How to Properly Address an Envelope for U S & International 2020

Understanding the KY K-4 Form

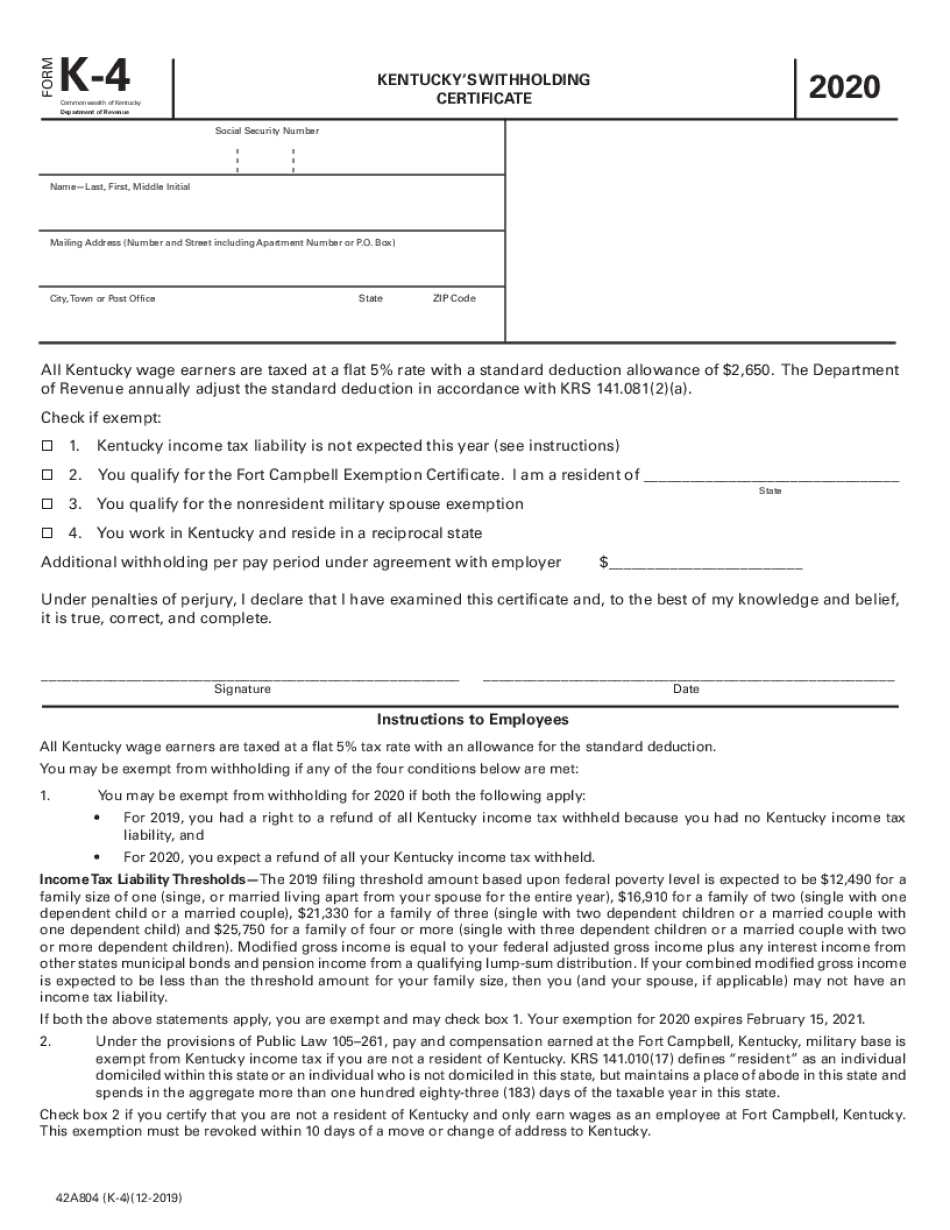

The Kentucky K-4 form, officially known as the Kentucky Withholding Certificate, is essential for employees in Kentucky to determine the amount of state income tax withheld from their paychecks. This form allows employees to claim personal exemptions and additional withholding allowances, which can affect their overall tax liability. Properly completing the KY K-4 form ensures that the correct amount of state tax is withheld, helping individuals avoid underpayment penalties or over-withholding throughout the year.

Steps to Complete the KY K-4 Form

Filling out the KY K-4 form requires careful attention to detail. Here are the steps to ensure accurate completion:

- Start by providing your personal information, including your name, address, and Social Security number.

- Indicate your filing status by checking the appropriate box, which may include single, married, or head of household.

- Claim the number of allowances you wish to take. This number can affect your withholding amount, so consider your tax situation carefully.

- If applicable, you may add any additional amount you want withheld from each paycheck.

- Finally, sign and date the form to certify that the information provided is accurate.

Filing Deadlines and Important Dates

It is crucial to submit the KY K-4 form in a timely manner to ensure that your employer withholds the correct amount of state tax. Typically, this form should be completed and submitted to your employer at the start of your employment or whenever you experience a change in your personal circumstances that affects your withholding. Keep in mind that any changes should be reported promptly to avoid discrepancies in your tax withholdings.

Penalties for Non-Compliance

Failure to properly complete and submit the KY K-4 form can lead to significant penalties. If you do not provide your employer with accurate withholding information, you may face under-withholding, resulting in a tax bill at the end of the year. Additionally, the Kentucky Department of Revenue may impose penalties for non-compliance, which can include fines or interest on unpaid taxes. It is essential to ensure that your form is filled out correctly to avoid these potential issues.

Legal Use of the KY K-4 Form

The KY K-4 form is legally recognized in the state of Kentucky as the official document for withholding allowances. It complies with the state’s tax regulations, ensuring that employers withhold the correct amount of state income tax from their employees' wages. Understanding the legal implications of this form is important for both employees and employers, as it helps maintain compliance with state tax laws and avoids legal complications.

Examples of Using the KY K-4 Form

Consider a scenario where an employee named Jane has recently moved to Kentucky and started a new job. She needs to complete the KY K-4 form to ensure her employer withholds the correct state tax from her paycheck. By accurately filling out her allowances based on her personal situation, Jane can manage her tax liability effectively. Another example is an employee who gets married and needs to update their KY K-4 form to reflect their new filing status, which may allow for additional allowances.

Quick guide on how to complete how to properly address an envelope for us ampamp international

Complete How To Properly Address An Envelope For U S & International effortlessly on any device

Managing documents online has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides all the tools needed to create, modify, and electronically sign your documents quickly without delays. Handle How To Properly Address An Envelope For U S & International on any platform using the airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to modify and eSign How To Properly Address An Envelope For U S & International without hassle

- Find How To Properly Address An Envelope For U S & International and then click Get Form to begin.

- Utilize the tools at your disposal to complete your form.

- Emphasize important sections of the documents or redact sensitive information with features specifically provided by airSlate SignNow for this purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your modifications.

- Select your preferred method for delivering your form: via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searching, or errors that necessitate reprinting new document versions. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choosing. Modify and eSign How To Properly Address An Envelope For U S & International to ensure excellent communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct how to properly address an envelope for us ampamp international

Create this form in 5 minutes!

How to create an eSignature for the how to properly address an envelope for us ampamp international

The way to make an eSignature for your PDF file in the online mode

The way to make an eSignature for your PDF file in Chrome

The way to make an eSignature for putting it on PDFs in Gmail

The best way to make an electronic signature straight from your smartphone

The way to make an electronic signature for a PDF file on iOS devices

The best way to make an electronic signature for a PDF document on Android

People also ask

-

What is the ky k 4 form and how is it used?

The ky k 4 form is a tax document used in Kentucky for reporting income and calculating tax liabilities. This form is essential for individuals and businesses to ensure compliance with state tax regulations. By utilizing airSlate SignNow, you can easily manage and eSign your ky k 4 form securely and efficiently.

-

How can airSlate SignNow help me with the ky k 4 form?

airSlate SignNow provides a user-friendly platform for creating, editing, and eSigning your ky k 4 form. Our solution simplifies the document workflow, allowing you to complete your tax forms rapidly and accurately. You can also access templates to streamline the process even further.

-

Is there a cost associated with using airSlate SignNow for the ky k 4 form?

Yes, airSlate SignNow offers various pricing plans tailored to meet your needs. Each plan provides access to features that simplify managing documents, including the ky k 4 form. You can choose a plan that fits your budget while enjoying all the benefits of our eSigning solution.

-

Can I integrate airSlate SignNow with other software to manage the ky k 4 form?

Absolutely! airSlate SignNow supports integrations with popular productivity and business tools. This allows you to seamlessly import or export your ky k 4 form into platforms like Google Drive, Dropbox, and many others for better document management and collaboration.

-

What are the benefits of using airSlate SignNow for my ky k 4 form?

Using airSlate SignNow for your ky k 4 form offers numerous benefits, including increased efficiency, enhanced security, and improved compliance. The platform helps you eliminate paperwork, reduce errors, and ensures your documents are signed and stored securely, all while saving you time.

-

Is the ky k 4 form submission process easier with airSlate SignNow?

Yes, airSlate SignNow simplifies the ky k 4 form submission process. Our intuitive interface guides you through each step, allowing you to complete and eSign your forms quickly. Plus, you can track the status of your submissions in real time.

-

Can I access my ky k 4 form from any device with airSlate SignNow?

Yes, airSlate SignNow is designed to be accessible from any device, whether it's a desktop, tablet, or smartphone. This means you can work on your ky k 4 form on-the-go, ensuring that you can manage your documents anytime and anywhere.

Get more for How To Properly Address An Envelope For U S & International

- Warranty deed from individual to llc west virginia form

- West virginia account 497431622 form

- West virginia form 497431624

- West virginia deed 497431625 form

- Warranty deed from husband and wife to corporation west virginia form

- Divorce worksheet and law summary for contested or uncontested case of over 25 pages ideal client interview form west virginia

- West virginia form 497431628

- West virginia lien 497431630 form

Find out other How To Properly Address An Envelope For U S & International

- Electronic signature Washington High Tech Contract Computer

- Can I Electronic signature Wisconsin High Tech Memorandum Of Understanding

- How Do I Electronic signature Wisconsin High Tech Operating Agreement

- How Can I Electronic signature Wisconsin High Tech Operating Agreement

- Electronic signature Delaware Legal Stock Certificate Later

- Electronic signature Legal PDF Georgia Online

- Electronic signature Georgia Legal Last Will And Testament Safe

- Can I Electronic signature Florida Legal Warranty Deed

- Electronic signature Georgia Legal Memorandum Of Understanding Simple

- Electronic signature Legal PDF Hawaii Online

- Electronic signature Legal Document Idaho Online

- How Can I Electronic signature Idaho Legal Rental Lease Agreement

- How Do I Electronic signature Alabama Non-Profit Profit And Loss Statement

- Electronic signature Alabama Non-Profit Lease Termination Letter Easy

- How Can I Electronic signature Arizona Life Sciences Resignation Letter

- Electronic signature Legal PDF Illinois Online

- How Can I Electronic signature Colorado Non-Profit Promissory Note Template

- Electronic signature Indiana Legal Contract Fast

- Electronic signature Indiana Legal Rental Application Online

- Electronic signature Delaware Non-Profit Stock Certificate Free