Form 990 Schedule H 2020

What is the Form 990 Schedule H

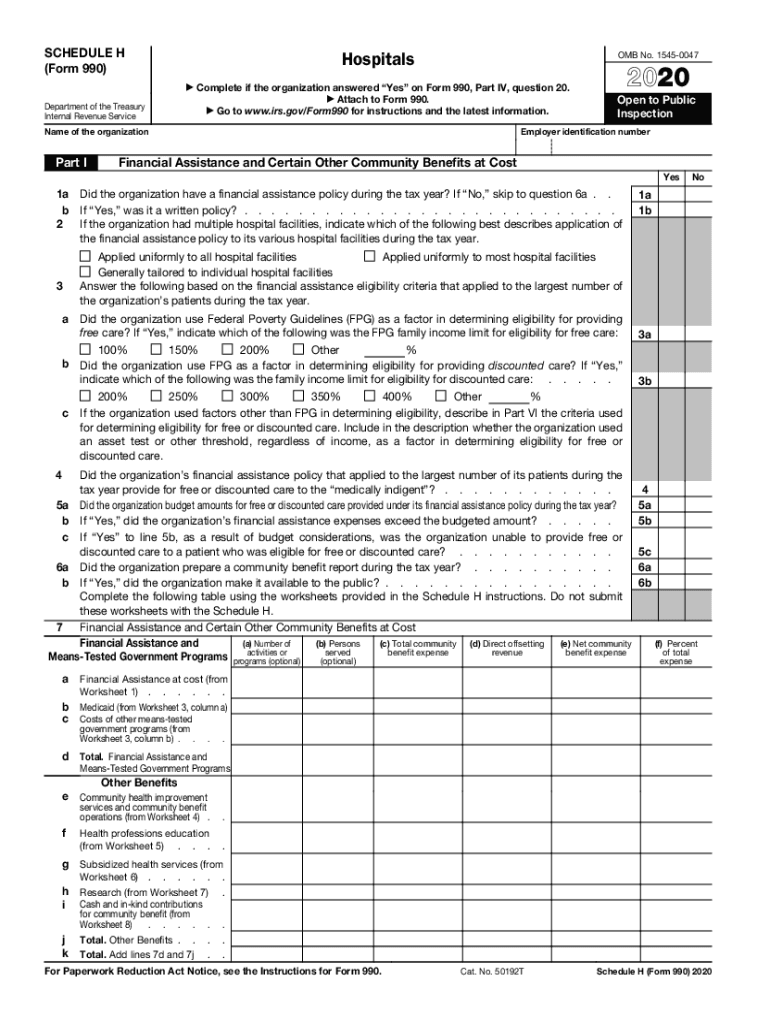

The Form 990 Schedule H is a crucial document used by hospitals and healthcare organizations in the United States to report their community benefit activities. This form is part of the larger Form 990, which tax-exempt organizations must file annually with the Internal Revenue Service (IRS). The Schedule H specifically focuses on detailing how hospitals meet their obligation to provide community benefits, including charity care and other services that support the health of the communities they serve.

How to use the Form 990 Schedule H

Using the Form 990 Schedule H involves providing detailed information about a hospital's community benefits. Organizations must categorize their activities into various sections, including charity care, community health improvement services, and financial assistance policies. Each section requires specific data, such as the amount spent on charity care and the number of patients served. Accurate reporting is essential for compliance and transparency, as this information is made public and can affect the hospital's reputation and funding.

Steps to complete the Form 990 Schedule H

Completing the Form 990 Schedule H involves several key steps:

- Gather necessary financial and operational data related to community benefits.

- Complete the identification section, including the hospital's name and EIN.

- Detail charity care expenses, including the costs incurred and the number of patients served.

- Report on community health improvement services, outlining programs and initiatives.

- Include information about financial assistance policies and how they are communicated to the public.

- Review all sections for accuracy and completeness before submission.

Legal use of the Form 990 Schedule H

The Form 990 Schedule H is legally binding and must be filed in accordance with IRS regulations. Accurate reporting is essential not only for compliance but also for maintaining tax-exempt status. Hospitals must ensure that the information provided is truthful and reflects their actual community benefit activities. Failure to comply with these regulations can result in penalties, including the loss of tax-exempt status.

Filing Deadlines / Important Dates

The filing deadline for the Form 990 Schedule H aligns with the overall deadline for Form 990, which is typically the 15th day of the fifth month after the end of the organization's fiscal year. For organizations operating on a calendar year, this means the form is due by May 15. Extensions may be available, but it is crucial to file on time to avoid penalties.

Penalties for Non-Compliance

Non-compliance with the filing requirements for the Form 990 Schedule H can lead to significant penalties. Organizations may face fines for failing to file on time or for submitting inaccurate information. Additionally, repeated non-compliance can jeopardize a hospital's tax-exempt status, impacting its ability to operate and serve the community effectively.

Quick guide on how to complete form 990 schedule h

Complete Form 990 Schedule H effortlessly on any device

Managing documents online has become increasingly favored by businesses and individuals alike. It offers an excellent environmentally-friendly substitute for traditional printed and signed documents, as you can easily access the correct form and securely store it online. airSlate SignNow delivers all the resources necessary to create, modify, and eSign your documents promptly without hold-ups. Handle Form 990 Schedule H on any device using the airSlate SignNow Android or iOS applications and streamline your document-driven workflows today.

The easiest way to adjust and eSign Form 990 Schedule H without hassle

- Locate Form 990 Schedule H and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of the documents or redact sensitive information with the tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign feature, which takes just moments and holds the same legal validity as a conventional wet ink signature.

- Verify the information and click the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow meets your document management needs in a few clicks from any device you prefer. Adjust and eSign Form 990 Schedule H and guarantee excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 990 schedule h

Create this form in 5 minutes!

How to create an eSignature for the form 990 schedule h

How to make an eSignature for a PDF online

How to make an eSignature for a PDF in Google Chrome

The way to create an eSignature for signing PDFs in Gmail

How to create an eSignature straight from your smartphone

The best way to make an eSignature for a PDF on iOS

How to create an eSignature for a PDF document on Android

People also ask

-

What is the 2018 H form and who needs it?

The 2018 H form is a tax form used to report household employment taxes. It is required for employers who pay household employees, such as nannies or caretakers. Understanding how to properly fill out the 2018 H form is crucial to ensure compliance with IRS regulations.

-

How can airSlate SignNow assist with completing the 2018 H form?

airSlate SignNow provides a user-friendly platform for electronically signing and managing your 2018 H form documents. With our service, you can seamlessly fill out and send the form for signatures, minimizing paperwork and streamlining your filing process. Our system ensures that all documents are securely stored and easy to retrieve.

-

What are the pricing options for using airSlate SignNow when working with the 2018 H form?

airSlate SignNow offers flexible pricing plans that cater to business needs, starting with a free trial. Depending on your requirements, choose from monthly or annual subscriptions that provide access to all features, including those necessary for managing your 2018 H form. This ensures you have a cost-effective solution for your document signing needs.

-

Are there any integrations available that support the 2018 H form process?

Yes, airSlate SignNow integrates seamlessly with various applications, enhancing the experience of managing the 2018 H form. You can connect with popular tools such as Google Drive, Dropbox, and more, allowing for effortless document sharing and collaboration. This integration ensures that your document workflows remain efficient.

-

What are the benefits of using airSlate SignNow for the 2018 H form?

Using airSlate SignNow for the 2018 H form simplifies the signing process while ensuring legal compliance. Our platform eliminates the hassle of physical paperwork, making it easier to track the status of your documents. Additionally, you gain access to templates and reminders, helping you stay organized and timely with submissions.

-

Can I save my 2018 H form in airSlate SignNow for future use?

Absolutely! airSlate SignNow allows you to save your completed 2018 H form securely in the cloud. This feature enables you to access your important documents anytime and from anywhere, simplifying future filings and ensuring you maintain records of past submissions.

-

Is airSlate SignNow compliant with regulations for the 2018 H form?

Yes, airSlate SignNow is designed to comply with key regulations for electronic signatures and document management. We ensure that all your transactions, including the execution of the 2018 H form, meet legal requirements, providing you peace of mind. Our commitment to security and compliance reinforces your trust in our services.

Get more for Form 990 Schedule H

- Legal last will and testament form for divorced person not remarried with no children west virginia

- Legal last will and testament form for divorced person not remarried with minor children west virginia

- Legal last will and testament form for divorced person not remarried with adult and minor children west virginia

- Mutual wills package with last wills and testaments for married couple with adult children west virginia form

- Mutual wills package with last wills and testaments for married couple with no children west virginia form

- Mutual wills package with last wills and testaments for married couple with minor children west virginia form

- West virginia form 497432030

- Wv legal for form

Find out other Form 990 Schedule H

- Can I eSignature West Virginia Sports Warranty Deed

- eSignature Utah Courts Contract Safe

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free

- eSignature Wyoming Courts Quitclaim Deed Later

- Electronic signature Michigan Banking Lease Agreement Computer

- Electronic signature Michigan Banking Affidavit Of Heirship Fast

- Electronic signature Arizona Business Operations Job Offer Free

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself

- Electronic signature Alaska Car Dealer Resignation Letter Myself

- Electronic signature Alaska Car Dealer NDA Mobile

- How Can I Electronic signature Arizona Car Dealer Agreement

- Electronic signature California Business Operations Promissory Note Template Fast

- How Do I Electronic signature Arkansas Car Dealer Claim

- Electronic signature Colorado Car Dealer Arbitration Agreement Mobile

- Electronic signature California Car Dealer Rental Lease Agreement Fast

- Electronic signature Connecticut Car Dealer Lease Agreement Now

- Electronic signature Connecticut Car Dealer Warranty Deed Computer