Irs Form 500es 2020

What is the IRS Form 500ES?

The IRS Form 500ES is a tax form used by individuals and businesses in Georgia to report and pay estimated taxes. This form is essential for those who expect to owe tax of $500 or more when filing their annual return. The estimated tax payments are typically made quarterly, and the 500ES form helps taxpayers calculate and submit these payments accurately. Understanding this form is crucial for compliance with state tax laws and avoiding penalties.

Steps to Complete the IRS Form 500ES

Completing the IRS Form 500ES involves several key steps:

- Gather necessary information: Collect your income details, deductions, and credits that may affect your estimated tax liability.

- Calculate your estimated tax: Use the information from your previous year’s tax return and any changes in income or deductions to estimate your current tax obligation.

- Fill out the form: Enter your calculated estimated tax amount on the form. Ensure all details are accurate to avoid issues.

- Submit the form: Choose your submission method, either online or by mail, and ensure you meet the deadlines for each quarter.

Filing Deadlines / Important Dates

Filing deadlines for the IRS Form 500ES are critical for avoiding penalties. Typically, estimated taxes are due on the following dates:

- April 15 for the first quarter

- June 15 for the second quarter

- September 15 for the third quarter

- January 15 of the following year for the fourth quarter

It's important to mark these dates on your calendar to ensure timely payments and compliance with Georgia tax laws.

Legal Use of the IRS Form 500ES

The IRS Form 500ES is legally binding when completed correctly and submitted on time. To ensure its validity, taxpayers must adhere to the guidelines set forth by the Georgia Department of Revenue. This includes providing accurate income estimates and making timely payments. Failure to comply with these regulations can result in penalties and interest on unpaid taxes.

Form Submission Methods

Taxpayers have several options for submitting the IRS Form 500ES:

- Online: Many taxpayers prefer to submit their forms electronically through the Georgia Department of Revenue’s website, which offers a secure and efficient process.

- By Mail: If you choose to mail your form, ensure it is sent to the correct address specified by the Georgia Department of Revenue to avoid delays.

- In-Person: Some taxpayers may opt to deliver their forms in person at local tax offices, although this is less common.

Key Elements of the IRS Form 500ES

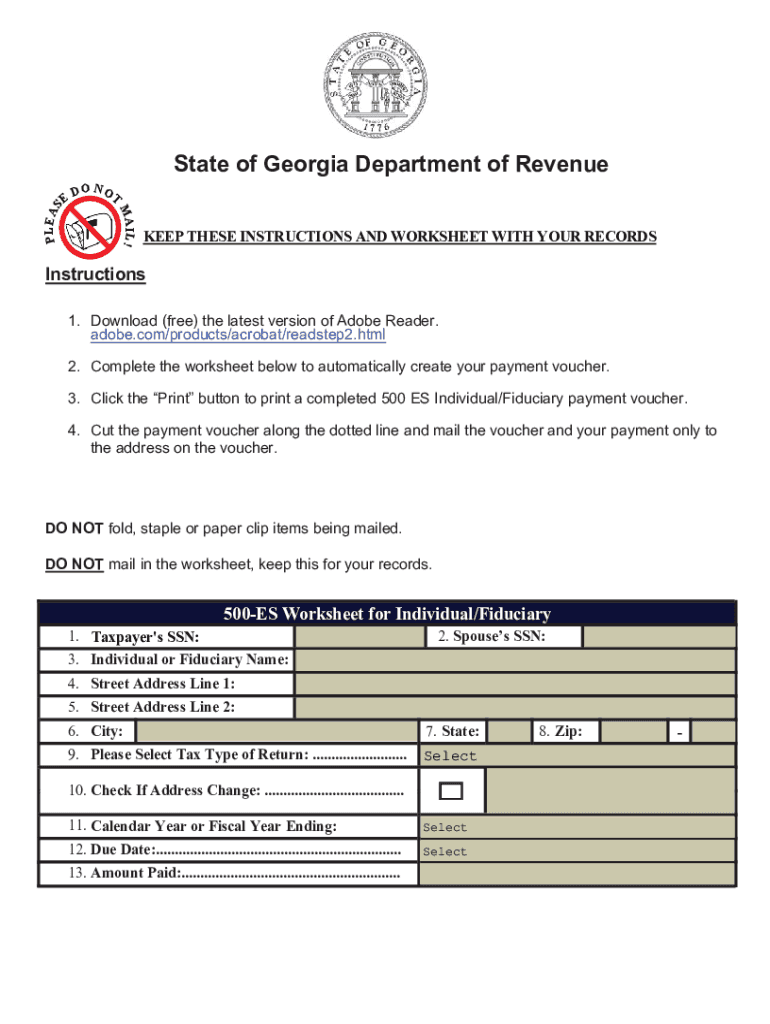

The IRS Form 500ES includes several key elements that taxpayers must complete:

- Taxpayer Information: Personal details such as name, address, and Social Security number.

- Estimated Tax Amount: The total estimated tax liability for the year, broken down by quarter.

- Payment Information: Details on how payments will be made, including payment amounts and due dates.

Each of these elements must be filled out accurately to ensure proper processing by the tax authorities.

Quick guide on how to complete irs form 500es

Complete Irs Form 500es effortlessly on any device

Web-based document management has become favored by both companies and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can easily locate the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents promptly without any hold-ups. Handle Irs Form 500es on any platform with airSlate SignNow Android or iOS applications and enhance any document-driven workflow today.

The simplest way to alter and eSign Irs Form 500es without hassle

- Find Irs Form 500es and click Get Form to commence.

- Utilize the tools we offer to complete your form.

- Highlight pertinent sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you want to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the worries of lost or misplaced files, tedious form searching, or errors that necessitate reprinting new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and eSign Irs Form 500es to ensure effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct irs form 500es

Create this form in 5 minutes!

How to create an eSignature for the irs form 500es

The way to generate an electronic signature for a PDF in the online mode

The way to generate an electronic signature for a PDF in Chrome

The way to create an eSignature for putting it on PDFs in Gmail

The way to create an eSignature straight from your smart phone

The best way to make an eSignature for a PDF on iOS devices

The way to create an eSignature for a PDF document on Android OS

People also ask

-

What is the 2019 500 es and how does it work?

The 2019 500 es is an electronic signature solution that simplifies the process of sending and signing documents. It enables users to create, manage, and securely eSign documents online, streamlining workflows for businesses of all sizes. With its easy-to-use interface, the 2019 500 es ensures that you can complete agreements efficiently and confidently.

-

What are the key features of the 2019 500 es?

The 2019 500 es offers a range of features designed to enhance your document management experience. Key features include customizable templates, mobile compatibility, and real-time tracking of document status. These capabilities make the 2019 500 es a comprehensive tool for businesses looking to improve their document workflows.

-

How does the pricing for the 2019 500 es compare to other eSignature solutions?

The 2019 500 es delivers a cost-effective solution for electronic signatures, often being more affordable than competing platforms. We offer various pricing plans to suit businesses of different sizes and needs, ensuring you only pay for the features you use. This competitive pricing structure makes the 2019 500 es an attractive option for companies looking to enhance their document processes.

-

Is the 2019 500 es compliant with legal standards?

Yes, the 2019 500 es complies with various legal standards, including the ESIGN Act and UETA, ensuring that your electronic signatures are legally binding. Our platform also includes security measures that protect sensitive information, giving you peace of mind as you manage your documents. Trust in the compliance of the 2019 500 es to help you meet regulatory requirements.

-

Can I integrate the 2019 500 es with my existing software?

Absolutely! The 2019 500 es offers seamless integrations with a variety of popular business applications. Whether you're using CRM systems, project management tools, or cloud storage solutions, you can easily incorporate the 2019 500 es into your existing workflows for enhanced productivity.

-

What benefits does using the 2019 500 es provide for businesses?

Using the 2019 500 es provides numerous benefits, including faster turnaround times for contracts and reduced paper usage. This eco-friendly solution not only streamlines operations but also improves collaboration among team members. By adopting the 2019 500 es, businesses can enhance efficiency and drive better results.

-

How can I get started with the 2019 500 es?

Getting started with the 2019 500 es is simple! You can sign up for a free trial on our website to explore its features and benefits first-hand. Once you’re ready, choose a pricing plan that suits your needs to unlock the full potential of the 2019 500 es.

Get more for Irs Form 500es

- Sanitary permit guam form

- Statement of temporary nature form

- Adoption questionnaire cat adoption service cats catadoptionservice form

- Firearm release form

- Bristol myers squibb patient assistance foundation application form 2020

- Cae certificate sample form

- East dunbartonshire blue badge form

- Gro application form

Find out other Irs Form 500es

- Can I Sign Ohio Healthcare / Medical Residential Lease Agreement

- How To Sign Oregon Healthcare / Medical Living Will

- How Can I Sign South Carolina Healthcare / Medical Profit And Loss Statement

- Sign Tennessee Healthcare / Medical Business Plan Template Free

- Help Me With Sign Tennessee Healthcare / Medical Living Will

- Sign Texas Healthcare / Medical Contract Mobile

- Sign Washington Healthcare / Medical LLC Operating Agreement Now

- Sign Wisconsin Healthcare / Medical Contract Safe

- Sign Alabama High Tech Last Will And Testament Online

- Sign Delaware High Tech Rental Lease Agreement Online

- Sign Connecticut High Tech Lease Template Easy

- How Can I Sign Louisiana High Tech LLC Operating Agreement

- Sign Louisiana High Tech Month To Month Lease Myself

- How To Sign Alaska Insurance Promissory Note Template

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself