Form 8898 Irs 2007

What is the Form 8898 Irs

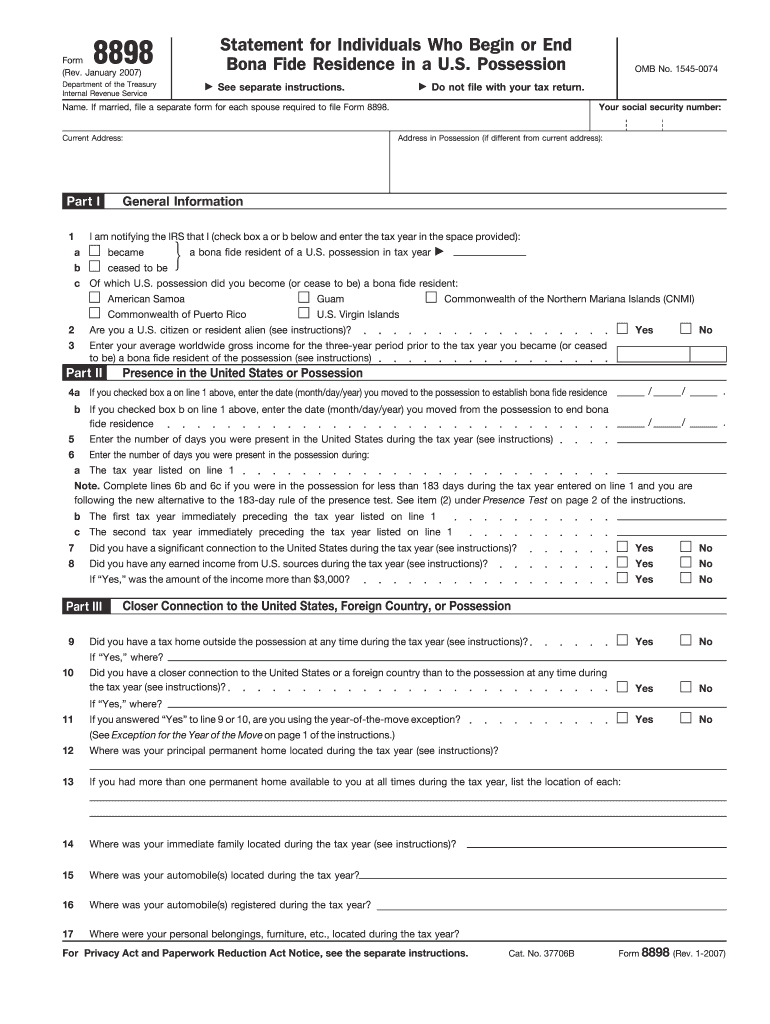

The IRS Form 8898, also known as the Statement for Individuals Who Begin or End Bona Fide Residence in a Foreign Country, is designed for U.S. citizens and resident aliens who are either starting or ending their bona fide residence in a foreign country. This form is crucial for reporting the status of residency and ensuring compliance with U.S. tax obligations while living abroad. Filing this form helps determine eligibility for certain tax benefits and exemptions related to foreign income.

How to use the Form 8898 Irs

To effectively use the IRS Form 8898, individuals must accurately report their residency status. This involves providing details such as the dates of residence, the country of residence, and any relevant income earned during that period. It's essential to follow the instructions carefully to ensure all required information is included. This form can be filed alongside your annual tax return or separately, depending on your circumstances.

Steps to complete the Form 8898 Irs

Completing the IRS Form 8898 involves several key steps:

- Gather necessary information, including your residency dates and foreign income details.

- Download the form from the IRS website or use tax software that includes it.

- Fill out the form, ensuring all sections are completed accurately.

- Review the form for any errors or missing information.

- Submit the form either electronically or by mail, as per IRS guidelines.

Filing Deadlines / Important Dates

Filing deadlines for IRS Form 8898 align with the annual tax return deadlines. Typically, U.S. citizens and resident aliens must file their tax returns by April 15. If you are living abroad, you may qualify for an automatic extension until June 15, but any taxes owed are still due by April 15. It's important to check for any updates or changes to deadlines each tax year.

Required Documents

When preparing to file IRS Form 8898, certain documents may be required to support your claims. These can include:

- Proof of residency in the foreign country, such as a lease agreement or utility bills.

- Tax documents from the foreign country, if applicable.

- Any previous tax returns that may be relevant to your residency status.

Penalties for Non-Compliance

Failing to file the IRS Form 8898 when required can result in significant penalties. The IRS may impose fines for late filings, and failure to report foreign income could lead to additional tax liabilities. It's essential to understand the implications of non-compliance and to seek assistance if you are unsure about your filing requirements.

Quick guide on how to complete form 8898 irs

Complete Form 8898 Irs effortlessly on any device

Digital document management has gained traction among organizations and individuals. It presents an ideal environmentally-friendly substitute for traditional printed and signed documents, allowing you to locate the necessary form and securely save it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents swiftly without delays. Manage Form 8898 Irs on any platform with airSlate SignNow Android or iOS applications and streamline any document-related tasks today.

How to alter and eSign Form 8898 Irs with ease

- Locate Form 8898 Irs and click on Get Form to begin.

- Utilize the tools we provide to finish your document.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes only seconds and has the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Alter and eSign Form 8898 Irs to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 8898 irs

Create this form in 5 minutes!

How to create an eSignature for the form 8898 irs

The way to make an eSignature for your PDF document in the online mode

The way to make an eSignature for your PDF document in Chrome

The way to make an electronic signature for putting it on PDFs in Gmail

How to make an electronic signature straight from your mobile device

The way to make an electronic signature for a PDF document on iOS devices

How to make an electronic signature for a PDF document on Android devices

People also ask

-

What is the tax form 8898 and who needs to file it?

The tax form 8898, officially known as the 'Return for Persons Receiving Income from Sources in the United States,' is required for certain foreign individuals and entities to report their income. If you are a foreign national earning income in the U.S. or have foreign tax credits, you may need to file this form to ensure compliance with IRS regulations.

-

How can airSlate SignNow help me with the tax form 8898?

airSlate SignNow offers an efficient platform for electronically signing and sending documents, including the tax form 8898. By using our intuitive solution, you can streamline the filing process, ensure document security, and maintain compliance, making it easier to manage your tax obligations.

-

What features does airSlate SignNow offer for completing tax form 8898?

Our platform includes features like customizable templates, real-time editing, and secure cloud storage to simplify the completion of tax form 8898. Additionally, the ability to track document status and send reminders helps ensure that you never miss a deadline.

-

Is airSlate SignNow compliant with tax form 8898 filing requirements?

Yes, airSlate SignNow is designed with compliance in mind, including measures to help you properly handle tax form 8898. Our platform adheres to industry standards for electronic signatures and document security, ensuring that your submissions meet IRS regulations.

-

What are the pricing options for using airSlate SignNow for tax form 8898?

AirSlate SignNow offers flexible pricing plans that cater to different business needs, including a free trial to help you explore the platform. Our cost-effective solution ensures you get excellent value while managing your documentation, including the tax form 8898.

-

Can I integrate airSlate SignNow with other software for tax form 8898 management?

Absolutely! airSlate SignNow allows integration with a variety of third-party applications and tools, making it easy to manage your tax form 8898 alongside other payroll or accounting software. This integration ensures seamless data flow and enhanced productivity for your tax filing process.

-

What benefits does airSlate SignNow provide for businesses handling tax form 8898?

Using airSlate SignNow for managing tax form 8898 offers several benefits, including time savings, improved document accuracy, and enhanced security. Our platform allows you to manage your tax documentation efficiently, ensuring crucial forms like 8898 are completed and filed on time.

Get more for Form 8898 Irs

- Pakistan application withdrawal form

- Ministry of planningdevelopment amp special initiatives form

- Wwwscribdcomdocument359602820chapter 2united states armed forcescivil service form

- Actra toronto member branch transfer form

- Pakistan attestation form

- Visa application for media embassy of pakistan washington dc form

- Annexure 44 resolution of cabinet form

- What is the nature and significance of the planning form

Find out other Form 8898 Irs

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors