Form 8879 EO IRS E File Signature Authorization for an Exempt Organization

What is the Form 8879 EO IRS E-file Signature Authorization for an Exempt Organization

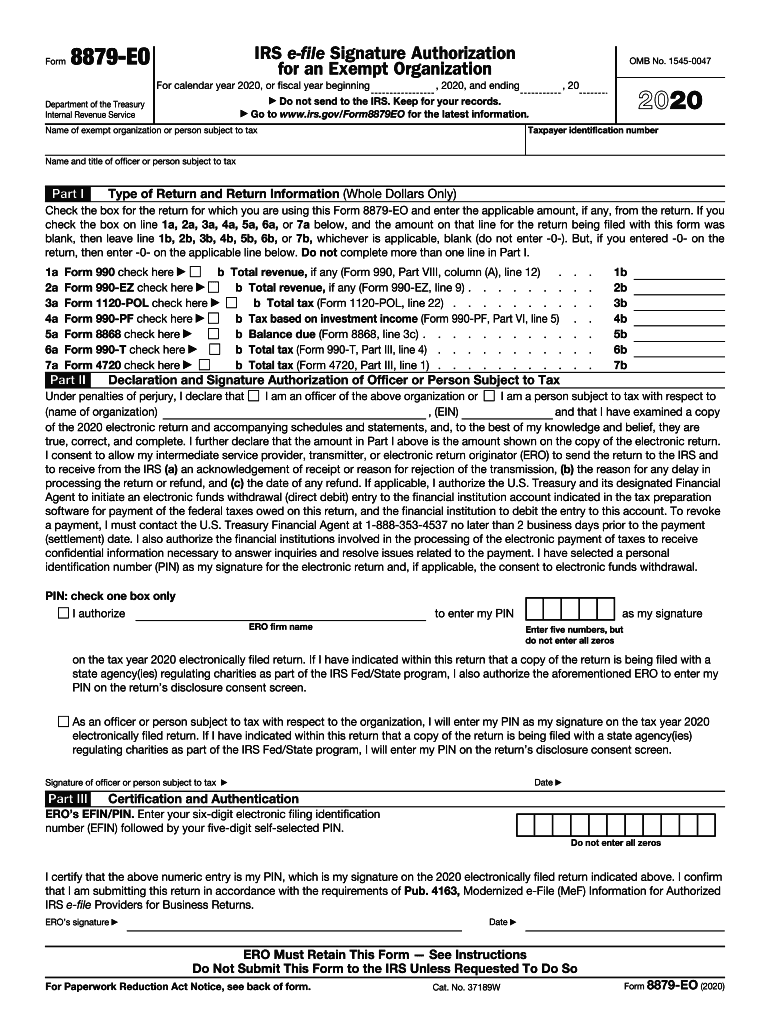

The Form 8879 EO is a crucial document for exempt organizations that need to electronically file their tax returns with the IRS. This form serves as the e-file signature authorization, allowing an authorized individual within the organization to sign the tax return electronically. It is specifically designed for entities that qualify for tax-exempt status under section 501(c)(3) and similar provisions. By using this form, organizations can streamline their filing process while ensuring compliance with IRS regulations.

Steps to Complete the Form 8879 EO IRS E-file Signature Authorization for an Exempt Organization

Completing the Form 8879 EO involves several key steps to ensure accuracy and compliance. First, the authorized representative must provide their name, title, and signature, confirming their authority to sign on behalf of the organization. Next, the organization must include the tax year for which the return is being filed. It is essential to review all information for correctness before submission. Additionally, the form must be retained for the organization's records, as it may be requested by the IRS for verification purposes.

Legal Use of the Form 8879 EO IRS E-file Signature Authorization for an Exempt Organization

The legal use of Form 8879 EO is governed by IRS regulations that outline the requirements for electronic signatures. This form is legally binding when completed correctly, allowing the IRS to accept the electronic signature as valid. Organizations must ensure that the individual signing the form has the appropriate authority to do so, as unauthorized signatures can lead to compliance issues. Adhering to the guidelines set forth by the IRS is crucial for maintaining the integrity of the filing process.

IRS Guidelines for Form 8879 EO

The IRS provides specific guidelines for the completion and submission of Form 8879 EO. These guidelines include instructions on who may sign the form, the necessary information to include, and how to maintain records of the signed form. Organizations must familiarize themselves with these guidelines to avoid errors that could result in penalties or delays in processing their tax returns. Staying informed about any updates to IRS regulations regarding electronic filings is also essential.

Filing Deadlines for Form 8879 EO

Filing deadlines for the Form 8879 EO align with the tax return deadlines for exempt organizations. Typically, the deadline for filing the tax return is the fifteenth day of the fifth month after the end of the organization’s fiscal year. If the deadline falls on a weekend or holiday, it is extended to the next business day. Organizations should ensure they submit the Form 8879 EO in a timely manner to avoid late filing penalties and maintain good standing with the IRS.

Required Documents for Form 8879 EO Submission

When submitting the Form 8879 EO, organizations must have several supporting documents on hand. These include the completed tax return, any schedules or attachments required for the return, and documentation that verifies the organization's tax-exempt status. Having these documents readily available will facilitate a smooth filing process and ensure that all necessary information is provided to the IRS.

Quick guide on how to complete 2020 form 8879 eo irs e file signature authorization for an exempt organization

Complete Form 8879 EO IRS E file Signature Authorization For An Exempt Organization seamlessly on any device

Digital document management has become increasingly favored by businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed materials, allowing you to find the right forms and securely store them online. airSlate SignNow provides all the resources necessary to create, modify, and eSign your documents quickly without delays. Manage Form 8879 EO IRS E file Signature Authorization For An Exempt Organization on any device using airSlate SignNow's Android or iOS applications and simplify your document-related processes today.

The easiest way to modify and eSign Form 8879 EO IRS E file Signature Authorization For An Exempt Organization effortlessly

- Obtain Form 8879 EO IRS E file Signature Authorization For An Exempt Organization and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight pertinent sections of the documents or cover sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional written signature.

- Review all the details and click on the Done button to preserve your modifications.

- Choose how you wish to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes necessitating the printing of new document copies. airSlate SignNow meets your document management needs efficiently from any device of your choosing. Modify and eSign Form 8879 EO IRS E file Signature Authorization For An Exempt Organization and guarantee outstanding communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2020 form 8879 eo irs e file signature authorization for an exempt organization

How to create an eSignature for your PDF document in the online mode

How to create an eSignature for your PDF document in Chrome

The best way to make an electronic signature for putting it on PDFs in Gmail

How to generate an eSignature from your mobile device

How to generate an electronic signature for a PDF document on iOS devices

How to generate an eSignature for a PDF file on Android devices

People also ask

-

What is the tn sales tax exemption process with airSlate SignNow?

The tn sales tax exemption process with airSlate SignNow allows businesses to easily manage and submit their exemption certificates electronically. By utilizing our platform, companies can streamline documentation and ensure accurate tax treatment. This simplifies compliance and reduces paperwork associated with tn sales tax exemptions.

-

How does airSlate SignNow assist with tn sales tax exemption applications?

airSlate SignNow provides a simple, intuitive interface for submitting tn sales tax exemption applications quickly. Users can create, send, and eSign the necessary documents with just a few clicks. Our electronic signature solution ensures that all applications are securely stored and easily accessible.

-

Are there any costs associated with obtaining a tn sales tax exemption through airSlate SignNow?

While there is no direct fee for obtaining a tn sales tax exemption, utilizing airSlate SignNow does involve subscription costs for access to our features. These costs are competitive and provide value through our efficient eSigning and document management capabilities. Investing in airSlate SignNow can save time and resources in managing the tn sales tax exemption process.

-

What features does airSlate SignNow offer for managing tn sales tax exemption documentation?

airSlate SignNow offers a variety of features tailored for managing tn sales tax exemption documentation, including customizable templates, automated workflows, and secure storage. Users can easily track the status of their documents and receive notifications upon completion. These features help ensure that businesses can efficiently handle their tn sales tax exemption needs.

-

Can airSlate SignNow integrate with my current systems for tn sales tax exemption?

Yes, airSlate SignNow offers integrations with popular business applications to enhance your tn sales tax exemption process. Whether you're using CRM systems, accounting software, or other platforms, we provide seamless integrations to streamline your workflows. This ensures a smooth experience when managing tn sales tax exemption documentation.

-

How does airSlate SignNow enhance security for tn sales tax exemption documents?

Security is a top priority for airSlate SignNow, especially for sensitive tn sales tax exemption documents. We implement industry-leading encryption and authentication measures to protect your information. This ensures that your documents are safe from unauthorized access throughout the entire eSigning process.

-

What are the benefits of using airSlate SignNow for tn sales tax exemption?

The benefits of using airSlate SignNow for tn sales tax exemption include speed, efficiency, and compliance. Our platform reduces the time spent on paperwork, allows for quick document turnaround, and maintains compliance with state regulations. This ultimately enhances your business operations and keeps you focused on growth.

Get more for Form 8879 EO IRS E file Signature Authorization For An Exempt Organization

- Denial paternity form

- Wpf ps 130100 petition for challenge to acknowledgment of paternity washington form

- Wpf ps 130200 summons challenge to acknowledgment of paternity washington form

- Washington order court form

- Wpf ps 140100 petition for challenge to denial of paternity washington form

- Wpf ps 140200 summons challenge to denial of paternity washington form

- Wpf ps 140300 response to petition for challenge to denial of paternity washington form

- Wpf ps 140400 findings of fact and conclusions of law on challenge to denial of paternity washington form

Find out other Form 8879 EO IRS E file Signature Authorization For An Exempt Organization

- Sign Tennessee Healthcare / Medical Business Plan Template Free

- Help Me With Sign Tennessee Healthcare / Medical Living Will

- Sign Texas Healthcare / Medical Contract Mobile

- Sign Washington Healthcare / Medical LLC Operating Agreement Now

- Sign Wisconsin Healthcare / Medical Contract Safe

- Sign Alabama High Tech Last Will And Testament Online

- Sign Delaware High Tech Rental Lease Agreement Online

- Sign Connecticut High Tech Lease Template Easy

- How Can I Sign Louisiana High Tech LLC Operating Agreement

- Sign Louisiana High Tech Month To Month Lease Myself

- How To Sign Alaska Insurance Promissory Note Template

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe