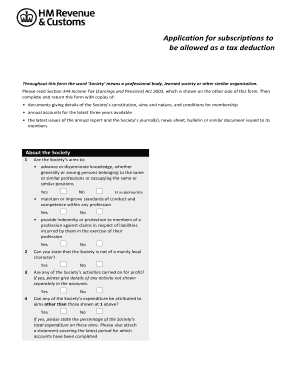

P356 Application for Subscriptions to Be Allowed as a Tax Deduction 2010

What is the P356 Application For Subscriptions To Be Allowed As A Tax Deduction

The P356 Application For Subscriptions To Be Allowed As A Tax Deduction is a specific form used by individuals or businesses to request the ability to deduct subscription expenses from their taxable income. This application is particularly relevant for those who subscribe to professional journals, trade publications, or other resources that support their business activities. By completing this form, taxpayers can ensure that their subscription costs are recognized as legitimate tax-deductible expenses under U.S. tax law.

How to use the P356 Application For Subscriptions To Be Allowed As A Tax Deduction

Using the P356 application involves several steps to ensure compliance with IRS requirements. First, gather all necessary information regarding your subscription expenses, including the type of subscriptions and the amounts paid. Next, accurately fill out the application form, providing details such as your name, address, and the specific subscriptions for which you seek deductions. Once completed, submit the form according to the instructions provided, either electronically or by mail, ensuring you keep a copy for your records.

Steps to complete the P356 Application For Subscriptions To Be Allowed As A Tax Deduction

Completing the P356 application involves a straightforward process:

- Gather your subscription documentation, including invoices or receipts.

- Fill out the form with your personal and subscription details.

- Review the completed application for accuracy.

- Submit the form as directed, ensuring you follow any specific submission guidelines.

- Retain a copy of the submitted form for your records.

Eligibility Criteria

To be eligible for deductions using the P356 application, taxpayers must meet certain criteria. Generally, the subscriptions must be directly related to their trade or business. This means that personal subscriptions may not qualify. Additionally, the taxpayer should be able to demonstrate that the subscriptions are necessary for their business operations and that they have incurred these expenses during the tax year for which they are applying.

IRS Guidelines

The IRS provides specific guidelines regarding the deductibility of subscription expenses. According to IRS regulations, subscriptions that are ordinary and necessary for business operations can be deducted. Taxpayers should refer to IRS publications for detailed information on what qualifies as a deductible expense and ensure compliance with all relevant tax laws when submitting the P356 application.

Form Submission Methods

The P356 application can be submitted through various methods. Taxpayers may choose to file the form electronically, which often expedites processing times. Alternatively, the form can be mailed to the appropriate IRS address. In-person submissions may also be possible at designated IRS offices, depending on local regulations. It is essential to follow the submission guidelines provided with the form to ensure proper processing.

Key elements of the P356 Application For Subscriptions To Be Allowed As A Tax Deduction

Key elements of the P356 application include the taxpayer's identification information, details of the subscriptions being claimed, and a declaration of the purpose of these subscriptions. Additionally, the form may require the taxpayer to provide supporting documentation, such as receipts or invoices, to substantiate the claims made. Ensuring all required information is accurately filled in will facilitate a smoother review process by the IRS.

Quick guide on how to complete p356 application for subscriptions to be allowed as a tax deduction

Complete P356 Application For Subscriptions To Be Allowed As A Tax Deduction effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It serves as an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct format and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and eSign your documents quickly without delays. Manage P356 Application For Subscriptions To Be Allowed As A Tax Deduction on any device using the airSlate SignNow Android or iOS applications and enhance any document-related processes today.

Simple steps to edit and eSign P356 Application For Subscriptions To Be Allowed As A Tax Deduction with ease

- Obtain P356 Application For Subscriptions To Be Allowed As A Tax Deduction and click Get Form to begin.

- Utilize the tools available to complete your document.

- Emphasize key sections of your documents or obscure sensitive details with tools specifically provided by airSlate SignNow.

- Create your signature using the Sign feature, which takes just seconds and holds the same legal validity as a traditional handwritten signature.

- Review all details and then click the Done button to save your modifications.

- Choose your preferred method to share your form—via email, SMS, invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document versions. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Modify and eSign P356 Application For Subscriptions To Be Allowed As A Tax Deduction and ensure excellent communication at every stage of the form development process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct p356 application for subscriptions to be allowed as a tax deduction

Create this form in 5 minutes!

How to create an eSignature for the p356 application for subscriptions to be allowed as a tax deduction

The best way to create an electronic signature for your PDF document online

The best way to create an electronic signature for your PDF document in Google Chrome

How to make an electronic signature for signing PDFs in Gmail

The best way to generate an electronic signature right from your smart phone

The way to create an electronic signature for a PDF document on iOS

The best way to generate an electronic signature for a PDF on Android OS

People also ask

-

What is the P356 Application For Subscriptions To Be Allowed As A Tax Deduction?

The P356 Application For Subscriptions To Be Allowed As A Tax Deduction is a specific form that businesses can use to apply for subscription costs to be deducted from their taxes. This application is particularly useful for companies looking to manage their expenses effectively by ensuring they maximize tax benefits associated with their digital subscriptions.

-

How can airSlate SignNow assist with the P356 Application For Subscriptions To Be Allowed As A Tax Deduction process?

airSlate SignNow streamlines the process of managing and signing the P356 Application For Subscriptions To Be Allowed As A Tax Deduction. With our efficient eSigning solution, you can easily complete and submit your application while maintaining compliance with tax regulations.

-

Is there a cost associated with using airSlate SignNow to file the P356 Application For Subscriptions To Be Allowed As A Tax Deduction?

Yes, while airSlate SignNow offers a cost-effective solution for document management, there are subscription plans available that cater to different company sizes and needs. You can choose a plan that fits your requirements for handling documents like the P356 Application For Subscriptions To Be Allowed As A Tax Deduction.

-

What features does airSlate SignNow offer for managing tax-related documentation like the P356 Application?

airSlate SignNow includes features such as customizable templates, secure cloud storage, and automated workflows, making it easy to manage tax-related documentation, including the P356 Application For Subscriptions To Be Allowed As A Tax Deduction. These tools ensure a smooth and efficient process for your tax filings.

-

Can I integrate airSlate SignNow with other software for handling the P356 Application For Subscriptions To Be Allowed As A Tax Deduction?

Absolutely! airSlate SignNow supports various integrations with popular software solutions, allowing you to streamline your workflow related to the P356 Application For Subscriptions To Be Allowed As A Tax Deduction. This can help you connect your financial software or CRMs for easier management.

-

What are the benefits of using airSlate SignNow for tax deduction applications?

Using airSlate SignNow provides numerous benefits, such as increased efficiency in managing documents like the P356 Application For Subscriptions To Be Allowed As A Tax Deduction, enhanced security through encryption, and a user-friendly interface that simplifies the eSigning process. These features help ensure you never miss important deadlines.

-

Is eSigning the P356 Application For Subscriptions To Be Allowed As A Tax Deduction legally binding?

Yes, eSigning the P356 Application For Subscriptions To Be Allowed As A Tax Deduction through airSlate SignNow is legally binding and compliant with eSignature laws. You can confidently submit your application knowing it meets legal requirements for tax deduction claims.

Get more for P356 Application For Subscriptions To Be Allowed As A Tax Deduction

Find out other P356 Application For Subscriptions To Be Allowed As A Tax Deduction

- How To Electronic signature Arkansas Real Estate Contract

- Electronic signature Idaho Plumbing Claim Myself

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney

- How Do I Electronic signature Wyoming Legal POA

- How To Electronic signature Florida Real Estate Contract

- Electronic signature Florida Real Estate NDA Secure

- Can I Electronic signature Florida Real Estate Cease And Desist Letter

- How Can I Electronic signature Hawaii Real Estate LLC Operating Agreement

- Electronic signature Georgia Real Estate Letter Of Intent Myself

- Can I Electronic signature Nevada Plumbing Agreement

- Electronic signature Illinois Real Estate Affidavit Of Heirship Easy

- How To Electronic signature Indiana Real Estate Quitclaim Deed

- Electronic signature North Carolina Plumbing Business Letter Template Easy

- Electronic signature Kansas Real Estate Residential Lease Agreement Simple

- How Can I Electronic signature North Carolina Plumbing Promissory Note Template

- Electronic signature North Dakota Plumbing Emergency Contact Form Mobile

- Electronic signature North Dakota Plumbing Emergency Contact Form Easy

- Electronic signature Rhode Island Plumbing Business Plan Template Later