Form 3949 A, Information Referral 2005

What is the Form 3949 A, Information Referral

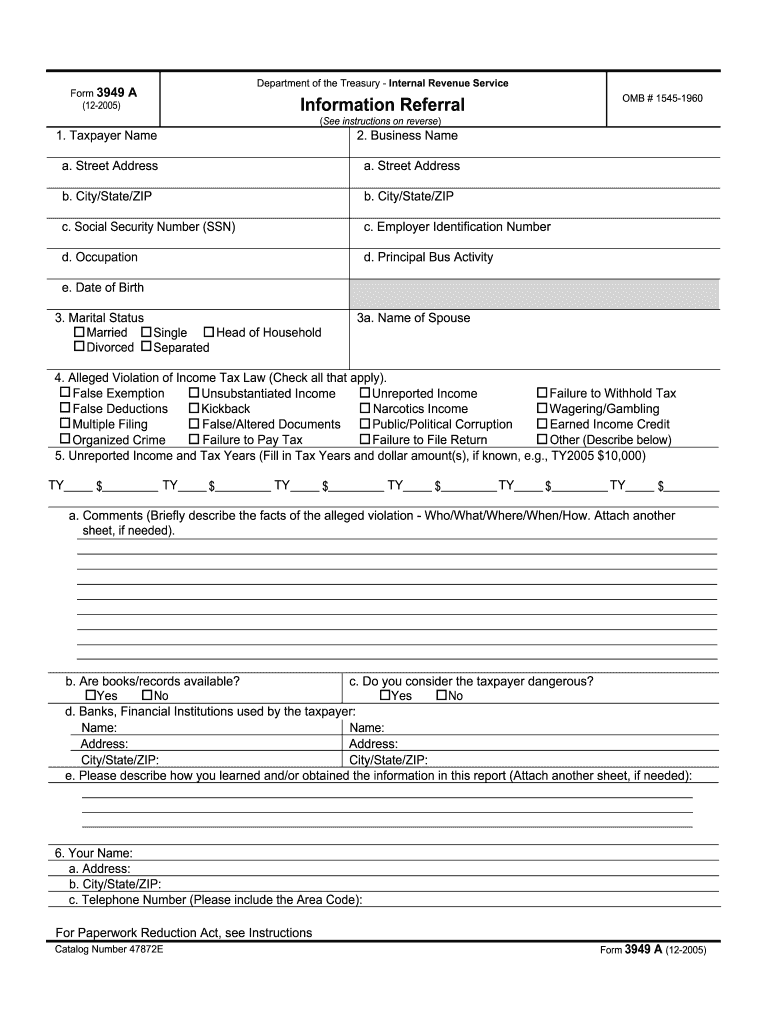

The Form 3949 A, Information Referral, is a document used by individuals to report suspected tax fraud or other violations of tax laws to the Internal Revenue Service (IRS). This form allows taxpayers to provide information about individuals or businesses that may be engaging in illegal activities, such as underreporting income or failing to file tax returns. By submitting this form, individuals play a crucial role in helping the IRS maintain tax compliance and integrity within the tax system.

How to use the Form 3949 A, Information Referral

Using the Form 3949 A involves several straightforward steps. First, you need to download the form from the IRS website or obtain a physical copy. Once you have the form, fill it out with accurate details regarding the suspected tax violation. This includes providing information about the person or business in question, the nature of the violation, and your contact information, if you choose to provide it. After completing the form, submit it to the IRS through the designated mailing address provided in the form's instructions. It's important to keep a copy of the submitted form for your records.

Steps to complete the Form 3949 A, Information Referral

Completing the Form 3949 A requires careful attention to detail. Follow these steps for accurate submission:

- Download the Form 3949 A from the IRS website.

- Provide your name and address at the top of the form, although this is optional.

- Fill in the information about the individual or business you are reporting, including their name, address, and tax identification number if known.

- Describe the suspected violation clearly and concisely, including any relevant details that support your claim.

- Review the completed form for accuracy before submitting.

- Mail the form to the address specified in the instructions.

Legal use of the Form 3949 A, Information Referral

The legal use of the Form 3949 A is crucial for ensuring that reports of tax fraud are handled properly. When submitting this form, individuals must provide truthful and accurate information to avoid legal repercussions. The IRS uses the information provided to investigate potential violations, and false reporting can lead to penalties. It is essential to understand that while you can report suspected fraud anonymously, providing your contact information may facilitate follow-up inquiries from the IRS.

IRS Guidelines

The IRS has specific guidelines for submitting the Form 3949 A. These guidelines emphasize the importance of providing detailed and factual information to assist in investigations. The IRS encourages individuals to report any suspicious activities they observe, but it is essential to ensure that the information is credible and not based on hearsay or unfounded claims. Adhering to these guidelines helps maintain the integrity of the reporting process and supports effective enforcement of tax laws.

Form Submission Methods (Online / Mail / In-Person)

The Form 3949 A can only be submitted by mail. There is no online submission option available for this form. After completing the form, individuals should send it to the IRS at the address specified in the form's instructions. It is advisable to use a secure mailing method to ensure that the form reaches the IRS safely. In-person submissions are not accepted for this particular form, as the IRS processes these referrals through its mail system.

Quick guide on how to complete form 3949 a information referral

Complete Form 3949 A, Information Referral with ease on any device

Digital document management has gained traction among businesses and individuals. It offers an excellent environmentally friendly substitute for traditional printed and signed documents, allowing you to access the correct form and safely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents swiftly without delays. Manage Form 3949 A, Information Referral on any device using airSlate SignNow's Android or iOS applications and enhance your document-driven processes today.

How to edit and electronically sign Form 3949 A, Information Referral effortlessly

- Obtain Form 3949 A, Information Referral and click Get Form to commence.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of the documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature with the Sign tool, which takes mere seconds and has the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to finalize your changes.

- Choose how you would like to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, time-consuming form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Form 3949 A, Information Referral and ensure exceptional communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 3949 a information referral

Create this form in 5 minutes!

How to create an eSignature for the form 3949 a information referral

The best way to create an eSignature for your PDF document in the online mode

The best way to create an eSignature for your PDF document in Chrome

The best way to make an electronic signature for putting it on PDFs in Gmail

The way to make an eSignature from your mobile device

The way to generate an electronic signature for a PDF document on iOS devices

The way to make an eSignature for a PDF file on Android devices

People also ask

-

What is Form 3949 A, Information Referral?

Form 3949 A, Information Referral, is a document used by individuals to report suspected tax fraud, underreporting of income, or other tax violations to the IRS. This form helps ensure that tax compliance is maintained and is essential for promoting fairness in the tax system.

-

How can airSlate SignNow help with submitting Form 3949 A, Information Referral?

With airSlate SignNow, you can easily prepare, sign, and send Form 3949 A, Information Referral electronically. Our platform streamlines the process, allowing you to fill out the form smoothly and ensure that all necessary signatures and documents are included.

-

Are there any costs associated with using airSlate SignNow for Form 3949 A, Information Referral?

airSlate SignNow offers a cost-effective solution for managing Form 3949 A, Information Referral submissions. We provide various pricing plans to suit your needs, and you can choose a package that best fits your budget while accessing all essential features.

-

What features does airSlate SignNow offer for Form 3949 A, Information Referral?

airSlate SignNow provides features such as template creation, electronic signatures, and document tracking specifically for Form 3949 A, Information Referral. This means you can easily manage multiple submissions, ensuring that your forms are completed accurately and promptly.

-

Can I integrate airSlate SignNow with other applications for my Form 3949 A, Information Referral submissions?

Yes, airSlate SignNow offers seamless integration with various applications and tools to enhance your workflow for Form 3949 A, Information Referral. This includes popular productivity apps, enabling you to keep all your documentation organized and accessible.

-

Is airSlate SignNow secure for handling Form 3949 A, Information Referral?

Absolutely! airSlate SignNow prioritizes your security, employing encryption and robust security measures to protect your submissions for Form 3949 A, Information Referral. You can trust that your sensitive information is safe while using our platform.

-

How does electronic signing for Form 3949 A, Information Referral work in airSlate SignNow?

The electronic signing process in airSlate SignNow is simple and user-friendly. Once you create or upload your Form 3949 A, Information Referral, you can invite signers to eSign via email, and they can complete the signing process from any device, enhancing convenience.

Get more for Form 3949 A, Information Referral

- Tenant increase rent 497302979 form

- Letter from landlord to tenant as notice to tenant to repair damage caused by tenant florida form

- Letter tenant rent 497302981 form

- Florida tenant landlord form

- Temporary lease agreement to prospective buyer of residence prior to closing florida form

- Fl eviction form

- Letter from landlord to tenant returning security deposit less deductions florida form

- Return security deposit florida form

Find out other Form 3949 A, Information Referral

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now

- How Can I eSign Alabama Car Dealer Executive Summary Template

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast

- eSign Arkansas Car Dealer Agreement Online

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself

- eSign Georgia Car Dealer POA Mobile

- Sign Nebraska Courts Warranty Deed Online

- Sign Nebraska Courts Limited Power Of Attorney Now

- eSign Car Dealer Form Idaho Online

- How To eSign Hawaii Car Dealer Contract

- How To eSign Hawaii Car Dealer Living Will

- How Do I eSign Hawaii Car Dealer Living Will

- eSign Hawaii Business Operations Contract Online

- eSign Hawaii Business Operations LLC Operating Agreement Mobile

- How Do I eSign Idaho Car Dealer Lease Termination Letter