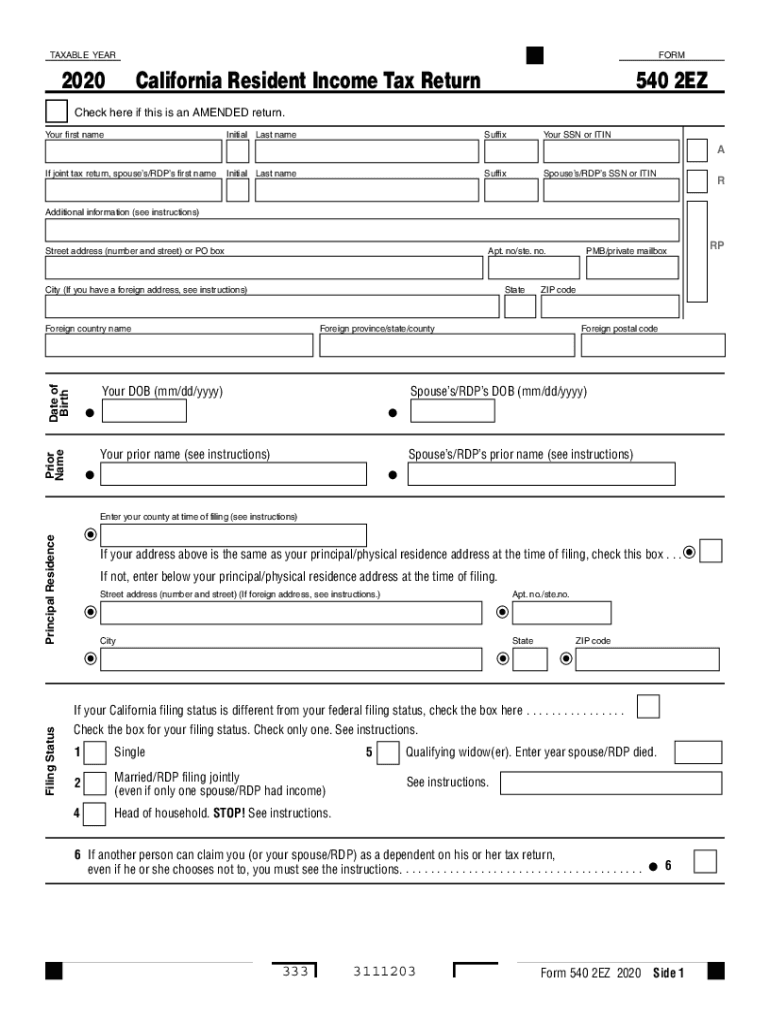

California Resident Income Tax Return Form 540 2EZ 2020

What is the California Resident Income Tax Return Form 540 2EZ

The California Resident Income Tax Return Form 540 2EZ is a simplified tax form designed for individual taxpayers who meet specific eligibility criteria. This form is intended for use by residents of California who have a straightforward tax situation, such as those with a single source of income and no complex deductions or credits. The 540 2EZ form allows for a more streamlined filing process, making it easier for taxpayers to report their income and calculate their tax liabilities.

How to obtain the California Resident Income Tax Return Form 540 2EZ

Taxpayers can obtain the California Resident Income Tax Return Form 540 2EZ through several methods. The form is available for download from the California Franchise Tax Board (FTB) website. Additionally, physical copies can be requested by contacting the FTB directly or visiting local tax offices. Many tax preparation services also provide access to this form as part of their filing assistance.

Steps to complete the California Resident Income Tax Return Form 540 2EZ

Completing the California Resident Income Tax Return Form 540 2EZ involves several straightforward steps:

- Gather all necessary documents, including W-2 forms and any other income statements.

- Fill out the personal information section, including your name, address, and Social Security number.

- Report your total income from all sources as indicated on your income statements.

- Calculate your standard deduction and any applicable tax credits.

- Determine your total tax liability and any payments or refunds due.

- Review the completed form for accuracy before submission.

Legal use of the California Resident Income Tax Return Form 540 2EZ

The California Resident Income Tax Return Form 540 2EZ is legally recognized by the state of California as a valid method for filing income taxes. To ensure compliance, it is essential that taxpayers complete the form accurately and submit it by the designated deadlines. Using this form correctly allows individuals to fulfill their tax obligations while benefiting from the simplified filing process it offers.

Filing Deadlines / Important Dates

Taxpayers should be aware of the key deadlines associated with the California Resident Income Tax Return Form 540 2EZ. Typically, the deadline for filing this form is April 15 of the following tax year. However, if this date falls on a weekend or holiday, the deadline may be extended. It is important to stay informed about any changes to filing deadlines, especially if you are requesting an extension.

Eligibility Criteria

To qualify for using the California Resident Income Tax Return Form 540 2EZ, taxpayers must meet specific eligibility criteria. Generally, this form is suitable for individuals with a total income below a certain threshold, those who do not claim any dependents, and those who do not have complex tax situations, such as itemized deductions or business income. Ensuring that you meet these criteria will facilitate a smoother filing process.

Quick guide on how to complete california resident income tax return form 540 2ez

Effortlessly Prepare California Resident Income Tax Return Form 540 2EZ on Any Device

Digital document management has gained popularity among businesses and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed papers, as you can obtain the necessary form and securely store it online. airSlate SignNow provides you with all the resources required to create, modify, and electronically sign your documents swiftly and efficiently. Manage California Resident Income Tax Return Form 540 2EZ on any device using airSlate SignNow apps for Android or iOS and enhance any document-focused workflow today.

The optimal method to modify and electronically sign California Resident Income Tax Return Form 540 2EZ effortlessly

- Locate California Resident Income Tax Return Form 540 2EZ and click on Get Form to begin.

- Utilize the tools provided to complete your document.

- Highlight important sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal significance as a traditional wet ink signature.

- Review all the information and click on the Done button to save your updates.

- Select your preferred method for delivering your form, whether by email, text message (SMS), invite link, or downloading it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that require reprinting new document copies. airSlate SignNow caters to all your document management needs in just a few clicks from your chosen device. Modify and electronically sign California Resident Income Tax Return Form 540 2EZ to ensure effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct california resident income tax return form 540 2ez

Create this form in 5 minutes!

How to create an eSignature for the california resident income tax return form 540 2ez

How to generate an eSignature for your PDF in the online mode

How to generate an eSignature for your PDF in Chrome

How to generate an electronic signature for putting it on PDFs in Gmail

How to make an eSignature straight from your smart phone

The best way to create an electronic signature for a PDF on iOS devices

How to make an eSignature for a PDF document on Android OS

People also ask

-

What is airSlate SignNow and how does it relate to 2017 ca?

airSlate SignNow is a user-friendly eSignature platform that helps businesses efficiently send and sign documents. In the context of 2017 ca, it provides a reliable solution for compliant electronic signing, ensuring legal validity and streamlined document management.

-

How much does airSlate SignNow cost for users looking for 2017 ca solutions?

Pricing for airSlate SignNow is competitive and offers various plans tailored to meet different business needs. For those focusing on 2017 ca services, the platform provides cost-effective options, allowing users to choose a plan based on their document signing volume and required features.

-

What features does airSlate SignNow offer for 2017 ca compliance?

airSlate SignNow offers essential features for 2017 ca compliance, including secure document sharing, advanced authentication, and audit trails. These features help ensure that all electronic signatures are legally binding and meet industry standards.

-

Can airSlate SignNow integrate with other tools for 2017 ca processes?

Yes, airSlate SignNow seamlessly integrates with various tools to enhance 2017 ca processes. This includes CRM systems, cloud storage services, and productivity software, allowing businesses to streamline workflows and improve efficiency.

-

What are the benefits of using airSlate SignNow for 2017 ca document signing?

Using airSlate SignNow for 2017 ca document signing offers numerous benefits, including reduced turnaround times, improved collaboration, and enhanced security. This empowers businesses to manage their signing processes more effectively while maintaining compliance.

-

Is training available for new users of airSlate SignNow focusing on 2017 ca?

Absolutely! airSlate SignNow provides comprehensive training resources for new users focusing on 2017 ca applications. This includes tutorials, webinars, and customer support to ensure that users can efficiently leverage the platform's features.

-

How does airSlate SignNow ensure security for 2017 ca transactions?

airSlate SignNow prioritizes security for 2017 ca transactions by employing industry-leading encryption and secure servers. This ensures that all documents and signatures are safe from unauthorized access and comply with legal requirements.

Get more for California Resident Income Tax Return Form 540 2EZ

Find out other California Resident Income Tax Return Form 540 2EZ

- Electronic signature Maine Contract for work Secure

- Electronic signature Utah Contract Myself

- How Can I Electronic signature Texas Electronic Contract

- How Do I Electronic signature Michigan General contract template

- Electronic signature Maine Email Contracts Later

- Electronic signature New Mexico General contract template Free

- Can I Electronic signature Rhode Island Email Contracts

- How Do I Electronic signature California Personal loan contract template

- Electronic signature Hawaii Personal loan contract template Free

- How To Electronic signature Hawaii Personal loan contract template

- Electronic signature New Hampshire Managed services contract template Computer

- Electronic signature Alabama Real estate sales contract template Easy

- Electronic signature Georgia Real estate purchase contract template Secure

- Electronic signature South Carolina Real estate sales contract template Mobile

- Can I Electronic signature Kentucky Residential lease contract

- Can I Electronic signature Nebraska Residential lease contract

- Electronic signature Utah New hire forms Now

- Electronic signature Texas Tenant contract Now

- How Do I Electronic signature Florida Home rental application

- Electronic signature Illinois Rental application Myself