If I Put an Apartment Number After My P O Box Will it Still Go to 2025-2026

Understanding the Kentucky K-4 Form

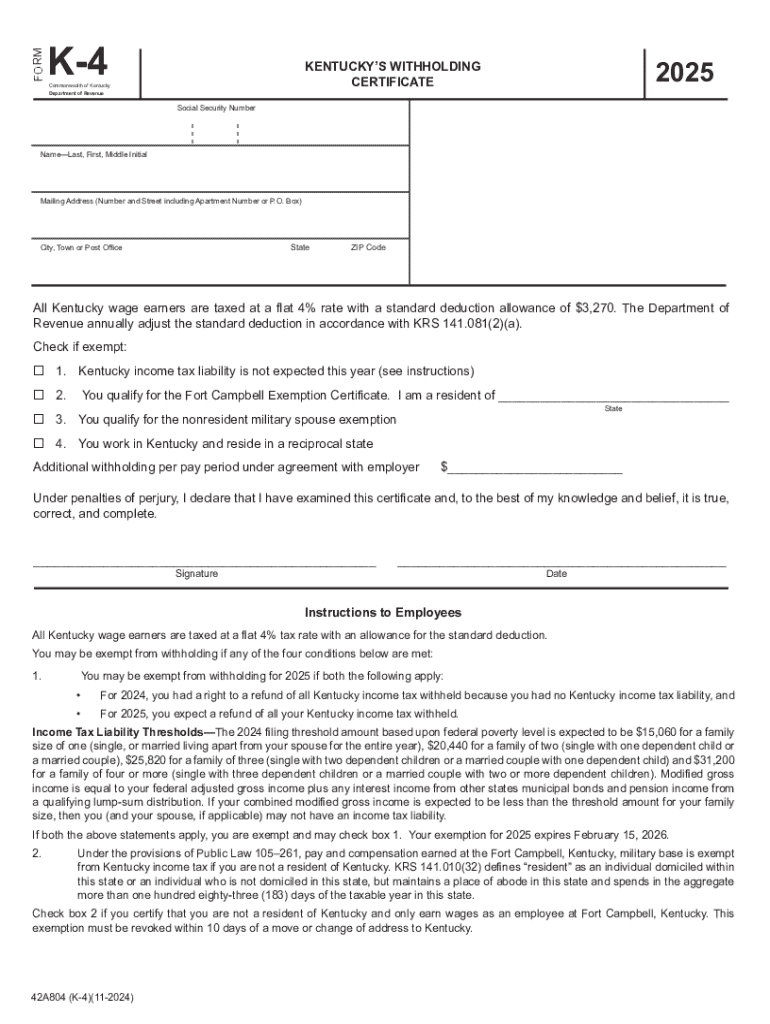

The Kentucky K-4 form, also known as the Kentucky withholding certificate, is essential for employees in Kentucky to determine the correct amount of state income tax withholding from their paychecks. This form allows employees to specify their filing status and the number of allowances they wish to claim, which directly affects their state tax withholdings. Understanding how to fill out this form accurately can help individuals avoid under-withholding or over-withholding, ensuring they meet their tax obligations without unnecessary financial strain.

Steps to Complete the Kentucky K-4 Form

Completing the Kentucky K-4 form involves several straightforward steps:

- Begin by entering your personal information, including your name, address, and Social Security number.

- Indicate your filing status by selecting the appropriate box—single, married, or head of household.

- Decide on the number of allowances you wish to claim. This number can impact your tax withholding significantly.

- If applicable, provide additional information for any additional withholding amounts you want to specify.

- Finally, sign and date the form to validate your submission.

Filing Deadlines and Important Dates

It is crucial to be aware of the filing deadlines associated with the Kentucky K-4 form. Generally, employees should submit their K-4 form to their employer at the start of their employment or whenever they experience a change in their personal or financial situation that affects their tax withholding. Additionally, any updates to the form should be made promptly to ensure accurate withholding throughout the year. Employers are required to keep this form on file for all employees and should ensure it is updated regularly.

Legal Use of the Kentucky K-4 Form

The Kentucky K-4 form is legally required for employees in Kentucky to ensure proper state tax withholding. Employers must provide this form to their employees and ensure that it is filled out correctly. Failure to submit a K-4 form may result in automatic withholding at the highest rate, which can lead to overpayment of taxes. It is important for both employees and employers to understand the legal implications of this form to maintain compliance with state tax laws.

Eligibility Criteria for Using the Kentucky K-4 Form

Any employee working in Kentucky who earns income subject to state withholding is eligible to complete the Kentucky K-4 form. This includes full-time, part-time, and temporary employees. It is important to note that individuals who are exempt from Kentucky income tax withholding must indicate this status on the form. Additionally, those who are self-employed or have other sources of income may need to consider separate tax obligations and should consult with a tax professional regarding their specific situation.

Examples of Using the Kentucky K-4 Form

Consider a scenario where an employee has recently married and wants to adjust their withholdings. By completing a new Kentucky K-4 form, they can change their filing status to married and potentially increase their number of allowances, which may reduce their state tax withholding. Another example involves an employee who has recently had a child; they may want to claim an additional allowance for the dependent, which can also be done through the K-4 form. These examples illustrate the flexibility and importance of keeping the K-4 form updated to reflect personal circumstances.

Handy tips for filling out If I Put An Apartment Number After My P o Box Will It Still Go To online

Quick steps to complete and e-sign If I Put An Apartment Number After My P o Box Will It Still Go To online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We understand how straining completing forms can be. Obtain access to a GDPR and HIPAA compliant service for maximum efficiency. Use signNow to electronically sign and send out If I Put An Apartment Number After My P o Box Will It Still Go To for e-signing.

Create this form in 5 minutes or less

Find and fill out the correct if i put an apartment number after my p o box will it still go to

Create this form in 5 minutes!

How to create an eSignature for the if i put an apartment number after my p o box will it still go to

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is ky 4 and how does it relate to airSlate SignNow?

Ky 4 is a powerful feature within airSlate SignNow that enhances document management and eSigning capabilities. It allows users to streamline their workflows, making it easier to send and sign documents securely. By utilizing ky 4, businesses can improve efficiency and reduce turnaround times for important documents.

-

How much does airSlate SignNow with ky 4 cost?

The pricing for airSlate SignNow with ky 4 is competitive and designed to fit various business needs. Plans typically start at an affordable monthly rate, with options for annual subscriptions that offer additional savings. By choosing airSlate SignNow, you gain access to ky 4 features that enhance your document signing experience.

-

What are the key features of ky 4 in airSlate SignNow?

Ky 4 includes features such as customizable templates, advanced security options, and real-time tracking of document status. These features ensure that users can manage their documents efficiently while maintaining compliance and security. With ky 4, airSlate SignNow provides a comprehensive solution for eSigning and document management.

-

How can ky 4 benefit my business?

Implementing ky 4 in airSlate SignNow can signNowly benefit your business by reducing the time spent on document processing. It allows for faster eSigning, which can lead to quicker deal closures and improved customer satisfaction. Additionally, ky 4 helps in minimizing paper usage, contributing to a more sustainable business model.

-

Does airSlate SignNow with ky 4 integrate with other software?

Yes, airSlate SignNow with ky 4 offers seamless integrations with various software applications, including CRM systems and cloud storage services. This flexibility allows businesses to incorporate ky 4 into their existing workflows without disruption. By integrating with other tools, you can enhance productivity and streamline your document management processes.

-

Is ky 4 user-friendly for non-technical users?

Absolutely! Ky 4 in airSlate SignNow is designed with user-friendliness in mind, making it accessible for non-technical users. The intuitive interface allows anyone to easily navigate the platform, send documents, and manage eSignatures without extensive training. This ensures that all team members can utilize ky 4 effectively.

-

What types of documents can I send using ky 4?

With ky 4 in airSlate SignNow, you can send a wide variety of documents, including contracts, agreements, and forms. The platform supports multiple file formats, ensuring that you can manage all your essential documents in one place. This versatility makes ky 4 an ideal solution for businesses of all sizes.

Get more for If I Put An Apartment Number After My P o Box Will It Still Go To

- Warranty deed two trustees to four individuals minnesota form

- Warranty deed to child reserving a life estate in the parents minnesota form

- Mineral deed grantor acting by and through attorney in fact minnesota form

- Discovery interrogatories from plaintiff to defendant with production requests minnesota form

- Discovery interrogatories from defendant to plaintiff with production requests minnesota form

- Discovery interrogatories form

- Mn deed form

- Mn warranty deed 497311929 form

Find out other If I Put An Apartment Number After My P o Box Will It Still Go To

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors