Hmrc Form Refund 2007

What is the Hmrc Form Refund

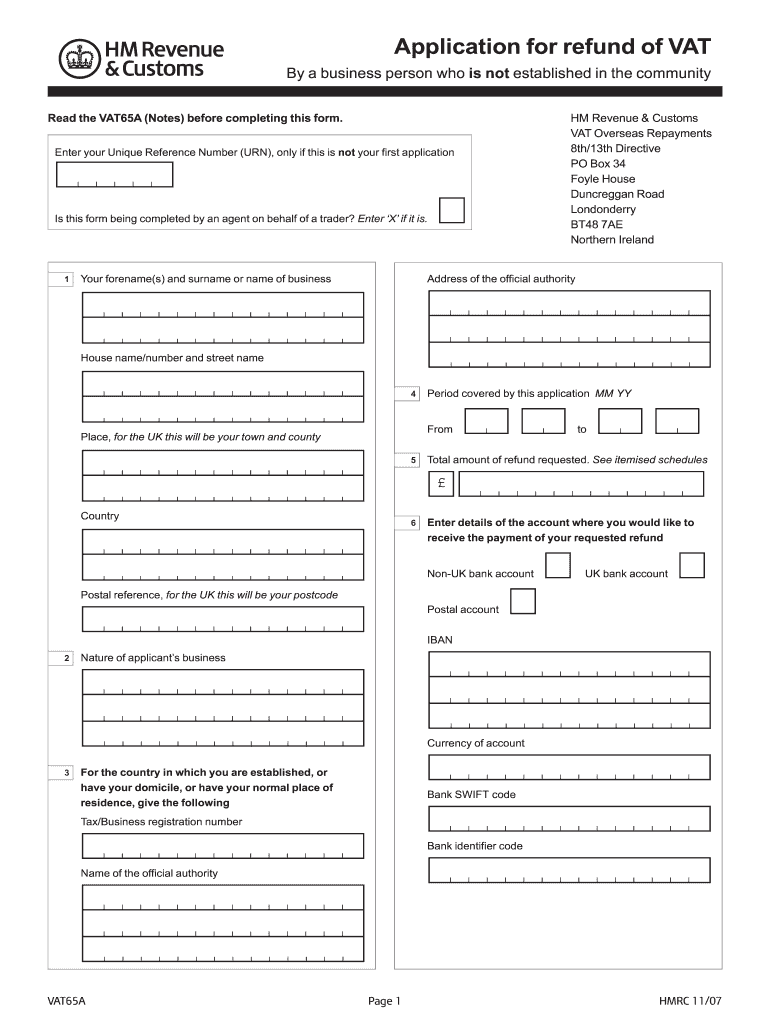

The Hmrc Form Refund is a document used to request a refund from the HM Revenue and Customs (HMRC) in the United Kingdom. While primarily relevant in the UK context, understanding its implications can be useful for U.S. taxpayers who may have international tax obligations or who are considering cross-border financial activities. The form is typically utilized by individuals or businesses seeking to reclaim overpaid taxes or to adjust tax liabilities. It is essential to ensure that the form is filled out accurately to avoid delays in processing the refund.

How to use the Hmrc Form Refund

Using the Hmrc Form Refund involves several key steps. First, gather all necessary financial documents, including tax returns, payment records, and any relevant correspondence with HMRC. Next, accurately complete the form, ensuring all information is correct and up to date. It is advisable to double-check the calculations to confirm that the refund amount is accurate. Once the form is completed, it can be submitted through the appropriate channels, which may include online submission or mailing it directly to HMRC.

Steps to complete the Hmrc Form Refund

Completing the Hmrc Form Refund requires careful attention to detail. Follow these steps for a smooth process:

- Gather necessary documents: Ensure you have all relevant tax documents, including previous tax returns and payment receipts.

- Fill out the form: Provide accurate personal and financial information, including your tax identification number and the reason for the refund request.

- Review your entries: Check all calculations and entries for accuracy to prevent delays.

- Submit the form: Choose your submission method, whether online or by mail, and keep a copy for your records.

Legal use of the Hmrc Form Refund

The legal use of the Hmrc Form Refund is governed by tax laws and regulations. It is essential to ensure compliance with these laws when submitting the form. This includes understanding the eligibility criteria for refunds and the specific circumstances under which a refund can be claimed. Failure to comply with legal requirements may result in penalties or denial of the refund request. It is advisable to consult with a tax professional if there are any uncertainties regarding the legal aspects of the form.

Required Documents

When submitting the Hmrc Form Refund, certain documents are required to support your claim. These typically include:

- Proof of income: This may include pay stubs, tax returns, or other income verification documents.

- Payment records: Documentation showing the taxes that were overpaid or incorrectly assessed.

- Identification: A valid form of identification, such as a driver's license or passport, may be necessary.

Form Submission Methods

The Hmrc Form Refund can be submitted through various methods, depending on the preferences of the taxpayer and the requirements of HMRC. Common submission methods include:

- Online submission: Many taxpayers prefer this method for its convenience and speed.

- Mail: For those who prefer traditional methods, mailing the completed form directly to HMRC is an option.

- In-person: Some taxpayers may choose to submit the form in person at designated HMRC offices, although this is less common.

Quick guide on how to complete hmrc form refund 2007

Complete Hmrc Form Refund with ease on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the appropriate form and securely save it online. airSlate SignNow provides you with all the necessary tools to create, modify, and electronically sign your documents swiftly without interruptions. Manage Hmrc Form Refund on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to alter and electronically sign Hmrc Form Refund effortlessly

- Locate Hmrc Form Refund and click Get Form to initiate.

- Make use of the tools we provide to fill out your form.

- Emphasize pertinent sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to finalize your changes.

- Choose how you prefer to send your form—via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device you prefer. Adjust and electronically sign Hmrc Form Refund to ensure exceptional communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct hmrc form refund 2007

Create this form in 5 minutes!

How to create an eSignature for the hmrc form refund 2007

How to create an eSignature for your Hmrc Form Refund 2007 online

How to make an eSignature for your Hmrc Form Refund 2007 in Google Chrome

How to make an eSignature for putting it on the Hmrc Form Refund 2007 in Gmail

How to make an eSignature for the Hmrc Form Refund 2007 from your smart phone

How to generate an electronic signature for the Hmrc Form Refund 2007 on iOS devices

How to make an electronic signature for the Hmrc Form Refund 2007 on Android OS

People also ask

-

What is the Hmrc Form Refund process?

The Hmrc Form Refund process involves submitting your tax return and claiming any overpaid taxes. Using airSlate SignNow, you can easily eSign and send your Hmrc Form Refund documents securely, ensuring a quick and efficient submission to HMRC.

-

How does airSlate SignNow support Hmrc Form Refund submissions?

airSlate SignNow provides a streamlined platform for submitting your Hmrc Form Refund. With our easy-to-use interface, you can complete and eSign your forms electronically, reducing the chances of errors and speeding up the refund process.

-

Are there any fees associated with filing Hmrc Form Refund through airSlate SignNow?

Yes, airSlate SignNow offers a cost-effective solution for managing your Hmrc Form Refund filings. Our pricing plans are designed to accommodate various business needs, ensuring that you get the best value for your eSigning and document management.

-

Can I track the status of my Hmrc Form Refund submission?

Absolutely! With airSlate SignNow, you can track the status of your Hmrc Form Refund submission in real-time. This feature allows you to stay informed about your refund process and ensures that you know when to expect your funds.

-

What features does airSlate SignNow offer for Hmrc Form Refund management?

airSlate SignNow includes features like customizable templates, secure eSigning, and document sharing specifically for Hmrc Form Refund management. These tools help you organize your documents efficiently and collaborate with team members seamlessly.

-

Is airSlate SignNow compatible with other tax software for Hmrc Form Refunds?

Yes, airSlate SignNow integrates with various tax software applications, making it easier to manage your Hmrc Form Refunds. You can import your data directly from your tax software, saving you time and ensuring accuracy.

-

How secure is my information when filing Hmrc Form Refund with airSlate SignNow?

Security is a top priority at airSlate SignNow. When you file your Hmrc Form Refund, your information is protected with advanced encryption and secure data storage, ensuring that your sensitive information remains confidential.

Get more for Hmrc Form Refund

Find out other Hmrc Form Refund

- eSignature Washington Real Estate Lease Agreement Form Mobile

- How Can I eSignature New York Sports Executive Summary Template

- eSignature Arkansas Courts LLC Operating Agreement Now

- How Do I eSignature Arizona Courts Moving Checklist

- eSignature Wyoming Real Estate Quitclaim Deed Myself

- eSignature Wyoming Real Estate Lease Agreement Template Online

- How Can I eSignature Delaware Courts Stock Certificate

- How Can I eSignature Georgia Courts Quitclaim Deed

- Help Me With eSignature Florida Courts Affidavit Of Heirship

- Electronic signature Alabama Banking RFP Online

- eSignature Iowa Courts Quitclaim Deed Now

- eSignature Kentucky Courts Moving Checklist Online

- eSignature Louisiana Courts Cease And Desist Letter Online

- How Can I Electronic signature Arkansas Banking Lease Termination Letter

- eSignature Maryland Courts Rental Application Now

- eSignature Michigan Courts Affidavit Of Heirship Simple

- eSignature Courts Word Mississippi Later

- eSignature Tennessee Sports Last Will And Testament Mobile

- How Can I eSignature Nevada Courts Medical History

- eSignature Nebraska Courts Lease Agreement Online