Form 1310 Rev October Statement of Person Claiming Refund Due a Deceased Taxpayer 2024-2026

What is the IRS Form 1310?

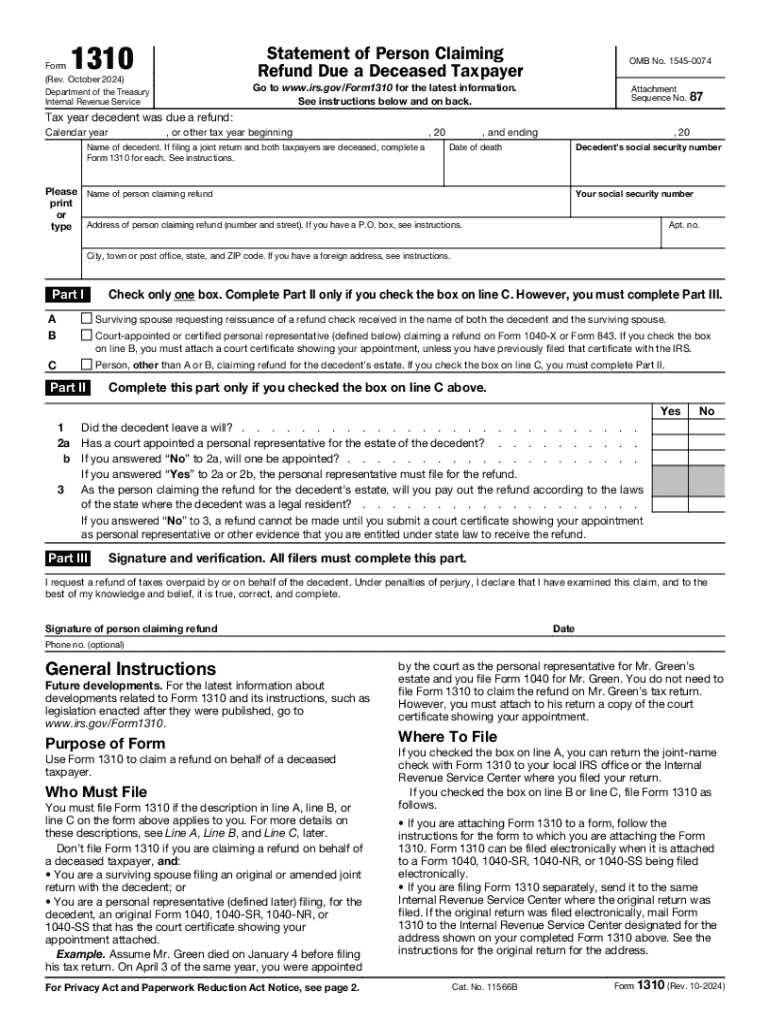

The IRS Form 1310, officially known as the Statement of Person Claiming Refund Due a Deceased Taxpayer, is a tax form used in the United States. This form allows individuals to claim a tax refund on behalf of a deceased taxpayer. It is essential for those who are entitled to receive a refund from the IRS after the death of the taxpayer. The form requires specific information about the deceased, including their Social Security number, and details about the claimant, who must be an eligible person such as a surviving spouse or a personal representative of the estate.

Steps to Complete the IRS Form 1310

Completing the IRS Form 1310 involves several important steps:

- Gather necessary information about the deceased taxpayer, including their name, Social Security number, and details of the tax return for which the refund is being claimed.

- Provide your information as the claimant, including your name, address, and relationship to the deceased.

- Indicate whether you are the executor or administrator of the estate, if applicable.

- Sign and date the form, certifying that the information provided is accurate.

Once completed, the form should be submitted along with the deceased taxpayer's final tax return to ensure the refund is processed correctly.

How to Obtain the IRS Form 1310

The IRS Form 1310 can be easily obtained from the official IRS website. It is available as a downloadable PDF, which can be printed for completion. Additionally, the form may be available at local IRS offices or through tax preparation services. Ensure that you are using the most current version of the form to avoid any processing issues.

Legal Use of the IRS Form 1310

The IRS Form 1310 is legally required when claiming a refund for a deceased taxpayer. It serves to verify the legitimacy of the claim and ensures that the refund is directed to the correct individual. Filing this form is crucial for compliance with IRS regulations, and it helps prevent fraudulent claims. Understanding the legal implications of using this form is important for anyone acting on behalf of a deceased taxpayer.

Required Documents for IRS Form 1310 Submission

When submitting IRS Form 1310, certain documents may be required to support the claim:

- The deceased taxpayer's final tax return.

- A copy of the death certificate to verify the taxpayer's death.

- Documentation proving your relationship to the deceased, such as marriage certificates or court documents if you are the executor.

Having these documents ready will help ensure a smooth submission process and expedite the refund claim.

IRS Guidelines for Filing Form 1310

The IRS provides specific guidelines for filing Form 1310, which must be followed to ensure compliance. It is important to file the form along with the deceased taxpayer's final tax return. The IRS recommends checking for any updates or changes to the form and its instructions annually. Additionally, the form must be signed by the claimant, and any supporting documentation should be included to avoid delays in processing.

Handy tips for filling out Form 1310 Rev October Statement Of Person Claiming Refund Due A Deceased Taxpayer online

Quick steps to complete and e-sign Form 1310 Rev October Statement Of Person Claiming Refund Due A Deceased Taxpayer online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We know how stressing filling out documents could be. Obtain access to a GDPR and HIPAA compliant solution for maximum straightforwardness. Use signNow to electronically sign and send out Form 1310 Rev October Statement Of Person Claiming Refund Due A Deceased Taxpayer for collecting e-signatures.

Create this form in 5 minutes or less

Find and fill out the correct form 1310 rev october statement of person claiming refund due a deceased taxpayer

Create this form in 5 minutes!

How to create an eSignature for the form 1310 rev october statement of person claiming refund due a deceased taxpayer

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is IRS Form 1310 and why is it important?

IRS Form 1310 is a tax form used to claim a refund on behalf of a deceased taxpayer. It is important because it allows the executor or administrator of the estate to receive any tax refunds owed to the deceased. Understanding how to properly fill out and submit IRS Form 1310 can ensure that the estate receives the funds it is entitled to.

-

How can airSlate SignNow help with IRS Form 1310?

airSlate SignNow provides a seamless platform for electronically signing and sending IRS Form 1310. With its user-friendly interface, you can easily prepare and share the form with necessary parties, ensuring that all signatures are collected efficiently. This simplifies the process of submitting IRS Form 1310, saving you time and reducing errors.

-

Is there a cost associated with using airSlate SignNow for IRS Form 1310?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. The cost is competitive and provides access to features that streamline the signing process for IRS Form 1310 and other documents. You can choose a plan that best fits your budget and requirements.

-

What features does airSlate SignNow offer for managing IRS Form 1310?

airSlate SignNow offers features such as customizable templates, secure cloud storage, and real-time tracking for IRS Form 1310. These features enhance the efficiency of document management and ensure that you can monitor the status of your submissions. Additionally, the platform supports multiple file formats, making it versatile for various document types.

-

Can I integrate airSlate SignNow with other software for IRS Form 1310?

Yes, airSlate SignNow integrates with various applications, allowing you to streamline your workflow when handling IRS Form 1310. Whether you use CRM systems, cloud storage solutions, or accounting software, these integrations can enhance your productivity. This means you can manage your documents more effectively without switching between different platforms.

-

What are the benefits of using airSlate SignNow for IRS Form 1310?

Using airSlate SignNow for IRS Form 1310 offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. The electronic signing process is faster than traditional methods, allowing you to complete submissions quickly. Additionally, the platform ensures that your documents are securely stored and easily accessible.

-

How secure is airSlate SignNow when handling IRS Form 1310?

airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect your IRS Form 1310 and other sensitive documents. The platform is designed to safeguard your data against unauthorized access, ensuring that your information remains confidential. You can trust airSlate SignNow to handle your documents securely.

Get more for Form 1310 Rev October Statement Of Person Claiming Refund Due A Deceased Taxpayer

Find out other Form 1310 Rev October Statement Of Person Claiming Refund Due A Deceased Taxpayer

- How To Sign North Carolina Gift Affidavit

- How Do I Sign Oregon Financial Affidavit

- Sign Maine Revocation of Power of Attorney Online

- Sign Louisiana Mechanic's Lien Online

- How To Sign New Mexico Revocation of Power of Attorney

- How Can I Sign Ohio Revocation of Power of Attorney

- Sign Michigan Mechanic's Lien Easy

- How To Sign Texas Revocation of Power of Attorney

- Sign Virginia Revocation of Power of Attorney Easy

- Can I Sign North Carolina Mechanic's Lien

- Sign Maine Payment Guaranty Myself

- Help Me With Sign Oklahoma Mechanic's Lien

- Sign Oregon Mechanic's Lien Simple

- How To Sign Utah Mechanic's Lien

- How To Sign Washington Mechanic's Lien

- Help Me With Sign Washington Mechanic's Lien

- Sign Arizona Notice of Rescission Safe

- Sign Hawaii Notice of Rescission Later

- Sign Missouri Demand Note Online

- How To Sign New York Notice to Stop Credit Charge