Instructions for Schedule H Form 990 InternalFederal 990 Schedule D Supplemental Financial Statements 20212020 Schedule H Form 9 2022

Understanding the 2017 990 Hospitals Form

The 2017 990 Hospitals form is a crucial document for tax-exempt hospitals in the United States. It provides detailed information about the hospital's financial activities, including revenue, expenses, and community benefits. This form is essential for compliance with IRS regulations, ensuring that hospitals maintain their tax-exempt status. The data collected helps the IRS monitor the financial health of these institutions and their contributions to the community.

Steps to Complete the 2017 990 Hospitals Form

Completing the 2017 990 Hospitals form involves several key steps:

- Gather necessary financial documents, including balance sheets and income statements.

- Review the specific instructions for the 2017 990 Hospitals form to understand the required information.

- Fill out the form accurately, ensuring all financial data is reported correctly.

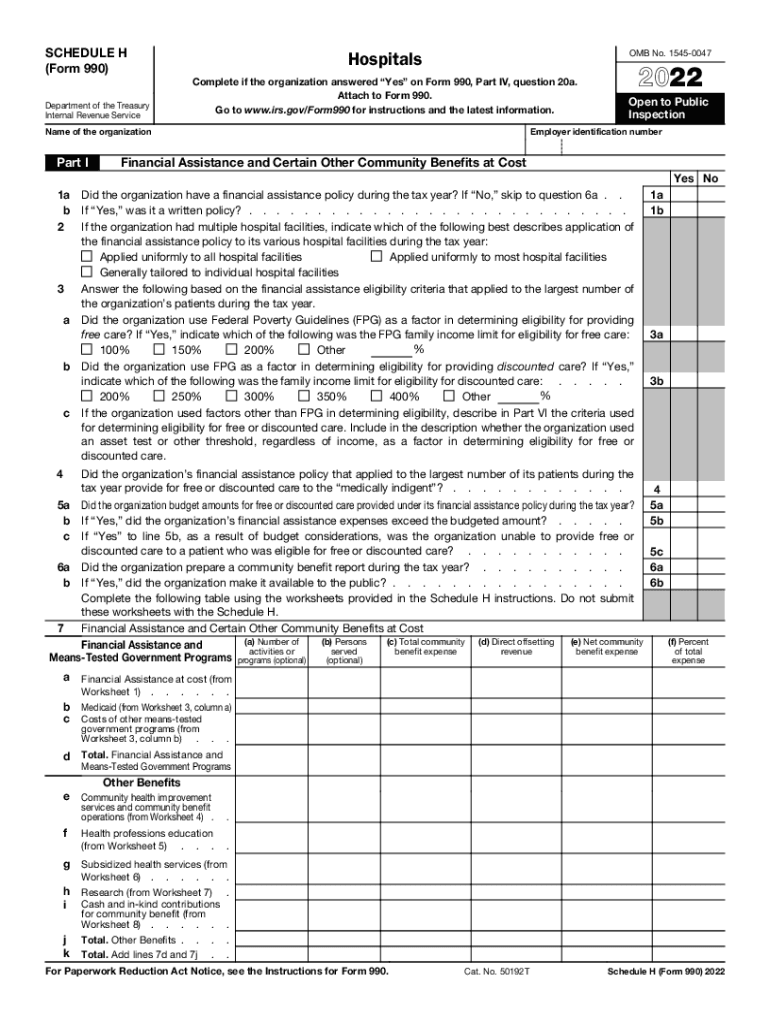

- Include any additional schedules required, such as Schedule H, which details community benefits.

- Review the completed form for accuracy before submission.

IRS Guidelines for the 2017 990 Hospitals Form

The IRS provides specific guidelines for completing the 2017 990 Hospitals form. These guidelines include:

- Requirements for reporting financial data and community benefits.

- Deadlines for submission to avoid penalties.

- Instructions for electronic filing options, which can streamline the submission process.

Filing Deadlines for the 2017 990 Hospitals Form

It is important to be aware of the filing deadlines for the 2017 990 Hospitals form. Typically, the form is due on the fifteenth day of the fifth month after the end of the hospital's fiscal year. Extensions may be available, but these must be requested in advance. Missing the deadline can result in penalties and jeopardize the hospital's tax-exempt status.

Key Elements of the 2017 990 Hospitals Form

The 2017 990 Hospitals form includes several key elements that must be completed:

- Basic organizational information, including the hospital's name and address.

- Financial statements detailing revenue, expenses, and net assets.

- Schedule H, which outlines community benefits and charity care provided by the hospital.

- Disclosure of any related organizations or partnerships.

Penalties for Non-Compliance with the 2017 990 Hospitals Form

Non-compliance with the requirements of the 2017 990 Hospitals form can lead to significant penalties. Hospitals may face fines for late submissions or inaccuracies in reporting. Additionally, failure to comply with IRS regulations can result in the loss of tax-exempt status, impacting funding and community services.

Quick guide on how to complete instructions for schedule h form 990 2020internalfederal 990 schedule d supplemental financial statements 20212020 schedule h

Effortlessly Prepare Instructions For Schedule H Form 990 InternalFederal 990 Schedule D Supplemental Financial Statements 20212020 Schedule H Form 9 on Any Device

Digital document management has gained immense traction among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, as you can access the correct format and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and electronically sign your documents promptly without any hold-ups. Handle Instructions For Schedule H Form 990 InternalFederal 990 Schedule D Supplemental Financial Statements 20212020 Schedule H Form 9 across any platform using airSlate SignNow’s Android or iOS applications, and streamline any document-related procedure today.

The Easiest Way to Edit and eSign Instructions For Schedule H Form 990 InternalFederal 990 Schedule D Supplemental Financial Statements 20212020 Schedule H Form 9 with Minimal Effort

- Find Instructions For Schedule H Form 990 InternalFederal 990 Schedule D Supplemental Financial Statements 20212020 Schedule H Form 9 and click on Get Form to initiate the process.

- Utilize the tools we provide to complete your document.

- Note signNow sections of your documents or redact sensitive information using the tools that airSlate SignNow offers specifically for that purpose.

- Generate your electronic signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Review all the details and click on the Done button to store your changes.

- Choose your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious searches for forms, or mistakes that necessitate reprinting new document copies. airSlate SignNow meets all your document management requirements with just a few clicks from any device you choose. Edit and electronically sign Instructions For Schedule H Form 990 InternalFederal 990 Schedule D Supplemental Financial Statements 20212020 Schedule H Form 9 to ensure outstanding communication at every phase of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct instructions for schedule h form 990 2020internalfederal 990 schedule d supplemental financial statements 20212020 schedule h

Create this form in 5 minutes!

People also ask

-

What are 2017 990 hospitals and why are they important?

2017 990 hospitals are healthcare facilities that are required to submit annual financial information through Form 990. Understanding these institutions is crucial for organizations looking to analyze the financial health and operational efficiency of hospitals, helping users make informed decisions regarding partnerships and investments.

-

How can airSlate SignNow help 2017 990 hospitals streamline their document processes?

airSlate SignNow provides a user-friendly platform for 2017 990 hospitals to eSign and manage documents with ease. By automating workflows, hospitals can reduce the time spent on paperwork and focus more on patient care and operational improvements.

-

What features does airSlate SignNow offer for 2017 990 hospitals?

airSlate SignNow offers various features tailored for 2017 990 hospitals, including customizable templates, secure eSigning, document tracking, and integration with popular healthcare management software. These tools empower hospitals to enhance efficiency and ensure compliance with documentation standards.

-

Is pricing affordable for 2017 990 hospitals using airSlate SignNow?

Yes, airSlate SignNow offers competitive pricing plans designed specifically for 2017 990 hospitals. The cost-effective solution enables these facilities to manage their documentation without hefty expenditures, allowing for budget allocation to more critical areas of healthcare.

-

Can airSlate SignNow integrate with existing systems used by 2017 990 hospitals?

Absolutely! airSlate SignNow seamlessly integrates with various existing systems used by 2017 990 hospitals, enhancing overall document management. This compatibility ensures that hospitals can incorporate eSigning solutions without disrupting their current workflows.

-

What are the benefits of using airSlate SignNow for 2017 990 hospitals?

By utilizing airSlate SignNow, 2017 990 hospitals can expect improved operational efficiency, reduced turnaround times for documents, and enhanced patient trust through timely communication. Additionally, the platform ensures compliance and security, which are critical in healthcare settings.

-

How does eSigning work for 2017 990 hospitals with airSlate SignNow?

eSigning for 2017 990 hospitals with airSlate SignNow is simple and intuitive. Users can upload documents, add necessary signers, and send them for electronic signatures, all while tracking the progress in real time, making document management far less cumbersome.

Get more for Instructions For Schedule H Form 990 InternalFederal 990 Schedule D Supplemental Financial Statements 20212020 Schedule H Form 9

- Paving contractor package new jersey form

- Site work contractor package new jersey form

- Siding contractor package new jersey form

- Refrigeration contractor package new jersey form

- Drainage contractor package new jersey form

- Tax free exchange package new jersey form

- Nj sublease form

- Nj buy online 497319640 form

Find out other Instructions For Schedule H Form 990 InternalFederal 990 Schedule D Supplemental Financial Statements 20212020 Schedule H Form 9

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament

- Sign New Mexico Doctors Living Will Free

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast

- How Can I Sign New York Doctors Residential Lease Agreement

- Sign New York Doctors Purchase Order Template Online

- Can I Sign Oklahoma Doctors LLC Operating Agreement

- Sign South Dakota Doctors LLC Operating Agreement Safe

- Sign Texas Doctors Moving Checklist Now

- Sign Texas Doctors Residential Lease Agreement Fast

- Sign Texas Doctors Emergency Contact Form Free

- Sign Utah Doctors Lease Agreement Form Mobile

- Sign Virginia Doctors Contract Safe

- Sign West Virginia Doctors Rental Lease Agreement Free