About Form 8898, Statement for Individuals Who Begin or End Bona Fide 2022-2026

Understanding Form 8898

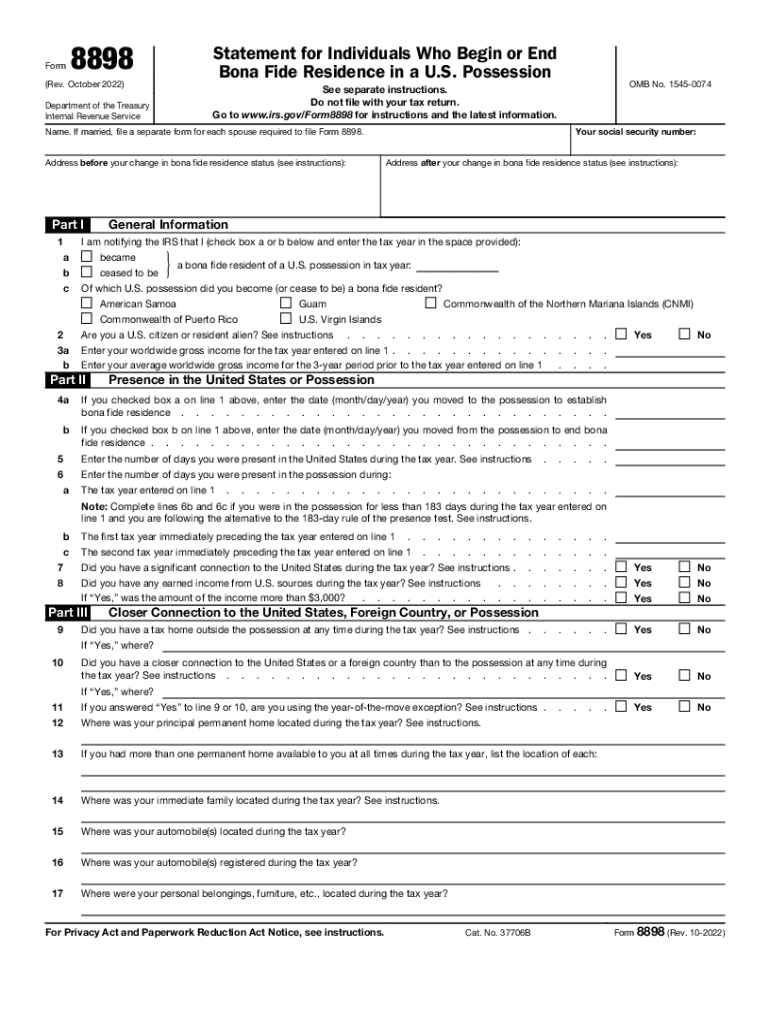

The 8898 form, officially known as the Statement for Individuals Who Begin or End Bona Fide Residence in a Foreign Country, is essential for U.S. citizens and residents who meet specific criteria regarding their residency status. This form is used to inform the IRS when an individual starts or ends their bona fide residence in a foreign country. Completing this form is crucial for maintaining compliance with U.S. tax regulations, as it helps clarify an individual's tax obligations based on their residency status.

Steps to Complete Form 8898

Filling out the 8898 form requires careful attention to detail. Here are the steps to ensure accurate completion:

- Gather necessary personal information, including your name, address, and taxpayer identification number.

- Determine the dates of your bona fide residence in the foreign country.

- Provide details about your foreign residence, including the country and the nature of your residence.

- Complete all sections of the form, ensuring that all information is accurate and truthful.

- Review the form for any errors before submission.

Legal Use of Form 8898

The 8898 form serves a legal purpose in the context of U.S. tax law. It helps establish an individual's residency status, which can significantly impact tax obligations. By submitting this form, taxpayers can avoid potential penalties associated with incorrect residency claims. Proper completion and submission of the form are crucial for ensuring compliance with IRS regulations regarding foreign income and tax credits.

Filing Deadlines for Form 8898

Timely submission of the 8898 form is important to avoid penalties. Generally, the form should be filed by the due date of your tax return, including extensions. If you fail to file the form on time, you may face penalties that can affect your overall tax liability. It is advisable to consult the IRS guidelines for specific deadlines related to your situation.

Required Documents for Form 8898

When completing the 8898 form, certain documents may be necessary to support your claims. These may include:

- Proof of residency in the foreign country, such as rental agreements or utility bills.

- Tax returns filed in the foreign country.

- Any correspondence from the IRS regarding your residency status.

Having these documents ready can facilitate a smoother filing process and ensure that all claims are substantiated.

Form Submission Methods

Form 8898 can be submitted through various methods, depending on your preference and circumstances:

- Online: Some taxpayers may choose to file electronically through tax software that supports IRS forms.

- Mail: You can also print the completed form and send it directly to the IRS via postal mail.

- In-Person: For those who prefer face-to-face assistance, visiting a local IRS office may be an option.

Penalties for Non-Compliance

Failing to file Form 8898 when required can lead to significant penalties. The IRS may impose fines based on the duration of non-compliance and the amount of tax owed. Understanding these penalties is crucial for maintaining compliance and avoiding unnecessary financial burdens. It is advisable to stay informed about your filing requirements to prevent any issues with the IRS.

Quick guide on how to complete about form 8898 statement for individuals who begin or end bona fide

Complete About Form 8898, Statement For Individuals Who Begin Or End Bona Fide seamlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can find the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly and without hindrances. Manage About Form 8898, Statement For Individuals Who Begin Or End Bona Fide on any device using airSlate SignNow’s Android or iOS applications and enhance any document-centric process today.

The easiest way to edit and eSign About Form 8898, Statement For Individuals Who Begin Or End Bona Fide effortlessly

- Obtain About Form 8898, Statement For Individuals Who Begin Or End Bona Fide and click on Get Form to begin.

- Use the tools we provide to fill out your document.

- Highlight important sections of the documents or obscure sensitive data with the tools specifically offered by airSlate SignNow for that purpose.

- Generate your signature using the Sign tool, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign About Form 8898, Statement For Individuals Who Begin Or End Bona Fide and guarantee outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct about form 8898 statement for individuals who begin or end bona fide

Create this form in 5 minutes!

People also ask

-

What is Form 8898 and why do I need it?

Form 8898 is an important IRS form that U.S. citizens living abroad must file to report their foreign financial accounts. Filing this form is crucial to avoid hefty penalties and ensure compliance with U.S. tax laws. Understanding how to complete Form 8898 can simplify your foreign reporting obligations.

-

How can airSlate SignNow help me with Form 8898?

airSlate SignNow provides a seamless platform for electronically signing and sending your Form 8898. With our easy-to-use interface, you can manage your documents efficiently while ensuring they are securely signed and stored. This saves you time and reduces the risk of errors in your submission.

-

Is there a cost associated with using airSlate SignNow for Form 8898?

Yes, airSlate SignNow offers flexible pricing plans that cater to various business needs. We provide cost-effective solutions for managing documents, including Form 8898, ensuring you get the best value for your investment. Check our website for detailed pricing information and choose the plan that suits you best.

-

Can I integrate airSlate SignNow with other software to handle Form 8898?

Absolutely! airSlate SignNow offers multiple integrations with popular business tools, allowing you to seamlessly manage your Form 8898 documentation workflow. This means you can send, sign, and store your documents directly within the applications you already use, streamlining your operations.

-

How does airSlate SignNow ensure the security of my Form 8898?

Security is a top priority at airSlate SignNow. We utilize advanced encryption methods to protect your Form 8898 and other sensitive documents during transmission and storage. Additionally, our platform complies with industry standards, ensuring your data remains confidential and secure.

-

What features does airSlate SignNow offer for managing Form 8898?

airSlate SignNow includes features like template creation, bulk sending, and detailed tracking to enhance your experience with Form 8898. These functionalities allow you to customize your forms, send them to multiple recipients effortlessly, and monitor their status in real-time. This makes document management both efficient and transparent.

-

Can I access my Form 8898 documents on mobile with airSlate SignNow?

Yes, airSlate SignNow is fully accessible on mobile devices, enabling you to manage your Form 8898 documents on the go. Our mobile app allows you to sign, send, and track documents from anywhere, ensuring you can handle your form submissions conveniently and efficiently.

Get more for About Form 8898, Statement For Individuals Who Begin Or End Bona Fide

- Concrete mason contractor package new jersey form

- Demolition contractor package new jersey form

- Security contractor package new jersey form

- Insulation contractor package new jersey form

- Paving contractor package new jersey form

- Site work contractor package new jersey form

- Siding contractor package new jersey form

- Refrigeration contractor package new jersey form

Find out other About Form 8898, Statement For Individuals Who Begin Or End Bona Fide

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement