Form 3949 a 2020-2026

What is the Form 3949 A

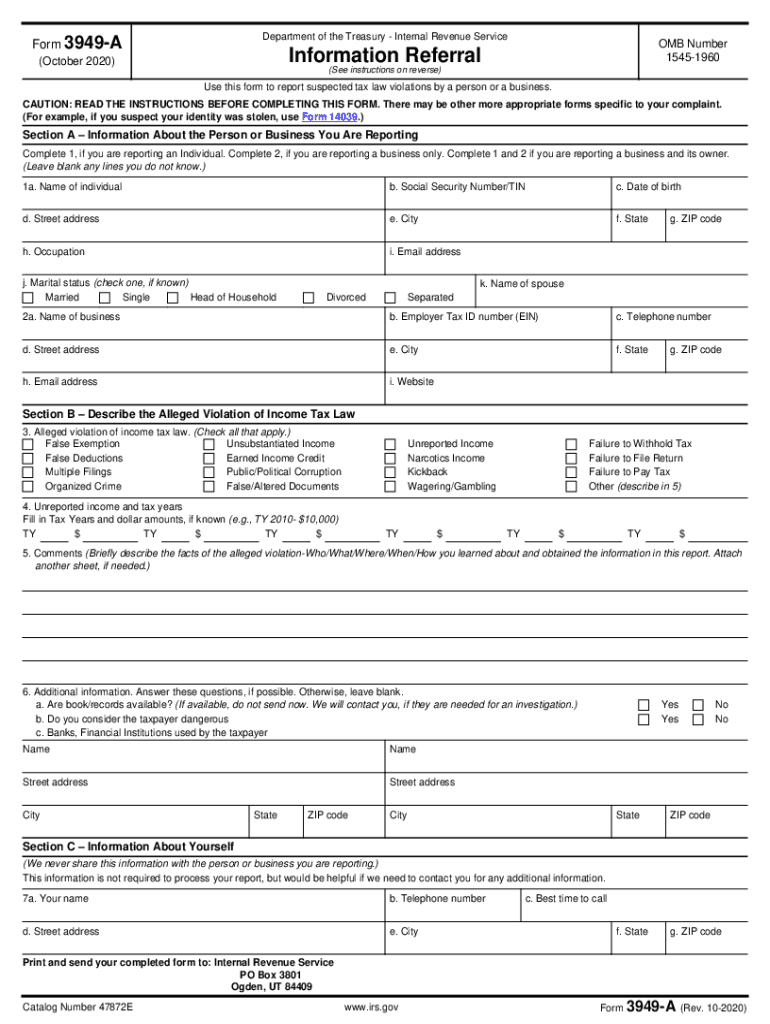

The Form 3949 A is an official document used by taxpayers to report suspected tax fraud or other tax-related issues to the Internal Revenue Service (IRS). This form allows individuals to provide information about potential violations of tax laws, including unreported income, false deductions, or other fraudulent activities. It is an essential tool for maintaining the integrity of the tax system and ensuring compliance with federal regulations.

How to use the Form 3949 A

Using the Form 3949 A involves several steps to ensure that your report is complete and accurate. First, gather all relevant information regarding the suspected fraud, including the name and address of the individual or business involved, as well as specific details about the suspected violations. Once you have this information, fill out the form carefully, providing as much detail as possible. After completing the form, submit it to the IRS through the designated channels, which may include mailing it to a specific address or submitting it online, depending on the current procedures.

Steps to complete the Form 3949 A

Completing the Form 3949 A requires attention to detail. Follow these steps:

- Download the form from the IRS website or obtain a hard copy.

- Provide your contact information, including your name, address, and phone number, if you wish to be contacted.

- Fill in the details of the person or business you are reporting, including their name, address, and any known tax identification numbers.

- Describe the suspected fraudulent activity clearly and concisely, including the nature of the fraud and any supporting evidence.

- Review the completed form for accuracy before submission.

Legal use of the Form 3949 A

The legal use of the Form 3949 A is governed by IRS regulations. It is crucial to understand that submitting this form is a serious matter; false reporting can lead to legal repercussions. The information provided must be truthful and based on reasonable belief or evidence of tax fraud. The IRS protects the identity of those who report suspected fraud, encouraging individuals to come forward without fear of retaliation.

IRS Guidelines

The IRS has specific guidelines for submitting Form 3949 A. These guidelines include ensuring that the form is filled out completely and accurately, as incomplete submissions may delay the investigation process. The IRS also advises that individuals should not contact the person they are reporting, as this could compromise the investigation. Additionally, the IRS does not provide updates on the status of investigations initiated through this form, maintaining confidentiality for both the reporter and the subject of the report.

Form Submission Methods

The Form 3949 A can be submitted to the IRS through various methods. The primary method is by mailing the completed form to the appropriate address specified by the IRS. As of now, the IRS does not offer an online submission option for this form. Ensure that you check the latest IRS guidelines for any updates regarding submission methods, as these may change over time.

Quick guide on how to complete form 3949 a

Complete Form 3949 A seamlessly on any device

Online document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly substitute to traditional printed and signed documents, enabling you to find the right form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents swiftly without interruptions. Handle Form 3949 A on any device with airSlate SignNow Android or iOS applications and enhance any document-focused process today.

The simplest method to modify and eSign Form 3949 A effortlessly

- Access Form 3949 A and click on Get Form to begin.

- Make use of the tools we provide to complete your document.

- Highlight important sections of your documents or obscure sensitive details with tools specifically available from airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to share your form: via email, text message (SMS), invitation link, or download it directly to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Form 3949 A and guarantee effective communication at any phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 3949 a

Create this form in 5 minutes!

How to create an eSignature for the form 3949 a

The best way to make an electronic signature for your PDF document online

The best way to make an electronic signature for your PDF document in Google Chrome

The best way to make an electronic signature for signing PDFs in Gmail

The way to generate an eSignature from your smart phone

How to generate an electronic signature for a PDF document on iOS

The way to generate an eSignature for a PDF file on Android OS

People also ask

-

What is IRS Form 3949 A and how does it relate to airSlate SignNow?

IRS Form 3949 A is used to report suspected tax law violations to the IRS. With airSlate SignNow, you can easily prepare and eSign IRS Form 3949 A securely online, ensuring that your reporting is accurate and meets IRS guidelines.

-

How can I use airSlate SignNow to fill out IRS Form 3949 A?

To fill out IRS Form 3949 A using airSlate SignNow, simply upload the form, enter the required information, and utilize our eSignature feature to sign the document. The process is designed to be user-friendly and efficient, saving you time.

-

What are the benefits of using airSlate SignNow for IRS Form 3949 A?

Using airSlate SignNow for IRS Form 3949 A offers many benefits, including fast document turnaround, secure data handling, and comprehensive compliance with IRS standards. Our platform provides an easy way to eSign and submit your form without the need for paper.

-

Is there a cost associated with eSigning IRS Form 3949 A using airSlate SignNow?

Yes, there is a cost associated with using airSlate SignNow, but it is designed to be affordable for businesses of all sizes. Subscribing gives you access to a range of features, including unlimited access to eSigning IRS Form 3949 A and other documents.

-

Can I integrate airSlate SignNow with other software to manage IRS Form 3949 A?

Absolutely! airSlate SignNow offers integrations with several popular software solutions, allowing you to seamlessly manage IRS Form 3949 A and other documents. This makes it easy to streamline your workflow and keep all your information in one place.

-

What features does airSlate SignNow provide to assist with IRS Form 3949 A?

airSlate SignNow includes features such as customizable templates, real-time tracking, and secure storage for IRS Form 3949 A. These tools help you efficiently complete and manage your documentation process while maintaining compliance.

-

How can I ensure the security of my IRS Form 3949 A when using airSlate SignNow?

airSlate SignNow prioritizes your security by implementing encryption and secure access protocols for IRS Form 3949 A. Your documents are stored securely, and only authorized users can access or modify them.

Get more for Form 3949 A

Find out other Form 3949 A

- eSign Delaware Termination of Employment Worksheet Safe

- Can I eSign New Jersey Job Description Form

- Can I eSign Hawaii Reference Checking Form

- Help Me With eSign Hawaii Acknowledgement Letter

- eSign Rhode Island Deed of Indemnity Template Secure

- eSign Illinois Car Lease Agreement Template Fast

- eSign Delaware Retainer Agreement Template Later

- eSign Arkansas Attorney Approval Simple

- eSign Maine Car Lease Agreement Template Later

- eSign Oregon Limited Power of Attorney Secure

- How Can I eSign Arizona Assignment of Shares

- How To eSign Hawaii Unlimited Power of Attorney

- How To eSign Louisiana Unlimited Power of Attorney

- eSign Oklahoma Unlimited Power of Attorney Now

- How To eSign Oregon Unlimited Power of Attorney

- eSign Hawaii Retainer for Attorney Easy

- How To eSign Texas Retainer for Attorney

- eSign Hawaii Standstill Agreement Computer

- How Can I eSign Texas Standstill Agreement

- How To eSign Hawaii Lease Renewal