IHT404 Jointly Owned Assets Use This Form with Form IHT400 to Give Details of All UK Assets the Deceased Owned Jointly with Anot 2015-2026

What is the IHT404 form?

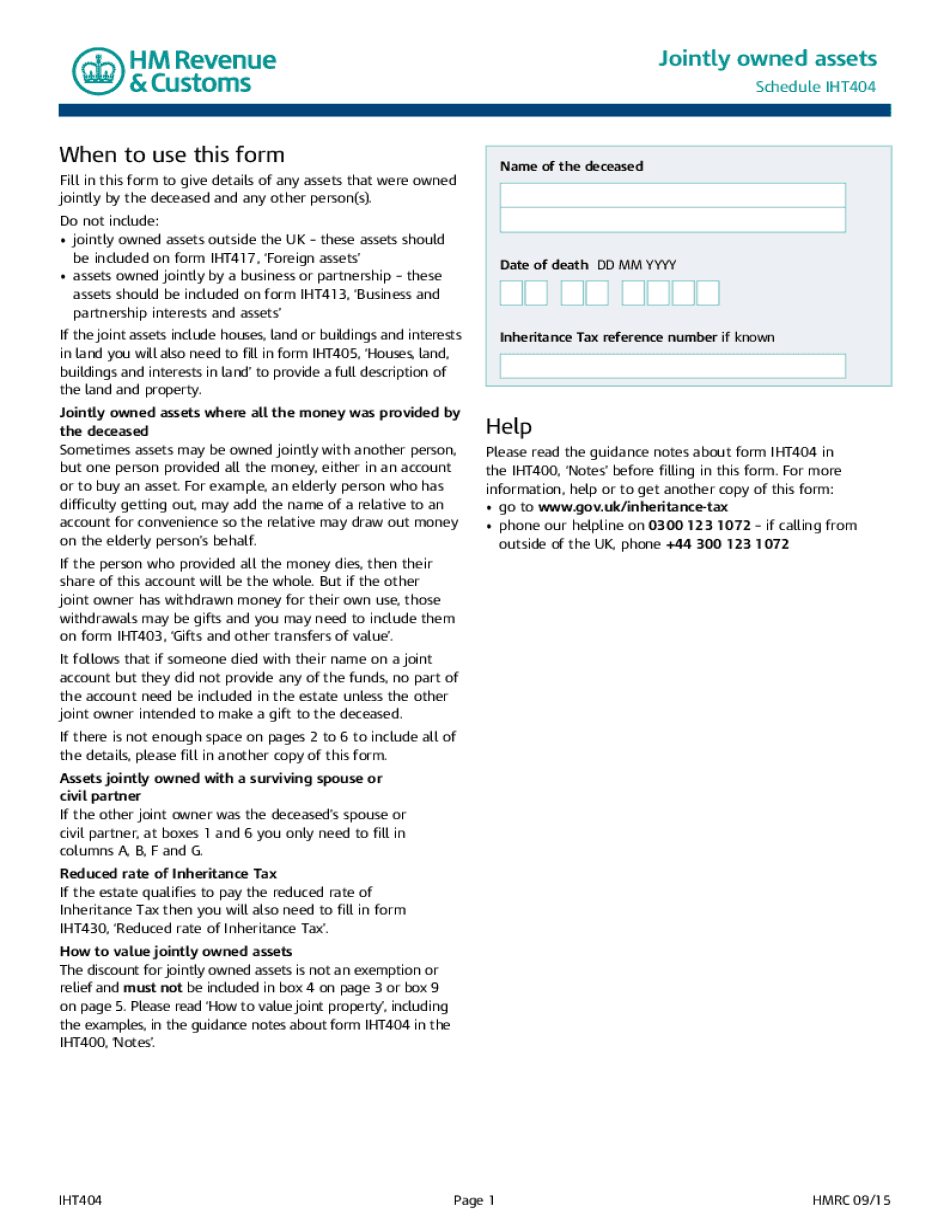

The IHT404 form is used to report jointly owned assets of a deceased individual in the United Kingdom. It is specifically designed to accompany the IHT400 form, which is the main inheritance tax return. This form provides detailed information about all UK assets that the deceased owned jointly with another person. Accurately completing the IHT404 is essential for ensuring that the estate is assessed correctly for inheritance tax purposes.

How to use the IHT404 form

To effectively use the IHT404 form, begin by gathering all necessary information regarding the jointly owned assets. This includes property, bank accounts, and investments that were held in joint names. Ensure that you have the details of the co-owner(s) and the value of the assets at the date of death. Once you have compiled this information, fill out the form accurately, providing all required details to ensure compliance with inheritance tax regulations.

Steps to complete the IHT404 form

Completing the IHT404 form involves several key steps:

- Gather all relevant information about the jointly owned assets.

- Obtain the date of death and the value of the assets at that time.

- Fill out the form with the details of the deceased and the co-owner(s).

- Review the completed form for accuracy and completeness.

- Submit the IHT404 along with the IHT400 form to the appropriate tax authority.

Key elements of the IHT404 form

The IHT404 form includes several key elements that must be addressed:

- Identification of the deceased and the co-owner(s).

- Details of each jointly owned asset, including type and value.

- Information regarding how the asset is held (e.g., as joint tenants or tenants in common).

- Signature of the person completing the form, affirming the accuracy of the information provided.

Legal use of the IHT404 form

The IHT404 form serves a legal purpose in the context of inheritance tax. It ensures that all jointly owned assets are accounted for in the estate of the deceased. Properly completing this form is crucial for compliance with UK inheritance tax laws, as it helps determine the total value of the estate and any tax liabilities that may arise. Failure to accurately report jointly owned assets can lead to penalties or complications in the estate settlement process.

Filing Deadlines / Important Dates

When dealing with the IHT404 form, it is important to be aware of key filing deadlines. The completed IHT400 and IHT404 forms must typically be submitted within six months of the date of death to avoid interest charges on any inheritance tax owed. It is advisable to check for any specific dates that may apply based on individual circumstances or changes in legislation.

Quick guide on how to complete iht404 jointly owned assets use this form with form iht400 to give details of all uk assets the deceased owned jointly with

Effortlessly complete IHT404 Jointly Owned Assets Use This Form With Form IHT400 To Give Details Of All UK Assets The Deceased Owned Jointly With Anot on any device

Managing documents online has gained signNow popularity among businesses and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the correct form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly without any holdups. Manage IHT404 Jointly Owned Assets Use This Form With Form IHT400 To Give Details Of All UK Assets The Deceased Owned Jointly With Anot on any device using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

The easiest way to alter and eSign IHT404 Jointly Owned Assets Use This Form With Form IHT400 To Give Details Of All UK Assets The Deceased Owned Jointly With Anot hassle-free

- Find IHT404 Jointly Owned Assets Use This Form With Form IHT400 To Give Details Of All UK Assets The Deceased Owned Jointly With Anot and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize key sections of the documents or conceal sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you would like to send your form: via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form hunting, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign IHT404 Jointly Owned Assets Use This Form With Form IHT400 To Give Details Of All UK Assets The Deceased Owned Jointly With Anot and ensure excellent communication throughout the entire form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct iht404 jointly owned assets use this form with form iht400 to give details of all uk assets the deceased owned jointly with

Create this form in 5 minutes!

How to create an eSignature for the iht404 jointly owned assets use this form with form iht400 to give details of all uk assets the deceased owned jointly with

The way to create an electronic signature for your PDF in the online mode

The way to create an electronic signature for your PDF in Chrome

How to generate an electronic signature for putting it on PDFs in Gmail

The way to make an eSignature straight from your smart phone

The best way to create an electronic signature for a PDF on iOS devices

The way to make an eSignature for a PDF document on Android OS

People also ask

-

What is iht404 in airSlate SignNow?

The iht404 is a specific identifier used within airSlate SignNow to facilitate efficient document management and eSigning processes. It ensures that all transactions are tracked and secure, allowing users to manage their documents with confidence.

-

How much does airSlate SignNow with iht404 cost?

Pricing for airSlate SignNow varies depending on your business needs and the number of users. Generally, plans start at an affordable monthly rate, making the iht404 feature accessible for businesses of all sizes looking to streamline their signing processes.

-

What features does the iht404 offer in airSlate SignNow?

The iht404 feature in airSlate SignNow includes comprehensive document tracking, customizable templates, and secure eSignature capabilities. These features combine to enhance the user experience, making it easier to send and receive signed documents efficiently.

-

What are the benefits of using the iht404 in airSlate SignNow?

Using the iht404 in airSlate SignNow provides several benefits, such as increased efficiency, improved document security, and a user-friendly interface. These advantages help businesses save time and resources while maintaining compliance with legal requirements.

-

Can I integrate airSlate SignNow with other tools while using iht404?

Yes, airSlate SignNow supports integrations with various third-party applications, even while utilizing the iht404 feature. This functionality allows businesses to streamline their workflows by connecting with popular tools like Google Drive, Salesforce, and more.

-

Is the iht404 feature suitable for all business sizes?

Absolutely! The iht404 feature in airSlate SignNow is designed to cater to businesses of all sizes. Whether you are a small startup or a large enterprise, this feature will help you manage your document signing needs effectively.

-

How does airSlate SignNow ensure the security of the iht404 feature?

AirSlate SignNow prioritizes security by implementing advanced encryption and compliance standards for the iht404 feature. This ensures that all documents signed through the platform are kept safe and secure, safeguarding sensitive information.

Get more for IHT404 Jointly Owned Assets Use This Form With Form IHT400 To Give Details Of All UK Assets The Deceased Owned Jointly With Anot

Find out other IHT404 Jointly Owned Assets Use This Form With Form IHT400 To Give Details Of All UK Assets The Deceased Owned Jointly With Anot

- Electronic signature Kentucky Government Promissory Note Template Fast

- Electronic signature Kansas Government Last Will And Testament Computer

- Help Me With Electronic signature Maine Government Limited Power Of Attorney

- How To Electronic signature Massachusetts Government Job Offer

- Electronic signature Michigan Government LLC Operating Agreement Online

- How To Electronic signature Minnesota Government Lease Agreement

- Can I Electronic signature Minnesota Government Quitclaim Deed

- Help Me With Electronic signature Mississippi Government Confidentiality Agreement

- Electronic signature Kentucky Finance & Tax Accounting LLC Operating Agreement Myself

- Help Me With Electronic signature Missouri Government Rental Application

- Can I Electronic signature Nevada Government Stock Certificate

- Can I Electronic signature Massachusetts Education Quitclaim Deed

- Can I Electronic signature New Jersey Government LLC Operating Agreement

- Electronic signature New Jersey Government Promissory Note Template Online

- Electronic signature Michigan Education LLC Operating Agreement Myself

- How To Electronic signature Massachusetts Finance & Tax Accounting Quitclaim Deed

- Electronic signature Michigan Finance & Tax Accounting RFP Now

- Electronic signature Oklahoma Government RFP Later

- Electronic signature Nebraska Finance & Tax Accounting Business Plan Template Online

- Electronic signature Utah Government Resignation Letter Online