Irs Form 1310 Printable 2020

What is the IRS Form 1310 Printable

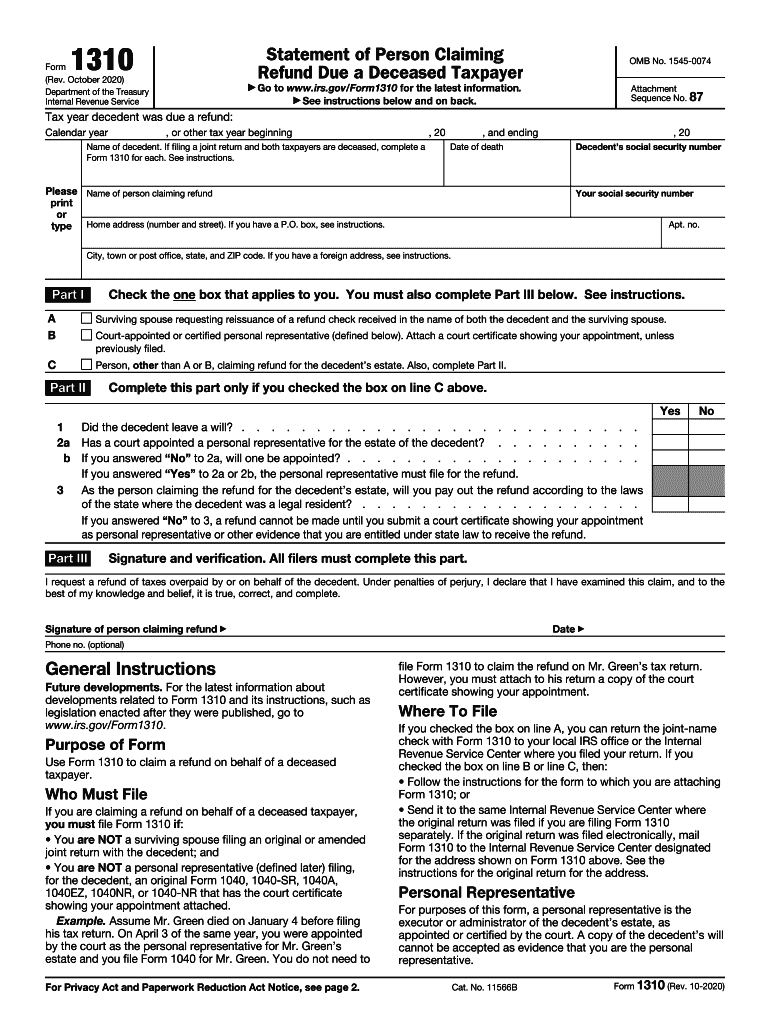

The IRS Form 1310, also known as the Statement of Person Claiming Refund Due a Deceased Taxpayer, is a tax form used in the United States. This form allows individuals to claim a tax refund on behalf of a deceased taxpayer. The IRS form 1310 printable version is essential for those who need to file taxes for someone who has passed away, ensuring that any eligible refunds are processed correctly. It is important to complete this form accurately to avoid delays in receiving the refund.

How to use the IRS Form 1310 Printable

Using the IRS Form 1310 is straightforward. First, ensure you have the correct version of the form, which can be downloaded in PDF format. Once you have the form, fill in the required information, including the deceased taxpayer's details and your own information as the claimant. It is crucial to provide accurate information to prevent any issues with the IRS. After completing the form, it can be submitted along with the tax return of the deceased taxpayer, or it can be filed separately if no return is required.

Steps to complete the IRS Form 1310 Printable

Completing the IRS Form 1310 involves several key steps:

- Download the IRS Form 1310 PDF from the official IRS website.

- Fill in the deceased taxpayer's name, Social Security number, and date of death.

- Provide your name, address, and relationship to the deceased.

- Indicate whether you are filing this form with a tax return or separately.

- Sign and date the form to certify that the information provided is accurate.

Legal use of the IRS Form 1310 Printable

The IRS Form 1310 is legally binding when filled out correctly and submitted according to IRS guidelines. It serves as a formal declaration that you are entitled to claim the refund on behalf of the deceased taxpayer. To ensure legal compliance, it is important to follow all instructions provided by the IRS and to submit any necessary supporting documents, such as a copy of the death certificate, if required.

Required Documents

When filing the IRS Form 1310, certain documents may be required to support your claim. These typically include:

- A copy of the deceased taxpayer's tax return, if available.

- A copy of the death certificate to verify the taxpayer's passing.

- Your identification, such as a driver's license or Social Security card, to establish your identity as the claimant.

Filing Deadlines / Important Dates

It is essential to be aware of the filing deadlines associated with the IRS Form 1310. Generally, the form should be submitted by the tax filing deadline, which is typically April 15 for individual tax returns. If you are filing for a deceased taxpayer, ensure that the form is submitted in conjunction with any applicable tax returns to avoid penalties or delays in receiving the refund.

Quick guide on how to complete irs form 1310 printable

Effortlessly handle Irs Form 1310 Printable on any device

Managing documents online has become increasingly favored among companies and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can access the necessary form and securely keep it online. airSlate SignNow provides all the tools required to create, edit, and eSign your documents swiftly without delays. Manage Irs Form 1310 Printable on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest method to modify and eSign Irs Form 1310 Printable effortlessly

- Find Irs Form 1310 Printable and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Mark relevant sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Generate your eSignature using the Sign tool, which takes seconds and carries the same legal significance as a conventional wet ink signature.

- Verify the details and click on the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misfiled documents, time-consuming form searching, or errors that require reprinting new document copies. airSlate SignNow meets your document management requirements in just a few clicks from any device you choose. Edit and eSign Irs Form 1310 Printable and ensure effective communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct irs form 1310 printable

Create this form in 5 minutes!

How to create an eSignature for the irs form 1310 printable

The best way to make an electronic signature for your PDF file online

The best way to make an electronic signature for your PDF file in Google Chrome

The best way to make an eSignature for signing PDFs in Gmail

The way to generate an eSignature right from your mobile device

How to generate an electronic signature for a PDF file on iOS

The way to generate an eSignature for a PDF on Android devices

People also ask

-

What is the IRS 1310 Form PDF used for?

The IRS 1310 Form PDF is used to claim a tax refund on behalf of a deceased taxpayer. By filling out this form, individuals can ensure that the correct party receives the refund due. It's essential for the executor or administrator to understand how to fill it out accurately.

-

How can airSlate SignNow assist with the IRS 1310 Form PDF?

airSlate SignNow simplifies the process of completing and eSigning your IRS 1310 Form PDF. Our platform allows you to upload the form, fill it out electronically, and securely sign it, saving you time and ensuring compliance with IRS standards.

-

Is there a cost associated with using airSlate SignNow for the IRS 1310 Form PDF?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Whether you are a small business or a large enterprise, you can choose a plan that suits your budget while streamlining your IRS 1310 Form PDF processing.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow provides features like customizable templates, document routing, and real-time tracking for your IRS 1310 Form PDF. These tools enhance your workflow and ensure that you can manage your documents efficiently, including compliance with IRS requirements.

-

Are there integrations available for handling the IRS 1310 Form PDF?

Yes, airSlate SignNow integrates with various third-party applications to create a seamless experience when managing the IRS 1310 Form PDF. This includes CRM systems and cloud storage solutions, allowing you to streamline your document processes.

-

How secure is my information when using airSlate SignNow for the IRS 1310 Form PDF?

Security is a top priority at airSlate SignNow. When submitting your IRS 1310 Form PDF, all data is encrypted, ensuring that sensitive information remains protected. Our platform complies with industry standards to keep your documents safe.

-

Can I access the IRS 1310 Form PDF from any device?

Absolutely! airSlate SignNow allows you to access and manage your IRS 1310 Form PDF from any device with internet access. This flexibility means you can complete and send your documents at your convenience.

Get more for Irs Form 1310 Printable

Find out other Irs Form 1310 Printable

- Electronic signature Indiana Postnuptial Agreement Template Later

- Electronic signature New York Postnuptial Agreement Template Secure

- How Can I Electronic signature Colorado Prenuptial Agreement Template

- Electronic signature California Divorce Settlement Agreement Template Free

- Electronic signature Virginia Prenuptial Agreement Template Free

- How Do I Electronic signature Maryland Affidavit of Residence

- Electronic signature Florida Child Support Modification Simple

- Electronic signature North Dakota Child Support Modification Easy

- Electronic signature Oregon Child Support Modification Online

- How Can I Electronic signature Colorado Cohabitation Agreement

- Electronic signature Arkansas Leave of Absence Letter Later

- Electronic signature New Jersey Cohabitation Agreement Fast

- Help Me With Electronic signature Alabama Living Will

- How Do I Electronic signature Louisiana Living Will

- Electronic signature Arizona Moving Checklist Computer

- Electronic signature Tennessee Last Will and Testament Free

- Can I Electronic signature Massachusetts Separation Agreement

- Can I Electronic signature North Carolina Separation Agreement

- How To Electronic signature Wyoming Affidavit of Domicile

- Electronic signature Wisconsin Codicil to Will Later