Form 8898 Rev October Internal Revenue Service 2020

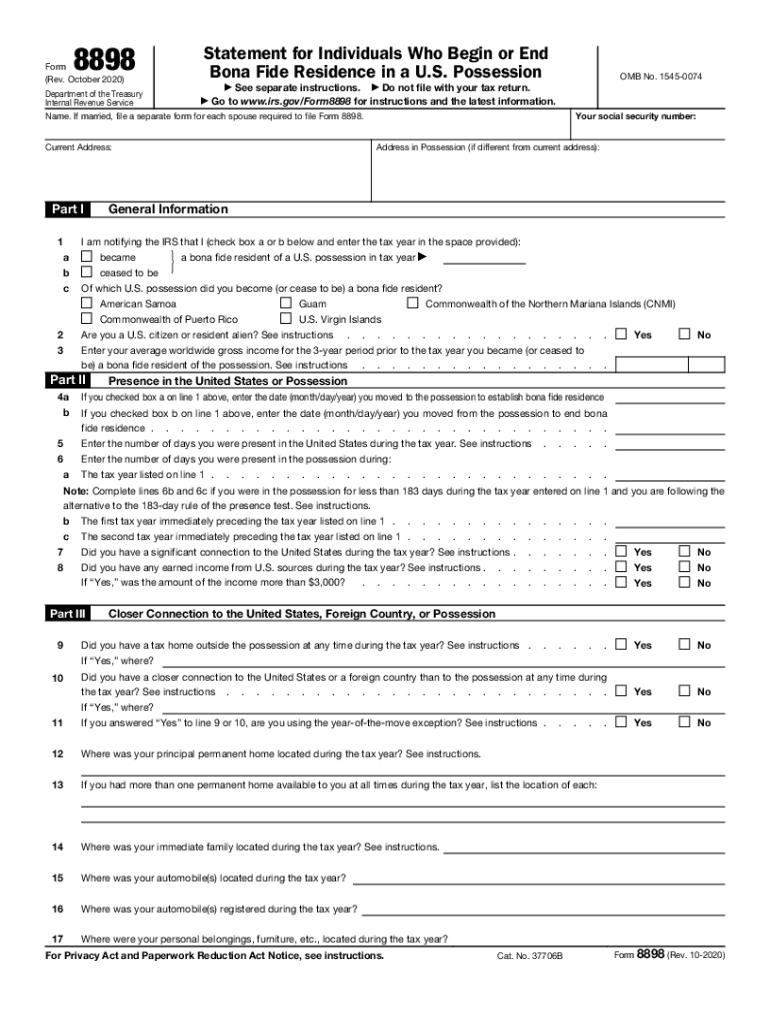

What is the Form 8898?

The Form 8898, also known as the IRS form 8898, is a tax document used by individuals who are expatriating or giving up their U.S. citizenship or long-term resident status. This form is essential for reporting specific information to the Internal Revenue Service (IRS) regarding the expatriation process. It helps ensure compliance with U.S. tax laws and provides necessary disclosures related to the individual's tax obligations.

Steps to Complete the Form 8898

Completing the Form 8898 involves several key steps:

- Gather necessary personal information, including your Social Security number and details about your residency status.

- Provide information about your assets, liabilities, and any tax obligations you may have.

- Complete each section of the form accurately, ensuring that all required fields are filled in.

- Review the form for any errors or omissions before submission.

- Sign and date the form to certify that the information provided is true and correct.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with Form 8898. Generally, the form must be submitted to the IRS within thirty days of the expatriation date. Missing this deadline can lead to penalties and complications with your tax status. Always check for any updates or changes to deadlines that may occur in a given tax year.

Required Documents

When filing Form 8898, certain documents may be required to support your claims and disclosures. These can include:

- Proof of U.S. citizenship or long-term residency status.

- Financial statements detailing your assets and liabilities.

- Previous tax returns to demonstrate compliance with U.S. tax laws.

Penalties for Non-Compliance

Failing to file Form 8898 or providing inaccurate information can result in significant penalties. The IRS may impose fines, and you could face challenges regarding your tax obligations. It is essential to adhere to all requirements and deadlines to avoid these repercussions.

Digital vs. Paper Version

Form 8898 can be completed and submitted either digitally or on paper. The digital version allows for easier completion and submission through IRS e-filing systems, while the paper version requires mailing to the appropriate IRS address. Consider your preferences and the requirements of your situation when choosing between these options.

Quick guide on how to complete form 8898 rev october 2020 internal revenue service

Complete Form 8898 Rev October Internal Revenue Service seamlessly on any device

Digital document management has become increasingly popular among organizations and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents rapidly and without delays. Handle Form 8898 Rev October Internal Revenue Service on any platform using airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest way to modify and eSign Form 8898 Rev October Internal Revenue Service effortlessly

- Find Form 8898 Rev October Internal Revenue Service and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight pertinent sections of the documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and then click the Done button to save your modifications.

- Choose how you would like to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets your needs in document management in just a few clicks from any device you prefer. Modify and eSign Form 8898 Rev October Internal Revenue Service and ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 8898 rev october 2020 internal revenue service

Create this form in 5 minutes!

How to create an eSignature for the form 8898 rev october 2020 internal revenue service

The best way to make an eSignature for a PDF file online

The best way to make an eSignature for a PDF file in Google Chrome

The way to create an electronic signature for signing PDFs in Gmail

The best way to generate an eSignature straight from your mobile device

How to make an eSignature for a PDF file on iOS

The best way to generate an eSignature for a PDF document on Android devices

People also ask

-

What is airSlate SignNow and how does it utilize the number 8898?

airSlate SignNow is an electronic signature software designed to streamline the document signing process. The number 8898 highlights our advanced features that make document handling efficient and straightforward. With airSlate SignNow, you can manage your documents effortlessly while ensuring compliance and security.

-

What pricing plans are available for airSlate SignNow and how do they relate to 8898?

airSlate SignNow offers several pricing plans to meet diverse business needs. The number 8898 reflects our competitive pricing structure aimed at providing value for all users. Regardless of your budget, we have a plan that includes everything you need for effective eSignature solutions.

-

What key features does airSlate SignNow offer for managing documents with the number 8898?

airSlate SignNow provides a host of features designed for efficiency and ease of use. Our tools, represented by the number 8898, include customizable templates, real-time notifications, and robust security measures. These features ensure that you can send and eSign documents smoothly while maintaining compliance.

-

How can airSlate SignNow improve my business's workflow related to 8898?

By integrating airSlate SignNow into your business operations, represented by the number 8898, you can signNowly enhance your workflow. The platform automates document management, reduces manual tasks, and accelerates turnaround times. This results in improved productivity and higher customer satisfaction.

-

What are the benefits of using airSlate SignNow for electronic signatures with the identifier 8898?

airSlate SignNow offers numerous benefits, exemplified by the identifier 8898, such as increased speed and efficiency in document processing. With our user-friendly interface, you can obtain signatures in minutes rather than days. Additionally, our platform ensures security and compliance, giving you peace of mind.

-

Does airSlate SignNow integrate with other software, and how does the number 8898 play a role?

Yes, airSlate SignNow integrates seamlessly with various software applications crucial for business operations. The number 8898 represents our commitment to connectivity, enabling a smooth flow of data between your preferred tools and our platform. This integration makes document management even more convenient and efficient.

-

How secure is the airSlate SignNow platform associated with the number 8898?

Security is a top priority for airSlate SignNow, and we ensure that all data is protected under stringent measures. The number 8898 is a testament to our high-security standards, including encryption and secure storage. You can trust that your documents and signatures are safe with us.

Get more for Form 8898 Rev October Internal Revenue Service

Find out other Form 8898 Rev October Internal Revenue Service

- Sign Hawaii Orthodontists Claim Free

- Sign Nevada Plumbing Job Offer Easy

- Sign Nevada Plumbing Job Offer Safe

- Sign New Jersey Plumbing Resignation Letter Online

- Sign New York Plumbing Cease And Desist Letter Free

- Sign Alabama Real Estate Quitclaim Deed Free

- How Can I Sign Alabama Real Estate Affidavit Of Heirship

- Can I Sign Arizona Real Estate Confidentiality Agreement

- How Do I Sign Arizona Real Estate Memorandum Of Understanding

- Sign South Dakota Plumbing Job Offer Later

- Sign Tennessee Plumbing Business Letter Template Secure

- Sign South Dakota Plumbing Emergency Contact Form Later

- Sign South Dakota Plumbing Emergency Contact Form Myself

- Help Me With Sign South Dakota Plumbing Emergency Contact Form

- How To Sign Arkansas Real Estate Confidentiality Agreement

- Sign Arkansas Real Estate Promissory Note Template Free

- How Can I Sign Arkansas Real Estate Operating Agreement

- Sign Arkansas Real Estate Stock Certificate Myself

- Sign California Real Estate IOU Safe

- Sign Connecticut Real Estate Business Plan Template Simple