There, You Can Also Stay Up to Date on Your 2015-2026

Key elements of the Kansas for profit corporation

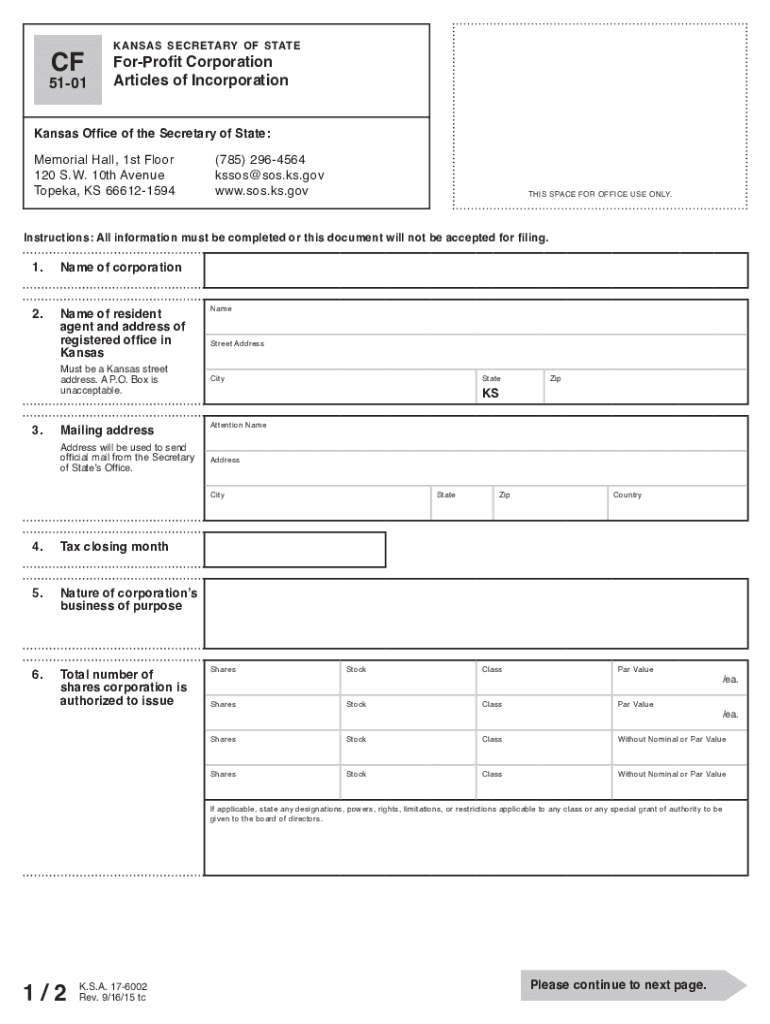

When establishing a Kansas for profit corporation, several key elements must be included to ensure compliance with state regulations. The articles of incorporation should detail the corporation's name, which must be unique and not deceptively similar to existing entities. Additionally, the purpose of the corporation must be explicitly stated, outlining the business activities it intends to pursue.

Furthermore, the articles must include the address of the corporation's principal office and the name and address of the registered agent, who will receive legal documents on behalf of the corporation. It is also essential to specify the number of shares the corporation is authorized to issue and the par value of those shares, if applicable. These components are crucial for the legal recognition of the corporation in Kansas.

Steps to complete the Kansas form for incorporation

Completing the Kansas form for incorporation involves several steps to ensure proper filing and compliance. First, gather the necessary information, including the corporation's name, purpose, registered agent details, and share structure. Next, access the appropriate form, typically the Articles of Incorporation, which can be obtained from the Kansas Secretary of State's website.

Fill out the form carefully, ensuring all required fields are completed accurately. Once the form is filled out, review it for any errors or omissions. After verification, submit the form along with the required filing fee to the Kansas Secretary of State, either online or by mail. It is advisable to keep a copy of the submitted form for your records.

Required documents for Kansas profit corporation incorporation

To incorporate a Kansas for profit corporation, specific documents are required to facilitate the filing process. The primary document is the Articles of Incorporation, which must be completed and submitted to the Kansas Secretary of State. This document outlines the essential details of the corporation, including its name, purpose, registered agent, and share structure.

In addition to the Articles of Incorporation, you may need to prepare an initial report, which provides additional information about the corporation's structure and operations. Depending on the nature of your business, other licenses or permits may also be required. It is important to verify all necessary documentation to ensure a smooth incorporation process.

Legal use of the Kansas articles online

The Kansas articles online can be legally binding when executed correctly. To ensure that your electronic documents hold legal weight, they must comply with the Electronic Signatures in Global and National Commerce (ESIGN) Act and the Uniform Electronic Transactions Act (UETA). Utilizing a reliable electronic signature platform can facilitate this process, providing features such as secure storage and audit trails.

When filling out the Kansas form for incorporation online, ensure that all signers use verified electronic signatures. This adds an extra layer of legitimacy to the documents. It is advisable to keep records of all electronic transactions, as these may be required for future reference or legal validation.

Filing deadlines / Important dates for Kansas incorporation

Understanding the filing deadlines and important dates for Kansas incorporation is crucial for compliance. Generally, there are no specific deadlines for submitting the Articles of Incorporation; however, it is advisable to file as soon as possible to avoid any potential delays in starting your business operations.

Once incorporated, corporations must adhere to annual reporting requirements, which typically include submitting an annual report to the Kansas Secretary of State. This report is due on the 15th day of the fourth month following the end of the corporation's fiscal year. Failing to meet these deadlines may result in penalties or loss of good standing.

IRS guidelines for Kansas for profit corporations

When forming a Kansas for profit corporation, it is essential to follow IRS guidelines to ensure compliance with federal tax regulations. After incorporation, the corporation must obtain an Employer Identification Number (EIN) from the IRS. This number is necessary for tax reporting and opening a business bank account.

Additionally, corporations must understand their tax obligations, which may include federal corporate income taxes and potential state taxes. It is advisable to consult with a tax professional to ensure that all requirements are met and to explore available deductions or credits that may apply to your business.

Quick guide on how to complete there you can also stay up to date on your

Complete There, You Can Also Stay Up to date On Your seamlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, as you can easily locate the appropriate form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents promptly and without hassle. Manage There, You Can Also Stay Up to date On Your on any device using the airSlate SignNow Android or iOS applications and enhance any document-centric workflow today.

The simplest way to modify and eSign There, You Can Also Stay Up to date On Your effortlessly

- Obtain There, You Can Also Stay Up to date On Your and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important parts of the documents or obscure sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to retain your changes.

- Select your preferred delivery method for your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs with just a few clicks from any device of your selection. Edit and eSign There, You Can Also Stay Up to date On Your and ensure effective communication at any point in the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct there you can also stay up to date on your

Create this form in 5 minutes!

How to create an eSignature for the there you can also stay up to date on your

The way to create an electronic signature for your PDF file online

The way to create an electronic signature for your PDF file in Google Chrome

How to make an eSignature for signing PDFs in Gmail

The way to make an eSignature straight from your mobile device

The best way to create an electronic signature for a PDF file on iOS

The way to make an eSignature for a PDF document on Android devices

People also ask

-

What is a kansas for profit corporation?

A kansas for profit corporation is a business entity that is formed under Kansas state law with the primary goal of making a profit. It allows businesses to operate with limited liability, meaning that owners are protected from personal liability for business debts. Understanding this structure is essential for entrepreneurs looking to establish a legal presence in Kansas.

-

How do I register a kansas for profit corporation?

To register a kansas for profit corporation, you need to file Articles of Incorporation with the Kansas Secretary of State. This process includes selecting a unique name for your corporation, appointing a registered agent, and paying the required filing fees. Ensuring that all required documents are correctly filled out is crucial for a smooth registration process.

-

What are the benefits of forming a kansas for profit corporation?

Forming a kansas for profit corporation provides several benefits, such as liability protection for owners and the ability to raise capital through the sale of stock. Additionally, corporations often enjoy tax advantages and enhanced credibility with customers and suppliers. These benefits make the kansas for profit corporation an attractive option for businesses looking to grow and succeed.

-

What are the costs associated with a kansas for profit corporation?

The costs of forming a kansas for profit corporation can vary, but typically include filing fees, legal fee expenses, and potential ongoing costs like annual reports and taxes. The initial filing fee for the Articles of Incorporation is relatively low compared to the long-term benefits. It's important to consider these costs in your startup budget.

-

Can airSlate SignNow support documentation for our kansas for profit corporation?

Yes, airSlate SignNow can effectively support all documentation processes for your kansas for profit corporation. Our platform allows you to eSign and send essential documents securely and efficiently, helping to streamline your business operations. Utilizing our solution can save time and reduce paperwork hassle for your corporation.

-

What features does airSlate SignNow offer for corporate needs?

airSlate SignNow offers features such as seamless eSigning, document templates, customizable workflows, and secure cloud storage specifically suited for corporations, including kansas for profit corporations. These features simplify the document management process, ensuring that all corporate paperwork is handled efficiently. This can signNowly enhance your productivity and compliance efforts.

-

Does airSlate SignNow integrate with other business tools?

Yes, airSlate SignNow integrates with various business tools and applications, enabling seamless collaboration for your kansas for profit corporation. You can connect our platform with popular tools like Slack, Google Drive, and Salesforce, making it easy to manage documents across multiple systems. This integration enhances your workflow and keeps your business operations smooth and connected.

Get more for There, You Can Also Stay Up to date On Your

- Payslip template pdf download form

- Permission letter for nss camp from parents form

- Hca flu tracker form

- Prisma diagram generator form

- Marketing management by philip kotler 15th edition ppt download form

- 2mm graph paper pdf form

- Reset form print form general tenancy agreement f 780290128

- Food request form 13744058

Find out other There, You Can Also Stay Up to date On Your

- How To eSign Illinois Business Operations Stock Certificate

- Can I eSign Louisiana Car Dealer Quitclaim Deed

- eSign Michigan Car Dealer Operating Agreement Mobile

- Can I eSign Mississippi Car Dealer Resignation Letter

- eSign Missouri Car Dealer Lease Termination Letter Fast

- Help Me With eSign Kentucky Business Operations Quitclaim Deed

- eSign Nevada Car Dealer Warranty Deed Myself

- How To eSign New Hampshire Car Dealer Purchase Order Template

- eSign New Jersey Car Dealer Arbitration Agreement Myself

- eSign North Carolina Car Dealer Arbitration Agreement Now

- eSign Ohio Car Dealer Business Plan Template Online

- eSign Ohio Car Dealer Bill Of Lading Free

- How To eSign North Dakota Car Dealer Residential Lease Agreement

- How Do I eSign Ohio Car Dealer Last Will And Testament

- Sign North Dakota Courts Lease Agreement Form Free

- eSign Oregon Car Dealer Job Description Template Online

- Sign Ohio Courts LLC Operating Agreement Secure

- Can I eSign Michigan Business Operations POA

- eSign Car Dealer PDF South Dakota Computer

- eSign Car Dealer PDF South Dakota Later