipts for medical expenses, mortgage interest statements, and charitable contributions.

Obtaining the California 540 Form

The California 540 form can be obtained from the California Franchise Tax Board's official website. It is available in both digital and printable formats. Taxpayers can also request a physical copy to be mailed to them if preferred. Ensuring you have the correct version of the form for the specific tax year is important for compliance and accuracy.

Quick guide on how to complete california 540 forms amp instructions 2019 personal income tax booklet california 540 forms amp instructions 2019 personal

Complete CALIFORNIA 540 Forms & Instructions Personal Income Tax Booklet CALIFORNIA 540 Forms & Instructions Personal Income Tax seamlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to locate the appropriate form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly and without hindrance. Manage CALIFORNIA 540 Forms & Instructions Personal Income Tax Booklet CALIFORNIA 540 Forms & Instructions Personal Income Tax on any platform with airSlate SignNow Android or iOS applications and enhance any document-driven process today.

The easiest way to modify and electronically sign CALIFORNIA 540 Forms & Instructions Personal Income Tax Booklet CALIFORNIA 540 Forms & Instructions Personal Income Tax effortlessly

- Obtain CALIFORNIA 540 Forms & Instructions Personal Income Tax Booklet CALIFORNIA 540 Forms & Instructions Personal Income Tax and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Sign feature, which only takes seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and then click on the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs in a few clicks from any device you prefer. Edit and electronically sign CALIFORNIA 540 Forms & Instructions Personal Income Tax Booklet CALIFORNIA 540 Forms & Instructions Personal Income Tax and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct california 540 forms amp instructions 2019 personal income tax booklet california 540 forms amp instructions 2019 personal

Create this form in 5 minutes!

How to create an eSignature for the california 540 forms amp instructions 2019 personal income tax booklet california 540 forms amp instructions 2019 personal

How to make an electronic signature for a PDF in the online mode

How to make an electronic signature for a PDF in Chrome

The best way to create an eSignature for putting it on PDFs in Gmail

The way to make an electronic signature from your smart phone

The best way to generate an eSignature for a PDF on iOS devices

The way to make an electronic signature for a PDF file on Android OS

People also ask

-

What are the 2017 California 540 instructions?

The 2017 California 540 instructions provide detailed guidelines on how to complete the California income tax return for residents. This document includes information on allowable deductions, credits, and filing requirements that are specific to the state of California. Following these instructions carefully is crucial to ensure accurate filing and avoid potential penalties.

-

How can I access the 2017 California 540 instructions?

You can access the 2017 California 540 instructions online through the California Department of Tax and Fee Administration's official website. They offer PDFs that you can download and print, ensuring you have the most up-to-date information available when preparing your tax return. Be sure to consult these instructions to understand specific details about your filing criteria.

-

Are there any changes in the 2017 California 540 instructions compared to previous years?

Yes, the 2017 California 540 instructions have incorporated various changes reflective of tax law updates. These adjustments may impact deductions, credits, and new reporting requirements. It’s essential to review these instructions thoroughly to ensure compliance and to maximize any potential tax benefits.

-

What benefits does airSlate SignNow provide for electronic signing of tax documents?

airSlate SignNow offers a streamlined, user-friendly platform for electronically signing your tax documents, including any related to the 2017 California 540 instructions. By using eSignature, you can save time and reduce the risk of errors. The service is also secure and compliant with legal standards, ensuring that your signed documents are valid and protected.

-

What is the pricing structure for using airSlate SignNow?

airSlate SignNow provides flexible pricing options tailored to accommodate different business needs. Pricing generally varies based on the features included, such as document templates and integrations. For exact pricing details, you can visit the airSlate SignNow website or contact their sales team for a customized quote.

-

Can airSlate SignNow integrate with my existing accounting software for tax filing?

Yes, airSlate SignNow offers integrations with numerous accounting software applications to facilitate seamless tax filing. This allows you to send documents for eSignature directly from your accounting platform, streamlining the process. Such integrations can make adhering to requirements in the 2017 California 540 instructions much more efficient.

-

How user-friendly is the airSlate SignNow platform for first-time users?

The airSlate SignNow platform is designed with user-friendliness in mind, making it easy for first-time users to navigate and manage their document signing needs. With intuitive dashboards and helpful resources, anyone can quickly understand how to send and sign documents. Users can also find support if they have questions about the 2017 California 540 instructions.

Get more for CALIFORNIA 540 Forms & Instructions Personal Income Tax Booklet CALIFORNIA 540 Forms & Instructions Personal Income Tax

- Foundation contract for contractor wyoming form

- Plumbing contract for contractor wyoming form

- Brick mason contract for contractor wyoming form

- Roofing contract for contractor wyoming form

- Electrical contract for contractor wyoming form

- Sheetrock drywall contract for contractor wyoming form

- Flooring contract for contractor wyoming form

- Agreement or contract for deed for sale and purchase of real estate aka land or executory contract wyoming form

Find out other CALIFORNIA 540 Forms & Instructions Personal Income Tax Booklet CALIFORNIA 540 Forms & Instructions Personal Income Tax

- Electronic signature Indiana Cease and Desist Letter Free

- Electronic signature Arkansas Hold Harmless (Indemnity) Agreement Fast

- Electronic signature Kentucky Hold Harmless (Indemnity) Agreement Online

- How To Electronic signature Arkansas End User License Agreement (EULA)

- Help Me With Electronic signature Connecticut End User License Agreement (EULA)

- Electronic signature Massachusetts Hold Harmless (Indemnity) Agreement Myself

- Electronic signature Oklahoma Hold Harmless (Indemnity) Agreement Free

- Electronic signature Rhode Island Hold Harmless (Indemnity) Agreement Myself

- Electronic signature California Toll Manufacturing Agreement Now

- How Do I Electronic signature Kansas Toll Manufacturing Agreement

- Can I Electronic signature Arizona Warranty Deed

- How Can I Electronic signature Connecticut Warranty Deed

- How To Electronic signature Hawaii Warranty Deed

- Electronic signature Oklahoma Warranty Deed Myself

- Can I Electronic signature Texas Warranty Deed

- How To Electronic signature Arkansas Quitclaim Deed

- Electronic signature Washington Toll Manufacturing Agreement Simple

- Can I Electronic signature Delaware Quitclaim Deed

- Electronic signature Iowa Quitclaim Deed Easy

- Electronic signature Kentucky Quitclaim Deed Safe