Kentucky 4 Form 2019

What is the Kentucky Employee Withholding Form?

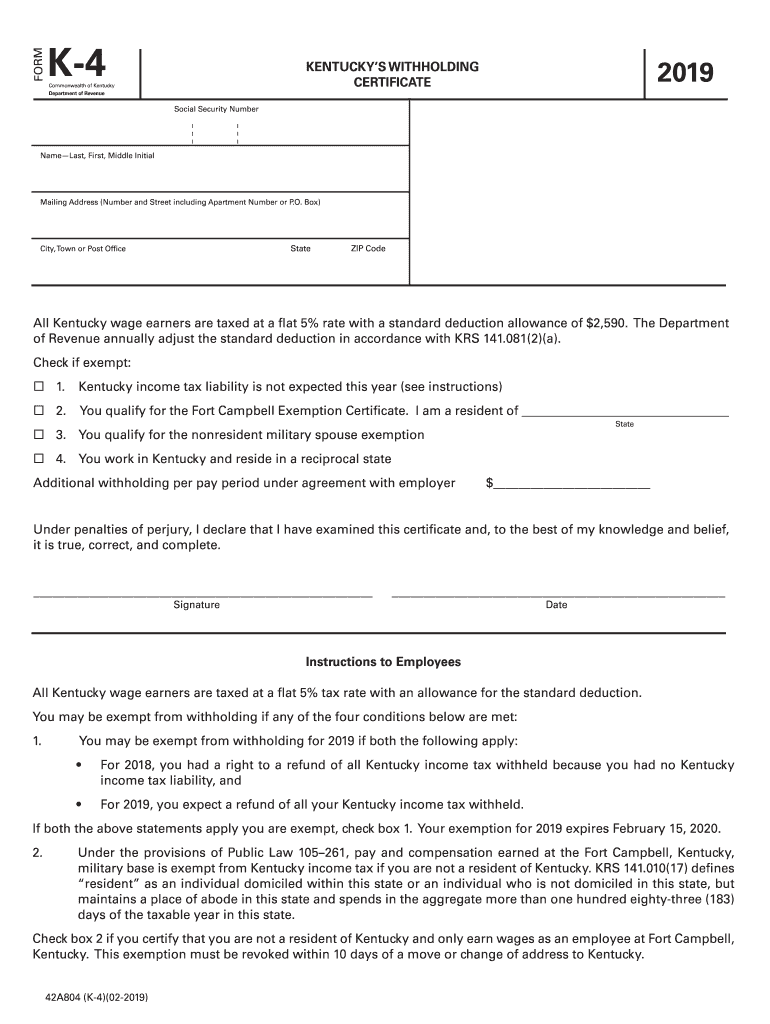

The Kentucky Employee Withholding Form, commonly referred to as the Kentucky W-4 or KY W-4, is a crucial document used by employers to determine the amount of state income tax to withhold from an employee's paycheck. This form is essential for ensuring that employees meet their state tax obligations and helps employers comply with Kentucky tax laws. The form allows employees to indicate their filing status, number of allowances, and any additional withholding amounts they wish to apply.

Steps to Complete the Kentucky Employee Withholding Form

Completing the Kentucky Employee Withholding Form involves several straightforward steps:

- Provide personal information, including your name, address, and Social Security number.

- Select your filing status, which can be single, married, or head of household.

- Calculate the number of allowances you are claiming based on your personal and financial situation.

- Indicate any additional amount you wish to withhold from each paycheck, if applicable.

- Sign and date the form to certify that the information provided is accurate.

How to Obtain the Kentucky Employee Withholding Form

The Kentucky Employee Withholding Form can be easily obtained through various channels. It is available for download from the Kentucky Department of Revenue's website, where you can find the most current version. Additionally, employers may provide this form to new employees during the onboarding process. It is important to ensure that you are using the correct version for the applicable tax year, such as the 2019 Kentucky Employee Withholding Form.

Legal Use of the Kentucky Employee Withholding Form

The Kentucky Employee Withholding Form is legally binding when completed correctly and submitted to the employer. It must comply with state regulations regarding tax withholding. Employers are required to keep this form on file for their records and must use the information provided to calculate the appropriate withholding amounts. Failure to use the form correctly can result in penalties for both the employer and the employee.

Key Elements of the Kentucky Employee Withholding Form

Several key elements are essential for the Kentucky Employee Withholding Form:

- Personal Information: This includes the employee’s name, address, and Social Security number.

- Filing Status: Employees must select their filing status, which impacts the withholding calculations.

- Allowances: The number of allowances claimed affects the amount withheld from each paycheck.

- Additional Withholding: Employees can specify any extra amount they wish to withhold.

Form Submission Methods

Employees can submit the Kentucky Employee Withholding Form to their employer through various methods. The most common method is to provide a physical copy in person or via mail. Some employers may also allow electronic submission through secure company portals. It is important to check with your employer regarding their preferred submission method to ensure timely processing of the form.

Quick guide on how to complete kentucky 4 form

Complete Kentucky 4 Form effortlessly on any device

Online document management has gained signNow traction among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to locate the appropriate form and securely save it online. airSlate SignNow equips you with all the tools needed to create, edit, and eSign your documents swiftly and without delays. Manage Kentucky 4 Form across any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to modify and eSign Kentucky 4 Form seamlessly

- Obtain Kentucky 4 Form and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of your documents or redact sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and then click the Done button to save your changes.

- Select how you wish to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Kentucky 4 Form to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct kentucky 4 form

Create this form in 5 minutes!

How to create an eSignature for the kentucky 4 form

The best way to generate an electronic signature for your PDF in the online mode

The best way to generate an electronic signature for your PDF in Chrome

The way to generate an electronic signature for putting it on PDFs in Gmail

How to make an electronic signature from your smart phone

The way to make an electronic signature for a PDF on iOS devices

How to make an electronic signature for a PDF file on Android OS

People also ask

-

What is the Kentucky employee withholding form 2019?

The Kentucky employee withholding form 2019 is a document used by employees to indicate their tax withholding preferences to their employers. It helps ensure that the correct amount of state income tax is withheld from their paychecks. Completing this form accurately is crucial for both employees and employers to comply with state tax regulations.

-

How can I access the Kentucky employee withholding form 2019?

You can easily access the Kentucky employee withholding form 2019 through the state’s official revenue website or your employer's HR department. Many organizations also provide this form digitally for convenience, allowing you to fill it out directly online or download it for printing.

-

Why is the Kentucky employee withholding form 2019 important for businesses?

The Kentucky employee withholding form 2019 is essential for businesses as it ensures accurate tax reporting and compliance with state laws. By collecting this information from employees, businesses can effectively manage their payroll processes and avoid potential tax penalties.

-

Is there a fee to file the Kentucky employee withholding form 2019?

There is no fee specifically for filing the Kentucky employee withholding form 2019, as it is typically completed internally within an organization. However, costs may arise from payroll processing services or software that assist with automating tax withholding and reporting.

-

Can airSlate SignNow help me manage the Kentucky employee withholding form 2019?

Yes, airSlate SignNow offers a seamless solution for managing the Kentucky employee withholding form 2019. You can easily send, eSign, and securely store the completed forms, helping you streamline your onboarding process and ensure compliance with state tax regulations.

-

What are the benefits of using airSlate SignNow for the Kentucky employee withholding form 2019?

Using airSlate SignNow simplifies the management of the Kentucky employee withholding form 2019 by providing an efficient platform for document delivery and signatures. This reduces manual paperwork, enhances security, and allows for quicker processing times, improving overall business operations.

-

How does airSlate SignNow integrate with payroll systems for the Kentucky employee withholding form 2019?

airSlate SignNow can integrate with various payroll systems to automate the handling of the Kentucky employee withholding form 2019. This integration helps synchronize employee data and ensures that the appropriate withholding amounts are calculated, making payroll processing more efficient.

Get more for Kentucky 4 Form

- Flood zone statement and authorization wyoming form

- Name affidavit of buyer wyoming form

- Name affidavit of seller wyoming form

- Non foreign affidavit under irc 1445 wyoming form

- Owners or sellers affidavit of no liens wyoming form

- Wyoming affidavit financial form

- Complex will with credit shelter marital trust for large estates wyoming form

- Child support modification information and instructions wyoming

Find out other Kentucky 4 Form

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now

- eSignature South Dakota Plumbing Emergency Contact Form Mobile

- eSignature South Dakota Plumbing Emergency Contact Form Safe

- Can I eSignature South Dakota Plumbing Emergency Contact Form

- eSignature Georgia Real Estate Affidavit Of Heirship Later

- eSignature Hawaii Real Estate Operating Agreement Online

- eSignature Idaho Real Estate Cease And Desist Letter Online

- eSignature Idaho Real Estate Cease And Desist Letter Simple

- eSignature Wyoming Plumbing Quitclaim Deed Myself

- eSignature Colorado Sports Living Will Mobile