51a111 Kentucky 2019-2026

What is the 51a111 Kentucky

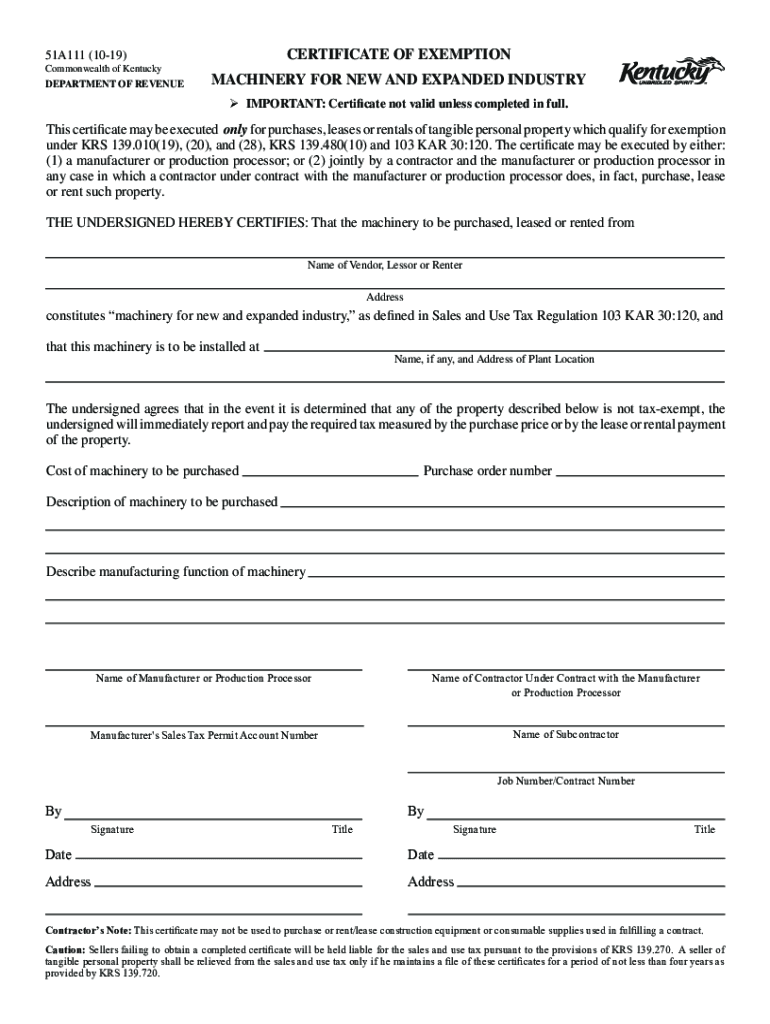

The 51a111 Kentucky form is a tax exemption certificate specifically designed for businesses operating within the machinery expanded industry in Kentucky. This form allows eligible entities to claim an exemption from sales and use tax on qualifying machinery and equipment purchases. By utilizing the 51a111 exemption, businesses can reduce their overall tax burden, thus promoting growth and investment within the state. This form is crucial for companies looking to maximize their financial resources while complying with state tax regulations.

How to use the 51a111 Kentucky

Using the 51a111 Kentucky form involves a straightforward process. First, ensure that your business qualifies for the exemption by reviewing the eligibility criteria outlined by the Kentucky Department of Revenue. Next, accurately fill out the form, providing all necessary information, including your business name, address, and the specific machinery or equipment for which you are claiming the exemption. Once completed, submit the form to the vendor from whom you are purchasing the machinery, allowing them to process the exemption during the sale.

Steps to complete the 51a111 Kentucky

Completing the 51a111 Kentucky form requires careful attention to detail. Follow these steps:

- Obtain the 51a111 form from the Kentucky Department of Revenue website or through authorized channels.

- Fill in your business information, including the name, address, and tax identification number.

- Specify the machinery or equipment for which you are claiming the exemption.

- Review the form for accuracy and completeness.

- Submit the completed form to your vendor at the time of purchase.

Eligibility Criteria

To qualify for the 51a111 exemption, businesses must meet specific eligibility criteria. Generally, the exemption applies to entities engaged in manufacturing, processing, or assembling tangible personal property. Additionally, the machinery and equipment must be directly used in the production process. It is essential to review the detailed guidelines provided by the Kentucky Department of Revenue to ensure compliance and avoid any potential issues during the exemption claim process.

Required Documents

When applying for the 51a111 Kentucky exemption, certain documents may be required to support your claim. These typically include:

- A completed 51a111 form.

- Proof of your business's eligibility, such as a business license or registration.

- Invoices or receipts for the machinery or equipment being purchased.

Having these documents ready can streamline the exemption process and ensure that your claim is processed without delays.

Form Submission Methods

The 51a111 Kentucky form can be submitted through various methods, depending on the vendor's preferences. Common submission methods include:

- In-person delivery at the time of purchase.

- Mailing the completed form directly to the vendor.

- Submitting the form electronically if the vendor supports digital submissions.

It is advisable to confirm the preferred submission method with your vendor to ensure a smooth transaction.

Quick guide on how to complete 51a111 kentucky

Complete 51a111 Kentucky effortlessly on any gadget

Digital document management has gained traction among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed paperwork, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Manage 51a111 Kentucky across any platform with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The simplest way to modify and eSign 51a111 Kentucky without hassle

- Locate 51a111 Kentucky and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to preserve your modifications.

- Select how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Edit and eSign 51a111 Kentucky and ensure excellent communication at any point of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 51a111 kentucky

Create this form in 5 minutes!

How to create an eSignature for the 51a111 kentucky

The way to generate an electronic signature for a PDF online

The way to generate an electronic signature for a PDF in Google Chrome

The way to create an eSignature for signing PDFs in Gmail

The way to create an eSignature straight from your smartphone

The best way to make an eSignature for a PDF on iOS

The way to create an eSignature for a PDF document on Android

People also ask

-

What is the ky 51a111 exemption?

The ky 51a111 exemption refers to a specific tax exemption in Kentucky that can signNowly reduce tax liabilities for qualified entities. Understanding this exemption is crucial for businesses looking to minimize costs and optimize their operations. It is essential to consult with a tax professional to see if your business qualifies for the ky 51a111 exemption.

-

How can airSlate SignNow help with the ky 51a111 exemption process?

airSlate SignNow simplifies the document signing process necessary for applying for the ky 51a111 exemption. With its user-friendly platform, you can create, send, and eSign critical documents securely and efficiently. This can streamline the paperwork required for tax exemptions, saving you time and effort.

-

Is there a cost associated with using airSlate SignNow for managing ky 51a111 exemption documents?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. These plans include features that ensure you can efficiently handle documents related to the ky 51a111 exemption without straining your budget. For detailed pricing information, visit our website or contact our sales team.

-

What features does airSlate SignNow provide for handling ky 51a111 exemption applications?

airSlate SignNow comes with an array of features designed to support the efficient handling of ky 51a111 exemption applications. These features include customizable templates, automated reminders, and secure storage for all documents. This ensures that your exemption applications are processed smoothly and tracked effectively.

-

Are there any integrations available with airSlate SignNow for processing ky 51a111 exemption documents?

Yes, airSlate SignNow integrates seamlessly with various third-party applications, enhancing your workflow for managing the ky 51a111 exemption. This allows you to connect with your existing systems, reducing redundancy and improving overall efficiency. Check our integration partners to see how you can optimize your document processes.

-

What benefits does airSlate SignNow offer for obtaining a ky 51a111 exemption?

Using airSlate SignNow to handle your ky 51a111 exemption documents provides numerous benefits. You can achieve faster processing times, improved accuracy, and enhanced security for your sensitive documents. These advantages can greatly help streamline the application process and ensure compliance.

-

Can I use airSlate SignNow on mobile devices for ky 51a111 exemption tasks?

Absolutely! airSlate SignNow is fully accessible on mobile devices, allowing you to manage your ky 51a111 exemption documents on the go. This flexibility ensures that you can send, sign, and organize important documents from anywhere, making it a great solution for busy professionals.

Get more for 51a111 Kentucky

- Letter from tenant to landlord about illegal entry by landlord washington form

- Statutory warranty form

- Quitclaim deed with representative acknowledgment washington form

- Quitclaim deed with individual acknowledgment washington form

- Letter from landlord to tenant about time of intent to enter premises washington form

- Deed real estate contract form

- Landlord notice rent 497429612 form

- Deed real estate 497429613 form

Find out other 51a111 Kentucky

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document