Search Department of Revenue Kentucky Department of 2021

Key elements of the K-4 form 2022

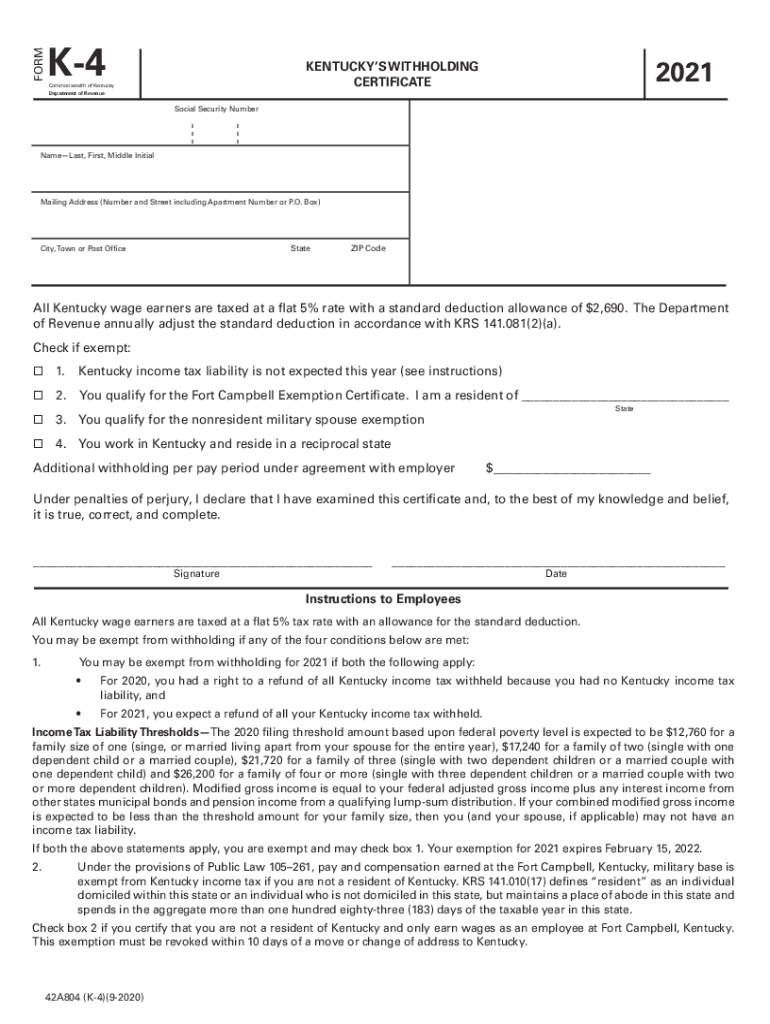

The K-4 form, also known as the Kentucky withholding form 2022, is essential for employees in Kentucky to determine the correct amount of state income tax to withhold from their paychecks. This form includes critical information such as the employee's name, address, Social Security number, and the number of exemptions claimed. Understanding these elements is vital for both employees and employers to ensure compliance with Kentucky tax laws.

The form also allows individuals to specify additional withholding amounts if desired, which can help manage tax liabilities more effectively. Completing the K-4 form accurately is crucial, as errors can lead to incorrect withholding and potential penalties.

Steps to complete the K-4 form 2022

Completing the K-4 form 2022 involves several straightforward steps:

- Download the form: Obtain the K-4 form from the Kentucky Department of Revenue website or through your employer.

- Fill in personal information: Provide your name, address, and Social Security number in the designated fields.

- Claim exemptions: Indicate the number of exemptions you are claiming. This will affect the amount withheld from your paycheck.

- Additional withholding: If you wish to have extra amounts withheld, specify this in the appropriate section.

- Sign and date: Ensure you sign and date the form to validate it before submission.

Once completed, submit the form to your employer, who will use it to calculate your state income tax withholding accurately.

Form submission methods

The K-4 form can be submitted through various methods, depending on your employer's preferences:

- Online submission: Some employers may allow digital submission of the K-4 form through their payroll systems.

- Mail: You can print the completed form and send it via postal mail to your employer's payroll department.

- In-person: Handing the form directly to your employer or payroll administrator is also an option.

It is essential to check with your employer regarding their preferred submission method to ensure timely processing.

Legal use of the K-4 form 2022

The K-4 form is legally binding and must be completed accurately to comply with Kentucky tax regulations. Employers are required to withhold state income tax based on the information provided in this form. Failure to complete the K-4 form or providing incorrect information can lead to penalties for both the employee and employer.

Additionally, the form must be updated whenever there are changes in your personal circumstances, such as marital status or the number of dependents. Keeping the K-4 form current helps ensure that the correct amount of state tax is withheld throughout the year.

Filing deadlines / Important dates

Understanding the filing deadlines associated with the K-4 form is crucial for compliance. Generally, the K-4 form should be submitted to your employer at the start of your employment or whenever changes occur that affect your withholding status.

Employers must ensure that they process the K-4 form promptly to adjust withholding amounts in accordance with Kentucky tax law. It's advisable to review any specific deadlines set by the Kentucky Department of Revenue to avoid penalties.

Quick guide on how to complete search department of revenue kentucky department of

Complete Search Department Of Revenue Kentucky Department Of effortlessly on any device

Online document management has become increasingly favored by companies and individuals alike. It serves as an ideal environmentally-friendly alternative to conventional printed and signed documents, allowing you to locate the necessary form and securely save it online. airSlate SignNow provides you with all the resources you require to create, modify, and eSign your documents quickly without delays. Manage Search Department Of Revenue Kentucky Department Of on any device using airSlate SignNow's Android or iOS applications and enhance any document-related procedure today.

How to edit and eSign Search Department Of Revenue Kentucky Department Of with ease

- Locate Search Department Of Revenue Kentucky Department Of and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight pertinent sections of your documents or obscure sensitive information using tools specifically designed by airSlate SignNow for this purpose.

- Generate your signature with the Sign feature, which only takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method of sharing your form, whether by email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious searches for forms, or mistakes that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choosing. Modify and eSign Search Department Of Revenue Kentucky Department Of and ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct search department of revenue kentucky department of

Create this form in 5 minutes!

How to create an eSignature for the search department of revenue kentucky department of

How to create an e-signature for your PDF file online

How to create an e-signature for your PDF file in Google Chrome

The best way to make an e-signature for signing PDFs in Gmail

The best way to generate an e-signature right from your mobile device

How to generate an electronic signature for a PDF file on iOS

The best way to generate an e-signature for a PDF on Android devices

People also ask

-

What is the k4 form 2022 and how is it used?

The k4 form 2022 is a tax form used in certain states to withhold personal income taxes from wages. It allows employers to accurately manage employee withholding based on their specific tax situations. Understanding the k4 form 2022 is essential for both employers and employees to ensure proper tax compliance.

-

How can airSlate SignNow help me manage the k4 form 2022?

airSlate SignNow streamlines the process of managing the k4 form 2022 by allowing you to electronically sign and send documents securely. Our easy-to-use platform ensures that you can quickly gather the required signatures and keep everything organized. This efficiency directly saves time during tax season.

-

What are the pricing options for using airSlate SignNow to manage the k4 form 2022?

airSlate SignNow offers flexible pricing plans suitable for businesses of all sizes. You can choose the plan that best fits your needs while managing forms like the k4 form 2022. Our cost-effective solutions provide great value, especially for frequent document senders.

-

Does airSlate SignNow offer any features specifically for the k4 form 2022?

Yes, airSlate SignNow provides features that streamline the filling and signing of the k4 form 2022, including customizable templates and automated workflows. These features make it easier to ensure that all necessary fields are completed accurately and that the form is sent promptly for signature.

-

What are the benefits of using airSlate SignNow for the k4 form 2022?

Using airSlate SignNow for the k4 form 2022 enhances efficiency and security for your document processes. Our platform reduces paperwork, minimizes the risk of errors, and ensures that your tax documents are handled swiftly and securely. This ultimately leads to improved compliance and peace of mind.

-

Is airSlate SignNow compatible with other software for managing the k4 form 2022?

Absolutely! airSlate SignNow seamlessly integrates with various software applications, simplifying the management of the k4 form 2022 within your existing workflows. Popular integrations include CRM systems, accounting software, and other productivity tools that enhance your document handling process.

-

How secure is airSlate SignNow when handling the k4 form 2022?

Security is a top priority at airSlate SignNow, especially for sensitive documents like the k4 form 2022. Our platform employs advanced encryption, two-factor authentication, and compliance with industry standards to ensure your documents are protected. You can trust that your information is safe with us.

Get more for Search Department Of Revenue Kentucky Department Of

- Legal last will and testament form for domestic partner with adult children colorado

- Legal last will and testament form for a domestic partner with no children colorado

- Colorado last will testament form

- Legal last will and testament form for divorced person not remarried with adult and minor children colorado

- Colorado will create 497300835 form

- Legal last will and testament form for a married person with no children colorado

- Legal last will and testament form for married person with minor children colorado

- Legal last will and testament form for civil union partner with adult children colorado

Find out other Search Department Of Revenue Kentucky Department Of

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple