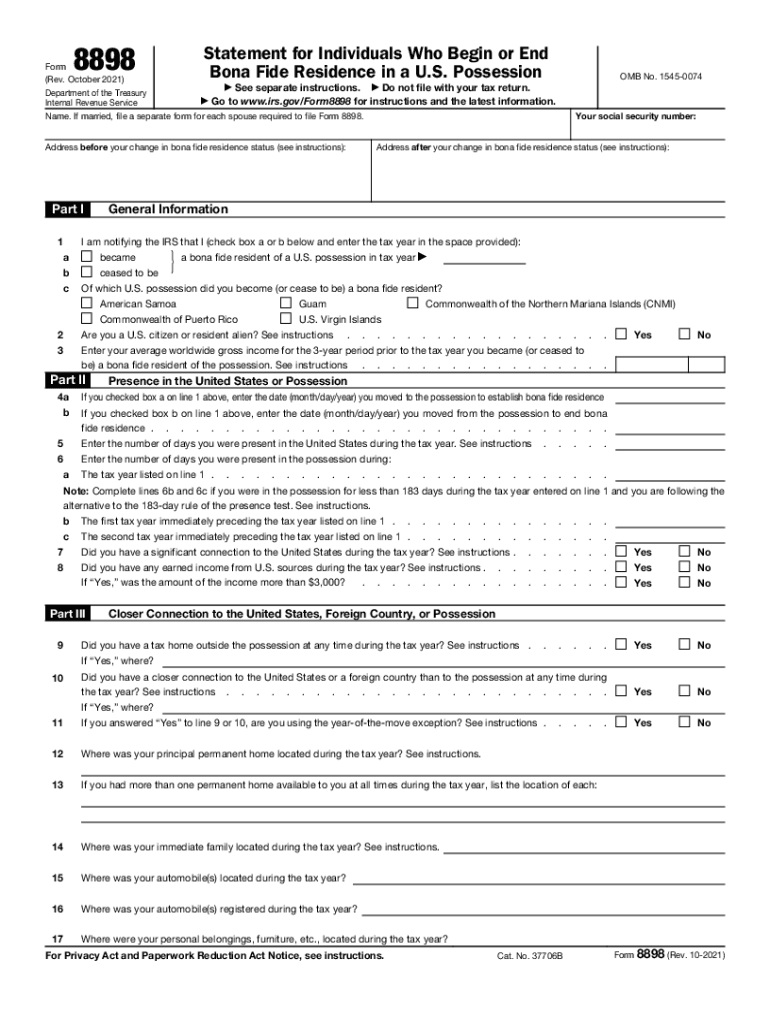

IRS Form 8898 "Statement for Individuals Who Begin or End 2021

What is the IRS Form 8898?

The IRS Form 8898, known as the "Statement for Individuals Who Begin or End Residency," is a crucial document for individuals who are transitioning in or out of U.S. residency. This form is primarily used to report residency status changes to the Internal Revenue Service (IRS). It is essential for individuals who may have tax obligations in the United States due to their residency status. Understanding the purpose of this form is vital for ensuring compliance with U.S. tax laws.

How to use the IRS Form 8898

Using the IRS Form 8898 involves several steps that ensure accurate reporting of residency changes. Individuals must first determine their residency status according to IRS guidelines. Once this is established, they can proceed to complete the form by providing necessary personal information, including their name, address, and taxpayer identification number. It is important to accurately fill out each section to avoid delays or complications in processing.

Steps to complete the IRS Form 8898

Completing the IRS Form 8898 requires careful attention to detail. Here are the steps to follow:

- Gather necessary personal information, including your Social Security number and address.

- Determine your residency status based on IRS criteria.

- Fill out the form, ensuring all sections are completed accurately.

- Review the form for any errors or omissions.

- Submit the form either electronically or via mail, depending on your preference.

Legal use of the IRS Form 8898

The IRS Form 8898 serves a legal purpose in the context of U.S. tax law. It is designed to formally notify the IRS of changes in residency status, which can affect tax liabilities. Proper completion and submission of this form are essential for compliance with federal tax regulations. Failure to submit the form when required may result in penalties or complications with tax filings.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the IRS Form 8898 is crucial for compliance. Generally, the form must be filed by the due date of your tax return for the year in which your residency status changes. This ensures that the IRS has timely information regarding your residency, which can impact your tax obligations. It is advisable to check the IRS website for specific dates and any updates regarding filing requirements.

Required Documents

When preparing to file the IRS Form 8898, certain documents may be required to support your residency status change. These documents typically include:

- Proof of residency, such as utility bills or lease agreements.

- Tax returns from previous years, if applicable.

- Identification documents, including your Social Security card.

Having these documents ready can facilitate a smoother filing process and help ensure that your form is accepted without issues.

Quick guide on how to complete irs form 8898 ampquotstatement for individuals who begin or end

Complete IRS Form 8898 "Statement For Individuals Who Begin Or End with ease on any device

Online document management has become increasingly prevalent among businesses and individuals. It offers an excellent eco-friendly solution to traditional printed and signed documents, as you can easily locate the appropriate form and safely store it online. airSlate SignNow equips you with all the resources you need to create, edit, and electronically sign your documents swiftly without interruptions. Handle IRS Form 8898 "Statement For Individuals Who Begin Or End on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to edit and eSign IRS Form 8898 "Statement For Individuals Who Begin Or End effortlessly

- Locate IRS Form 8898 "Statement For Individuals Who Begin Or End and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of the document or redact sensitive information with tools that airSlate SignNow specially offers for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your chosen device. Edit and eSign IRS Form 8898 "Statement For Individuals Who Begin Or End and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct irs form 8898 ampquotstatement for individuals who begin or end

Create this form in 5 minutes!

How to create an eSignature for the irs form 8898 ampquotstatement for individuals who begin or end

How to generate an e-signature for a PDF in the online mode

How to generate an e-signature for a PDF in Chrome

How to create an e-signature for putting it on PDFs in Gmail

The way to make an e-signature right from your smart phone

The best way to create an e-signature for a PDF on iOS devices

The way to make an e-signature for a PDF on Android OS

People also ask

-

What is the pricing structure for airSlate SignNow 8898?

airSlate SignNow 8898 offers flexible pricing plans that cater to businesses of all sizes. You can choose from various subscription tiers based on your usage needs, ensuring you only pay for what you need. The plans include essential features at competitive rates, making it a cost-effective solution.

-

What features are included in the airSlate SignNow 8898 solution?

The airSlate SignNow 8898 solution includes a variety of robust features such as eSignature, document templates, and real-time collaboration. These tools streamline your document management process, making it easier to execute contracts and agreements. Additionally, the platform supports secure storage and compliance for your documents.

-

How does airSlate SignNow 8898 benefit my business?

Using airSlate SignNow 8898 can signNowly enhance your workflow efficiency by reducing the time spent on manual document processes. You'll enjoy faster turnaround times, improved accuracy in transactions, and a seamless user experience. This overall boost in productivity allows your team to focus on more crucial tasks.

-

Can airSlate SignNow 8898 integrate with other software?

Yes, airSlate SignNow 8898 is designed to integrate with various third-party applications and tools, enhancing its functionality. Popular integrations include CRM software and project management platforms, making it easier to manage documents within the context of your existing workflow. This ensures a cohesive and streamlined experience for users.

-

Is airSlate SignNow 8898 secure for sensitive documents?

Absolutely! airSlate SignNow 8898 prioritizes security with advanced encryption protocols and compliance with industry standards. Whether you're signing contracts or handling sensitive information, you can trust that your documents are protected against unauthorized access. This commitment to security instills confidence in your document management processes.

-

What types of businesses can benefit from airSlate SignNow 8898?

airSlate SignNow 8898 is versatile and can benefit businesses across various industries, including real estate, legal, and healthcare. Its ease of use and comprehensive features make it suitable for small startups as well as large enterprises. Any organization looking to streamline their signing processes can find value in this solution.

-

How can I get started with airSlate SignNow 8898?

Getting started with airSlate SignNow 8898 is simple. You can visit our website to sign up for a free trial or choose a subscription plan that fits your needs. Once registered, you’ll have access to all the features and can begin sending documents for eSignature immediately.

Get more for IRS Form 8898 "Statement For Individuals Who Begin Or End

- Account corporation form

- Florida notice transfer form

- Florida abandonment form

- Affidavit of abandonment and intent to recommence construction form mechanic liens corporation or llc florida

- Notice form construction 497302784

- Notice form construction 497302785

- Notice commencement 497302786 form

- Notice termination form 497302787

Find out other IRS Form 8898 "Statement For Individuals Who Begin Or End

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF

- How To Sign Pennsylvania Legal Word

- How Do I Sign Wisconsin Legal Form

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation